Why the Classic Rotation of Cryptocurrencies Has Failed in This Cycle

Author: Ignas

Translated by: Baihua Blockchain

Long time no see. My argument about why cryptocurrencies have underperformed compared to other industries over the past year has been validated.

In previous articles, I referred to it as "The Great Rotation," but I rarely had detailed sources to clearly explain its meaning. As Ray Dalio might say, this phenomenon has occurred many times in other industries, but it has never happened in the lifecycle of cryptocurrencies.

BTC has won, and early BTC advocates are realizing profits.

This is not a panic sell-off, but a natural process of decentralizing from centralized exchanges.

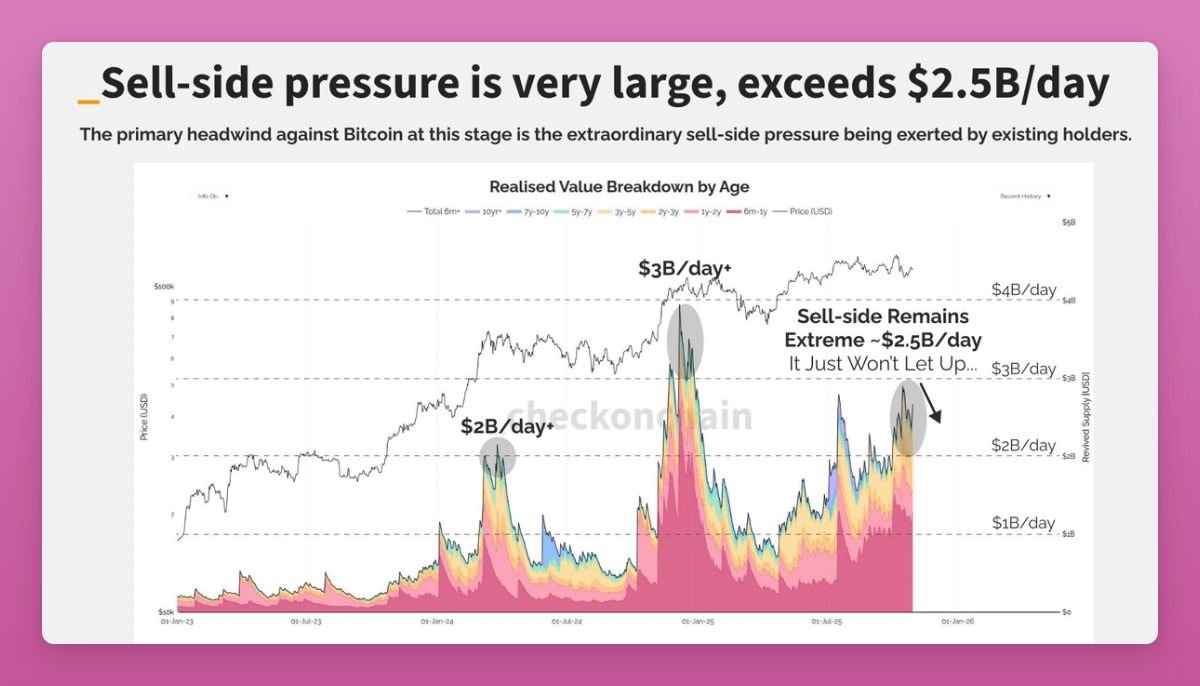

Among all traceable on-chain metrics, the signal is the selling off by whales.

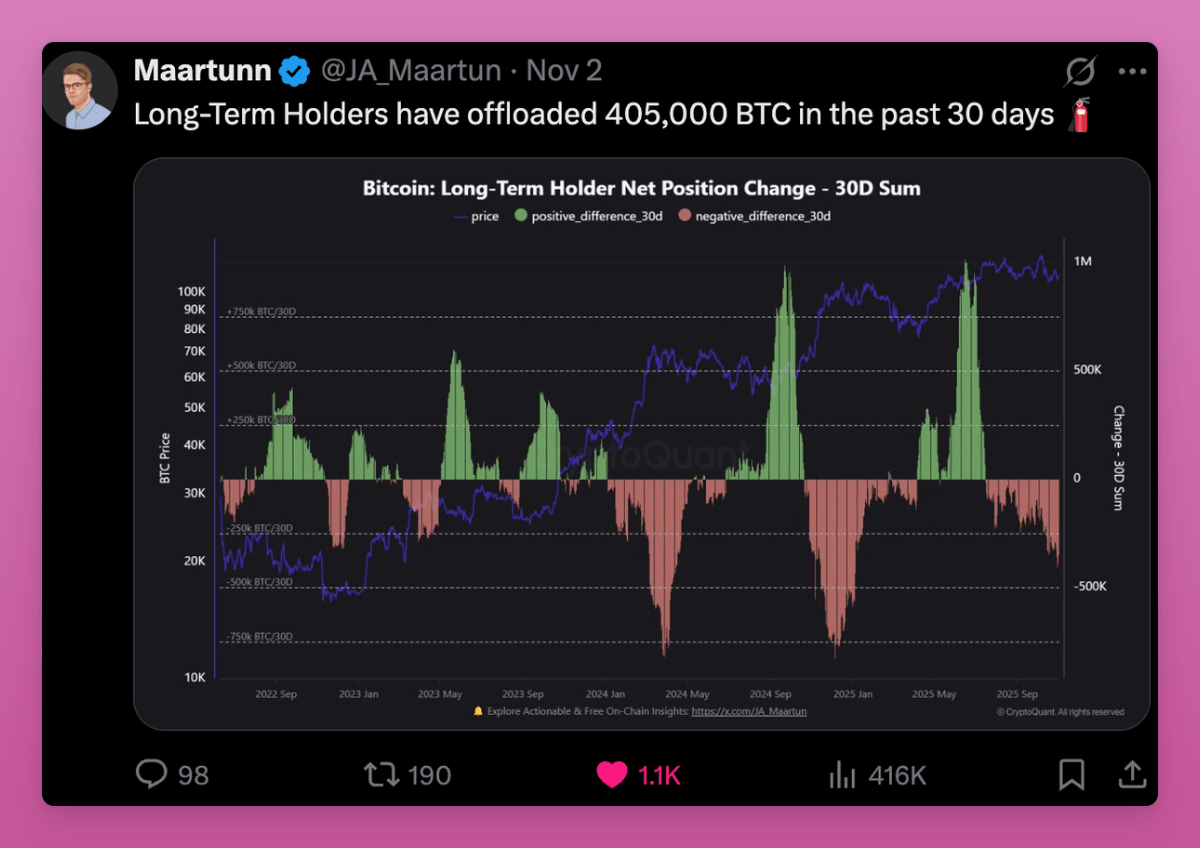

Long-term holders sold 405,000 BTC within just $30. This accounts for 1.9% of the total BTC.

Take Owen Gunden as an example.

- Owen Gunden is an OG Bitcoin whale. He has traded extensively on Mt. Gox, building huge positions, and is a board member of LedgerX. His associated wallet holds over 11,000 BTC, making him one of the largest individual holders on-chain.

Recently, his wallet has started sending large amounts of Bitcoin to Kraken. He transferred thousands of tokens in several batches, which usually indicates a sell-off. On-chain analysts believe he may be preparing to sell off most of his holdings, worth over $1 billion. He hasn't tweeted since 2018, but this move aligns with my "Great Rotation" theory. Some are turning to ETF considerations for value advantages or selling for portfolio valuation (buying $ZEC?).

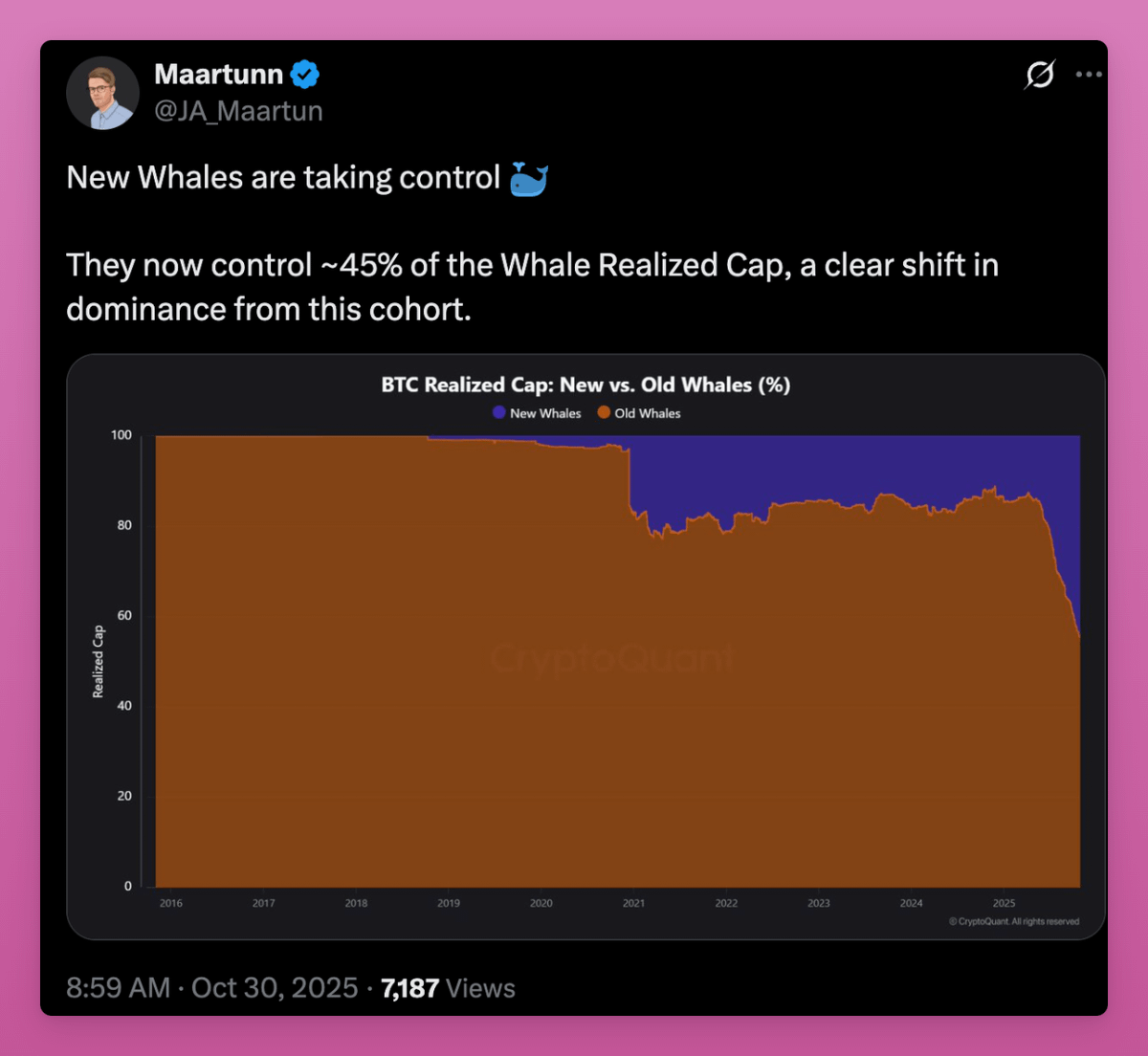

As supply shifts from OG holders to new buyers, unrealized profits continue to rise. New whales are now gaining control.

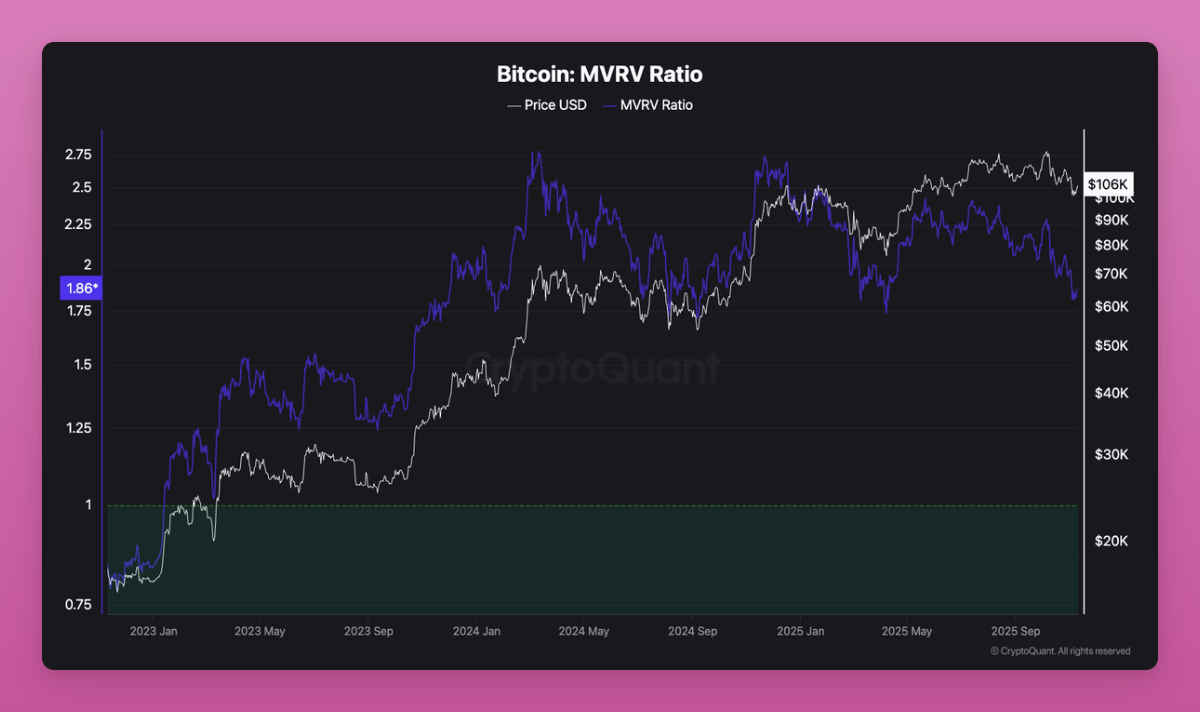

You can see the MVRV (Market Value to Realized Value) rising as the average cost basis shifts from early miners to ETF buyers and new institutions.

Source: Cryptoquant

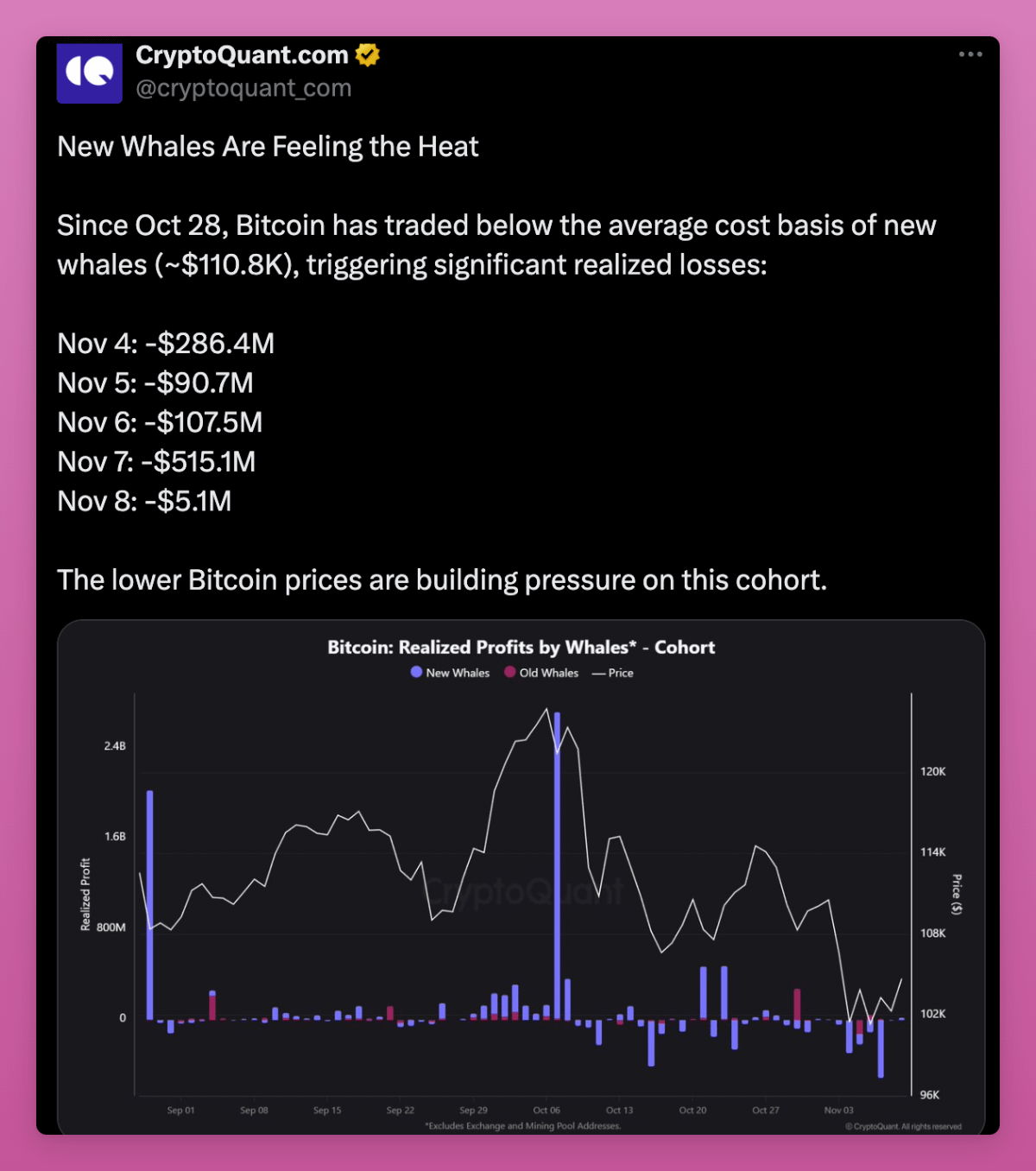

Some might say this looks like it will drop, as OG whales have long held significant profits while new whales are at a loss.

The average cost basis nearing $110,800 raises concerns that if BTC continues to lag, new whales may sell.

But the rise in MVRV indicates that the thread is decentralizing and becoming more mature.

Bitcoin is shifting from a few low-cost holders to a more diversified base with a higher cost basis. This is bullish.

Ethereum

BTC has won, but what about ETH?… Can we see the same Great Rotation pattern in ETH? Like BTC, this may partially explain the lag in ETH prices.

At first glance, ETH also seems to have won: both have ETFs, DATs (Digital Asset Trusts), and institutional interest, although of different natures. Data suggests that ETH is undergoing a similar transitional phase, just earlier and more chaotic.

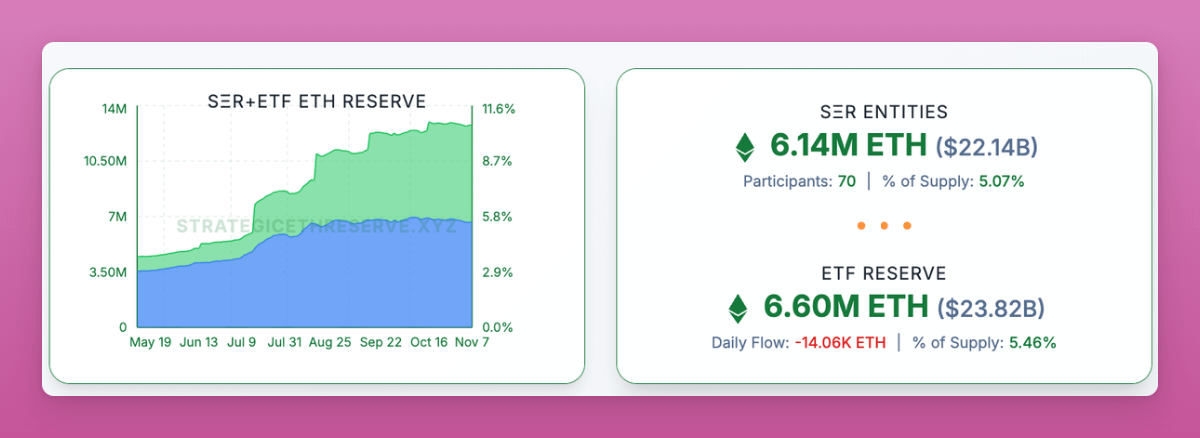

In fact, ETH is in a significant transition to catch up with BTC: about 11% of ETH is now held by DATs and ETFs…

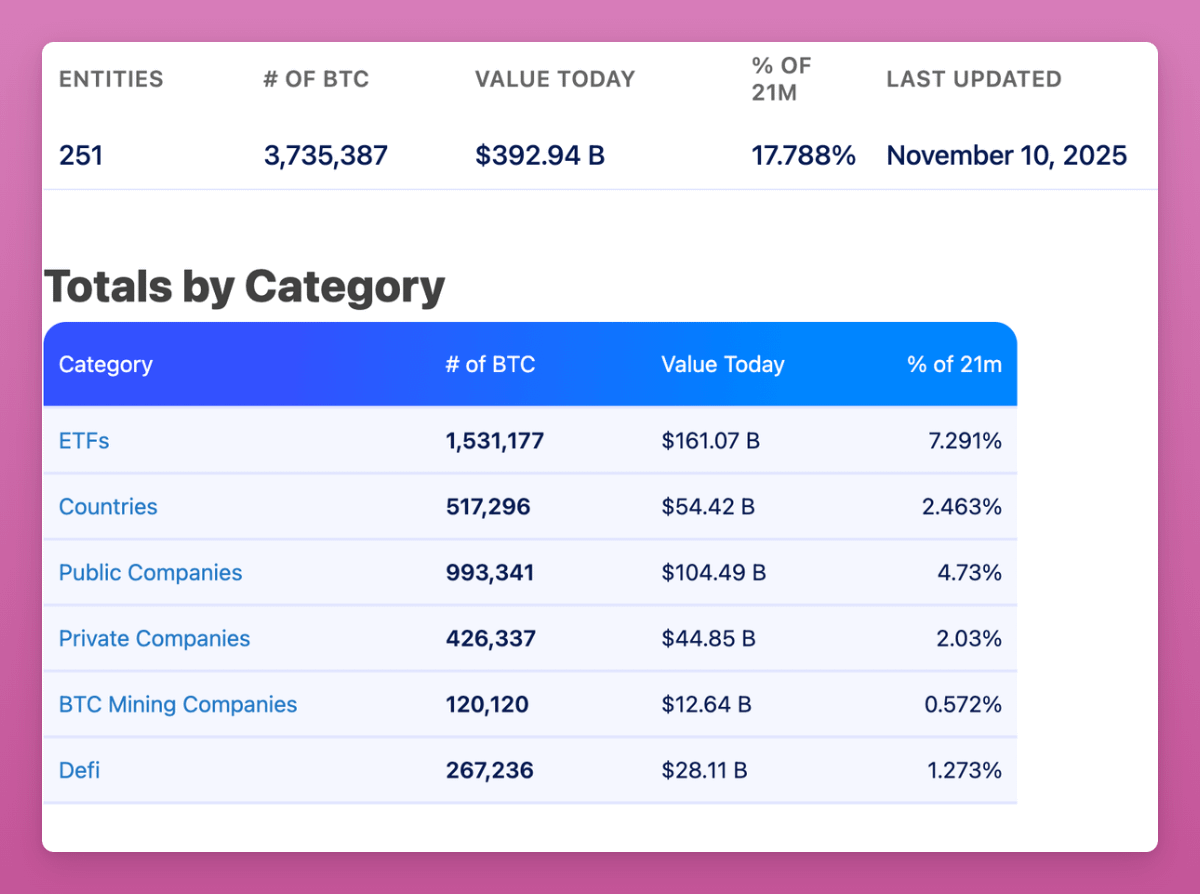

While BTC has about 17.8% considered to be held by spot ETFs and large vaults. With Saylor's years of purchases, ETH is catching up quickly.

I tried to find data on ETH to verify whether old whales are selling to new whales like BTC, but I couldn't find it. I even contacted Ki Young Ju from CryptoQuant, who told me it's difficult because ETH uses an account model rather than Bitcoin's UTXO model.

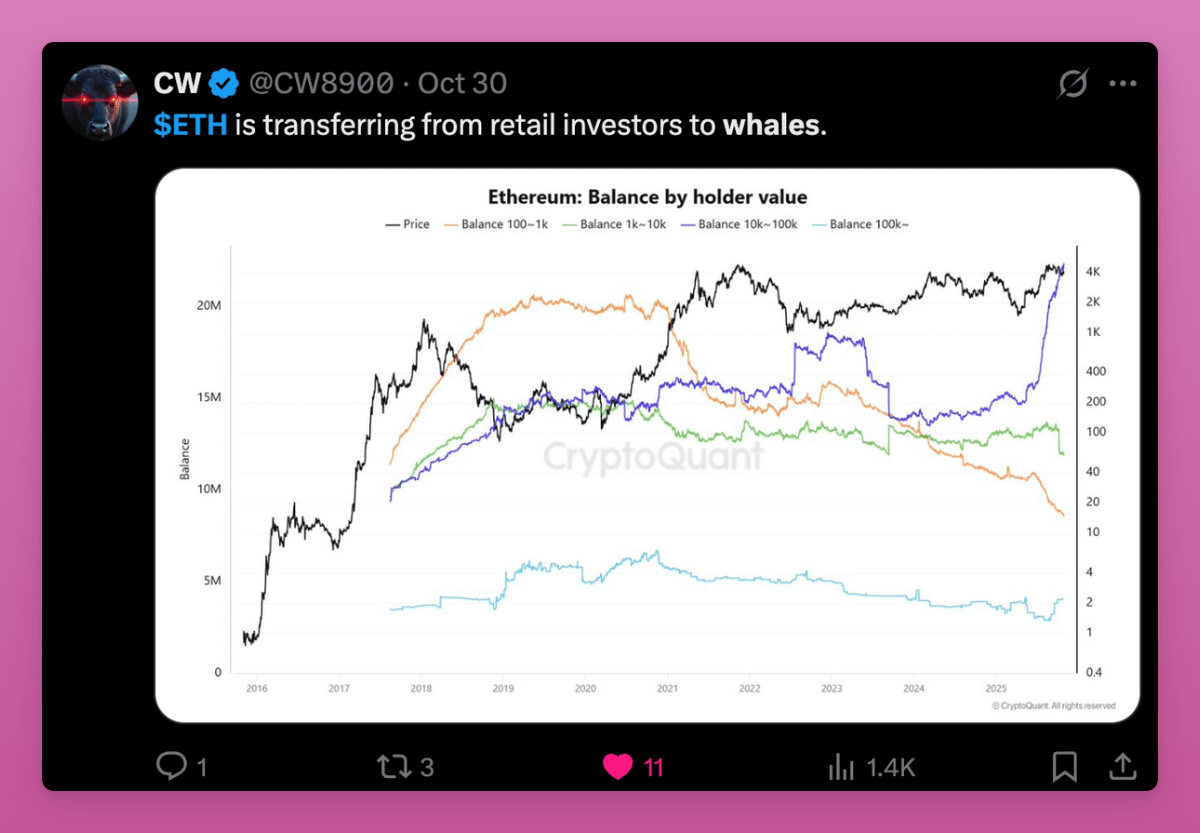

In any case, the main difference seems to be that the transition in ETH is from retail to whales, while the main transition in BTC is from OG whales to new whales.

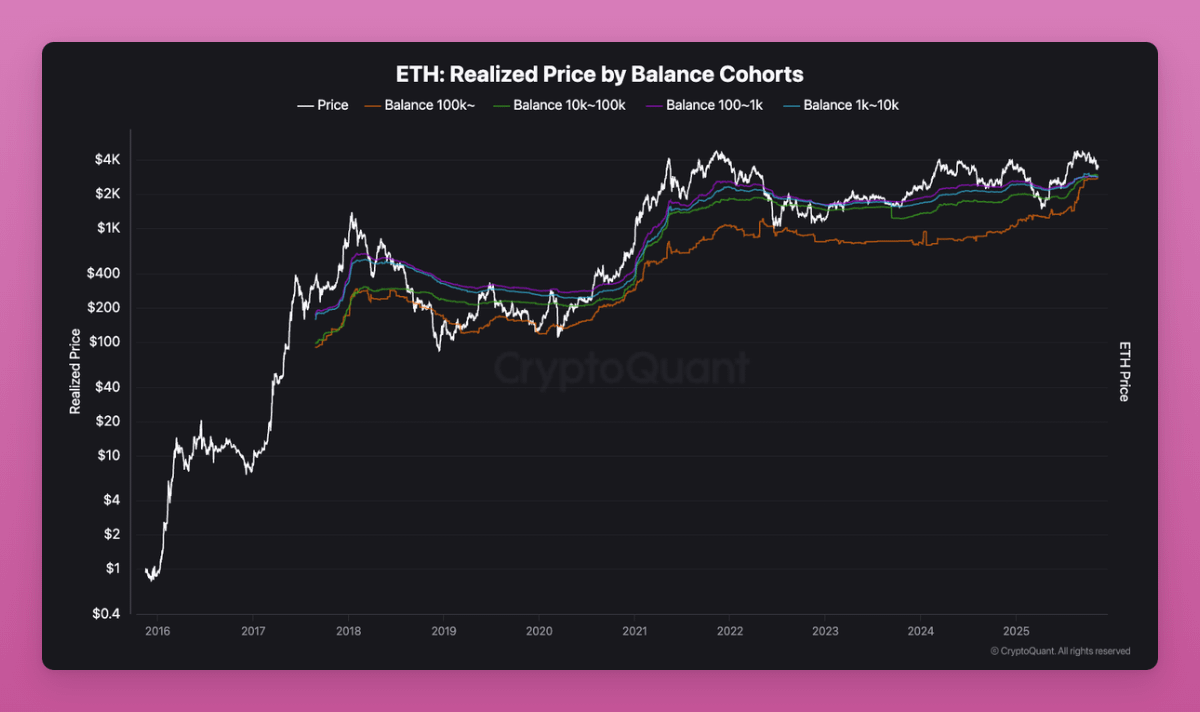

The following chart also shows the transfer of ETH from retail to whales.

The realized price of large wallets (100,000+ ETH) is rising rapidly, indicating that new large buyers are entering at higher prices while smaller holders are selling.

Note that all lines (orange, green, purple) are now clustering in the same vicinity. This means that wallets of various sizes share similar cost bases, which is a unification indicating that old cheap chips have rotated into new hands. This reset level of cost basis should occur at the end of the accumulation cycle and major price increases. Structurally, this indicates that ETH supply is consolidating into stronger hands. This is bullish for ETH.

This transition makes sense because:

ETH: Retail is surrendering while whales and funds are accumulating, due to 1) stablecoin and tokenization adoption 2) staking ETFs 3) institutional adoption

Retail previously viewed ETH as "Gas," and they lost when other L1s emerged. Belief whales see it as yield-bearing collateral and accumulate for long-term on-chain gains.

BTC has won, while ETH remains in a gray area, leading whales to enter early before institutions.

The combination of ETFs and DATs makes the ETH holder base more institutionalized, but it remains to be seen whether they align better with long-term growth.

The main FUD (Fear, Uncertainty, and Doubt) point is that ETHZilla announced it would sell ETH to buy back its stock price. This is not a reason for panic, but it has set a precedent.

Overall, ETH aligns with the Great Rotation theory. It’s just that its structure is not as pronounced as Bitcoin's, because ETH's holder base is more flexible, with more examples (like liquidity inflows into a few large wallets), and holders have more reasons to transfer tokens on-chain.

Solana

Figuring out Solana's unstable position in this rotation is a painful task. Even identifying team wallets or major holders is very difficult (I tried). However, some patterns have emerged.

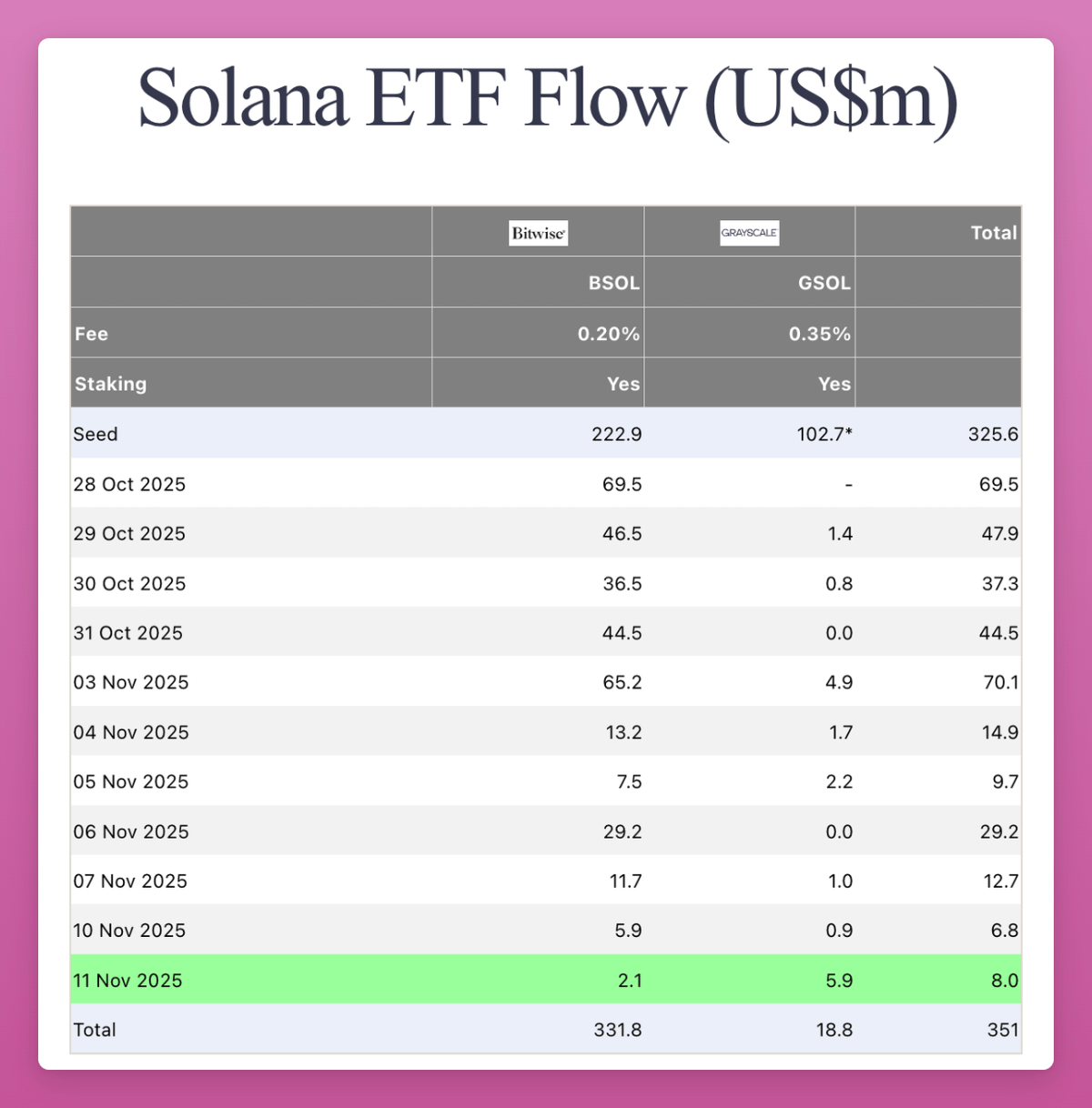

Solana is entering the same institutional phase as Ethereum. Last month, spot ETFs quietly launched in the U.S., with hardly any hype on CT (Crypto Twitter). The flow is not particularly high (totaling $351 million), but there is positive inflow daily.

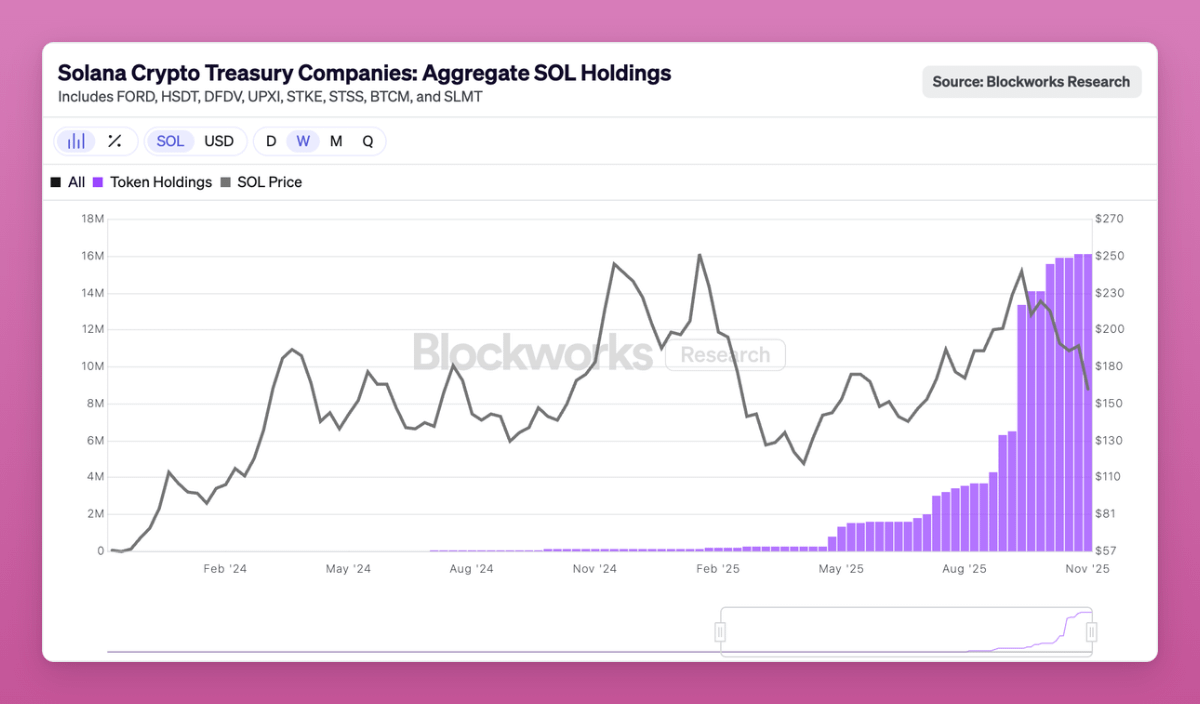

Some early DATs have also started purchasing SOL, in considerable amounts:

Currently, 2.9% of all SOL circulation exists in DATs, worth $2.5 billion.

Thus, Solana currently has the same TradFi investor infrastructure as Bitcoin and Ethereum, including regulated funds and corporate treasuries, just on a smaller scale. On-chain data is messy, but supply remains concentrated in early insiders and VC wallets. Gradually, these tokens are being transferred to new institutional buyers through ETFs and vaults. The Great Rotation has become associated with Solana. It just happened a cycle late.

Therefore, if the rotation of BTC and to some extent ETH is nearing its end, and prices could rise at any time, then the situation for SOL is not so hard to predict.

What Happens Next?

As BTC matures first, the lag in ETH is about to come, and SOL will take longer. So, where does that leave us in the cycle?

In past cycles, the flow was simple: BTC rises, then ETH rises, and the gains permeate. Cryptocurrency suddenly profits from mainstream coins, then rotates into low market cap altcoins, boosting the entire market. But this time it’s different.

This cycle has already reached the BTC stage. Even if BTC rebounds, OGs either exit ETFs or cash out, ultimately improving their lives outside the crypto casino. Wealth effect, no spillover effect, only the PTSD (Post-Traumatic Stress Disorder) brought by FTX and ongoing torment.

Altcoins no longer compete with BTC as "currency," but rather shift towards competition in utility, yield, and investment mechanisms. Most will not be able to pass these tests.

A minority will survive:

Chains with real utility: Ethereum, Solana, and perhaps a couple more

Products with advantages or real added value

Assets with unique demand that BTC cannot replace (like ZEC)

Infrastructure capable of capturing fees and attention

Stablecoins and RWAs (Real World Assets)

The emergence of innovation and experimentation in cryptocurrencies means I don't want to miss out on the next hot thing. But everything else will become noise.

The fee switch of Uniswap is a key moment: they are not the first, but the most prominent DeFi protocol, which has pressured all other protocols as they emulate and begin to share fees with token holders. 5 out of 10 network protocols are already sharing revenue with holders.

The result is that DAOs are becoming on-chain companies, and the valuation of tokens depends on the revenue they generate and redistribute. This is where the next rotation will happen.

Article link: https://www.hellobtc.com/kp/du/11/6116.html

Source: https://www.ignasdefi.com/p/the-great-rotation-btc-won-what-happens

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。