In the past week, the macro environment has had a significant negative impact on the overall cryptocurrency market. First, after the U.S. government shutdown ended and the stock market "reopened," U.S. stocks plummeted, and market sentiment has dropped to recent lows. The crypto asset sentiment index (Fear and Greed Index) has fallen to around 10, marking a new low since the beginning of the year. This reflects that both institutions and retail investors are in a state of high caution and wait-and-see.

Secondly, there are signs of a reversal in institutional capital flows. There has been a large net outflow from spot Bitcoin ETFs, with data showing a single-day outflow exceeding $900 million, making it the second-largest outflow day ever. Ethereum ETF funds have also shown a net outflow for several consecutive days. This indicates that the support from major capital has weakened recently.

Furthermore, the macroeconomic monetary policy environment is putting pressure on the market. With several Federal Reserve officials expressing hawkish views, market expectations for a rate cut by the Fed have continued to decline, putting overall pressure on risk assets. In this environment, Bitcoin, as a relatively volatile risk asset, has seen its upward momentum suppressed, leading to consecutive declines that affect the entire crypto market.

This week, the September non-farm payroll report, which was absent due to the government shutdown, is about to be released, and the data is expected to be unfavorable. Additionally, the minutes from the Federal Reserve's monetary policy meeting will be published this week, and several officials are expected to speak again, with various data currently appearing to be unfavorable for bulls. The cryptocurrency market will continue to face challenges this week!

From a technical perspective, Bitcoin has been fluctuating in a narrow range between 96,500 and 94,500 over the weekend, but this morning it tested 93,000 again before rebounding. The current price is around 95,000, with the weekly and daily MACD indicators continuing to expand below the zero line. There is a demand for a corrective rebound on the four-hour and hourly levels, so the focus for the day is on the strength of the rebound. The short-term resistance above is at 96,500 and 98,000, with the key area still being the 100,000 mark. As for support, under the current market panic, the price has already fallen below the key area and entered a downward channel, with significant support temporarily concentrated around the psychological level of 90,000, while short-term attention should be paid to the 93,000 and 92,000 levels.

Short-term trading suggestions for Bitcoin:

1. Buy near the 94,000-93,000 area, target 95,000-96,000

2. Sell near the 98,000-97,500 area, target 96,500-95,500

Ethereum's market sentiment is similar to Bitcoin's and is also in a relatively weak state. The cooling expectations for a Fed rate cut remain a core pressure point, and in a strong dollar environment, the high volatility of Ethereum is under more significant pressure. In the past 48 hours, on-chain monitoring has shown 40,000 ETH (approximately $127 million) transferred to exchanges, raising concerns about selling pressure, compounded by a slowdown in Ethereum ETF inflows and continued net outflows, indicating insufficient institutional buying support in the short term.

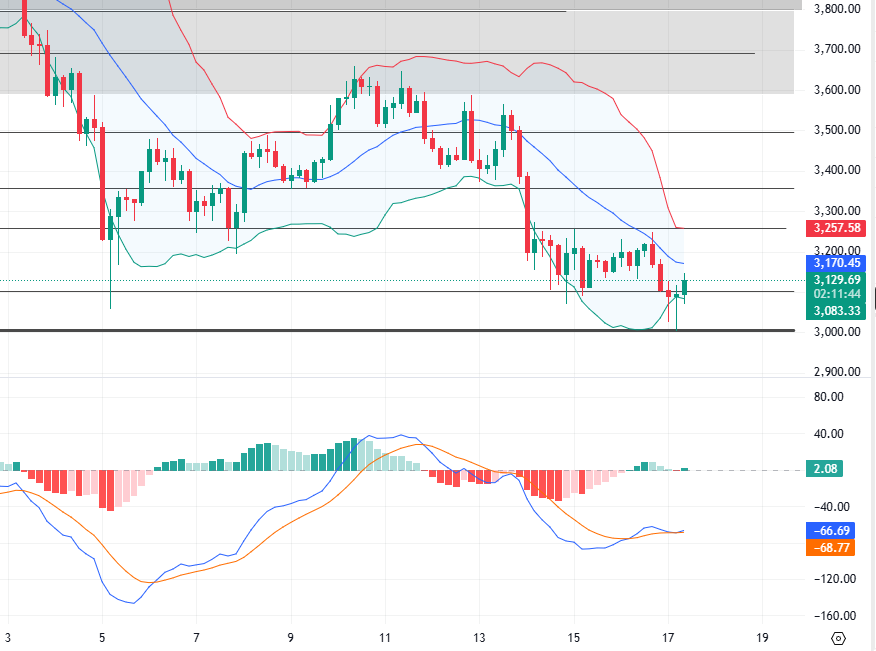

The short-term trend for Ethereum follows Bitcoin's rhythm, with a key support area at 3,000. After testing this level once in the morning, it rebounded to around 3,130. Previous analysis indicated that this level corresponds to Bitcoin's drop below 100,000, but it has shown strong resilience, hence it has not tested and broken below it. This indicates strong support; if it fails to hold, it may drop to the 2,800 range. However, if it can continue to test and stabilize around 3,000, a weak rebound may occur, but it will still struggle to break the resistance at 3,600-3,800, which is on a larger cycle. As for the short-term, the hourly and four-hour levels also show a demand for corrective rebounds, so the focus for the day is on the strength of the rebound. The short-term resistance above is at 3,250 and 3,350, while the support below is at 3,050 and 3,000.

Short-term trading suggestions for Ethereum:

1. Buy near the 3,050-3,000 area, target 3,130-3,200

2. Sell near the 3,250-3,300 area, target 3,200-3,150

【Friendly reminder: Market conditions change rapidly, and suggestions are for reference only. For more real-time consultation, feel free to communicate with me online.】

—— Original by the author, welcome to follow and like.

This article is exclusively published by (public account: Jane Crypto) for reference only. Trading itself is not difficult; the challenge lies in human psychology and self-discipline. I hope we can all continuously improve ourselves through learning, refine ourselves, and strive for long-term strength.

Market conditions fluctuate in real-time and have time constraints. Feel free to scan the code to follow the public account for daily market information and real-time communication.

Friendly reminder: This article is solely owned by the public account (as shown above) of Jane Crypto. Any other advertisements at the end of the article and in the comments section are unrelated to the author!! Please be cautious in distinguishing between true and false, thank you for reading.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。