Every year, a buyback plan worth hundreds of millions of dollars is equivalent to initiating a continuous "shareholder return." This not only hopes to catch up with competitors but also represents the value return of the protocol to its token holders.

Author: CoinW Research

Uniswap's latest buyback proposal has attracted significant market attention, but public discourse is highly focused on the buyback mechanism within the proposal. If the buyback mechanism is activated subsequently, will it lead to a long-term parabolic growth in the price of UNI tokens?

I. Uniswap's Major Proposal: In-Depth Analysis

Uniswap CEO Hayden Adams recently announced its first governance proposal, which includes measures such as enabling protocol fees, burning UNI tokens, and increasing Unichain fees, shifting the UNI token towards a deflationary model. If the proposal passes, the Uniswap protocol is expected to generate approximately $460 million to $510 million annually for the buyback of UNI, which will provide strong support for the token price. The specifics of the proposal are as follows:

1. Enable protocol fees, with all protocol-side income used for buyback + burning UNI.

This is the core value capture mechanism of this proposal. It fundamentally changes the UNI token model, transforming it from a purely governance token into a "productive asset" supported by direct cash flow. This is similar to how publicly listed companies buy back shares with profits, providing long-term and solid value support for the token price, and is the core engine driving it into a "deflationary appreciation" flywheel. This is the essence of value capture. UNI will transition from a governance token with no cash flow to a "productive asset" supported by direct income, akin to stock buybacks.

2. Unichain sequencer fees incorporated into the burn pool.

This move aims to consolidate the value generated by the entire Uniswap ecosystem onto the UNI token. Sequencer fees are inherent revenues of the Unichain Layer 2 blockchain, and incorporating them into the burn pool means that the value of UNI no longer relies solely on DEX trading activities but is deeply tied to the prosperity of the entire Uniswap ecosystem (including its public chain), broadening its value base.

3. One-time destruction of 10 million UNI (retrospective destruction for the historical fee-free period).

This is a strong deflationary signal and a measure to boost market confidence. The one-time destruction accounts for 16% of the total supply, which can immediately enhance the scarcity of the remaining tokens. The logic of "retrospective compensation" aims to fairly reward early supporters and attempts to "compensate" for the historical failure to generate returns for holders, which is expected to have a significant short-term stimulating effect on market sentiment.

4. Launch PFDA: Offer traders "fee discounts" through auctions while keeping MEV revenue within the protocol.

This is an innovative mechanism that achieves two goals at once. It cleverly recovers the MEV value that was originally captured by third-party searchers back to the protocol by auctioning fee discount rights. Ultimately, this portion of revenue will feed back into the UNI buyback, enhancing the robustness of the entire economic model.

5. v4 Aggregator Hook: Aggregate external DEX liquidity and collect protocol fees.

This means Uniswap is evolving from a "liquidity provider" to a "liquidity aggregation layer and fee collection point." Even if trades do not occur in Uniswap's own liquidity pools, as long as they are routed through its Hook, the protocol can capture fees. This greatly expands Uniswap's chargeable market and represents a strategic breakthrough for its revenue ceiling.

6. Unified fee standards: No additional charges for interface/wallet/API, with revenue standards unified at the protocol level.

This move is intended to solidify the core position of the protocol layer and the moat of its business model. It prevents various front ends (such as the official website and third-party interfaces) from engaging in "zero-fee" internal wars for competition, which would erode the revenue base of the entire ecosystem. Unified charging ensures the visibility, predictability, and stability of protocol revenue, which is an important guarantee for the long-term healthy operation of the economic model.

7. Governance and organization: Merge Labs and the foundation, setting a budget of 20 million UNI per year for growth.

This reflects Uniswap's pursuit of balance between short-term financial returns and long-term ecological development. The merger can enhance decision-making efficiency, and establishing a clear growth budget indicates that the team is not only focused on the current token price but is also committed to continuous investment in developers, liquidity, and other ecological construction, ensuring the protocol remains vibrant and competitive in the next decade.

8. Asset migration: Unisocks liquidity migrated to Unichain v4, and the LP position is burned.

This operation is more symbolically strategic. It indicates that the team is cleaning up old assets and fully redirecting resources and attention to the next-generation strategy centered on Unichain and v4. It can be seen as a "metabolism" of the ecosystem, symbolizing a break from the old model and concentrating efforts on building the future.

Image source: Uniswap founder (Hayden Adams)

Researcher's viewpoint: The core of this proposal lies in constructing a value flywheel of "protocol income → buyback and burn → token deflationary appreciation." If it operates smoothly, it will provide UNI with continuous cash flow discounting and price support.

II. Proposal Approval: Buyback Estimation and Protocol Revenue Analysis

We conducted calculations based on historical data and publicly available proposal parameters. This proposal involves a direct destruction of 10 million tokens (16% of the total), with the core assumption being a daily buyback trading volume of 0.05%. That is, protocol fees (0.3%) - LP rewards (0.25%) = buyback (0.05%).

1. Core Revenue Source Analysis

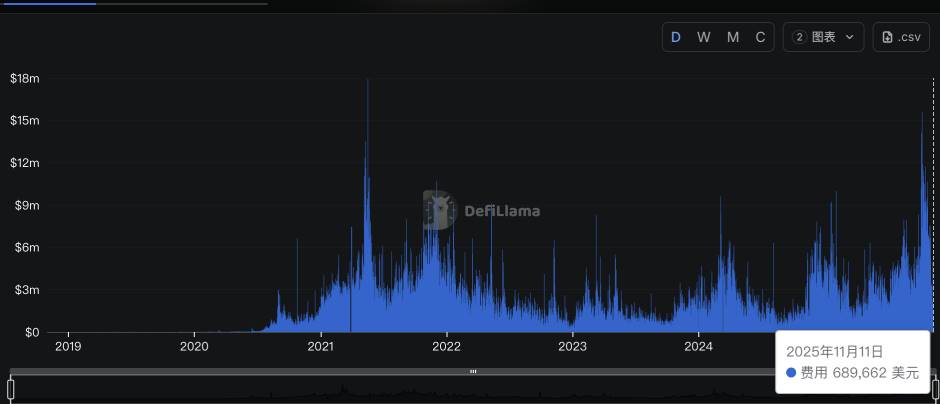

Core DEX business: Based on an annual trading volume of approximately $1 trillion for versions V2 and V3, calculating at a 0.05% fee rate, it is expected to generate about $500 million in annual protocol revenue.

v4 aggregator business: As an incremental source, it is expected to contribute 10%-20% of the core trading volume, bringing in a potential annual revenue of $50 million to $100 million.

PFDA and MEV capture: Although an important innovative revenue source, it is currently difficult to quantify precisely and has not been included in this calculation. Unichain sequencer fees: still in the early stages of development and relatively small in scale, also not included.

2. Annual Buyback Fund Summary

Conservative scenario (only counting core DEX business): Annual buyback funds are approximately $500 million.

Optimistic scenario (including v4 aggregator revenue): Annual buyback funds are expected to be between $550 million and $600 million.

Researcher's viewpoint: Based on market consensus and this report's calculations, a daily protocol buyback of 0.05% is expected to achieve an annual deflation rate of 1.5%-2%. At the current trading volume level, the funds available for Uniswap to buy back UNI annually are estimated to fall within the range of $500 million to $550 million, which is a relatively conservative estimate. This equates to a continuous buying support of $35 million to $42 million per month for the market, providing solid support for its medium to long-term value.

III. Market Reaction: Huge Buyback Expectations Drive Price Surge

In response to this proposal, various market participants quickly provided positive feedback. Alexander, CEO of Dromos Labs, the development team behind the leading DEX in the Base ecosystem, Aerodrome, pointed out that based on Uniswap's current trading volume, approximately $460 million in fees is expected to be used for buybacks and burns annually, which will become a strong and sustainable buying support for the $UNI token.

CryptoQuant CEO Ki Young Ju also noted that the fee conversion mechanism could drive Uniswap's price to rise parabolically. He analyzed that even when only considering versions V2 and V3, the protocol's annual trading volume reaches $1 trillion, and based on this calculation, the annual value of UNI burned will reach approximately $500 million. Additionally, the trading platform only holds $830 million in UNI, meaning that future unlocking selling pressure is relatively limited. Driven by this optimistic expectation, UNI surged nearly 50% within hours of the proposal's announcement.

Data source: defillama

Researcher's viewpoint: This proposal undoubtedly establishes a "hard bottom" for UNI's long-term value. Its core mechanism is: in the short term, creating a deflationary shock by one-time destruction of 10 million UNI (16% of circulation); in the long term, relying on continuous buybacks of approximately $38 million per month (annualized $400-$500 million) to provide stable buying support. This dual deflationary model provides strong support for the price.

IV. Competitor Comparison: Buyback Strength Ranks Among the Top

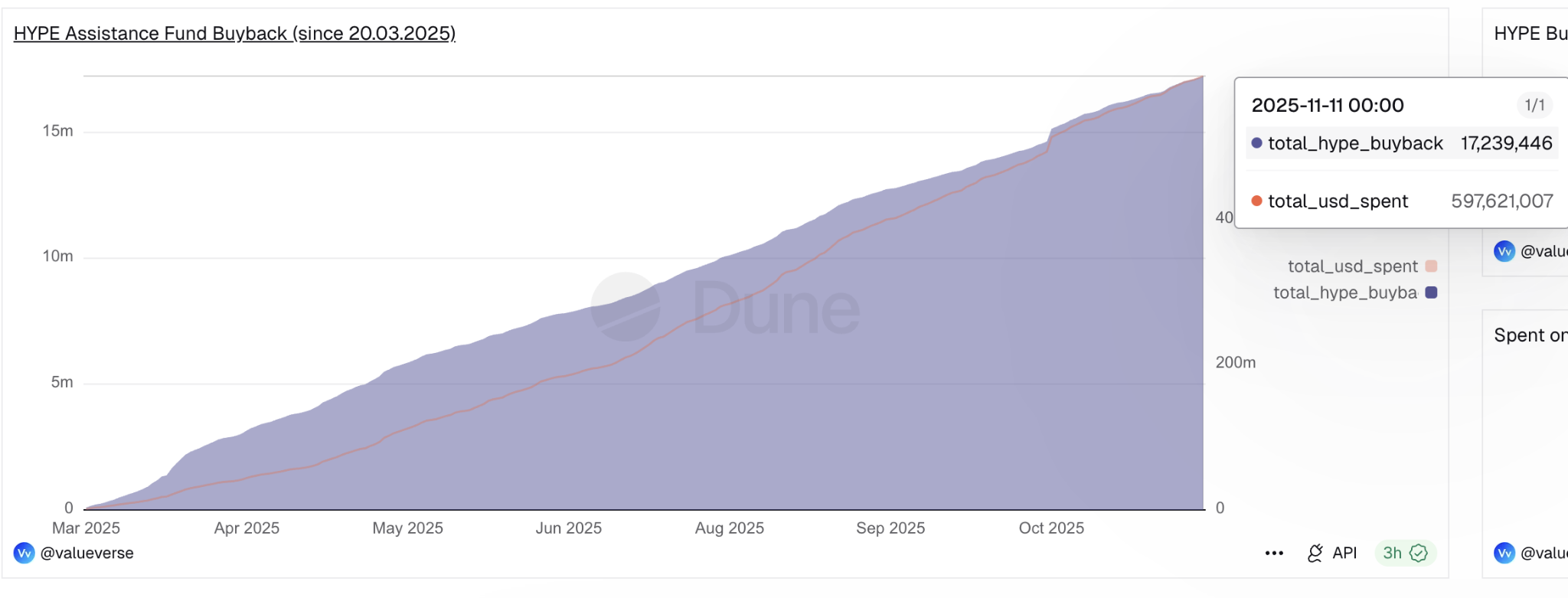

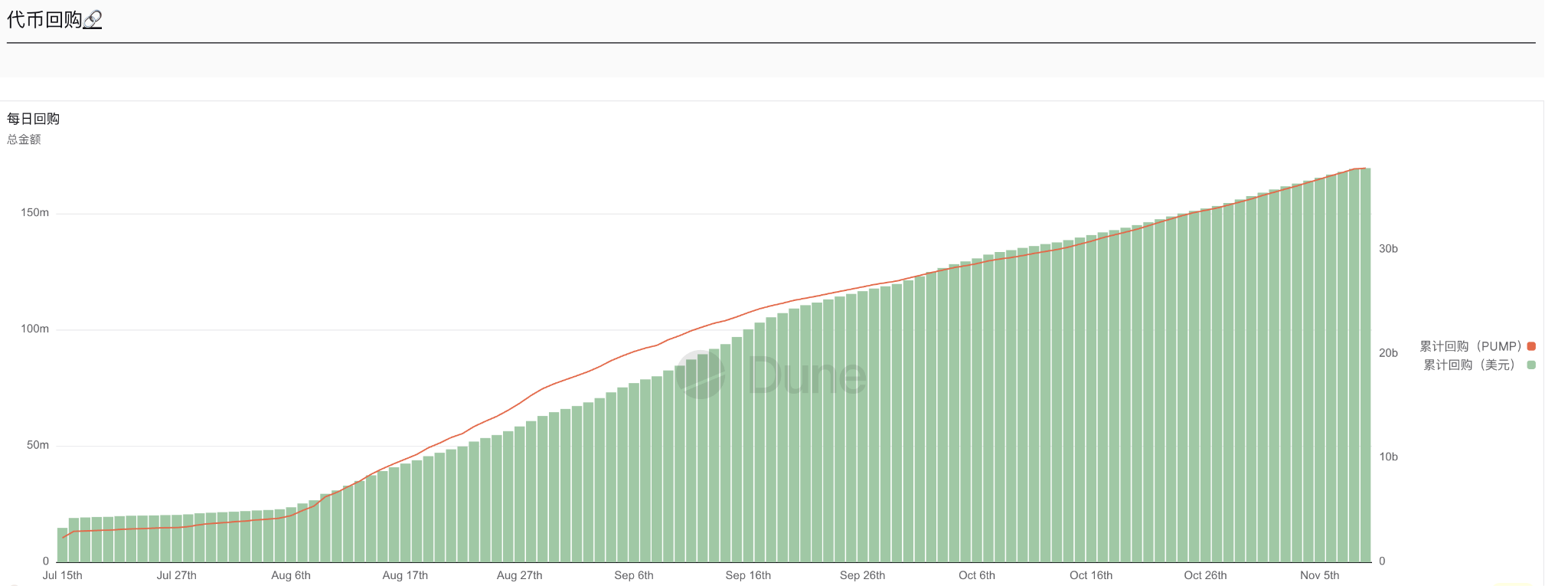

According to the proposal mechanism, Uniswap plans to split the original 0.3% LP fee, with 0.25% still going to liquidity providers, while 0.05% will be allocated to the protocol for UNI buybacks. If calculated based on its approximately $28 billion annual fee revenue, this means the protocol can generate about $38 million in special buyback funds each month. This scale places it in a strong position among tokens with buyback mechanisms: not only significantly surpassing PUMP ($35 million/month) but also aligning with the current highest HYPE ($95 million/month).

Image source: DUNE (HYPE)

Image source: DUNE (PUMP)

Researcher's viewpoint: Previously, UNI's massive trading volume could not bring direct benefits to its token holders. However, the annual buyback plan worth hundreds of millions of dollars is equivalent to initiating a continuous "shareholder return." This not only hopes to catch up with competitors but also represents the value return of the protocol to its token holders.

V. Future Outlook: Success Depends on the Anchor of Liquidity Providers (LP)

If Uniswap's proposal passes, it will bring long-term benefits to UNI, effectively establishing a "bottoming mechanism" for the token price. However, its success entirely depends on one core aspect: whether liquidity providers (LP) will stay.

Successful Path: The proposal reduces LP fees from 0.3% to 0.25% (a 17% reduction). LPs will only stay if new revenues from PFDA and MEV internalization can fully compensate for their losses. Stability of LPs ensures the depth of the liquidity pool and trading experience, allowing protocol fee revenue to continue, and the buyback and burn "bottoming" mechanism to operate healthily.

Risk Path: Conversely, if LPs withdraw due to reduced earnings, it will lead to liquidity shrinkage and trading volume loss, ultimately causing protocol revenue and buyback funds to shrink simultaneously, making the bottoming mechanism untenable.

Therefore, for ordinary users, two key points need to be closely monitored. Short-term: Governance voting results and contract launch timing. Long-term: LP retention rate and liquidity pool depth, whether the $38 million monthly buyback is stable, the actual effects of PFDA and MEV internalization, and changes in competitor market shares.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。