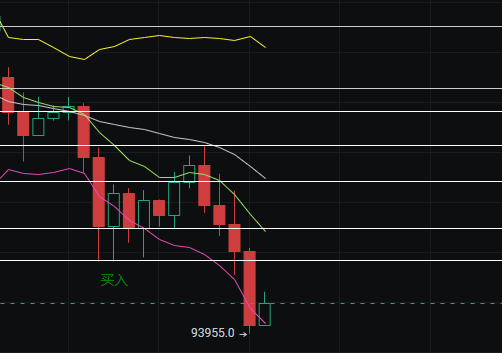

With the continuous decline over the past few days, today's market has rebounded, which is logical. However, we can only view this as a rebound because all indicators are still bearish, so we believe the current market is still dominated by bears.

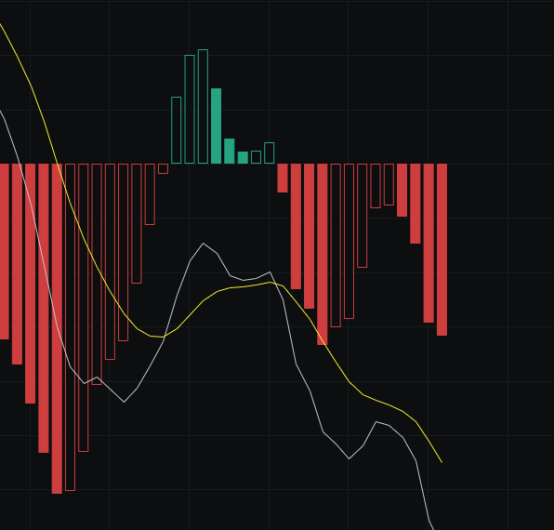

From the MACD perspective, the energy bars continue to move downward, and both the fast and slow lines are also continuing to decline. This pattern favors the bears, indicating a bearish trend on the MACD.

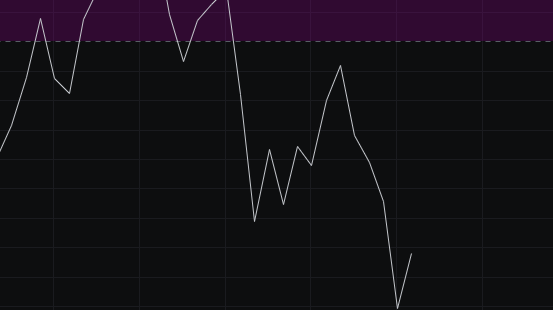

From the CCI perspective, there is a slight rebound, but the magnitude is relatively small, and the CCI is still quite far from -100, so we maintain a bearish mindset.

From the OBV perspective, the declines over the past few days have led to a significant outflow in OBV, causing a certain level of panic, so the bulls will not be able to make waves in the short term.

From the KDJ perspective, the KDJ has now touched 20, which we previously expected to reach. The next step is to see whether the KDJ rebounds or continues to fall below 20. If it breaks below, it will continue to decline; if it rebounds, we still cannot immediately turn bullish, as it will need to go through a period of consolidation first.

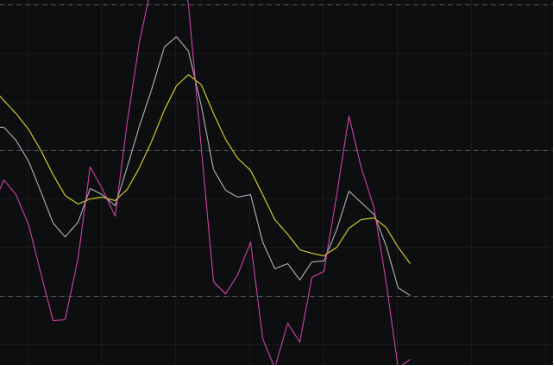

From the MFI and RSI perspectives, both indicators are currently in the weak zone, indicating market fatigue. Therefore, we cannot turn bullish just because of a slight pullback; we need to continue observing before drawing conclusions.

From the moving averages perspective, several moving averages are currently pressing down, which also favors the bears, so we will continue to maintain a bearish mindset.

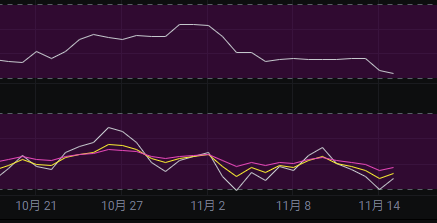

From the Bollinger Bands perspective, yesterday we observed the upper band flattening, and we were concerned about the possibility of a false breakdown. Today, the upper band opened upward and then started to move downward, indicating a downward channel. Therefore, our previous concerns about a false breakdown may be alleviated, and the Bollinger Bands also indicate a bearish trend.

In summary: Although the market has risen by nearly two points, all indicators are fundamentally bearish, so we will continue to maintain a bearish mindset. Today's resistance is seen at 97000-99000, and support is at 94000-92500.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。