Original author: 1912212.eth, Foresight News

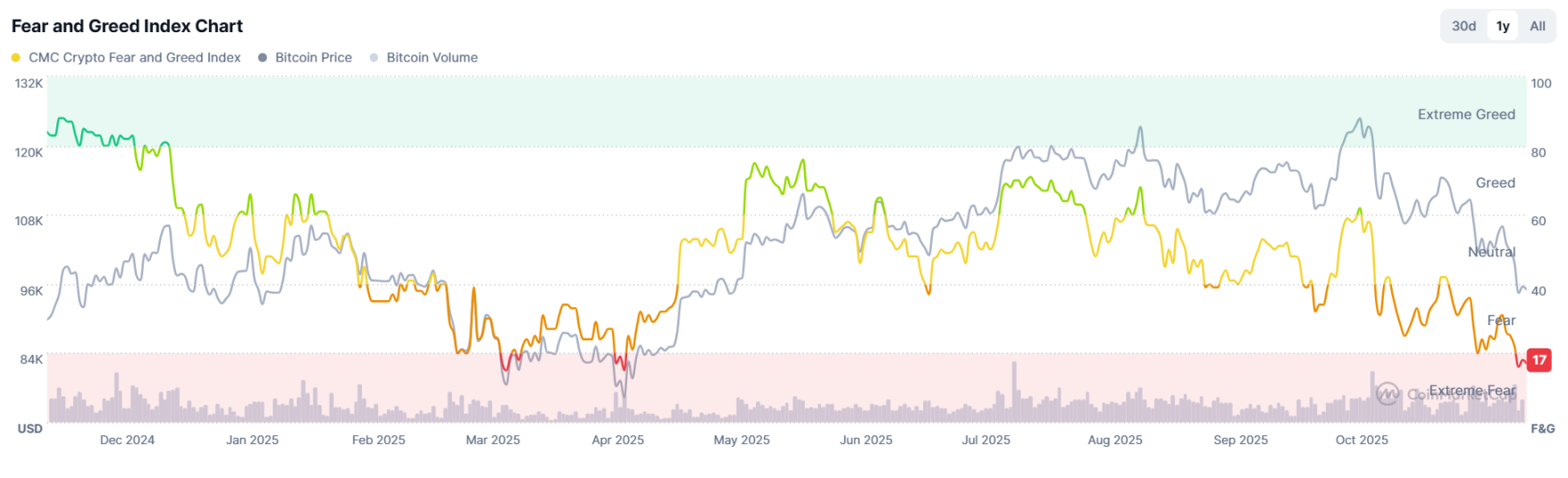

After BTC fell below the $100,000 mark, the market situation took a sharp downturn, testing the $93,000 level at one point. Market panic has been spreading, with data showing that the fear index dropped to 17, a level of panic not seen since April of this year.

Discussions about whether the four-year cycle will continue and whether the market has turned bearish are increasing. So, from a data perspective, what is happening with Bitcoin and Ethereum?

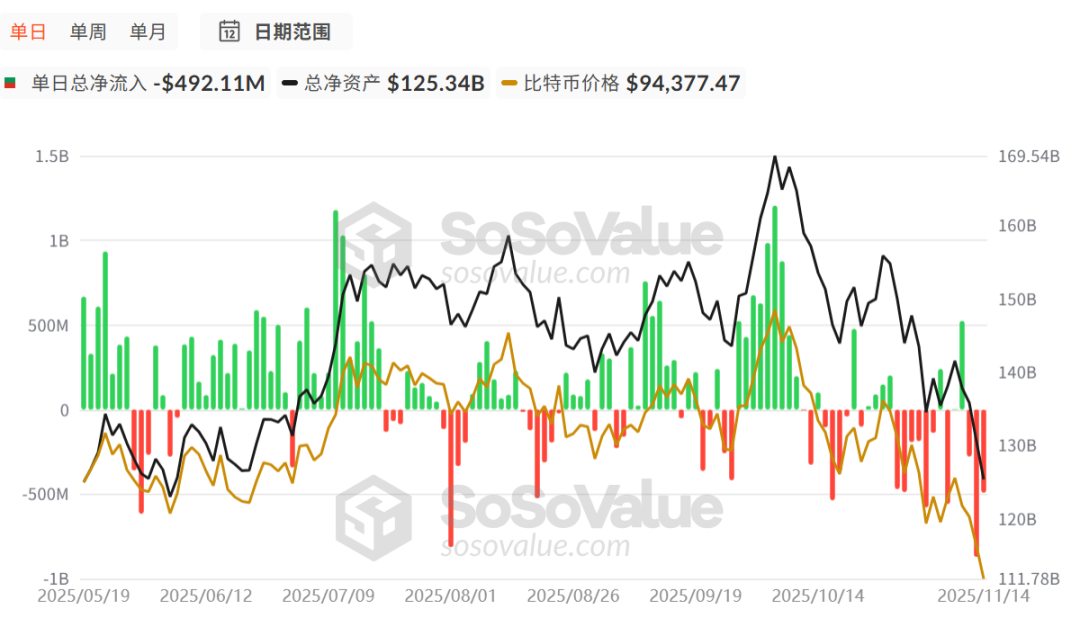

Significant Net Outflows from Bitcoin and Ethereum Spot ETFs

Since October of this year, the performance of Bitcoin spot ETF data, an important indicator of capital observation, has been far from optimistic.

Specifically, from October 10 to October 14, there were only 8 days of net inflows, and the amounts were not high, with November 11 being the only highlight, recording a single-day inflow of $523.98 million. On the net outflow side, the situation has worsened, with a rare single-day net outflow of $869.86 million on November 13, setting a new high in 9 months.

Throughout October, the net inflow data for Bitcoin spot ETFs was $3.419 billion, while in just half a month of November, the net outflow has reached $2.334 billion.

The performance of Ethereum spot ETF data is equally poor.

Since October 10, there have only been 6 days of net inflows, with the rest being net outflows. Additionally, the net outflow amounts have remained around $150 million to $200 million. Currently, the total net inflow of funds stands at $13.13 billion.

Who is Selling, Who is Buying

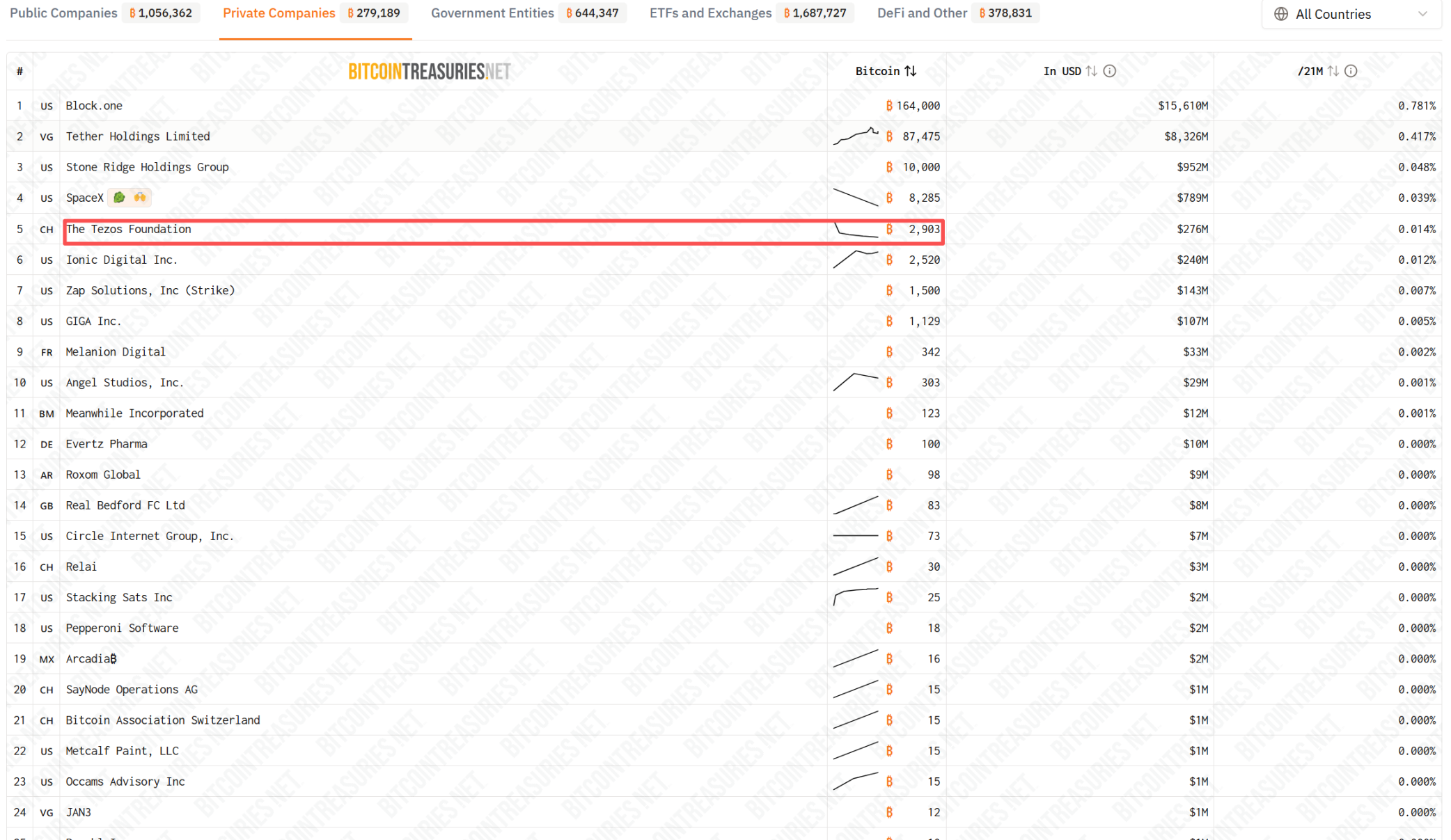

Data from bitcointreasuries shows that among the top 20 private companies holding BTC reserves, only the Tezos Foundation has chosen to reduce its BTC holdings, while the others have opted to increase or maintain their positions.

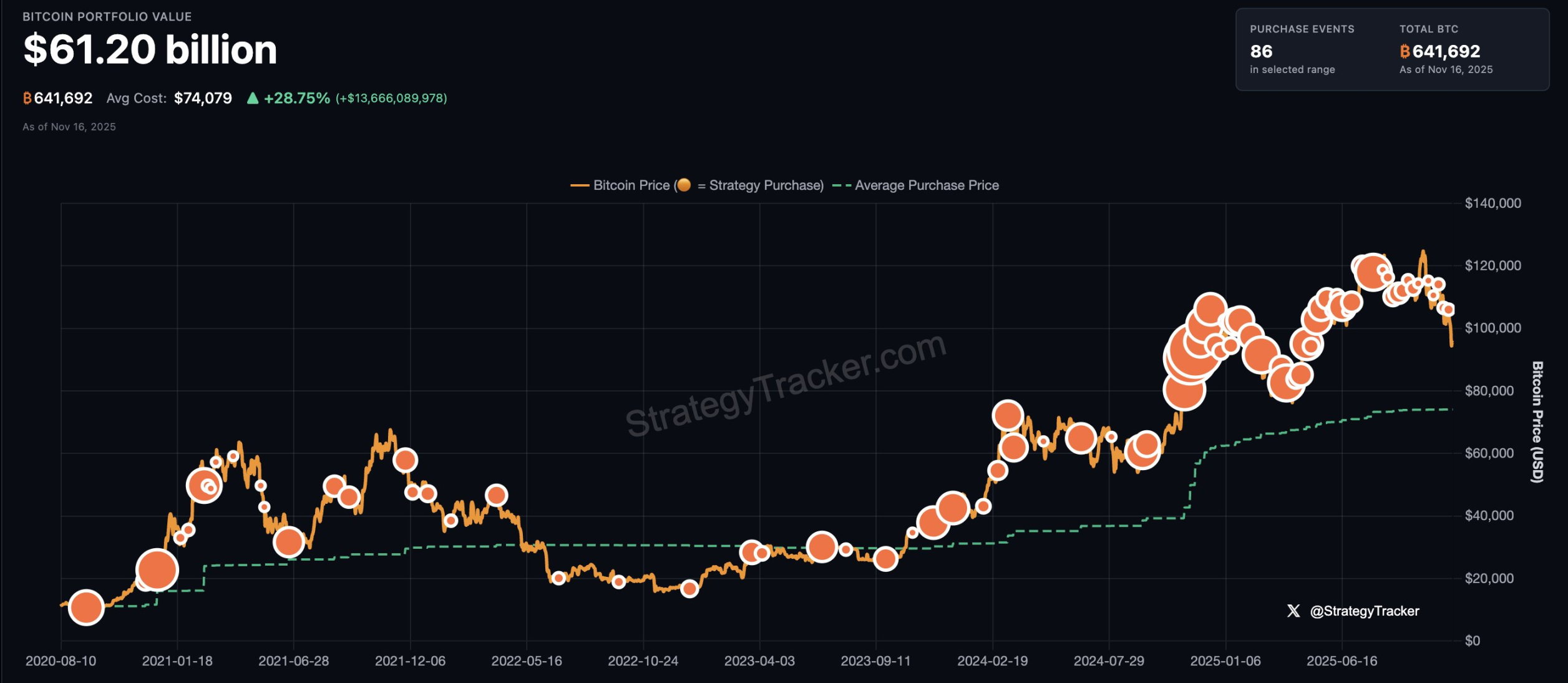

Bitcoin big player Michael Saylor has been consistently buying. Currently, a screenshot from his official website shows that his BTC holdings have risen to 641,692 coins, with a total value of $6.12 billion, and his average purchase price is $740,790. Additionally, he tweeted that he would continue to buy BTC. Currently, MSTR's stock price is $199.7, with a market value of $57.4 billion, and the mNAV (the ratio of enterprise value to the value of held BTC) has fallen below 1.

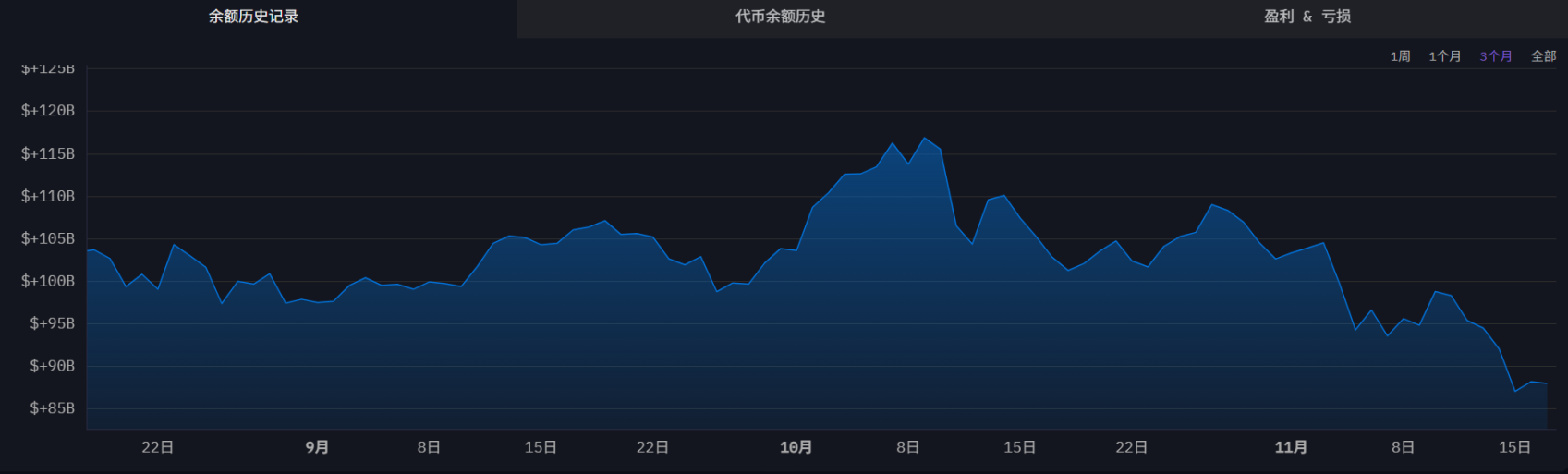

Another market player, BlackRock, has chosen to sell. Arkham monitoring shows that it has reduced its holdings by 0.41% of Bitcoin and 0.89% of Ethereum in the past. Its wallet balance has fallen from $115 billion to around $88 billion.

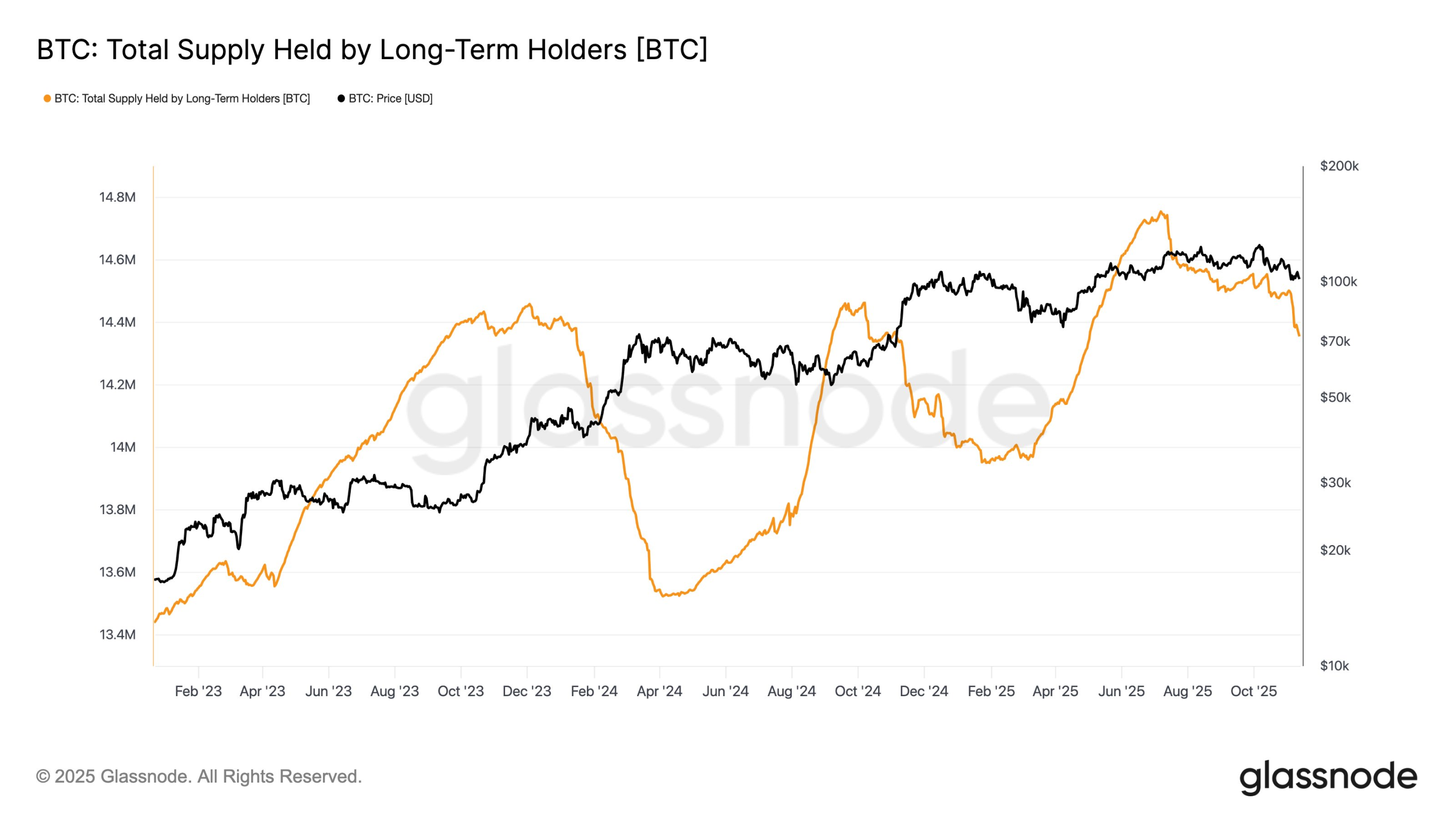

On-chain data shows who is continuously selling BTC.

Glassnode provides the answer: long-term holders of BTC. The supply of Bitcoin is rapidly decreasing, and the net holding changes have sharply turned negative.

As the bulls defend the $100,000 mark, long-term holders (LTHs) are taking profits.

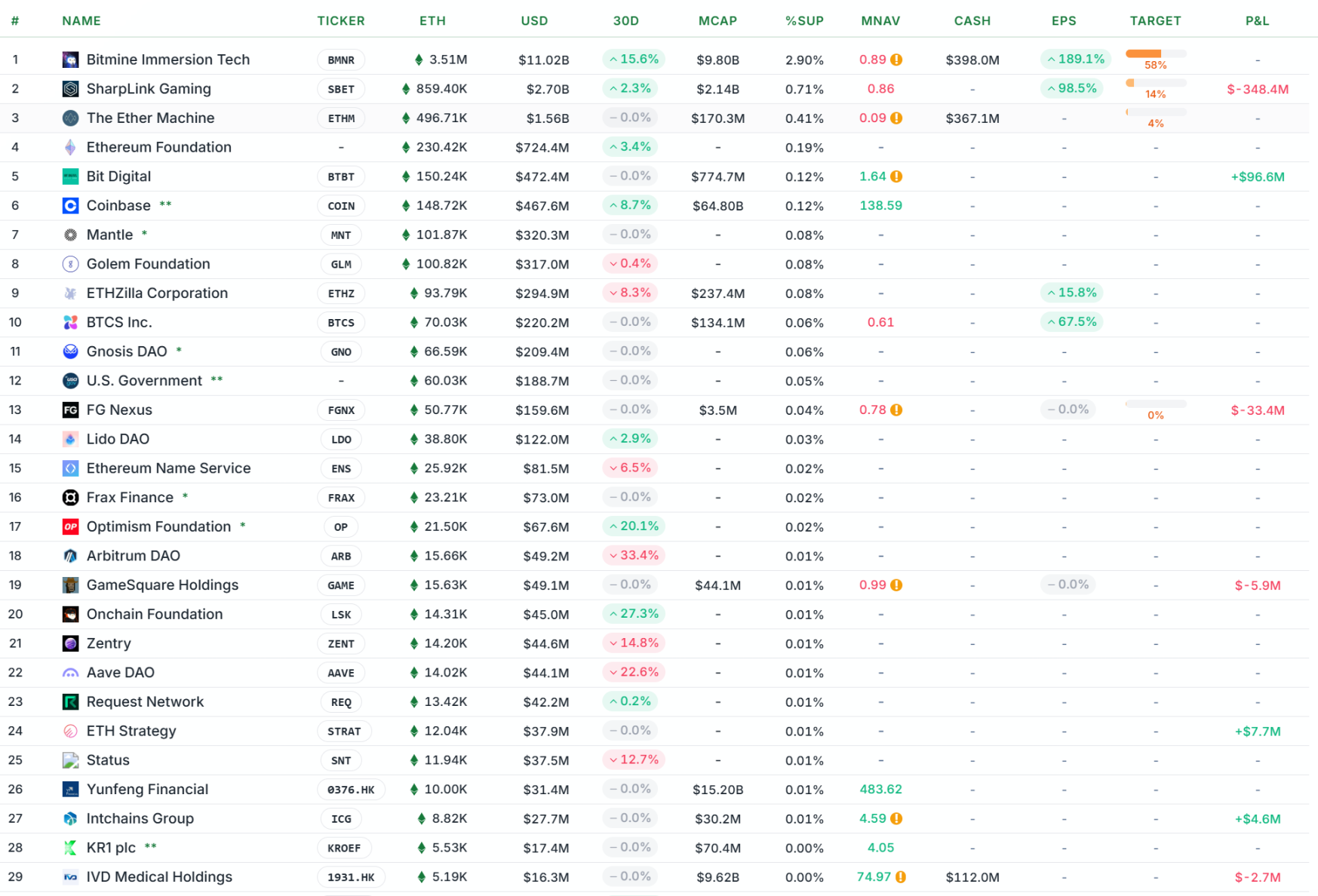

In the Ethereum reserve treasury companies, the divergence is evident.

Ranked first, BitMine has crazily increased its total holdings by 15.6% within 30 days, raising its reserve to 3.51 million ETH, currently valued at $11.02 billion. The second-ranked SharpLink has also chosen to increase its holdings by 2.3%, currently holding $859.4 million. In addition, the Ethereum Foundation, Coinbase, Lido DAO, Optimism Foundation, and Onchain Foundation have all chosen to increase their holdings, with the last two even exceeding a 20% increase.

However, some have chosen to sell, with ETHZilla, ENS, Arbitrum DAO, Zentry, and Aave DAO all experiencing significant reductions in their holdings.

It is worth mentioning that players ranked outside the top 20 have reduced their ETH holdings far more than they have increased them.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。