Abstract

● Oracles are the key infrastructure connecting blockchain and the real world: They can securely and transparently bring off-chain data (such as prices, events, asset statuses, etc.) on-chain, enabling smart contracts to perceive and interact with the real world, becoming the "trust engine" and "data settlement layer" of the Web3 ecosystem.

● Market scale explosion: Oracles have upgraded from being the price input layer of DeFi protocols to the underlying trust foundation of the entire Web3 ecosystem. As of October 2025, the total locked value (TVS) in the oracle sector has surpassed $102.1 billion, with an overall market value exceeding $14.1 billion and annual call volumes reaching hundreds of billions, becoming an important component of the on-chain data economy.

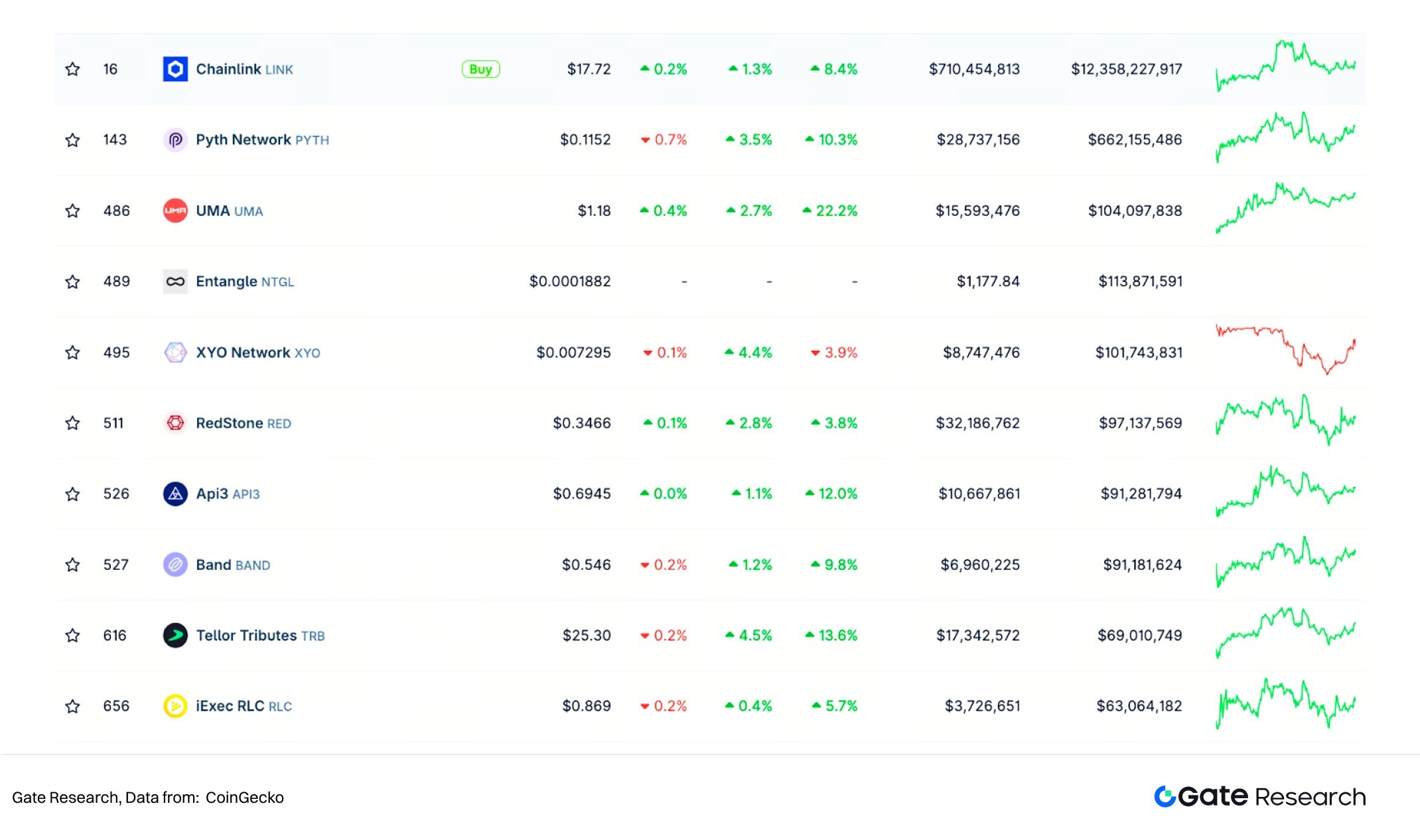

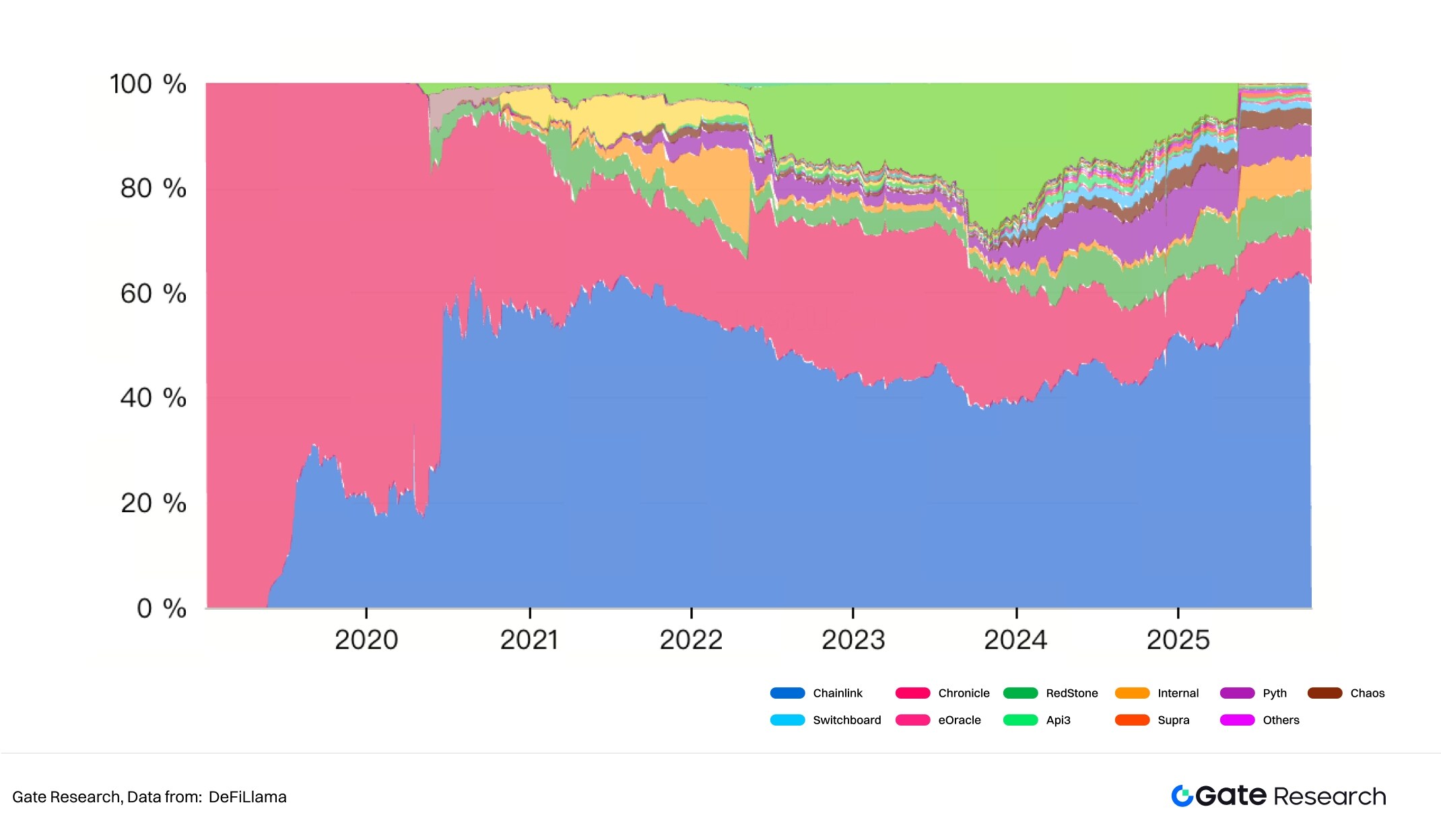

● Oligopoly pattern and shift in competition focus: The current market has formed an oligopoly dominated by Chainlink (with a market share exceeding 87% and a TVS share of 61.58%). The focus of competition is shifting from single price feeding efficiency to service quality, sustainability of economic models, and cross-chain communication integration capabilities. Meanwhile, emerging protocols like Pyth Network and RedStone are rapidly rising in low-latency and high-frequency data scenarios, forming differentiated competitive advantages.

● DeFi, RWA, and institutional adoption become core driving forces: The growth of oracles has formed a "multiplier effect" pattern. DeFi (with a total TVL of about $168.3 billion) remains the primary battlefield; RWA (with asset sizes exceeding $35 billion) is becoming the most incrementally potential institutional growth engine; while emerging applications such as cross-chain communication (CCIP), prediction markets, and AI + Oracle constitute the second growth curve for the future.

● Value capture model transformation: from call volume-driven to service staking model. The industry is transitioning from an early revenue structure reliant on call volume to an economic cycle system centered on node staking, security budgets, and service fees. This model provides oracle tokens with long-term sustainable value support and establishes their macro-financial position as a "decentralized trust layer."

● Future valuation anchoring: The long-term value of oracle tokens (such as LINK) is jointly determined by protocol revenue, the quality of TVS growth, and staking ratios. The valuation logic is also shifting from "narrative-driven" to focusing on fundamental indicators such as MCap/TVS. Current estimates suggest that LINK's long-term reasonable valuation range is $26–35; introducing a Smart Value Recovery (SVR) mechanism could amplify the overall valuation by about 1.2–1.5 times, with price potential reaching $40–45.

● Macro-financial connection and the birth of "information interest rates": Oracles are becoming the key hub between real finance and on-chain finance. By synchronizing macro data such as bond yields, exchange rates, and interest rate curves in real-time, and exploring CCIP settlement paths with institutions like SWIFT and Visa, oracles are driving the digitalization of real finance and giving rise to a new revenue concept centered on data—information interest rates.

Keywords: Gate Research, Oracles, Chainlink, Pyth Network

1. Introduction

In the closed system of blockchain, smart contracts can ensure the determinism of the computation process and consensus on results, but they cannot actively access off-chain information. This design guarantees the security of the system but also brings inherent limitations—the on-chain world cannot directly "understand" changes in the real world, such as asset price fluctuations, weather events, or payment statuses. Oracles have emerged as a key infrastructure in this context: they are the trusted transmission layer connecting blockchain and the real world, securely, transparently, and verifiably bringing external uncertain information on-chain, thus endowing smart contracts with the ability to perceive and interact with the real world.

By 2025, the strategic position of oracles has been completely reshaped. They are no longer just the price input layer for DeFi protocols but have become the "trust engine" and "data settlement layer" of the entire Web3 ecosystem. In an increasingly complex environment of multi-chain parallelism and cross-chain communication, oracles are responsible for providing trusted data inputs for core modules such as DeFi, stablecoins, RWA (real-world assets), cross-chain communication, prediction markets, and PayFi. According to data from DefiLlama and CoinGecko, as of October 2025, the overall valuation of the oracle sector has exceeded $14.1 billion, with the total locked value (TVS) of mainstream decentralized oracles surpassing $100 billion, and annual call volumes reaching hundreds of billions, serving thousands of on-chain protocols. Among them, Chainlink remains the dominant player in the industry, while emerging projects like Pyth, UMA, and RedStone continue to innovate and break through in low-latency data distribution, privacy computing, and "decentralized publishing networks."

Figure 1: Market Value of the Oracle Sector

From the perspective of ecological demand, oracles are the underlying engine driving the expansion of on-chain applications, serving as the foundational connection layer for DeFi, RWA, and the emerging data economy. From the perspective of economic models, the value capture of oracle tokens is undergoing a structural transformation—from the early reliance on call volume as "Gas-type revenue" to a transition towards a "service staking model" centered on staking security and service economy. From the perspective of macro finance, the role of oracles is evolving from a "data relay layer" to a "decentralized trust layer," becoming a key pivot for the digitalization of the real financial system and the integration of crypto finance. They provide traditional financial (TradFi) institutions with a verifiable, compliant, and secure mechanism for asset and data on-chain, reshaping the trust logic of global financial infrastructure. Therefore, this report will systematically reveal the internal logic and value evolution path of the oracle sector from three mutually supportive dimensions:

Ecological demand perspective: Analyzing how DeFi, RWA, prediction markets, and AI scenarios drive the continuous growth of oracles;

Economic model perspective: Analyzing how oracles form value capture mechanisms through data consumption, node staking, and token circulation;

Macro-financial perspective: Exploring the opportunities and potential risks of oracle expansion in the trend of integration between on-chain finance and traditional finance.

Through this analytical framework, we believe that the long-term value of oracles far exceeds the single functions of "price feeding" or "cross-chain verification," and lies in their role in shaping a new economic layer centered on "verifiable data." Future competition will no longer be about who provides faster data, but about who can become the "trusted source of truth" supporting the operation of trillions of digital assets. In this sense, oracles are not only the data entry point of the Web3 world but also the ultimate trust cornerstone of the next-generation financial system.

2. Overview of Oracles: The Trust Engine Connecting On-Chain and the Real World

2.1 Definition and Core Functions of Oracles

Blockchain is essentially a deterministic, closed system. To ensure that global nodes reach consensus after executing the same transaction, smart contracts cannot directly access off-chain data (such as prices, weather, IoT information, or corporate databases). Therefore, smart contracts face limitations of "blindness" and "deafness" in the face of real-world information, known as the "oracle problem."

Oracles are the core infrastructure created to solve this "information island problem." They are not tools for predicting the future but secure middleware, acting as "data notaries" and "information translators." Their core responsibility is to securely and reliably transmit off-chain, uncertain external data into the deterministic blockchain environment after verification and processing, for smart contracts to call.

Oracles are not just "data input ports," but the foundational layer and trust engine of the on-chain economy. They map the uncertainties of the real world into verifiable states on-chain through trusted mechanisms, greatly expanding the application boundaries of smart contracts. It can be said that if blockchain is the "skeleton" of the Web3 world and smart contracts are the "muscles," then oracles are the "value neural network" that connects and drives everything, endowing it with perceptual capabilities.

Typical functions include:

● Price feeding: Providing real-time cryptocurrency exchange rates for DeFi protocols;

● Verifiable Random Function (VRF): Used for NFT minting, on-chain games, and lotteries;

● Proof-of-Reserve: Verifying the reserves of stablecoins or asset custodians;

● Cross-chain data transmission: Enabling information interaction between smart contracts on different public chains;

● AI/IoT data input: Supporting off-chain models or physical device data on-chain.

2.2 Basic Principles and Technical Architecture of Oracles

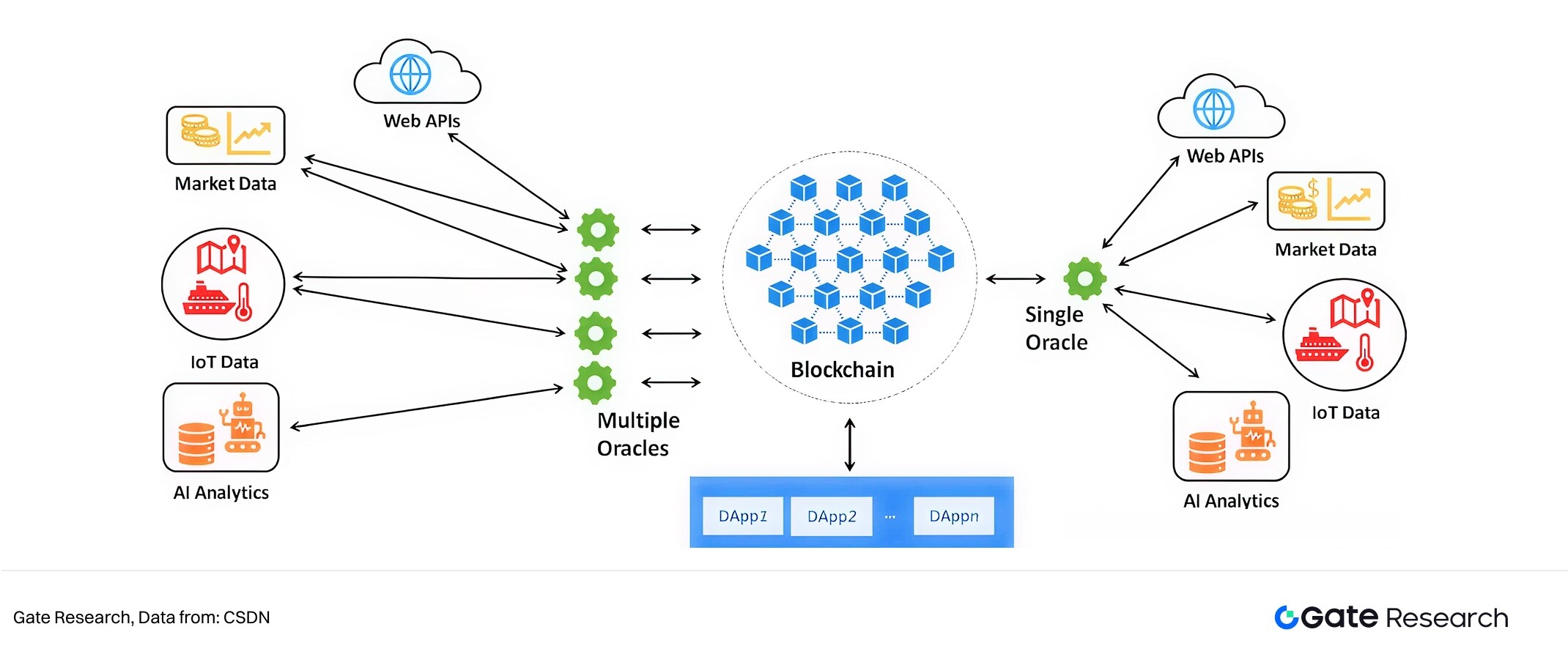

A typical oracle system aims to securely and accurately transform off-chain information into usable on-chain data, usually involving the following core processes and technical mechanisms:

1. Data Collection (Data Source Layer): Oracle nodes (or systems) first need to obtain information from off-chain raw data sources. These data sources are extremely diverse, including exchange market APIs, financial data providers, IoT device sensors, government public databases, sports event result websites, and even events that require manual input. The quality and diversity of data sources are the first line of defense for the reliability of oracles.

2. Off-Chain Processing and Verification (Aggregation & Verification Layer): After obtaining raw data, especially in decentralized oracle networks (DONs), multiple independent nodes perform verification and aggregation tasks.

○ Multi-source acquisition: To prevent manipulation or failure of a single data source, nodes typically obtain the same data from multiple designated sources.

○ Verification and consensus: Nodes sign the obtained data and aggregate and verify data from different nodes and sources through consensus algorithms (such as taking the median, weighted average, or excluding outliers). This step aims to eliminate erroneous or malicious inputs, generating a single, highly credible final value.

○ Economic incentive mechanisms: To ensure that nodes act honestly, staking and slashing mechanisms are usually introduced. Nodes need to stake native tokens as collateral, receiving rewards for providing reliable data, while malicious actions or downtime result in the forfeiture of tokens.

3. Data On-Chain and Transmission (Transmission Layer): The verified and aggregated final data is formatted and submitted to the chain through a blockchain transaction, typically stored in specific smart contracts deployed by the oracle service provider.

4. Contract Interaction and Consumption (Contract Layer): DApp smart contracts that require data read the necessary data by calling the interfaces provided by the oracle contract and trigger corresponding logical executions based on this data.

Figure 2: Oracle Technical Architecture

2.3 Development History and Classification of Oracles: From Centralization to Diversified Trust

The development of oracles is a history of continuous evolution in pursuit of security, decentralization, efficiency, and functionality. This evolution is reflected not only in the iteration of technical architectures but also in the deepening market demand for "on-chain trusted data."

2.3.1 Development Stages: From Single Point Trust to Decentralized Networks

The development of the oracle sector can be roughly divided into three key stages:

First Stage (Approx. 2014-2017): The Era of Centralized Oracles

● Characteristics: Early solutions were typically operated by project teams or single entities running a centralized server, which fetched data from external APIs via scripts and directly published it on-chain.

● Although this model was simple and efficient, it had fatal single points of failure and trust risks. If the centralized entity acted maliciously, was attacked, or ceased operations, all DApps relying on its data would face the risk of paralysis. Therefore, this model has been eliminated by the mainstream market and is only suitable for low-value or internal testing scenarios.

Second Stage (Approx. 2017-2021): The Birth and Establishment of Decentralized Oracle Networks (DONs)

● Characteristics: Marked by the rise of Chainlink. The core innovation was the introduction of a decentralized network architecture composed of numerous independent, geographically dispersed node operators; the introduction of economic incentive mechanisms, where nodes must stake native tokens as collateral, earning rewards for honest behavior while malicious actions (providing incorrect data) would result in penalties; and the introduction of multi-source aggregation, where nodes obtain the same data from multiple sources and aggregate it through on-chain consensus algorithms (such as taking the median) to resist errors or manipulations from a single data source.

● DONs significantly enhanced the security and reliability of oracles through decentralization and economic incentive mechanisms, enabling them to support DeFi applications with values in the hundreds of billions, becoming the industry-recognized "gold standard."

Third Stage (Approx. 2021 to Present): Specialization, Efficiency Optimization, and Function Expansion

The market has evolved towards more specialized, efficient, and feature-rich models based on DONs. On one hand, new models optimized for specific scenarios have emerged, such as first-party oracles (Pyth Network, where data sources run nodes directly) and optimistic oracles (UMA, using a "propose-dispute" model). On the other hand, the functions of oracles have expanded beyond simple data feeding to include more complex services such as off-chain computation, cross-chain interoperability, and verifiable randomness (VRF), evolving into a general decentralized computing platform.

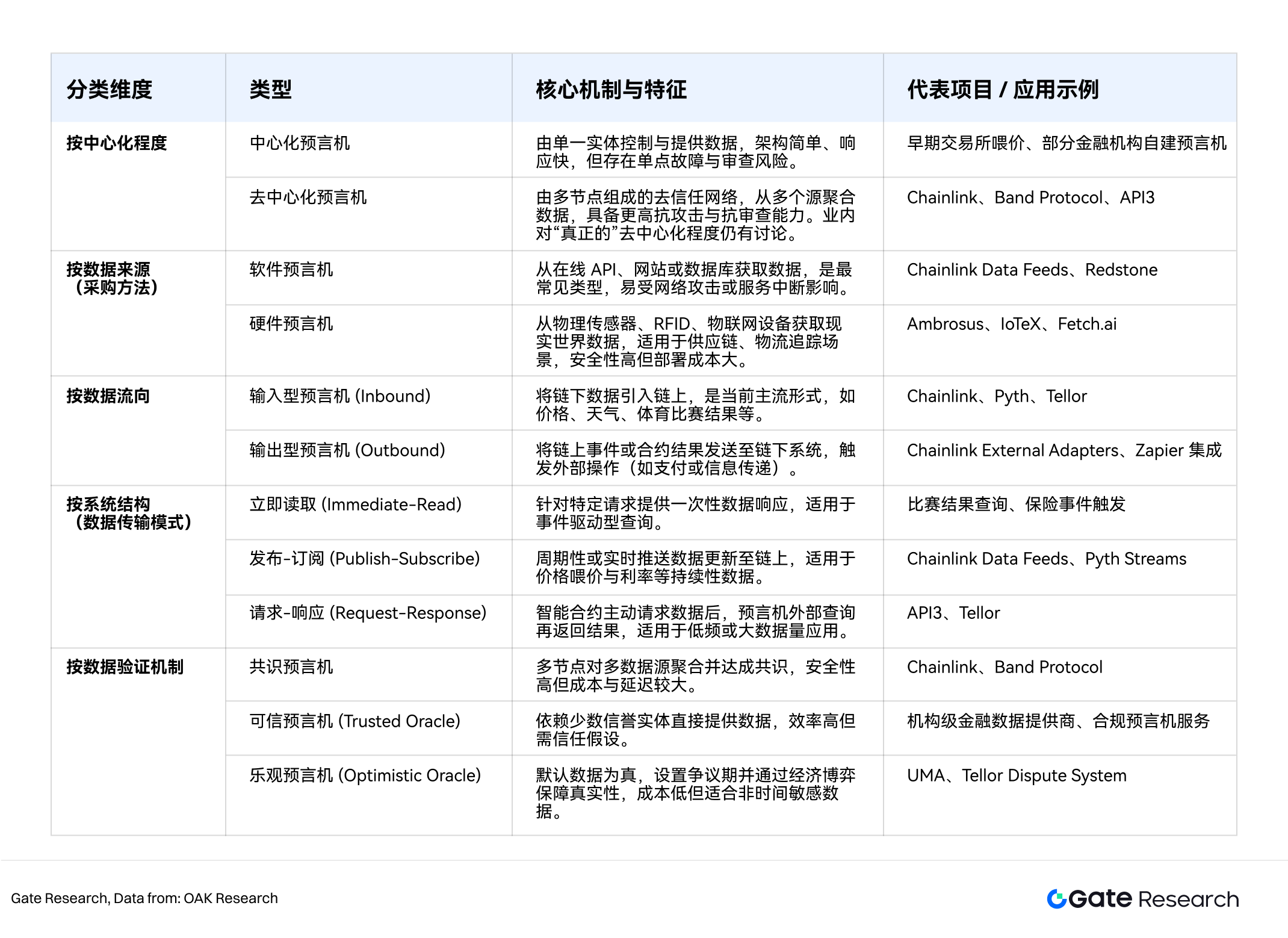

2.3.2 Multi-Dimensional Classification: Understanding Different Paradigms of Oracles

To comprehensively understand the diversity and systemic differences of oracles, they can be classified from multiple dimensions, including degree of centralization, data sources, data flow, system structure, and verification mechanisms. Different dimensions reflect the trade-offs of oracles in terms of security, performance, trust models, and costs, and also indicate their adaptation paths in diversified Web3 applications.

Figure 3: Classification of Oracles

In summary, there are many classification dimensions for oracles, but they are not mutually exclusive; rather, they intersect in multiple dimensions. For example, Chainlink possesses a decentralized structure, software data sources, input types, and a publish-subscribe architecture, ensuring data reliability through node consensus and cryptographic signature mechanisms; while Pyth Network simplifies off-chain dependencies with a "first-party data provider" model, achieving a balance between speed and trust. Understanding these paradigms helps researchers weigh security, cost, latency, and verifiability in different applications, and build optimal oracle architectures tailored to specific needs (such as high-frequency clearing, RWA auditing, or AI predictions).

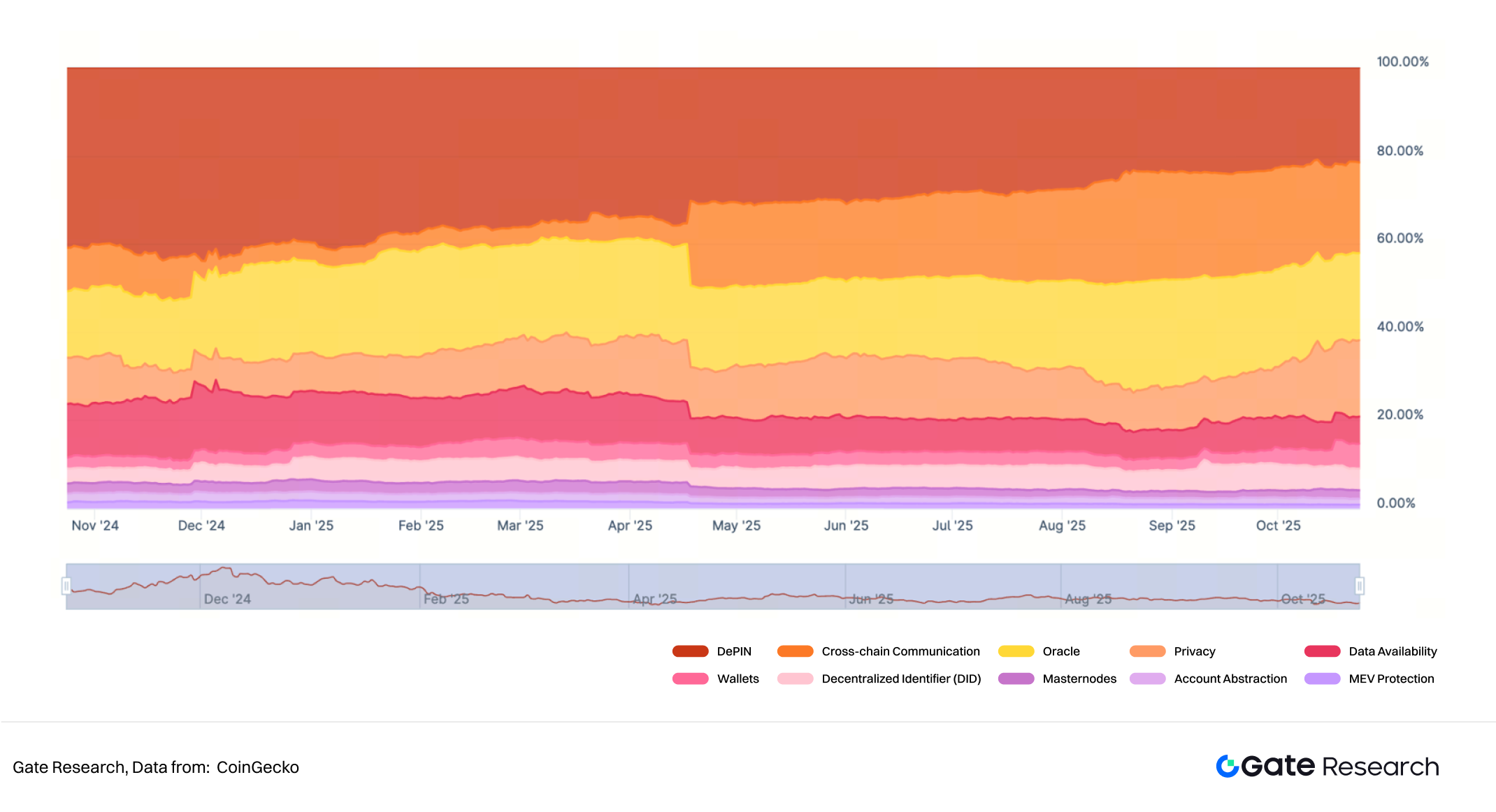

2.4 Industry Scale and Market Landscape of Oracles

2.4.1 Market Scale: From Functional Components to Infrastructure Ecosystem

Over the past five years, the oracle market has undergone an evolution from "auxiliary infrastructure" to "core data layer." Oracles no longer merely serve the function of on-chain data input but have become the underlying support for key modules such as DeFi, RWA, derivatives, and cross-chain communication.

As of October 2025, according to DefiLlama Total Value Secured (TVS) and CoinGecko market data, the overall locked value of oracle protocols is approximately $102.179 billion, with an overall market value of about $14.1 billion, representing a growth of over 43% compared to the same period in 2024 (approximately $9.8 billion). In the blockchain infrastructure sector, the market value share of oracles has approached 20%, making it one of the fastest-growing subfields.

Figure 4: Market Value Share of Different Blockchain Infrastructure Sectors

2.4.2 Market Landscape: Head Dominance and Multi-Layered Expansion

From a competitive structure perspective, the current oracle market has formed an oligopoly centered around Chainlink, gradually developing a multi-layered specialized competition system. The overall industry structure exhibits a typical "head dominance + emerging breakthroughs" characteristic: Chainlink builds a solid moat based on multi-chain compatibility and enterprise partnerships, firmly occupying the market core; Pyth Network has native performance advantages in high-frequency trading public chains (Solana, Sui, Aptos), quickly capturing specific niche markets; API3 and RedStone focus on data transparency and native API access, enhancing first-party data source capabilities to achieve differentiated competition.

In terms of market capitalization structure, Chainlink dominates the industry with over 87% market share, with a market value of approximately $12.3 billion; followed by Pyth Network (approximately 4.6%), UMA (approximately 0.73%), and XYO (approximately 0.71%). Chainlink has built a solid ecological barrier through deep integration in core scenarios such as DeFi, cross-chain communication (CCIP), and proof of reserves (PoR); while emerging protocols like Pyth, UMA, and RedStone continue to expand their differentiated competitive space through innovations in high-speed data distribution, privacy computing, and first-party data source mechanisms.

Figure 5: Market Capitalization of Top Oracle Protocols

In terms of locked value, the total collateral value in the industry has exceeded $102.1 billion. Among them, Chainlink holds an absolute leading position with a market share of 61.58% (TVS reaching $62.922 billion); followed by Chronicle (10.15%) and RedStone (7.94%), with Pyth Network ranking fifth at 5.84% and API3 at ninth with 0.55%. Overall, although Chainlink still dominates the market, the penetration speed of emerging protocols is noticeably accelerating, and the industry structure is evolving from a unipolar to a multipolar landscape.

Figure 6: TVS Share of Top Oracle Protocols

From the perspective of on-chain ecological distribution, the use of oracles is showing a clear trend towards multi-chain and ecological binding. Based on weighted analysis results from multiple data sources such as DefiLlama and Dune Analytics:

● The Ethereum ecosystem remains the core battlefield for oracle applications, relying on the extensive deployment of Chainlink's official Data Feeds, gathering the main sources of calls and revenue (among over 2,000 protocols integrating Chainlink, the number deployed on Ethereum reaches 1,339);

● Solana's growth momentum is reflected in the high-frequency updates and continuously rising call volumes of Pyth Network, which has rapidly risen in high-frequency derivatives and real-time data scenarios due to its high throughput and low latency characteristics;

● Layer 2 networks (such as Arbitrum, Base, Optimism, etc.) have become the fastest-growing frontiers for oracle protocol expansion, with their call volume curves observable in Chainlink CCIP and L2 statistics;

● Emerging public chains (such as Sui, Aptos, Sei) tend to build built-in or vertically integrated oracle systems through deep integration with RedStone and Pyth.

Overall, the market is gradually evolving from single-chain dependence to a multi-chain collaborative pattern. Leading protocols are reshaping the competitive landscape through the integration of data layers and cross-chain communication layers, and oracles are evolving from basic functional components to the most strategically significant "data hub infrastructure" in the blockchain ecosystem. In summary, the oracle market in 2025 has evolved from a "single-point price feeding tool" to a "cross-ecosystem data coordination layer." With the influx of institutional funds and the advancement of RWA, the industry will enter a second round of protocol upgrade cycles, and future competition will shift from single price feeding efficiency to service quality, sustainability of economic models, and cross-chain communication integration capabilities.

3. Ecological Demand Perspective: Oracle-Driven Expansion of On-Chain Applications

As the functions of oracles expand, their on-chain application scenarios continue to enrich, evolving from simple price feeding to multi-type event triggers and cross-chain data coordination, making oracles a driving force for on-chain innovation.

3.1 The Ecological Position of Oracles: The "Input Layer" of On-Chain Applications

The core value of oracles lies not only in "data transmission" but also in their foundational input position within the entire Web3 technology stack. In a typical Web3 architecture, the information flow presents the following hierarchy:

User Layer (Wallet / DApp) → Application Layer (DeFi, RWA, Prediction Markets, On-Chain AI) → Protocol Layer (Smart Contracts) → Oracle Layer (External Data Input) → Off-Chain Reality Layer (Prices, Events, Assets)

Thus, oracles become the "Truth Interface" of the entire decentralized system, and their reliability directly determines the credibility of on-chain applications:

● DeFi: Whether liquidation and collateral valuation are safe and reliable;

● RWA: Whether the mapping of real assets is accurate and trustworthy;

● Cross-Chain Assets: Whether state verification and transaction traceability are guaranteed;

● Prediction Markets: Whether settlement fairness is ensured;

● On-Chain AI Computation: The authenticity of data input and the credibility of decision-making.

In other words, the role of oracles in Web3 is akin to the "external data TCP/IP protocol" in the blockchain world. They are the foundational premise for building a trusted computing economy and the underlying infrastructure that drives the robust operation of on-chain innovations.

3.2 Ecological Demand Pattern: Five Main Lines of Oracle Growth

As the "value hub" connecting the real world and on-chain smart contracts, the growth potential of oracles is closely tied to the expansion of the entire Web3 ecosystem, particularly depending on the maturity and scaling of high-value application scenarios. By 2025, the demand for oracles has evolved from the early single DeFi price inputs to a "multiplier effect" pattern driven by multiple high-growth tracks.

3.2.1 Structural Driving Forces of Oracle Ecosystem Expansion

The growth of the oracle market size is driven by the following three key factors:

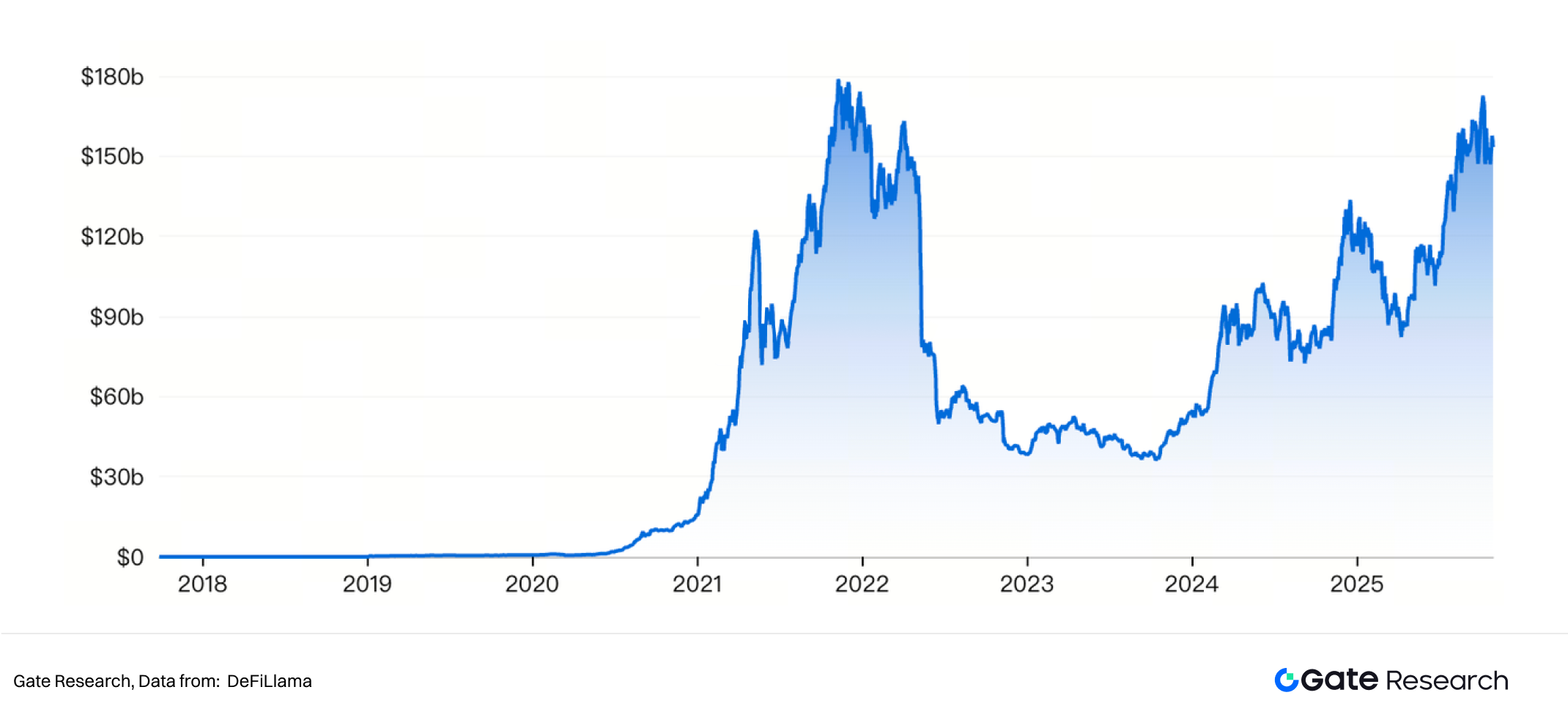

1. Expansion of DeFi Scale and Strengthening Systemic Dependence (TVL Driven): By October 2025, the total locked value (TVL) in DeFi reached approximately $168.373 billion, returning to the historical highs of DeFi Summer, indicating a continuous increase in on-chain capital scale. With over 80% of DeFi protocols relying on oracle data sources, DeFi has become the earliest and most core application domain for oracles. High-frequency scenarios such as lending liquidation, derivatives pricing, and asset valuation have created a natural ecological closed loop for oracles, establishing a stable value capture mechanism and competitive barrier within the DeFi system. Whether it is mainstream protocols like Aave, Synthetix, or GMX, their system security and asset anchoring are inseparable from reliable oracle data. This makes oracles the underlying infrastructure for risk control in DeFi and on-chain asset pricing.

Figure 7: DeFi TVL

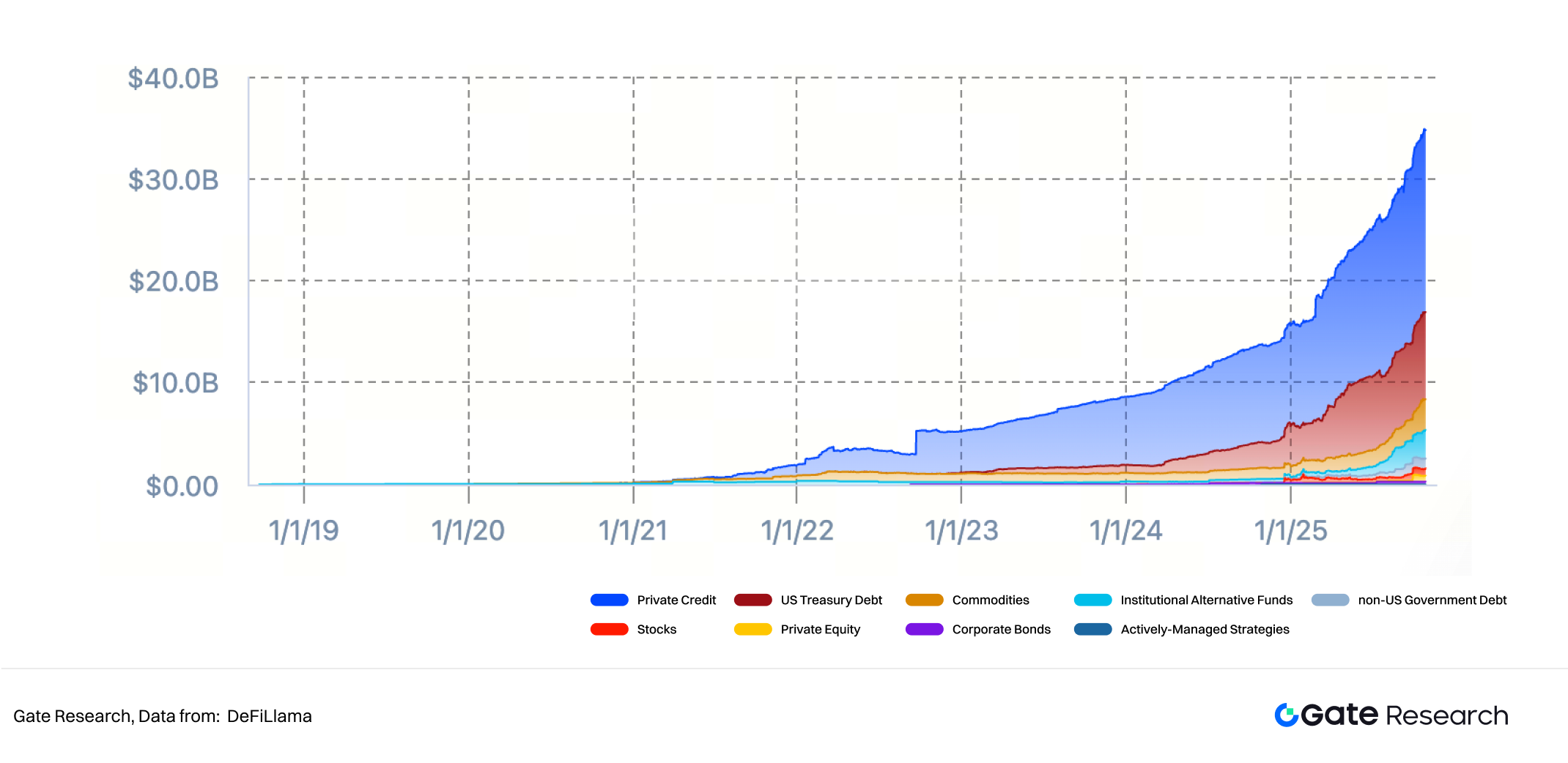

2. Institutional Growth of RWA and Demand for On-Chain Data from Off-Chain Sources: The rapid development of RWA is becoming the second core engine driving the demand for oracle services. By October 2025, the observable on-chain RWA asset scale has exceeded $35 billion and continues to grow steadily. Key data involved in RWA, such as valuation, interest rates, payment status, and credit ratings, all originate from off-chain systems and must rely on highly credible oracles for on-chain integration. Thus, the institutional expansion of RWA is constructing a long-term and rigid demand structure for the oracle market: the requirements for high-precision, low-latency data synchronization are continuously increasing; the demand for multi-source verification and audit proof is constantly enhancing; and the reliance on standardized interfaces for off-chain financial data (such as government bond interest rates, fund net values, and bill payments) is deepening. In other words, the rise of RWA is driving the injection of trillions of dollars in traditional financial liquidity into the oracle ecosystem, accelerating its evolution from "on-chain data services" to "cross-system data infrastructure."

Figure 8: Total Scale of RWA Assets

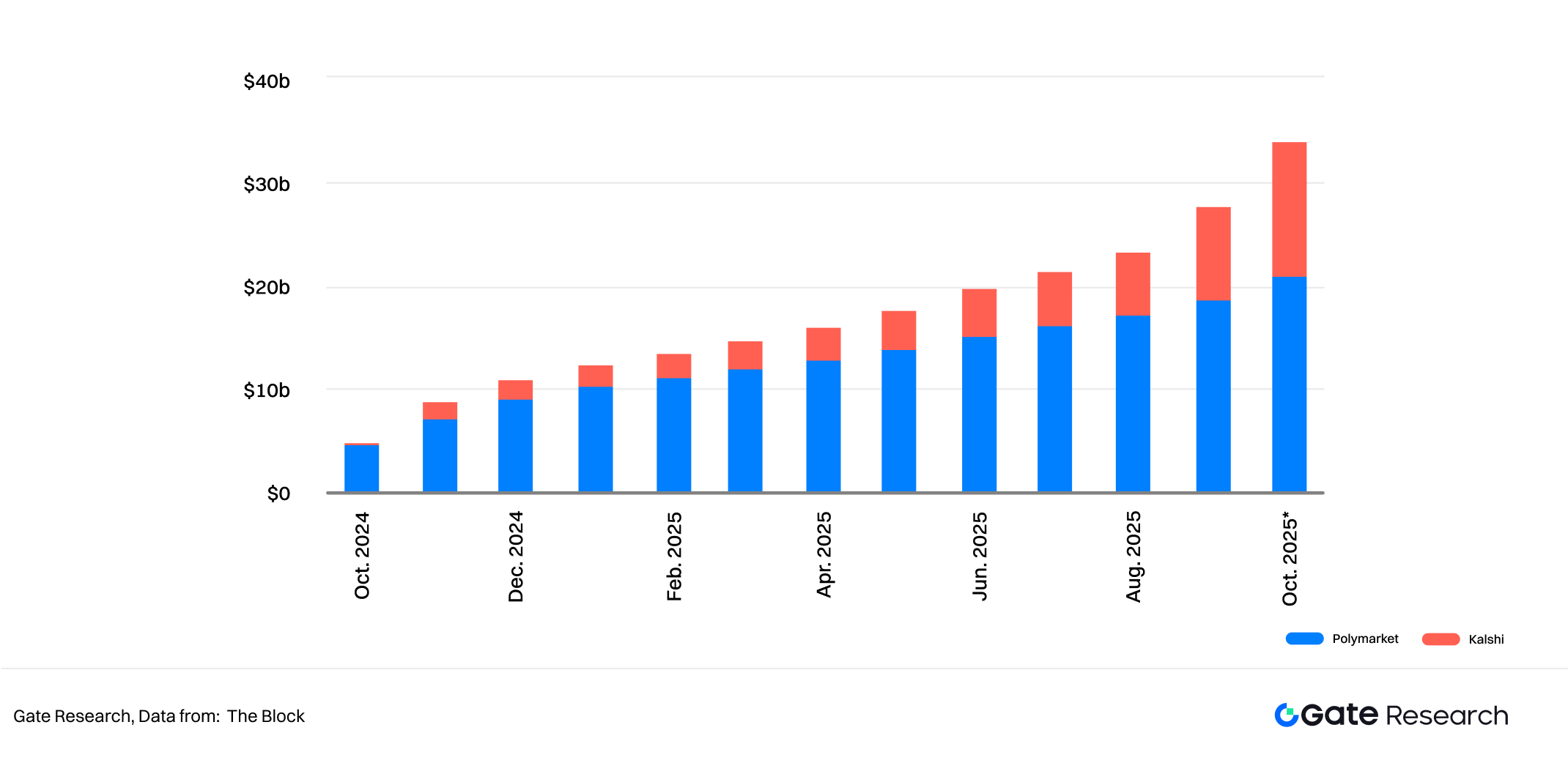

3. Explosive Demand for Low Latency and Cross-Chain Communication in Emerging Application Scenarios: The new generation of applications is placing higher performance and architectural requirements on oracles. With the rise of emerging scenarios such as AI and prediction markets, the demand for low-latency, high-precision data and cross-chain messaging has significantly increased. These applications not only require oracles to provide price information quickly and accurately but also need capabilities for multi-chain synchronization and trusted verification. For example, prediction markets are a typical application direction for oracles in the "event verification" domain. Platforms like Polymarket and Kalshi rely on oracles to confirm the outcomes of real-world events, such as election results, sports events, or macroeconomic data. As the trading volume in this field rapidly grows—by October 2025, the cumulative trading volume of Kalshi and Polymarket has reached $33.94 billion—the event verification and messaging capabilities of oracles are becoming an important force driving ecological expansion. Thus, the role of oracles is evolving from "information feeders" to "cross-chain event coordinators," further strengthening their stickiness and infrastructural position within the Web3 ecosystem.

Figure 9: Cumulative Trading Volume of Kalshi and Polymarket

Overall, the ecological demand for oracles is forming a spiral growth path from DeFi → RWA → high-performance new applications. In this process, oracles are no longer merely data input interfaces but are becoming the key foundation driving the financialization, assetization, and interoperability processes of Web3. In the future, their market growth logic will shift from single transaction demands to systematic data infrastructure construction, becoming the central layer for the credible operation of the on-chain economy.

3.2.2 Oracle and Ecosystem Correlation Matrix: From Dependence to Multiplier Effect

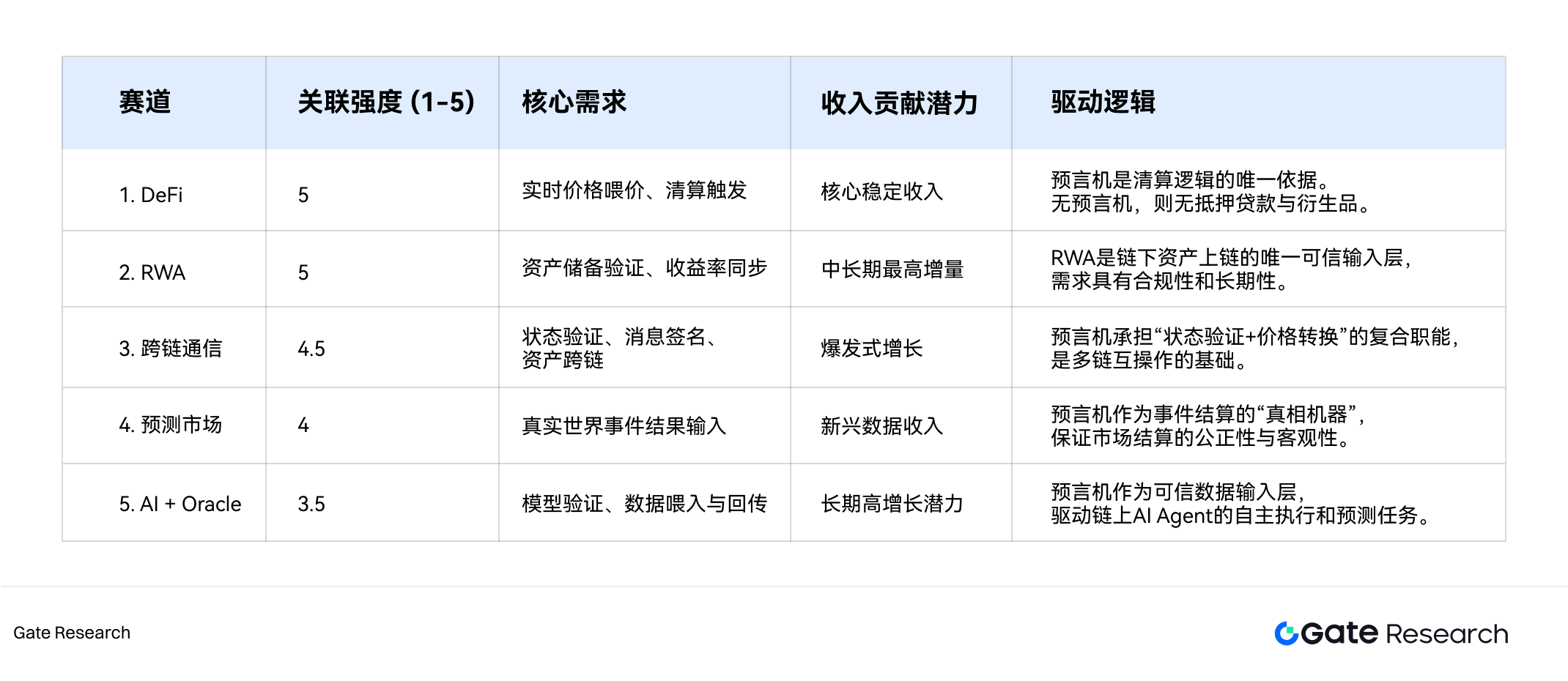

Based on the aforementioned three driving factors, and in conjunction with the current oracle call volume, revenue contribution potential, and strategic synergy, this report categorizes the main service targets of the oracle ecosystem into five core tracks: DeFi, RWA, cross-chain communication, prediction markets, and AI+Oracle. Among them, DeFi is the native main battlefield for oracles, RWA is the institutional growth engine, while cross-chain communication, prediction markets, and AI+Oracle constitute the emerging growth curve.

The value of oracles is highly correlated with the scale and depth of their service tracks. To quantify this relationship, this report constructs a "correlation strength matrix" to assess the degree of dependence of different tracks on oracle services. The model sets four equally weighted dimensions (each accounting for 25%): data dependence, call frequency, revenue contribution potential, and strategic synergy. The final scoring formula is as follows:

Correlation Strength = (Data Dependence + Call Frequency + Revenue Contribution Potential + Strategic Synergy) / 4

Based on this model, the quantitative assessment results for the five tracks are as follows:

Figure 10: Correlation Strength of Oracles with Different Ecosystem Tracks

3.2.2.1. DeFi: The Native Main Battlefield for Oracles (Correlation Strength: 5.0)

In all DeFi applications, price input is the decisive factor triggering the logic of smart contracts. Whether it is the liquidation logic of lending protocols like Aave and Compound, the asset anchoring of synthetic asset platforms like Synthetix, or the collateral verification of stablecoin systems like MakerDAO (including proof of reserves, PoR), price input directly determines whether the protocol can accurately trigger liquidation and rebalancing mechanisms.

Core Logical Features:

● High-frequency calls: Updates at minute-level or even higher frequencies to respond to rapid market fluctuations;

● Sensitivity to price stability: Minor deviations can trigger large-scale liquidations or systemic risks;

● High node fault tolerance: Multi-node aggregation and strict reputation mechanisms, with an error rate below 0.05%.

Data Support and Economic Contribution: Currently, nearly all of the top ten contributors to oracle TVS come from DeFi protocols. For example, Chainlink has 1,043 DeFi protocols among its over 2,000 protocols. It provides over 100 million price updates monthly for top protocols like Aave v3; in Q3 2025, it recovered over $1.6 million in MEV through Aave liquidation activities, with a month-on-month growth of over 15 times and an average recovery rate of about 80%.

3.2.2.2. RWA: The Strongest Growth Driver in the Medium to Long Term (Correlation Strength: 5.0)

RWA is the fastest-growing Web3 track from 2024 to 2025, representing the trend of trillion-dollar traditional financial assets migrating on-chain. Since the authenticity, valuation, and yield of RWA exist off-chain, oracles become the core driving engine with the most incremental potential and institutional value in this track.

The core challenge of RWA lies in how to establish a uniquely trusted input layer for the value of off-chain assets to be represented on-chain. Oracles play two key roles here:

● Proof of Reserves (PoR): Verifying whether custodial assets (such as government bonds) genuinely exist, ensuring token value anchoring;

● Yield Feed: Synchronizing off-chain interest rates, asset net values, or payment statuses to on-chain protocols, ensuring accurate yield distribution.

Market Potential is Huge: The daily demand for updating interest rates and asset net values makes RWA projects have higher call frequency and value density for oracles. This provides the oracle network with high-value, long-term stable service revenue; for every additional $100 million in RWA assets, the annual revenue for oracles is expected to grow by about $30,000 to $50,000. Industry estimates suggest that the daily synchronization scale of off-chain reserve data served by Chainlink PoR may reach hundreds of millions of dollars, with its share in Chainlink's overall revenue reportedly exceeding 25%.

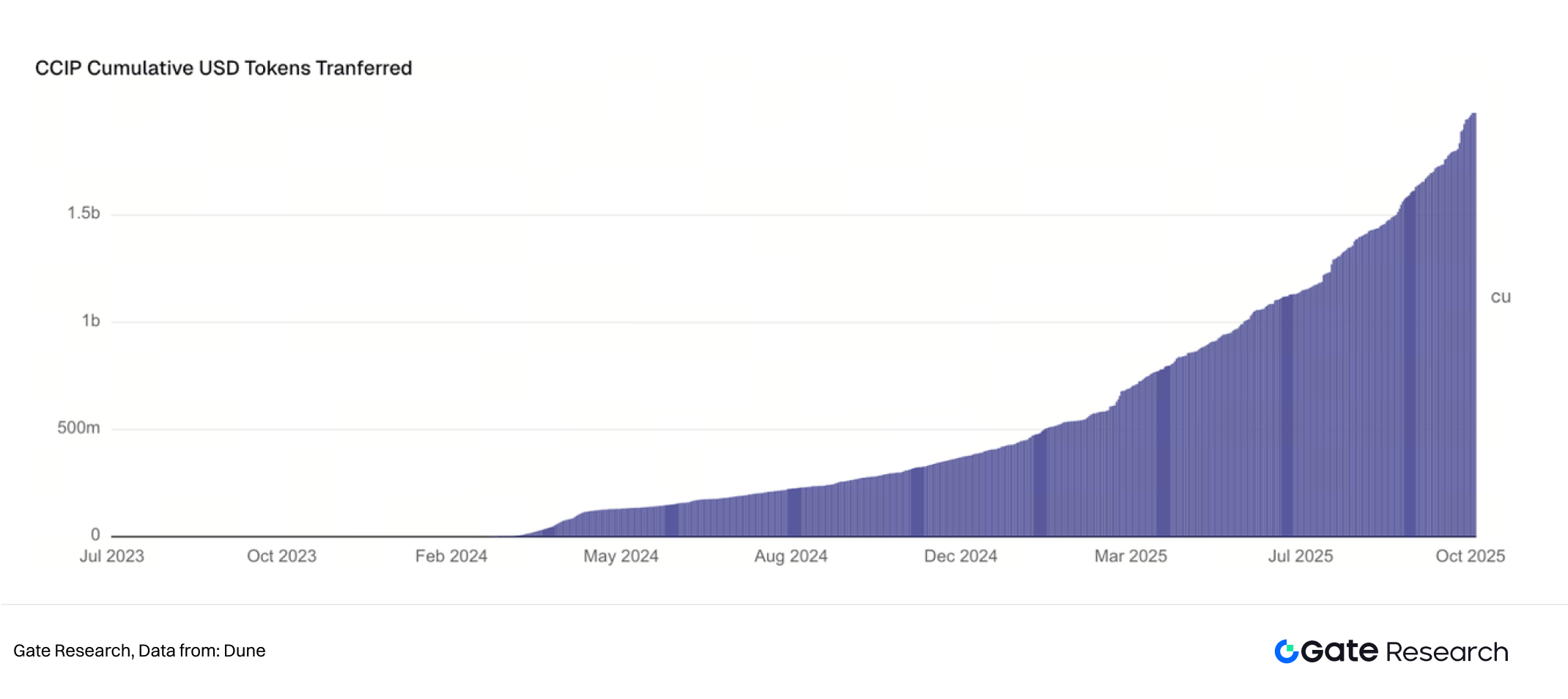

3.2.2.3. Cross-Chain Communication: The New Frontier for Oracles (Correlation Strength: 4.5)

With the maturation of modular blockchains and multi-chain ecosystems, oracles have transitioned from the "price layer" to the "message layer." In cross-chain interoperability architectures, oracles are not only responsible for price feeding but also undertake core functions such as cross-chain message transmission, asset state verification, and transaction settlement execution, becoming the trust pivot of multi-chain ecosystems.

A typical representative of this model is Chainlink's CCIP (Cross-Chain Interoperability Protocol). CCIP is based on a distributed oracle node network, integrating three major functions: "state verification + message signing + price conversion." Its working mechanism includes: the application layer initiates cross-chain requests → oracle nodes verify source chain events → CCIP network generates cross-chain proofs → the target chain updates its state based on trusted proofs.

Data Support: The CCIP model has validated through testing collaborations with traditional financial institutions like SWIFT that the oracle network can support bank-level cross-system settlements, opening up a multiplicative growth space for oracles to enter the traditional financial clearing market, becoming an important engine for Chainlink's future value growth. Chainlink has indicated that its cross-chain protocol CCIP has expanded to over 65 networks (public chains + L2), with significant growth in both cross-chain message volume and the number of service chains. As of October 2025, the cumulative service volume of token transfers via CCIP has approached $2 billion.

Figure 11: Cumulative Transfer Volume of CCIP

3.2.2.4. Prediction Markets: The Realization of Information Economy (Correlation Strength: 4.0)

Prediction markets are a direct application of oracle technology in the fields of information verification and event settlement, regarded as the "information economy" testing ground of Web3. Platforms like Polymarket price future event outcomes through economic incentives, while oracles serve as the "truth machines" that ensure fair market settlements.

Symbiotic Relationship and Core Functions: Prediction markets have a rigid dependence on oracles, as oracles must provide the final credible results of real-world events (such as elections, sports scores, macroeconomic indicators) during the settlement phase to complete users' asset liquidation and distribution. The two form a natural upstream-downstream symbiotic relationship:

● Oracles: Act as the "truth input layer," providing secure and trustworthy external data on-chain, ensuring that "facts" are auditable.

● Prediction Markets: Serve as the "truth pricing layer," aggregating collective wisdom through market games and transactions, and paying data call fees to achieve value settlement.

Emerging High-Value Revenue Scenarios: The application boundaries of oracles continue to expand, gradually entering the "information verification economy," covering non-financial areas such as real-time news verification and AI-generated data validation, with enormous potential. For example, Polymarket's trading volume grew from $360 million at the beginning of 2024 to approximately $21 billion in 2025, significantly increasing the demand for event settlement data. High-value events (such as political elections) will drive a large number of liquidation calls, bringing considerable fee revenue to the oracle network.

3.2.2.5. AI + Oracle: A Collaborative Direction for Data Credibility (Correlation Strength: 3.5)

The combination of AI and oracles represents a trend in the new generation of on-chain data ecosystems, aiming to achieve Verifiable AI and Machine Economy. In this technological wave, oracles upgrade from data intermediaries to the core trust interface between smart contracts and AI agents.

Collaborative Logic: AI models typically compute off-chain, and for their predictions or decision results to be securely relied upon by smart contracts, oracles must serve as a trusted data input layer, addressing the authenticity, auditability, and security of AI outputs.

● Core Role: Oracles are responsible for bringing the inference results, data analysis, or action instructions of AI models on-chain in a trusted and signed manner.

● Typical Case: Bittensor (TAO) is responsible for model training and inference, while Chainlink Functions securely feeds high-value inference results into on-chain smart contracts, achieving AI-driven on-chain automation.

New Payment Model for the "Machine Economy": As AI agents autonomously execute transactions, predictions, or automated tasks on-chain, they will generate a rigid demand for continuous and diverse data. This brings a new, sustainable payment model to the oracle network—data subscriptions for the machine economy. Analysis shows that the average external data subscription cost for each AI agent is about $0.5–$2 per day, forming a long-term and predictable revenue stream.

Overall, the growth of oracles is no longer linearly dependent on a single track but is polynomially related to the total asset volume on-chain, cross-chain call volume, and the marketization process of RWA. The core logic is that every tokenized, on-chain, or cross-chain asset and event will generate new demands for credible data calls. This ecological structure forms a clear "multiplier effect" growth pole: DeFi and RWA constitute the "trust center" of oracles, providing stable and high-value cash flow; cross-chain communication (CCIP) and prediction markets expand their "state verification" boundaries, serving as the explosion point for mid-term revenue; while AI + Oracle represents the commercial extension, ushering in a new era of "AI calling blockchains," which is the long-term and largest growth potential driving the total revenue of the oracle track.

4. Economic Demand Perspective: The Value Capture Mechanism of Oracles

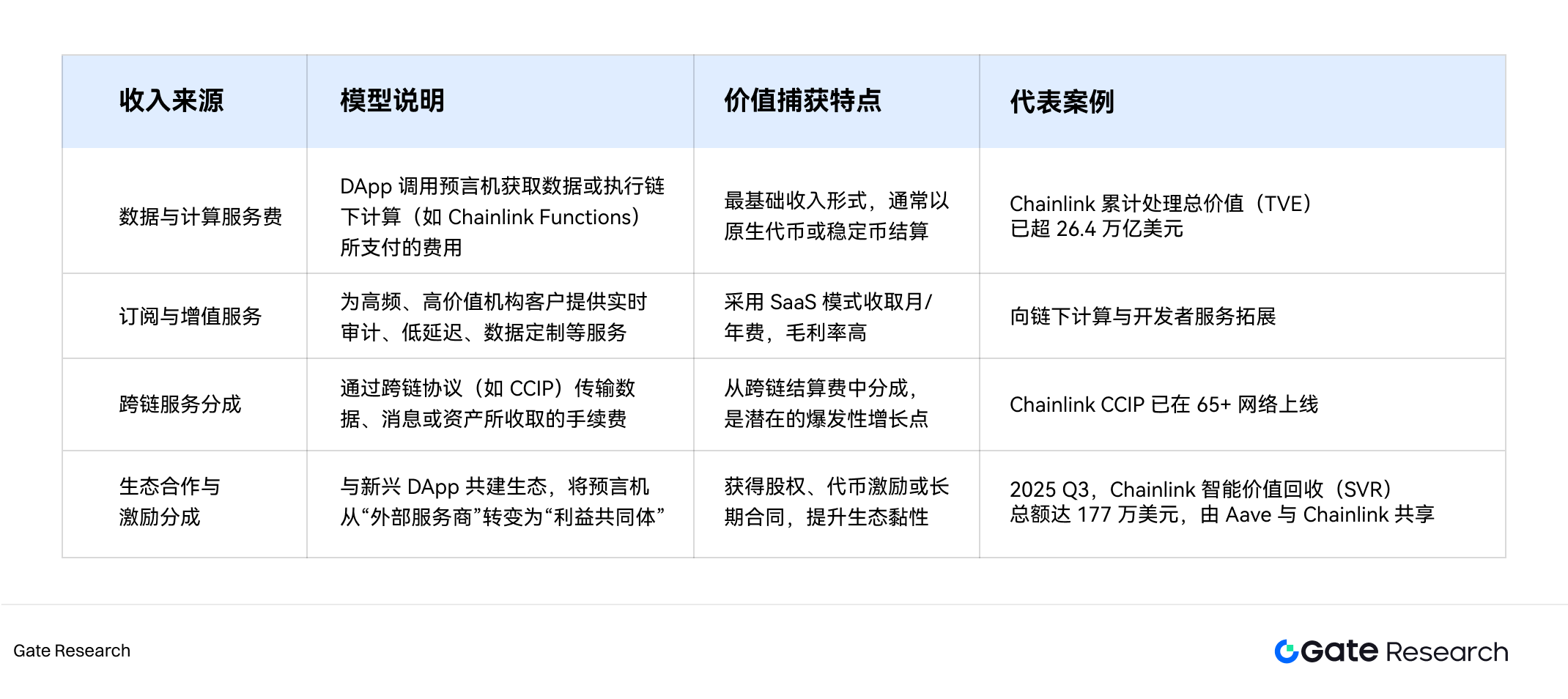

As oracles evolve from a single data feeding tool to a "data infrastructure layer" supporting DeFi, RWA, AI, and cross-chain communication, their economic essence has transformed into an economic system driven by data demand. The oracle network, as a commercial entity, depends on building a positive cycle economic model for its long-term sustainability. This model must address two core issues: how to capture value (protocol revenue) and how to ensure network security (token economics).

4.1 Value Capture: From Data Services to Data Economy

4.1.1 Value Logic of Oracles

The essence of oracles is the relay service for off-chain data, but as decentralized networks mature, they have evolved into "data markets" with complete economic systems. The core participants include:

● Data Providers (Publisher): Provide off-chain price or event information;

● Node Operators (Operator): Responsible for data aggregation and on-chain signing;

● Protocol Consumers (Consumer): Such as Aave, Synthetix, etc., pay fees to obtain credible data;

● Token Holders: Provide network security through staking and earn rewards.

Unlike traditional Layer 1 blockchains, the value capture of oracles does not come from transaction fees or block rewards but relies on the economic equation of "data consumption rate × call frequency," which can be simplified into the core economic function:

Token Value = f(On-chain Call Volume, Data Unit Price, Protocol Cut, Staking Ratio, Inflation Dilution Rate)

Therefore, the key to the growth of oracles lies in enhancing ecological scale and call density, rather than merely technological upgrades.

4.1.2 Value Capture Mechanism

With business diversification, the revenue sources of oracles have gradually expanded, transforming from "single data providers" to "comprehensive platform service providers." The main revenue structure is as follows:

Figure 12: Oracle Revenue Sources

4.2 Token Economics: Building a Moat of "Crypto-Economic Security"

Oracle tokens (such as LINK, PYTH) are not only payment mediums but also core tools for ensuring network security and economic incentives. Their economic design follows a basic principle: the cost to attack a reliable oracle network (Cost to Corrupt) must be significantly higher than the potential profit from corruption (Profit from Corruption). This principle forms the foundation of the oracle's "Crypto-Economic Security."

The tokens of the oracle network serve three functions:

● Payment Layer: Acts as the settlement medium for on-chain data services and calls;

● Security Layer: Provides economic guarantees through staking mechanisms;

● Governance Layer: Coordinates the behaviors of nodes, publishers, and consumers, and allocates protocol revenue.

4.2.1 Implementation Mechanism: Staking and Penalties

In the oracle network, node operators must stake a large amount of native tokens as "collateral" to qualify for providing data services.

● Staking Mechanism: Nodes lock their economic rights by staking native tokens, ensuring their actions align with network security goals.

● Incentive Mechanism: Nodes can earn service fees paid by users and token rewards distributed by the protocol after providing accurate and timely data.

● Penalty Mechanism: If a node submits erroneous data, delays responses, or engages in malicious behavior, its staked assets will be automatically forfeited, ensuring the system's economic deterrence.

This design allows the oracle network to achieve self-correction of data quality and economic security without centralized arbitration.

4.2.2 Value Flywheel: Symbiotic Growth of Security and Demand

The economic model of oracles constructs a self-reinforcing positive flywheel mechanism:

1. Ecological Demand Growth → Continuous increase in data service demand from high-value DApps like DeFi and RWA;

2. Protocol Revenue Increase → Increased call volume and service fees, forming stable cash flow;

3. Staking Value Enhancement → Nodes increase staking to earn rewards, raising the total locked value of the network;

4. Network Security Enhancement → Increased attack costs, improving system trustworthiness;

5. High-Value User Attraction → Enhanced security, in turn, attracts more institutions and financialization scenarios, forming new demand-side growth.

This mechanism achieves the co-evolution of security and revenue, making oracles one of the few infrastructures in the Web3 ecosystem with a sustainable business model.

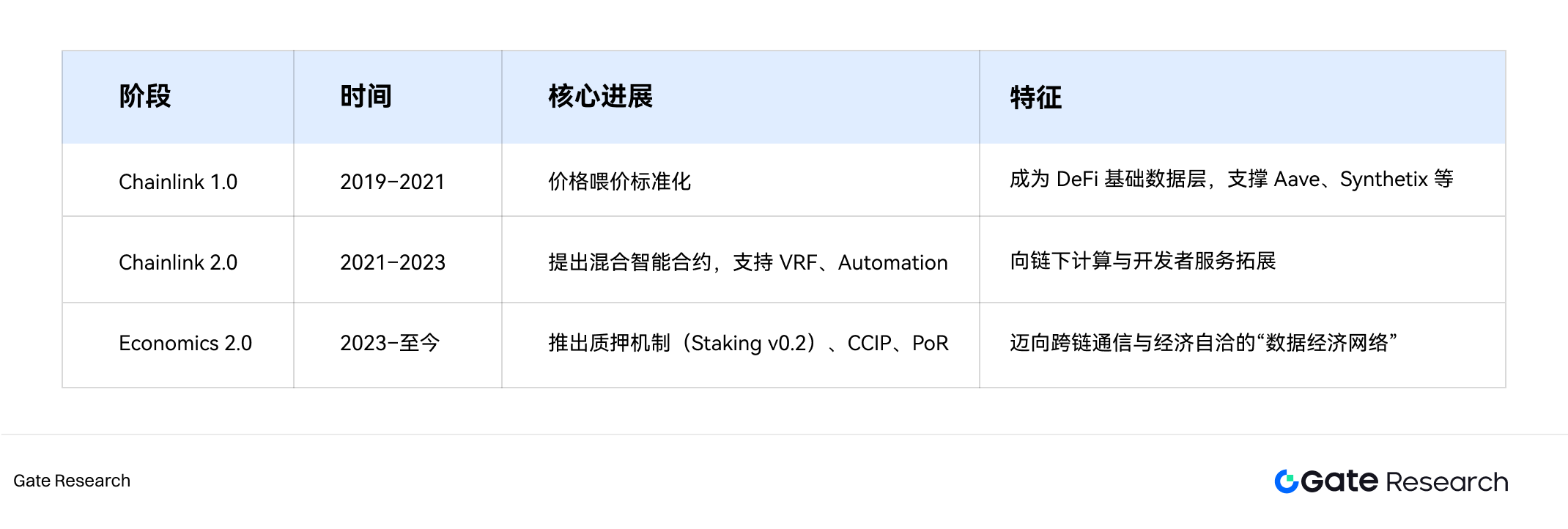

4.3 Chainlink (LINK): The Universal Trust Layer and Value Capture Logic of the Data Economy

Oracle tokens are not only payment mediums but also the core of network security and incentive mechanisms. Their designs all follow the same principle— the cost to attack the network must exceed the potential profit.

4.3.1 Project Evolution and Technical Architecture

Chainlink was founded in 2017 by Sergey Nazarov and Steve Ellis, aiming to provide trustworthy and verifiable external data inputs for smart contracts. After years of evolution, Chainlink has expanded from a price oracle to a universal data infrastructure covering cross-chain communication, off-chain computation, and data verification.

Figure 13: Chainlink Evolution Stages

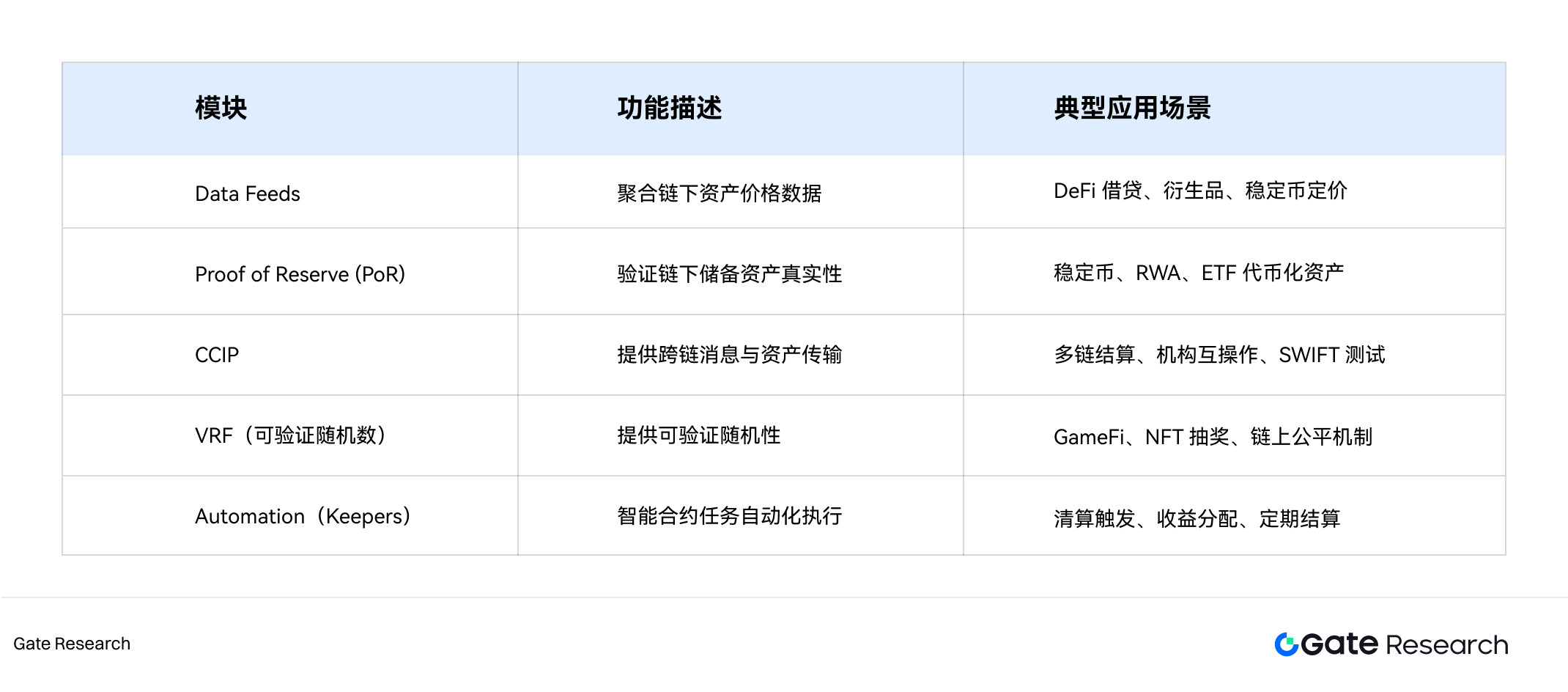

Currently, Chainlink is no longer just a price data network but a universal data transmission protocol spanning oracles, cross-chain bridges, random number generation, and computation layers, becoming the underlying trust layer of the Web3 data economy. Chainlink builds a data ecosystem through modular design, where each layer can independently serve different scenarios, forming strong composability and ecological stickiness.

Figure 14: Chainlink Technical Modules

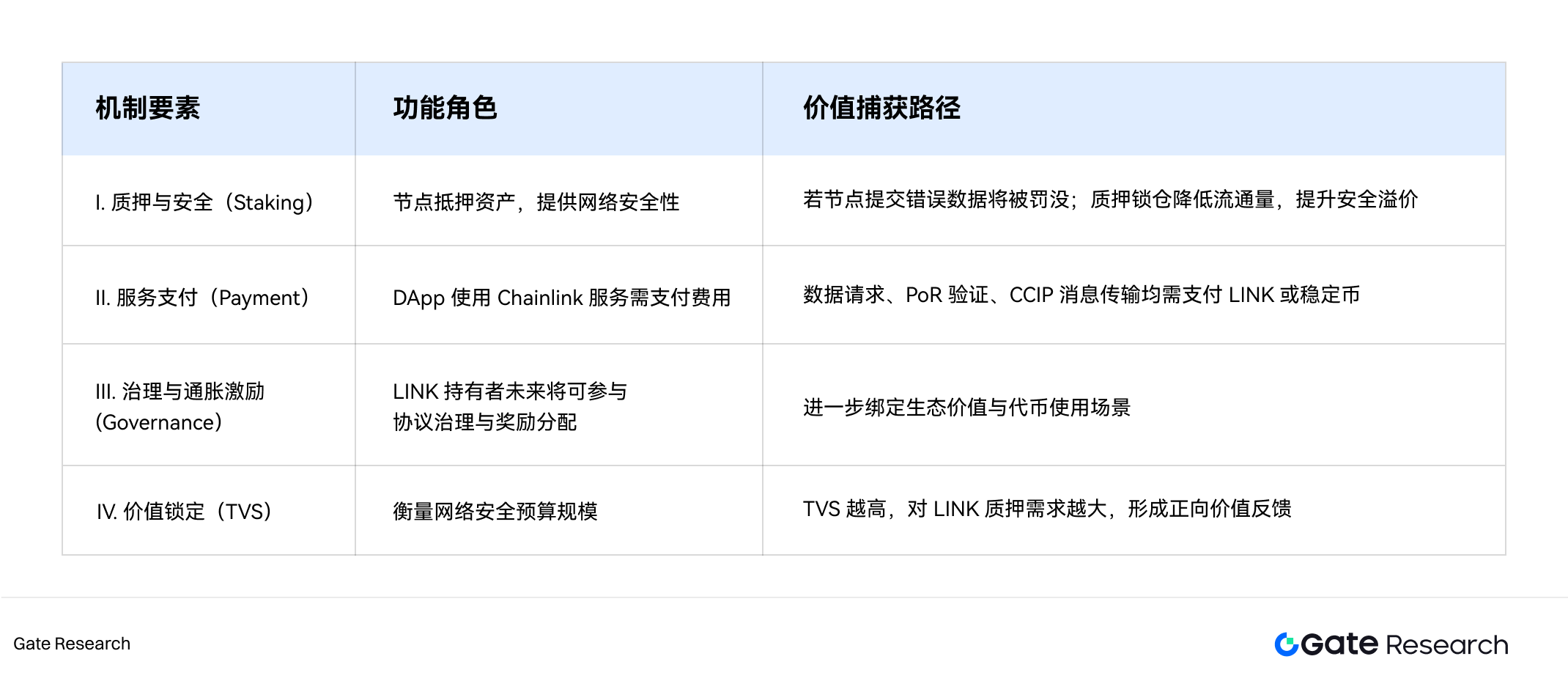

4.3.2 LINK Token Economic Model and Value Capture Mechanism

LINK is the economic core of the Chainlink network, encompassing payment medium, staking collateral, and security budget, serving as the energy source supporting the operation of the entire decentralized data infrastructure. Its value capture logic can be divided into four dimensions:

Figure 15: LINK Value Mechanism

1. Mechanism Evolution from Incentive Subsidies to Service Staking

The LINK token economic model has undergone a transformation from being driven by inflation incentives to being driven by service staking.

● v1 Phase (2019–2022): Primarily relied on inflation issuance and node reward mechanisms, with revenue coming from LINK rewards and call subsidies, limited on-chain usage, and significant price volatility.

● v2 Phase (2023 to present): Launched Staking v0.2 and data payment models, with node earnings composed of actual call fees (ETH, USDC, etc.) and LINK rewards, directly linked to on-chain economic activities, forming a stronger deflationary support logic.

As of October 2025, the community has staked over 40.875 million LINK (accounting for 5.8% of the circulating supply), with a total staked value exceeding $700 million (according to DeFiLlama data), establishing a solid economic security buffer.

Figure 16: Total Staked Value of LINK

2. Sources of LINK Revenue and Economic Distribution

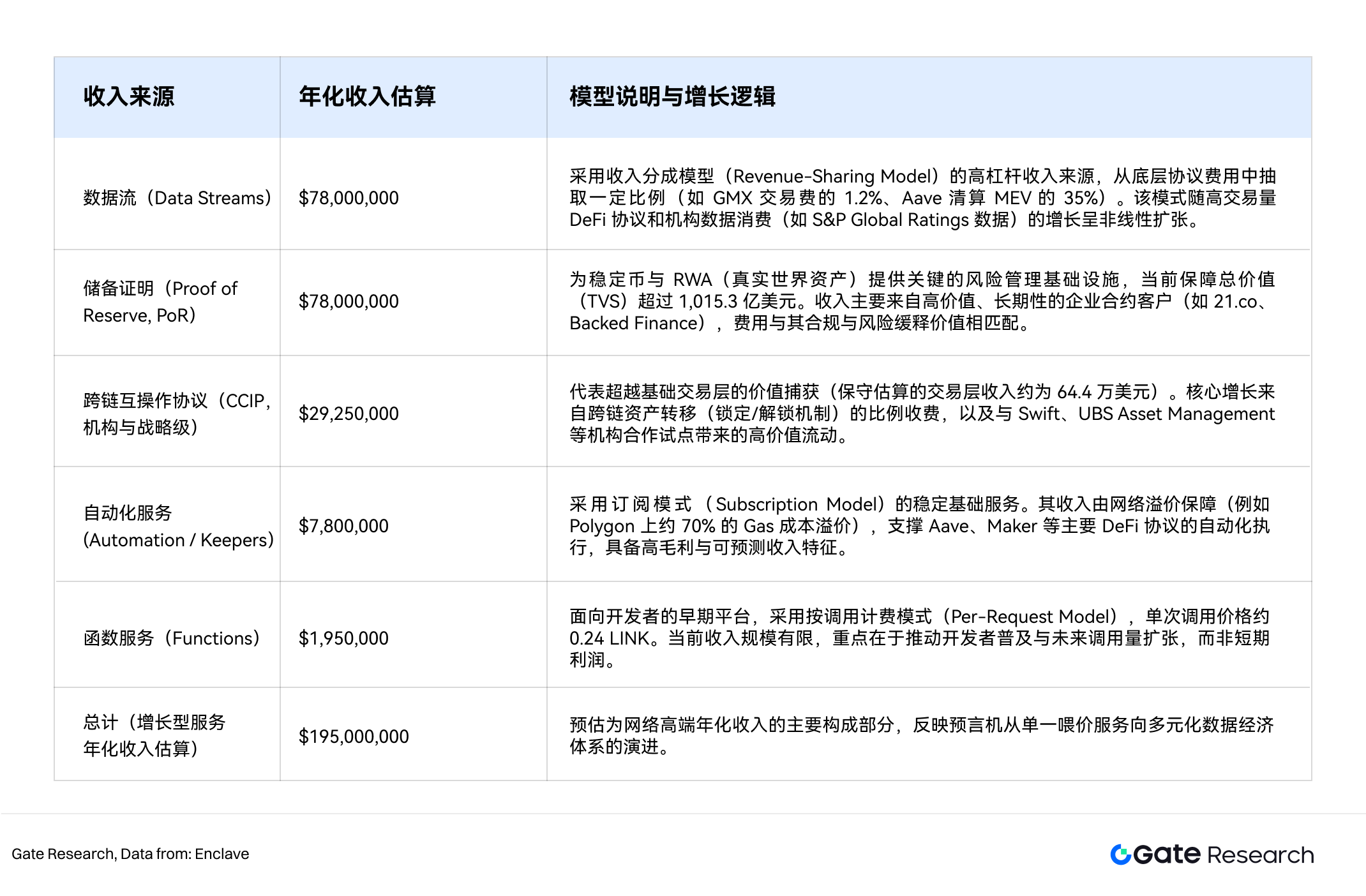

The core revenue structure of Chainlink has expanded from a single price feeding service to a multidimensional data economy system, with recovered revenue used to enhance LINK staking rewards and network sustainability. According to estimates from Enclave, the network revenue in 2025 is approximately $195 million, with the specific composition as follows:

Figure 17: Chainlink Revenue Composition

3. Deepening LINK's Value Capture Mechanism: Smart Value Recapture (SVR)

The value capture system of LINK has evolved from a single functional token to a multi-layered structure with deflationary support, security premiums, ecological premiums, and sustainable revenue streams. Among these, the Smart Value Recapture mechanism (SVR) is a key innovation driving its economic model towards a sustainable closed loop. Overall, LINK's value capture can be summarized as a "three-layer structure": security budget anchoring, protocol revenue capture, and smart value recapture (SVR).

The core innovation of SVR is that it enables Chainlink to no longer be just a "data provider," but to become a co-capturer of on-chain Oracle Extractable Value (OEV). This mechanism combines oracle price updates with liquidation execution opportunities through a "dual aggregator architecture," recovering the OEV generated by price fluctuations during liquidations in DeFi protocols through bidding and auction methods, thus transforming on-chain value that would have flowed to third-party arbitrageurs into endogenous revenue for the protocol and tokens.

In terms of revenue distribution, the OEV recovered by SVR is allocated at a ratio of approximately 60%:40%: 60% is returned to the DeFi protocol to enhance liquidation security budgets and risk mitigation capabilities; 40% is allocated to the Chainlink network and nodes, further increasing LINK staking rewards and security budget scale. According to data from the third quarter of 2025, SVR recovered over $1.6 million in OEV within the Aave protocol, effectively improving node yield and promoting the sustainability of the LINK token economic cycle.

The introduction of SVR marks the upgrade of LINK's economic model from "service payment" to a multidimensional structure of "security participation + revenue sharing + value recapture." This mechanism not only allows the Chainlink network to achieve direct cash flow capture from real on-chain economic activities for the first time but also strengthens the binding relationship between LINK and the network security budget, forming an economically self-consistent closed loop centered on security and incentives.

4.3.3 LINK Token Valuation Logic and Intrinsic Value Anchoring

As the economic model of the Chainlink network matures, the valuation logic of LINK is shifting from traditional "narrative-driven" to an intrinsic value system centered on security budgets and protocol cash flows. Its price is no longer solely driven by market sentiment but is structurally bound to network usage intensity, TVS, and real income capture capabilities. This framework can be abstracted as:

Token Value ∝ (Usage Volume × Fee per Use × Capture Rate) + (Staked Value × Security Multiplier)

Where:

● Usage Volume: The number of data calls and cross-chain communications;

● Fee per Use: The fee paid for each call (in LINK or equivalent stablecoins);

● Capture Rate: The proportion of protocol revenue converted into LINK for burning, staking, or distribution;

● Security Multiplier: The capital multiplier effect of the security budget, reflecting the amplifying effect of LINK staking value on TVS.

From a valuation structure perspective, Market Cap / TVS has become an important reference indicator for assessing LINK's reasonable price. From 2020 to 2025, this ratio decreased from about 2.0 to 0.12, indicating a shift in market valuation focus from speculation to fundamentals. Specific manifestations include:

Figure 18: Chainlink Market Cap and TVS Ratio

● TVS Growth Rate Exceeds Market Cap Growth: RWA and CCIP drive rapid increases in TVS, while token price growth lags behind;

● Security Budget Value Underestimated: The current 0.12 MCap/TVS level is significantly below the long-term average range (0.3–0.5), indicating that the market has not fully priced LINK's security budget and cash flow value;

● Revaluation Potential is Promising: If TVS maintains an annual growth rate of 30–40% over the next two years, and the staking rate and protocol revenue increase in tandem, the MCap/TVS ratio is expected to rise to the 0.3–0.4 range, corresponding to a LINK token price center of about $26–$35 (based on the current TVS of approximately $62.922 billion).

At the same time, the introduction of the SVR mechanism adds a "revenue multiplier" dimension to LINK's valuation, making it no longer reliant on a single fee model. This mechanism transforms potential on-chain liquidity into protocol cash flow by recovering OEV generated during DeFi liquidations and directly distributing it to stakers. Its economic effects include:

● Enhancing Staking Yield (APY): OEV profit-sharing increases the actual returns for stakers;

● Strengthening Cash Flow Sustainability: Revenue sources expand from service calls to DeFi activities themselves;

● Reinforcing Valuation Support: SVR creates dual demand for LINK's usage and locking, enhancing the valuation floor.

It is estimated that when the annual recovery scale of SVR exceeds $10 million, it has an amplification effect of about 1.2–1.5 times on LINK's overall valuation, equivalent to raising the MCap/TVS ratio to the 0.35–0.45 range, with LINK's price potential reaching $40–$45.

In summary, LINK's long-term value anchoring can be expressed as:

LINK Value = f(TVS Growth, Protocol Revenue, Staking Ratio)

When the expansion of TVS, protocol cash flow, and staking ratio resonate, LINK will possess structural revaluation potential. With the integration of new scenarios such as RWA, AI Agents, and prediction markets, LINK is expected to become an infrastructure token with the attributes of "real yield + security budget + cross-chain liquidation," with its long-term reasonable valuation center projected in the $25–$35 range, with upside potential exceeding $40.

Overall, from the perspective of the economic model, the core competitiveness of oracles has shifted from "data accuracy" to "economic sustainability and security verifiability of data services." Chainlink builds a systematic moat through "security budget + fee model," evolving oracles from cost centers to sustainably profitable infrastructures.

5. Macroeconomic Perspective: Opportunities and Risks in the Integration of Real Finance and On-Chain Finance

Oracles have evolved from a single data feeding tool to a "financial neural hub" supporting DeFi, RWA, AI, and cross-chain communication. Their expansion is driving deep interconnections in global financial infrastructure, reshaping asset pricing, settlement, and regulatory systems, and ushering in a new phase of digitalization in real finance.

5.1 Opportunities: The Birth of Financial Digitalization and Information Yield

Digitalization of Real Finance: The Data Trust Hub

Oracles synchronize key macro and micro data in real-time, making the execution logic of on-chain financial contracts closer to the real world, providing a reliable bridge for traditional financial institutions (TradFi) to embrace decentralized finance (DeFi).

In terms of RWA asset pricing and settlement, oracles can synchronize key macro indicators such as bond yields, foreign exchange prices, interest rate curves, and stock indices to the chain in real-time, allowing RWA protocols to automatically adjust yields and risk premiums based on real financial variables.

In terms of institutional collaboration and settlement, traditional financial infrastructure institutions such as SWIFT, DTCC, and Visa have integrated with Chainlink's CCIP and other oracle services to explore the automation of interbank information exchange and asset settlement. Chainlink collaborates with 24 financial institutions, including SWIFT, Deutsche Bank, and ANZ, aiming to simplify corporate action processing and explore a "hybrid structure" financial system: on-chain for contract execution and fund settlement, off-chain for identity verification and regulatory compliance.

In terms of on-chain macroeconomic data, oracles securely synchronize macroeconomic data such as CPI, GDP, and federal funds rates to the chain, enabling on-chain risk models to dynamically reflect changes in real economic cycles, promoting real-time interaction between regulation and market information.

Financialization of Data: "Information Yield" and Capital Repricing

The oracle network has become the realization carrier of "Information Yield"—high-quality, low-latency, verifiable data can generate returns, becoming a tradable capital factor.

This mechanism is reshaping capital pricing logic. The value of on-chain assets no longer solely depends on "narratives," but is directly related to the accuracy and verifiability of data. Through data aggregation, verification, and distribution, oracles have built a capital market for the data layer, enhancing the efficiency of smart contract execution and reducing systemic risks in the on-chain financial system.

For institutions, high-quality oracle data means more accurate risk pricing, more flexible interest rate curves, and more robust liquidation parameters. Institutional investors can thus engage in arbitrage and efficiency optimization based on "data quality," realizing the value transformation of information as capital.

5.2 Risks: Model Consistency and Systemic Vulnerabilities

As the "public layer" of financial data infrastructure, the security and governance stability of oracles determine the resilience of the entire financial system. The new risks brought about by integration mainly focus on three aspects: technology, governance, and regulation.

Technical and Algorithmic Risks: The Model Consistency Trap

When the market overly relies on a single data source or algorithmic model, any errors or delays in that oracle data can be systematically amplified, leading to collective misjudgments or chain reactions in the financial market, forming what is known as the "model consistency trap." Although decentralized structures enhance the system's resistance to attacks, collusion among nodes, data pollution, and algorithmic bias remain potential sources of risk. Especially in scenarios involving large asset liquidations or cross-chain bridge transactions, any data error could trigger systemic financial events.

Governance and Centralization Risks: The Hidden Worry of Data Monopoly

The oracle ecosystem also faces centralization risks at the governance level. If services are concentrated among a few networks or large node operators, it may lead to a de facto "data monopoly." Once this monopoly extends to the CCIP or RWA asset layer, it will undermine the spirit of decentralization and pose challenges to the openness of the global financial system.

Without unified industry standards and transparent governance mechanisms, the oracle ecosystem may be dominated by a few enterprises, and its long-term stability will depend on the openness and anti-manipulation capabilities of the governance structure.

Regulatory and Compliance Risks: Interoperability Barriers Across Jurisdictions

The differences in data governance, privacy protection, and financial compliance across jurisdictions are core challenges facing the globalization of oracles. Significant differences in regulatory standards for on-chain financial data exist in different regions, leading to compliance risks for oracles in cross-border applications. In the future, financial regulatory guidance is shifting from "risk prevention" to "promoting transparency," with compliance and standardization focusing on three pillars:

● Data Verifiability: Ensuring data sources and signatures are traceable;

● Privacy Protection and Minimal Disclosure: Achieving verification transparency while protecting privacy;

● Interoperability Across Jurisdictions: Providing a compliance foundation for data flow between global financial institutions.

Overall, the role of oracles has elevated to the core hub connecting real finance and on-chain finance. They not only promote the transparency and automation of the financial system but also accelerate the global interconnection of capital markets, constructing a unified settlement framework across chains, markets, and assets. At the same time, risks such as data monopolies, algorithmic biases, and governance centralization may weaken the core spirit of decentralized finance and introduce new systemic vulnerabilities.

6. Outlook: From Data Pipeline to Trust Layer Elevation

The evolution of oracles is essentially an upgrade from a "data pipeline" to a "trust layer" that provides "verifiable truths" for the entire digital world. This elevation means that future financial and commercial activities will not only rely on the efficiency of on-chain settlements but also depend on the authenticity and verifiability of on-chain data. Whether it is DeFi liquidation systems, RWA asset certificates, or corporate compliance reports and central bank digital currency interactions, oracles will play a key role in information transmission and verification. As more real financial institutions, governments, and enterprises connect to the on-chain system, the marginal value of the oracle network will grow exponentially.

For investors, the long-term value of oracle projects should focus on "real usage" and "economic security." Investment judgments should concentrate on three key indicators: first, protocol revenue (i.e., the real data fees paid by DApps, financial institutions, etc.) is the most sustainable valuation basis; second, the quality of TVS (Total Value Secured) growth should be deeply analyzed—attention should be paid to whether its service targets are concentrated on blue-chip DeFi protocols rather than high-leverage or short-cycle projects; third, the economic security model (including staking mechanisms, slash penalties, and node incentive structures) determines the underlying resilience of the network to withstand attacks and maintain data reliability.

For institutions, it is recommended to actively explore the deployment model of "first-party oracle nodes." By directly running nodes and securely and authoritatively putting their trading data, pricing models, or asset information on-chain, institutions can not only enhance market transparency but also gain data dominance in the future digital economy system. This means that financial institutions can shift from being consumers of data to issuers and verifiers of data, thereby gaining a higher voice between regulation and innovation.

For developers, oracles should be viewed as core foundational components of DApps. Developers should fully utilize advanced features such as off-chain computation, verifiable randomness functions (VRF), and automation triggering mechanisms to build next-generation applications that can deeply interact with the real world. For example, bringing weather, logistics, legal rulings, or IoT data on-chain can give rise to new business models such as insurance, supply chain finance, carbon credits, and AI smart contracts.

Ultimately, the competition in the oracle space is fundamentally a struggle for the "definition of facts in the digital world." Whoever can become the safest, most reliable, and most networked "source of truth" will become an irreplaceable cornerstone of the future value internet. Just as Google defined the standards for information retrieval in the internet era and AWS established the standards for computing power in the cloud computing era, the leaders in the oracle era will define the standards for "trusted data" and occupy a decisive position in the next revolution of financial infrastructure.

Author: Ember

7. References

https://oakresearch.io/en/analyses/fundamentals/zoom-on-different-types-crypto-oracles

https://defillama.com/protocol/chainlink?staking_tvl=true&fees=false

https://blog.chain.link/chainlink-reserve-strategic-link-reserve/?utm_source=chatgpt.com

https://www.theblock.co/data/decentralized-finance/prediction-markets-and-betting

https://blog.chain.link/chainlink-smart-value-recapture-svr/

https://www.tokenmetrics.com/blog/chainlink-link-price-prediction

https://coinlaw.io/chainlink-statistics#Blockchain-Networks-Supported

https://enclaveresearch.com/chainlink-network-other-services-revenue-estimate-for-2025/

https://www.coingecko.com/en/categories/infrastructure#key-stats

The Gate Research Institute is a comprehensive blockchain and cryptocurrency research platform that provides readers with in-depth content, including technical analysis, hot insights, market reviews, industry research, trend forecasts, and macroeconomic policy analysis.

Disclaimer

Investing in the cryptocurrency market involves high risks. Users are advised to conduct independent research and fully understand the nature of the assets and products they are purchasing before making any investment decisions. Gate does not take responsibility for any losses or damages resulting from such investment decisions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。