The market panic is spreading, and the operational strategies of whales, institutions, and KOLs are showing significant differentiation, revealing deep changes in the cryptocurrency market. The Bitcoin market is experiencing a severe shock. On November 17, Eastern Eight Time, the price of Bitcoin continued to plummet, briefly falling below the $93,000 mark, down over 20% from this year's peak. This crash triggered massive liquidations, with over 150,000 people liquidated in the cryptocurrency market within the past 24 hours, and market panic continues to spread.

I. Multiple Factors Triggering Deep Corrections

This round of declines in the cryptocurrency market is not caused by a single factor but is the result of multiple negative factors overlapping.

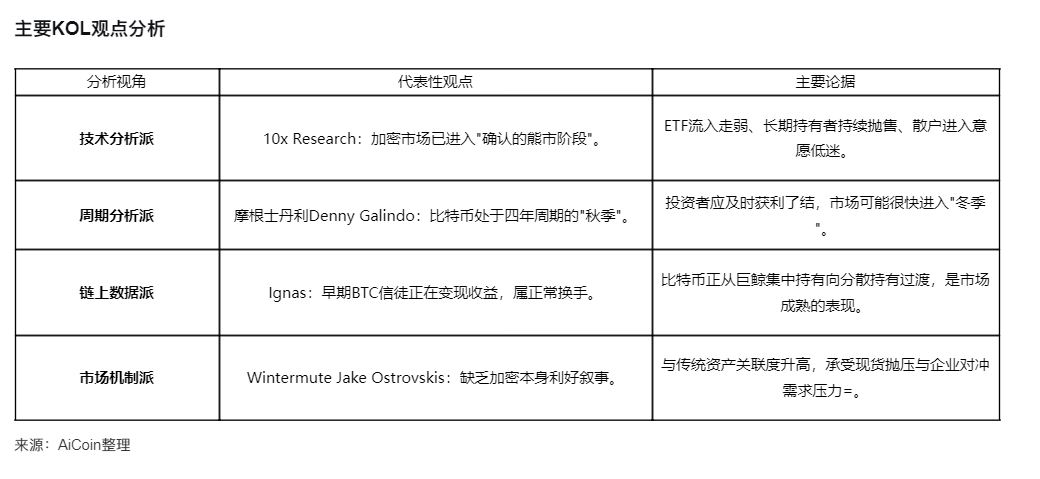

- Large-scale capital withdrawal has become a key signal of market fragility. A report from 10x Research clearly states that the crypto market has entered a "confirmed bear market phase." The agency analyzes that "weak ETF inflows, continuous selling by long-term holders, and low willingness of retail investors to enter all indicate that market sentiment is secretly deteriorating."

- The market structure is increasingly correlated with traditional assets. Jake Ostrovskis, head of OTC trading at Wintermute, points out that "Bitcoin has recently faced significant spot selling pressure and corporate hedging demand, and in the absence of positive narratives for crypto itself, its correlation with traditional assets has rapidly increased, becoming an important driving force behind the day's market decline."

- In the derivatives market, demand for hedging is rapidly heating up. Investors have significantly raised their demand for put options with execution prices below $100,000, with protective contracts around $90,000 and $95,000 being the most actively traded.

- Concentrated selling by long-term holders has intensified market pressure. A report from ForesightNews shows that long-term holders sold 405,000 BTC in just 30 days, accounting for 1.9% of the total BTC supply. This is not panic selling but a natural process of shifting from concentrated holding to diversified holding.

II. Whale Movements: Operational Strategies Show Significant Differentiation

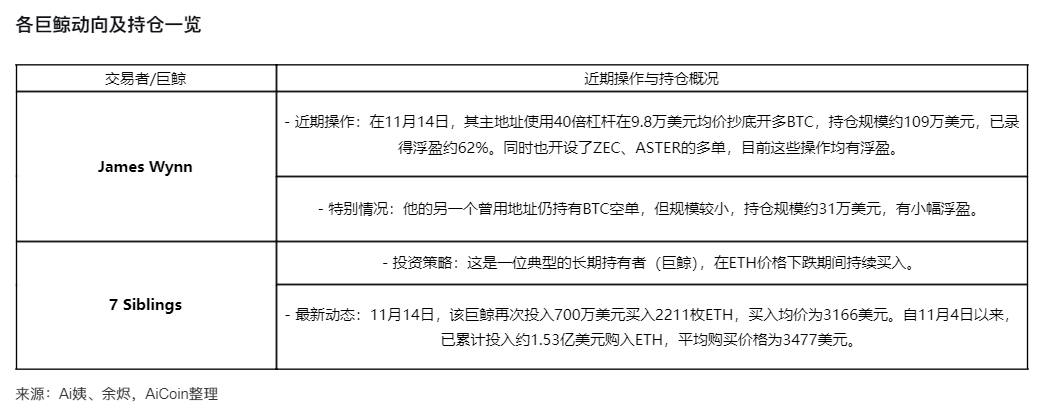

In the midst of severe market fluctuations, different types of whales exhibit distinctly different operational strategies, showing a clear differentiation trend.

Market Signals Behind Whale Behavior

- Panic liquidations contrast sharply with steadfast holding. Take James Wynn as an example; during the market decline, he opened both long and short positions, indicating a divergence in his judgment of the market's short-term direction, adopting a hedging strategy to avoid risk.

- Strategic accumulation of tokens shows long-term confidence. In stark contrast to panic liquidations, the super whale group has remained relatively calm during this round of corrections. Whales like "7 Siblings" have continued to accumulate ETH during the price drop, demonstrating long-term confidence in cryptocurrencies.

- The market chip structure is undergoing fundamental changes. On-chain data shows that early BTC believers are realizing profits, which is not panic selling but a natural transition from concentrated whale holding to broader investor diversification.

Among all traceable on-chain indicators, the most obvious signal is whale selling.

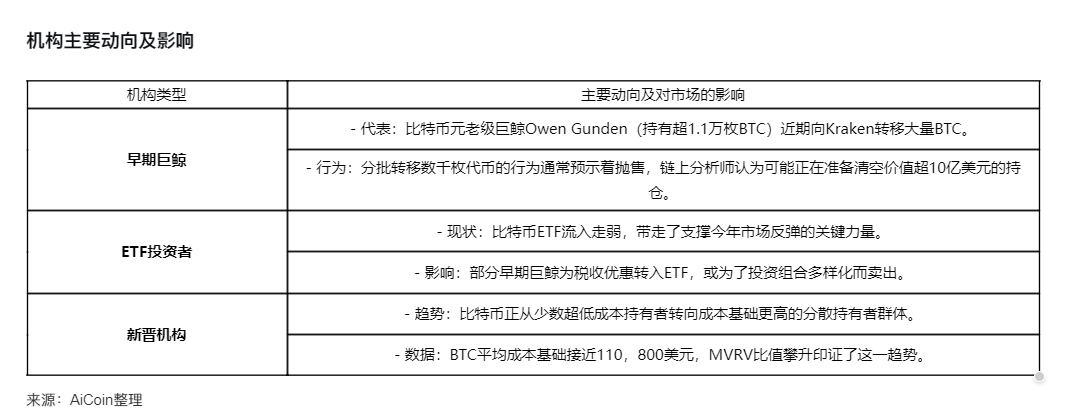

III. Institutional Game: New and Old Capital Accelerate Turnover

As the market declines, institutional investors also show significant strategic divergence, engaging in a long-short showdown.

Clear Divergence Among Institutional Investors

- Public companies face severe tests. With the turbulence in the cryptocurrency market, the wealth of the Trump family, which has consistently supported the market through action, has also significantly shrunk.

The Trump family's cryptocurrency investment portfolio, including Trump Media & Technology Group, World Liberty Financial, and American Bitcoin, has plummeted about 30% since Bitcoin's peak in October.

- There are significant differences in institutional views. 10x Research holds a cautious attitude towards the market outlook, pointing out that "the two rounds of bear markets in the summer of 2024 and early 2025 brought declines of 30% to 40%, while Bitcoin has only retraced over 20% from its 2025 peak, which is not enough to form a true bottom signal."

- Morgan Stanley investment strategist Denny Galindo analyzes from a cyclical perspective, believing that "Bitcoin is currently in the 'autumn' phase of a four-year cycle, which is a good time for investors to take profits." He warns that the market may soon enter "winter," which is the phase of price decline.

IV. KOL Perspectives: Clear Discrepancies in Market Interpretation

In the face of the market crash, KOLs in the cryptocurrency field have also offered distinctly different interpretations and predictions regarding market trends.

Structural Changes in the Market

- The cryptocurrency market is undergoing fundamental changes. ForesightNews' analysis points out that "even if BTC surges, early whales are either switching to ETFs or cashing out, with no wealth spillover effect."

This indicates that this cycle is different from previous ones, with essential changes in market structure and capital flow.

- The relationship between altcoins and Bitcoin is being restructured. Ignas pointed out in an article published on Coinglass that "altcoins are no longer competing with BTC for monetary status but are shifting to compete in terms of practicality, yield, and speculation."

Most altcoins will not survive these conditions, with only a few categories likely to endure.

- Significant evolution is occurring in the DeFi space. The activation of the Uniswap fee switch is a milestone, as it "forces all other protocols to follow suit and begin distributing fees to token holders."

This means that DAOs are evolving into on-chain companies, and the value of tokens will depend on their ability to create and redistribute revenue.

V. Potential Opportunities Amid Uncertainty

In the face of the current market's severe volatility, investors urgently need to clarify their market position and seize potential opportunities.

- The Federal Reserve's monetary policy may become a key factor in the market's turning point. Bitcoin is undergoing a "great turnover," with early low-cost holders transferring chips to new holders with higher cost bases, which is essentially a sign of market maturation.

- The short-term technical outlook remains weak. Currently, Bitcoin has only retraced over 20% from its 2025 peak, which is not enough to form a true bottom signal. The agency reviews historical data and points out that "the two rounds of bear markets in the summer of 2024 and early 2025 brought declines of 30% to 40%," suggesting that this round of adjustments may not yet be over.

- Different tokens are at different stages of their rotation cycles. ForesightNews analysis suggests that "BTC matures first, ETH follows with a lag, and SOL still needs time." This difference in rotation phases provides investors with various opportunities: BTC's turnover is nearing its end, ETH is following closely but slightly lagging, while SOL requires more time.

- Market sentiment is approaching extreme levels. From the perspective of market sentiment, the cryptocurrency market has entered a "confirmed bear market phase," and such extreme sentiment indicators often signal that the market may soon experience a rebound opportunity.

Despite the short-term uncertainty in market trends, on-chain data shows that core chips are still firmly held. As tokens shift from veteran holders to new buyers, unrealized profit prices continue to rise, and a new generation of whales is taking over market dominance.

In the investment world, market volatility is always a constant theme. As Bitcoin falls below $94,000, the game between whales and institutions is quietly changing the market landscape, and this deep-seated change may be the key clue to the future direction of the market.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。