November 17, 2025 - The cryptocurrency trading platform BitMart announced the launch of BMRUSD, a yield-generating USD stablecoin supported by DigiFT. DigiFT is a digital asset platform regulated by the MAS, focusing on providing services for institutional tokenization of real-world assets (RWA). This issuance reflects the structural changes occurring in the stablecoin space—this category is shifting from merely being a value-anchored stable asset to one that is supported by real economic assets and generates sustainable yields.

Stablecoins Entering the Third Development Stage

The development of stablecoins can be divided into different stages:

- First Generation: Achieving price stability through pegging to fiat currencies.

- Second Generation: Expanding to more uses such as payments, trading, and liquidity.

- Third Stage (emerging): Achieving stable, verifiable yields while maintaining liquidity and risk transparency.

BMRUSD is a product designed for this new stage.

It maintains a 1:1 peg with USDT while automatically accruing daily yields, sourced from tokenized U.S. Treasury bonds and regulated money market funds. BitMart also offers additional yield incentives, projecting an annual return rate between 6% and 8%, depending on market dynamics and BitMart's promotional yield support.

Unique Advantages of BMRUSD

Unlike other yield-bearing stablecoins such as USDY, USDM, or STBT, BMRUSD is deeply integrated with the BitMart exchange ecosystem, enabling instant subscriptions and redemptions, zero lock-up periods, and seamless use for trading, collateral, and yield strategies.

BMRUSD is launched in collaboration between BitMart and DigiFT, the latter being a RWA tokenization partner holding a license from the Monetary Authority of Singapore (MAS). It combines regulated real-world asset backing, exchange-level liquidity, and on-chain transparency to provide users with compliant and composable yield solutions, naturally integrating into daily trading and portfolio management.

A Stablecoin with Functionality and Asset Value

Users can subscribe to or redeem BMRUSD at any time on BitMart, enjoying instant settlement with no lock-up period.

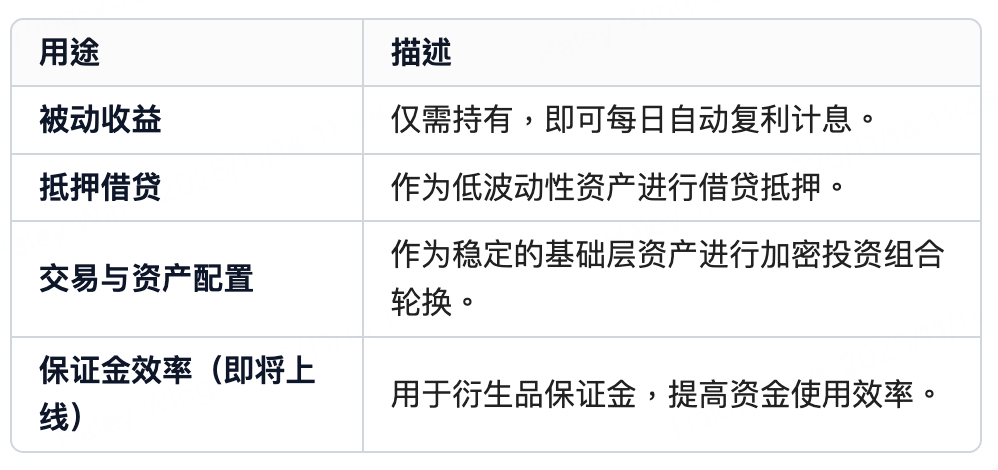

In addition to holding, the uses of BMRUSD include:

This makes BMRUSD suitable not only as a store of value but also as a yield-bearing collateral asset for stable positions and active allocations.

Regulated, On-Chain Verifiable Real-World Asset Support

Its underlying asset portfolio consists of diversified RWAs acquired through DigiFT, issued by global financial institutions, including:

- UBS uMINT

- CMB International (CMBMINT)

- Fundbridge (ULTRA), managed by Wellington Management

All underlying RWA tokens are issued on public blockchains like Ethereum, with yield accrual and redemption processes fully auditable. DigiFT operates under the license of the Monetary Authority of Singapore (MAS), ensuring compliance and transparency of the underlying asset issuers and fund managers. BMRUSD holders do not directly hold the underlying real-world assets.

“Stablecoins are transforming from passive capital containers into yield-generating assets,” said the head of financial business at BitMart. “BMRUSD targets a market seeking transparency, sustainability, and composable utility. The collaboration with DigiFT not only ensures regulatory compliance but also enables open verification on public blockchains.”

Market Significance of BMRUSD

During periods of increased market uncertainty, users often shift funds into stablecoins to avoid volatility. However, traditional stablecoins do not generate returns during the holding period.

The launch of BMRUSD by BitMart fills this gap, allowing users to achieve continuous compound returns while maintaining stability.

This will bring:

- More efficient capital management

- Stable liquidity provision

- Long-term portfolio construction with reliable underlying assets

How to Start Using BMRUSD

- Subscribe to BMRUSD at a 1:1 exchange rate with USDT.

- Enjoy daily automatic compound interest earnings.

- Use BMRUSD for asset allocation, collateral, or yield strategy operations.

- Redeem for USDT at any time, with instant settlement (daily personal redemption limit: 50,000 BMRUSD).

For more information, please visit: https://www.bitmart.com/bmusd

About BitMart

BitMart is a leading global digital asset trading platform with over 12 million users worldwide. BitMart has consistently ranked among the top on CoinGecko for several years, offering over 1,700 trading pairs with competitive fees. BitMart is committed to continuous innovation and financial inclusion, aiming to provide a seamless trading experience for global users. For more information about BitMart, please visit the website, follow X (Twitter), or join Telegram for updates, news, and promotions. Download the BitMart App to trade anytime, anywhere.

About DigiFT

DigiFT is a next-generation platform focused on the tokenization of real-world assets (RWA), regulated by the Monetary Authority of Singapore (MAS) and the Securities and Futures Commission (SFC) of Hong Kong, providing end-to-end digital asset services tailored for institutional-grade RWA, including tokenization, issuance, distribution, trading, and instant liquidity supply. As a trusted on-chain tokenization and distribution partner for leading global asset management companies, DigiFT collaborates with institutions such as Invesco, UBS Asset Management, DBS Bank, CMB International, and Wellington Management. For more information, please visit http://www.digift.io.

Risk Warning:

The above information is for reference only and should not be considered as advice to buy, sell, or hold any financial assets. All information is provided in good faith. However, we make no express or implied representations or warranties regarding the accuracy, adequacy, effectiveness, reliability, availability, or completeness of such information.

Using BitMart's services and participating in BMRUSD is entirely at your own risk. All cryptocurrency investments (including yields) are inherently highly speculative and carry significant risk of loss. Past performance, hypothetical results, or simulated data do not necessarily represent future results. The value of digital currencies may rise or fall, and buying, holding, or trading digital currencies may involve significant risks. Before trading or holding digital currencies, you should carefully assess whether participating in such investments is suitable for you based on your investment objectives, financial situation, and risk tolerance. BitMart does not provide any investment, legal, or tax advice. BitMart does not guarantee any specific rate of return for BMRUSD, and all yields may change without prior notice.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。