Original Title: State of Filecoin Q3 2025

Original Author: Armita, Messari

Original Translation: Filecoin Network

Key Insights

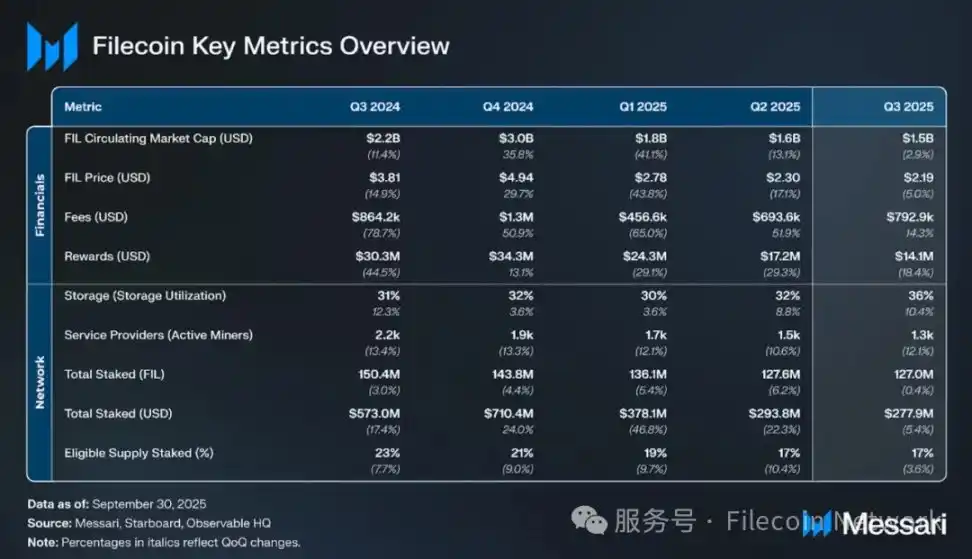

· Network utilization rose to 36% (up from 32% in Q2), while total network storage capacity decreased by 10% to 3.0 EiB. This reflects the exit of some storage providers (SP) and improved network efficiency following the network v27 "Golden Week" upgrade.

· Total network fees increased by 14% to $793,000, with nearly all of the growth driven by penalties (accounting for 99.5%). With the removal of the legacy sector method, batch fees and base fees have dropped to nearly zero.

· Active storage demand remained stable, with total stored data only slightly decreasing by 1% to 1,110 PiB. Although storage providers and allocators are adapting to the new Fil+ pathways and operational adjustments, the daily new transaction volume has decreased by 19%.

· The number of live datasets increased by 3% to 2,491, with 925 datasets exceeding 1,000 TiB, indicating a continued growth in adoption of large-scale, persistent storage by enterprises and research institutions.

· The Filecoin Foundation, in collaboration with the GSR Foundation, funded an impact project group, including The Starling Lab and CROSSLUCID's Oceanic Whispers project, further solidifying Filecoin's key role in verifiable, socially-driven data preservation.

Project Overview

Filecoin (FIL) is dedicated to building a decentralized marketplace for data services, with its first core service being data storage based on the InterPlanetary File System (IPFS). Filecoin employs a market-driven model where users can negotiate variable pricing for storage transactions with storage providers. Storage transactions are akin to a service agreement, where users pay providers to store their data for a specified duration.

Filecoin uses a cryptographic proof-based incentive model—namely, Proof of Replication (PoRep) and Proof of Spacetime (PoSt)—to verify that storage providers reliably store customer data throughout the protocol period. Additionally, Proof of Data Possession (PoDP) was launched in May 2025, adding continuous lightweight verification for stored data and providing a hot storage layer for high-speed data availability. Providers earn the network's native token FIL as a reward for participating in storage transactions. If a storage provider fails to provide reliable online duration or engages in malicious behavior, their staked FIL will be slashed.

In terms of data retrieval, Filecoin users pay retrieval providers to access data. Unlike on-chain storage transactions, retrieval transactions settle off-chain using payment channels for faster retrieval speeds. Besides storage and retrieval, Filecoin aims to provide an open market where computing power can be directly called upon data, offering a more efficient alternative to traditional centralized systems. Key protocol upgrades to enable "compute-over-data" services include smart contracts (Filecoin Virtual Machine - FVM) and scaling solutions (InterPlanetary Consensus - IPC). With the upcoming Filecoin Onchain Cloud, the network's infrastructure will further expand to support complete on-chain cloud services.

Key Metrics

Performance Analysis

The primary use case of Filecoin is to achieve decentralized data storage through two participating parties:

· Demand side, which consists of storage users needing data storage.

· Supply side, which consists of storage providers with idle storage capacity.

The metric for measuring Filecoin's storage demand is the total amount of data in effective storage transactions between users and storage providers.

Storage Transactions

In Q3 2025, the total amount of data stored through active transactions on Filecoin reached 1,110 PiB, a slight decrease of 1% from 1,120 PiB in Q2, indicating that on-chain storage demand remains stable overall. The average number of active transactions decreased by 1% to 35.2 million. Despite the ongoing reduction in total network capacity, the slight decrease in data volume highlights that Filecoin is transitioning from maximizing raw storage supply to supporting higher-value, enterprise-grade, and verified data workloads.

In Q3 2025, the daily new storage transaction volume on Filecoin decreased by 19%, from 3.4 PiB to 2.8 PiB. This trend contrasts with the growth seen in the previous quarter, reflecting a slowdown in the onboarding of new data, even though the total active storage volume remained relatively stable (only decreasing from 1,120 PiB to 1,110 PiB). This divergence indicates a slowdown in the onboarding speed of new data, while existing verified datasets remain stable.

The Filecoin Plus (Fil+) allocator pathways launched at the end of Q2 2025 prioritize large verified data clients and streamline the onboarding process for enterprise users, leading to a reduction in transaction numbers but higher value per transaction. Currently, verified storage dominates total network activity, while smaller, shorter-term ordinary transactions have nearly disappeared. Meanwhile, the network v27 "Golden Week" upgrade simplified SP operations and deprecated several old packaging and aggregation methods, temporarily leading to a decrease in new transactions as storage providers needed time to adapt to the new toolset. Miner consolidation is another reason, as many small operators chose to exit under stricter efficiency standards and increasing staking requirements.

Despite the short-term decline in new transaction volume, overall utilization has improved due to the continued activity of existing verified datasets. These datasets are particularly related to long-term archiving, research, and enterprise use cases introduced through projects like the "Cultural and Scientific Preservation Program" launched in Q3.

Utility vs. Capacity

In Q3 2025, Filecoin's storage utilization increased from 32% in Q2 to 36%, while total network committed capacity decreased by 10% from 3.3 EiB to 3.0 EiB during the same period. This inverse trend reflects ongoing SP consolidation and right-sizing within the network. The decline in total capacity primarily stems from the exit of some smaller or underperforming storage providers following the introduction of stricter operational and staking requirements with the network v27 "Golden Week" upgrade. This upgrade simplified sector packaging and maintenance processes through proposals like FIP-0101, FIP-0103, and FIP-0106, phasing out outdated and inefficient workflows, prompting some SPs to retire obsolete infrastructure. Meanwhile, the daily new transaction onboarding volume decreased by 19%, reducing the influx of new data. Therefore, despite the contraction in total network capacity, the remaining storage space is being utilized more efficiently, resulting in increased utilization even as the network size shrinks.

Clients

Filecoin currently primarily targets enterprises and developers, providing cold storage solutions (e.g., data archiving and recovery). Low storage prices help attract traditional enterprises seeking cost-effective alternatives for vast amounts of archival data.

DeStor is a Filecoin service provider connecting clients with storage providers, and it has partnered with Qamcom's Decentralized Data Security (DDS). Potential data clients in this partnership include Web3 gaming studio YayPal, which has over 500,000 users, and the AI marketing analytics platform Fieldstream. Other client solution examples include:

· GhostDrive: Focused on enhancing privacy and security through encryption, decentralization, and innovative storage optimization technologies;

· CIDGravity: Focused on enterprise-level integration with open-source platforms like Nextcloud.

In addition to cold storage, projects like Lighthouse, Akave, and Storacha are also driving the development of other storage solutions.

As of the end of Q3 2025, there were 2,491 live datasets hosted on Filecoin, a 3% increase from 2,416 in Q2. Among these, 925 datasets exceeded 1,000 TiB, up 7% from 864 in Q2, highlighting the market's continued adoption of large-capacity, persistent storage. This growth is attributed to ongoing Filecoin Plus onboarding activities, new on-ramp integration solutions (which lowered the entry barriers for datasets), and an increase in enterprise and research workloads.

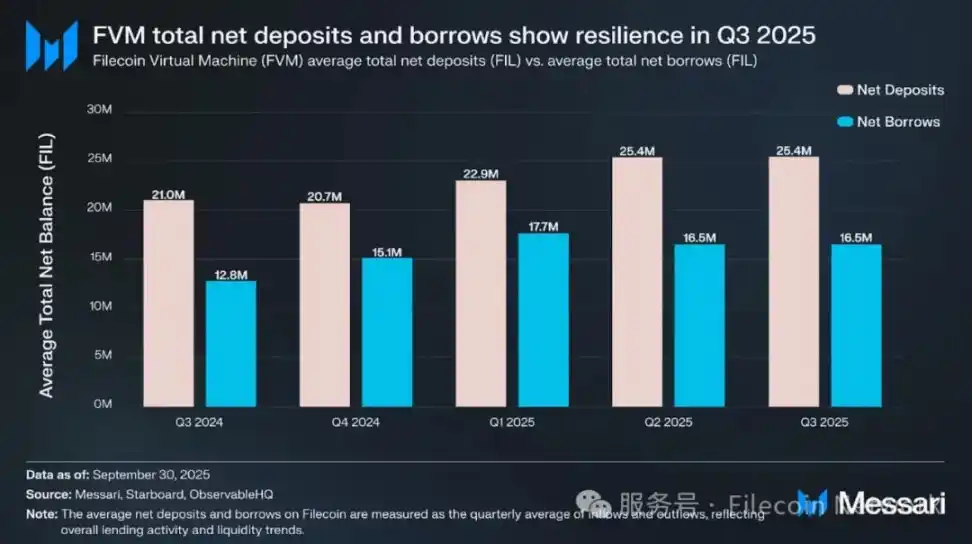

Momentum of FVM Development

The Filecoin Virtual Machine (FVM) allows developers to deploy Ethereum-like smart contracts directly on Filecoin's storage layer, enabling the construction of applications that can automate processes such as data onboarding, pricing, retrieval, and computation coordination.

In Q3 2025, Filecoin's total inflow (net deposits) was $62.4 million, a decrease of 6.5% from $66.8 million in Q2; meanwhile, total outflows and borrowing decreased by 6.8%, from $43.4 million to $40.5 million.

However, when measured in FIL, token activity showed a contrasting trend: inflows slightly increased by 0.16%, from 25.39 million FIL to 25.43 million FIL; while outflows decreased by 0.03%, from 16.53 million FIL to 16.52 million FIL. This discrepancy is due to a 5% drop in FIL price during the quarter (from $2.30 to $2.19), which reduced the dollar-denominated value of what should have been stable on-chain token liquidity.

Financial Overview

Filecoin's revenue model is similar to Ethereum's, as it employs a gas mechanism inspired by EIP-1559, where a portion of network fees is burned to regulate network congestion. However, unlike Ethereum, Filecoin's economic model is storage-driven, with storage users paying fees, and storage providers earning revenue while managing collateral and penalties.

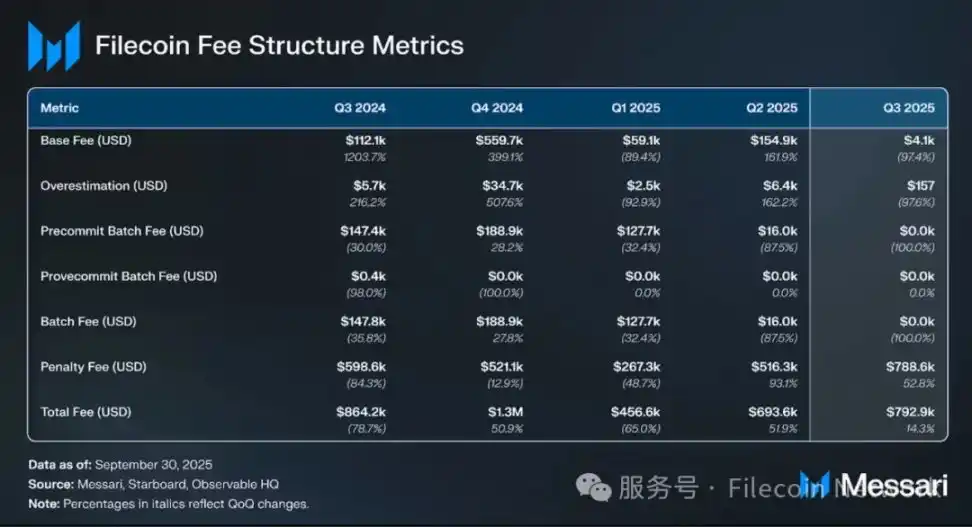

Network Fees

According to Messari's revenue analysis, the fee structure for Filecoin is as follows:

· Base Fees: Determined by the level of congestion in block space, any storage proof requires payment.

· Batch Fees: Used to bundle multiple storage proofs to optimize costs.

· Overestimation Fees: Fees paid to optimize gas usage.

· Penalty Fees: Charged due to failures or violations by storage providers.

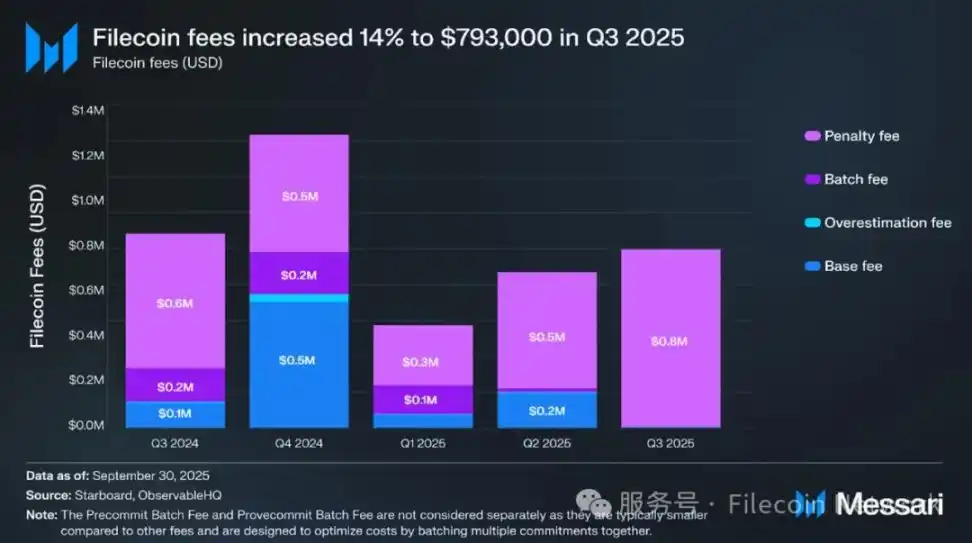

In Q3 2025, Filecoin's total network fees reached $792,900, a 14.3% increase from $693,600 in Q2 2025. This growth was almost entirely driven by penalties, while base fees and batch-related fees have nearly collapsed following protocol layer changes introduced in the network v27 upgrade.

· Base Fees: Plummeted by 97% to $4,100. This drop reflects a decrease in on-chain transaction throughput after multiple sector-related methods (FIP-0103, FIP-0106, FIP-0101) were deprecated, rather than a decline in network demand.

· Batch Fees: Decreased by 100% to $0. This aligns with the reduction in sector onboarding activity and the ongoing decline in total active storage, leading to a significant decrease in batch pre-submission transactions submitted by SPs.

· Overestimation Fees: Plummeted by 98% to just $157 (down from $6,400 in the previous quarter), reflecting a corresponding reduction in gas-related activity as overall transaction frequency declined.

· Penalties: Soared by 53% to $788,600, accounting for about 99.5% of total network fees. This surge may reflect an increase in slashing events during the exit of miners amid network restructuring and stricter operational requirements.

Q3 was a transitional period for Filecoin's economic model, as the network simplified operational processes under version v27. The reduction in batch fees and base fees reflects a shift from a high transaction volume, short-cycle onboarding model to fewer but larger verified transactions. The surge in penalties highlights the operational pressure on smaller providers due to increased quality standards. These trends indicate that the network is undergoing a consolidation phase, with reduced fee activity from expansion, but the execution and efficiency of existing participants are improving.

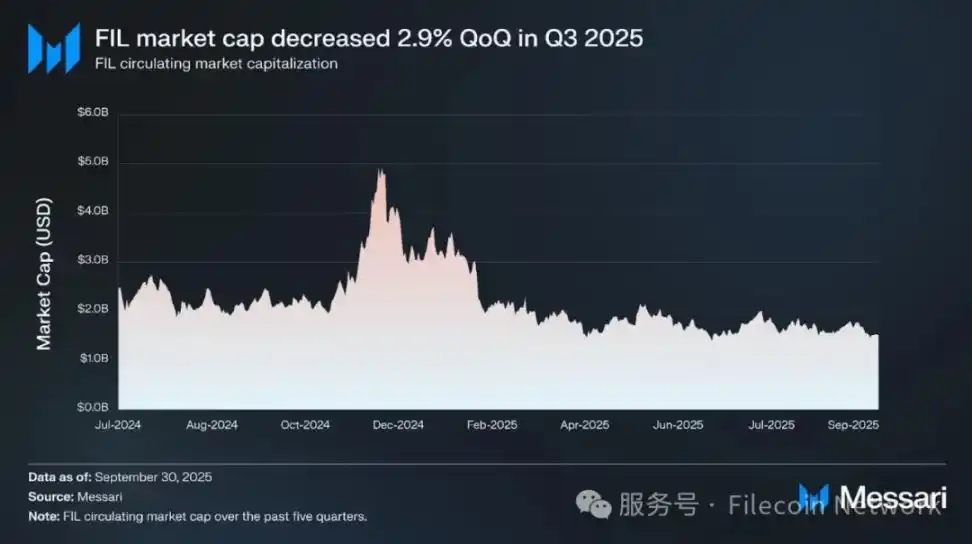

Market Capitalization

In Q3 2025, FIL's circulating market cap in dollar terms decreased by 3% to $1.5 billion, down from $1.6 billion in Q2 2025. This decline was primarily driven by a 5% drop in the price of FIL tokens (from $2.30 to $2.19), while the circulating supply increased by 2.2% to 692.4 million FIL, consistent with the previous issuance rate.

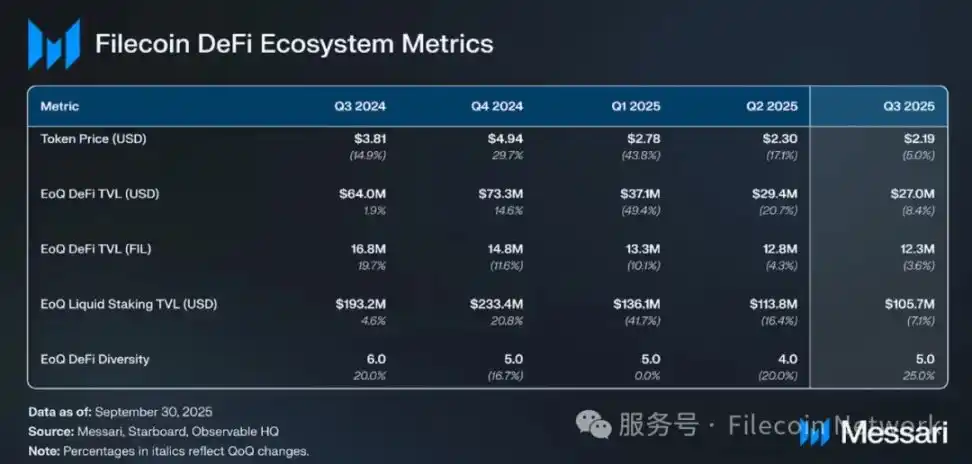

DeFi Ecosystem

In Q3 2025, the total staking amount of FIL slightly decreased by 0.4%, from 127.6 million FIL to 127 million FIL, marking the fifth consecutive quarter of decline. In dollar terms, the total staked value fell by 5.4% to $27.79 million, primarily due to the 5% drop in FIL price during the quarter, rather than a significant change in staking participation.

The staking rate for qualified supply remained stable at 17%, unchanged from Q2, but down from 19% in Q1 2025, reflecting stable but relatively low network participation. Meanwhile, the annual nominal yield dropped significantly from 52% to 24%. This was due to a short-term spike in rewards driven by decreased staking participation and inflation in Q2, which has returned to normal levels following stabilization in staking activity.

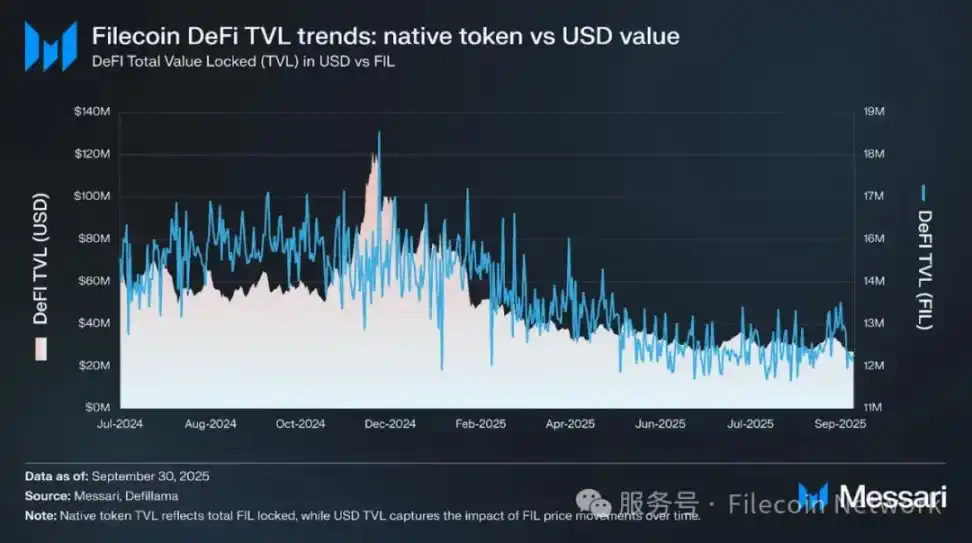

TVL Trends

In Q3 2025, Filecoin's DeFi activity continued to contract, extending the downward trend that began in early 2024. The total value locked (TVL) in DeFi at the end of the quarter decreased by 8.4% to $27 million, down from $29.4 million in Q2, marking the fifth consecutive quarter of decline. When measured in FIL, the decline in TVL was much milder, decreasing by 3.6% to 12.3 million FIL, indicating that most of the value decline was driven by the 5% drop in FIL price rather than substantial capital outflows.

The TVL for liquid staking also exhibited the same trend, decreasing by 7.1% to $10.57 million. This was due to a normalization of staking rewards following a spike in yields in Q2, while network incentives gradually weakened. In FIL terms, the core liquidity products and staking participation remained stable, indicating that even as dollar-denominated metrics declined, user participation and network engagement remained healthy.

Stablecoins

USDFC is a FIL-backed stablecoin launched by Secured Finance in early 2025. It aims to increase liquidity within the Filecoin economy by allowing FIL to be used as collateral and reducing selling pressure on FIL. It provides a native, dollar-pegged asset for transactions, lending, and DeFi applications, allowing users to operate without leaving the Filecoin network.

In Q3 2025, the circulating supply of USDFC decreased by 8.5%, from $301,000 at the end of Q2 to $275,000 on September 30, marking its first contraction since launch. After peaking at nearly $355,000 in mid-August, the circulating supply of this stablecoin gradually declined throughout September as DeFi activity and yield opportunities cooled.

This pullback is market-driven rather than indicative of structural issues. The 5% drop in FIL price reduced the value of collateral supporting new issuances, while staking and DeFi yields returned to normal levels from the short-term peak of 52% in Q2 to 24%, reducing minting incentives for liquidity providers and borrowers. Following the network v27 "Golden Week" upgrade, participants prioritized protocol stability, which also led to a broader reduction in on-chain liquidity.

Despite this mild contraction, USDFC maintained complete peg stability and a healthy circulating state, indicating stable confidence among storage providers and DeFi participants. This contraction is not a sign of weakness but rather a natural consolidation phase following rapid expansion in Q2, laying the groundwork for more robust growth as the FIL-denominated market and FVM-based integration solutions mature in 2025.

Qualitative Analysis

Protocol Upgrades

The network v27 upgrade (codenamed "Golden Week"): The Filecoin network v27 upgrade (codenamed "Golden Week") was successfully deployed on September 24, 2025, at block height 5,348,280, and officially completed the next day (September 25). This version focused on simplifying the operations of storage providers (SP), enhancing EVM compatibility, and reducing technical debt.

Key Filecoin Improvement Proposals (FIPs) implemented include:

· FIP-0105: Introduced BLS12-381 precompiled contracts for Filecoin EVM (equivalent to EIP-2537) to support efficient BLS signature verification and achieve cross-chain interoperability with Ethereum-based rollup solutions.

· FIP-0077: Introduced deposit requirements for newly created storage provider (SP) IDs, amounting to 10% of the initial staking amount for 10 TiB of storage capacity (approximately 4 FIL at current rates), aimed at curbing the creation of spam accounts and improving network state efficiency.

· FIP-0103 / FIP-0106 / FIP-0101: Removed deprecated methods (such as "extend sector lifetime," "proof of replication update," "proof aggregation submission") to streamline the logic and maintenance work of SP actors.

· FIP-0109: Enabled smart contract notifications for Direct Data Onboarding (DDO) functionality, allowing on-chain applications to subscribe to storage events and programmatically trigger corresponding workflows.

· FRC-0108: Expanded the snapshot format to include Fast Finality (F3) certificates, thereby reducing node synchronization time and bandwidth requirements for new participants.

All major client implementations (Lotus, Venus, Forest, Curio, Boost) released compatible versions before the upgrade activation. This upgrade enhanced developer tools and aligned the Filecoin virtual machine with Ethereum standards, laying the foundation for programmable data services and retrieval markets.

Cultural and Scientific Data Storage on Filecoin

On September 30, 2025, the Filecoin Foundation announced a new batch of partners who will preserve cultural and scientific archives on the Filecoin network. This initiative builds on early collaborations with several well-known institutions, highlighting Filecoin's increasingly important role as a decentralized physical infrastructure network (DePIN) in the realm of persistent, verifiable, and censorship-resistant data storage. New datasets preserved on Filecoin include:

· Digital Public Library of America (DPLA): A pilot project aimed at storing selected materials from its collection of over 50 million cultural artifacts, such as photographs, oral histories, and government documents.

· Earth Species Project (ESP): Preserving the BEANS-Zero benchmark dataset, which is used to train NatureLM-audio—a language model for animal vocalizations—to ensure global researchers have resilient access to this data.

· Prelinger Archives: Tens of thousands of archival films documenting American social and cultural history, including Rick Prelinger's "Lost Landscapes" series.

· Rohingya Project: A community-led archive aimed at preserving the cultural identity and oral histories of the stateless Rohingya community.

· CROSSLUCID's "Oceanic Whispers": Co-developed in part with RadicalxChange, this is an experimental data trust that stores datasets from marine protected areas on Filecoin and transforms them into AI-generated interactive experiences with partial ownership revenue models.

These collaborations collectively demonstrate how decentralized storage can support open science and cultural preservation through verifiable, tamper-proof archiving.

Ecosystem Integration and Collaboration

Filecoin Foundation and GSR Foundation Impact Cohort: On July 23, 2025, the Filecoin Foundation announced a partnership with the GSR Foundation to jointly launch the "Impact Cohort." This is a joint initiative aimed at supporting five blockchain-based public welfare projects within the Filecoin ecosystem. The GSR Foundation is the charitable arm of digital asset market maker GSR, and it collaborated with the Filecoin Foundation to co-fund The Starling Lab for Data Integrity, Easier Data Initiative, Transfer Data Trust, Akashic, and CROSSLUCID's "Oceanic Whispers." Each project applies decentralized storage to socially impactful areas such as digital truth preservation, geospatial data access, art governance, and environmental management. This collaboration highlights Filecoin's critical role as a core technological infrastructure supporting social impact and real-world applications.

S3-Compatible Object Storage via Akave Cloud: On September 16, 2025, Akave announced the launch of an S3-compatible object storage service supported by Filecoin, designed for enterprise and DePIN application scenarios. This integration allows developers and organizations to store and access data using standard S3 APIs while benefiting from Filecoin's verifiable storage and retrieval guarantees. Akave's release aims to connect traditional cloud tools with decentralized infrastructure, simplifying the process for enterprises to migrate to blockchain storage and achieving verifiable, low-latency "warm" data use cases through support for Proof of Data Possession (PDP).

Storacha's Bluesky Backup Application: Storacha is a decentralized hot storage network built on Filecoin and IPFS, which launched bsky.storage on June 12, 2025 (its adoption rate continued to expand in Q3). This user-facing application automatically backs up Bluesky social data every hour. The tool enables users to independently export and recover their posts and identity keys, further reinforcing Filecoin's grand vision of achieving data portability, user ownership, and self-sovereign digital identity.

Developer Programs and Community Growth

Seventh Filecoin Developer Summit (FDS-7): Announced in September 2025, the seventh Filecoin Developer Summit is scheduled to be held online on October 16-17 and in-person during DevConnect Argentina in Buenos Aires from November 13-15. This summit focuses on scaling Filecoin to accommodate enterprise-level and data-intensive applications and explores advancements brought by network v27, including Direct Data Onboarding (DDO), BLS precompiled contracts, and Fast Finality snapshots, as well as new retrieval markets and AI data workflows.

Filecoin Onchain Cloud (Alpha Cohort): On August 12, 2025, FIL-Builders and FilOz launched the Onchain Cloud Alpha Cohort. This program introduces modules such as on-chain payments, warm storage, standardized retrieval interfaces, and smart contract-based service level agreements (SLAs), enabling developers to easily deploy decentralized data services as if using smart contracts.

PL Genesis Hackathon – "Leveraging Filecoin to Crack the Sovereign Data Layer": As part of the "Modular World" series of events hosted by Protocol Labs, this hackathon began in early June and ran until July 6, 2025. The event invited developers to experiment with decentralized data ownership and retrieval using Filecoin's on-chain technology stack, exploring new applications for programmable storage and verifiable data access. Award-winning projects announced on September 5, 2025, showcased innovations such as smart contract-based retrieval logic, verifiable AI datasets, and developer tools for Data DAOs. The hackathon had a total prize pool of $15,000, enhancing developer engagement in Filecoin's evolving on-chain cloud ecosystem.

Orbit Program and Community Activities: During September 2025, FIL Builders' Orbit Program expanded its reach to global developers through a series of community workshops and hackathons. Highlighted events included FIL Warsaw (September 5) and ETHAccra (September 4-6), featuring AI and DeFi bounty challenges; Code & Corgi workshops held in Pune (September 12) and Delhi (September 25); and Decentralized Storage 101 co-hosted with Pacific Meta in Japan (September 18). These meetings focused on developer education around the Filecoin virtual machine (FEVM), data onboarding tools, and community-led open-source development.

Key Governance Progress

ProPGF Batch 1: On August 11, 2025, Protocol Labs completed the first batch of Filecoin Public Goods Funding (ProPGF), allocating $3.68 million to 14 ecosystem projects, including IPNI, CID Gravity Gateway, Curio Storage, Fil Ponto, and FilCDN Retrieval Services. This program supports forward-looking infrastructure and developer initiatives to strengthen Filecoin's core ecosystem and long-term sustainability.

RetroPGF Round 3: On August 25, 2025, the third round of Retroactive Public Goods Funding (RetroPGF) was announced, allocating 585,000 FIL to retroactively fund contributors who delivered verifiable impact across the ecosystem. This round adopted an Optimism-style public goods funding model, rewarding open-source contributions in infrastructure, tools, research, and customer onboarding, reinforcing Filecoin's commitment to sustainable, impact-driven ecosystem growth.

Filecoin Plus (Fil+) Allocator Pathway: As of September 2025, the Fil+ governance team reviewed over 140 allocator applications, with an approval rate of approximately 75%, distributing over 450 PiB of DataCap. A new meta-allocator pathway was introduced to streamline enterprise onboarding processes and automate allocation tools. Regular governance calls and published recordings in August and September improved transparency, accountability, and operational efficiency within the program.

Summary

In Q3 2025, Filecoin's circulating market cap decreased by 3% to $1.5 billion, primarily influenced by a 5% drop in FIL price to $2.19, while circulating supply increased by 2.2%. Network activity remained stable, with active storage slightly declining by 1% to 1,110 PiB, due to a 10% capacity contraction from SP consolidation, while network utilization increased from 32% to 36%.

The network v27 "Golden Week" upgrade simplified storage operations, deprecated the old sector method, and enhanced FVM compatibility. Although this temporarily slowed the formation of new transactions, it improved long-term efficiency. Economic activity returned to normal, with total network fees increasing by 14% to $793,000, primarily driven by penalties; staking participation remained at 17%, and yields fell from 52% to 24%. As on-chain yields cooled, DeFi TVL decreased by 8% to $27 million, and the FIL-supported stablecoin USDFC contracted by 8.5% to $275,000.

In terms of ecosystem, the Filecoin Foundation advanced cultural and scientific preservation efforts and launched a joint funding project group with the GSR Foundation; Akave and Storacha announced new applications for the network; FIL-Builders and FilOz expanded developer programs through the Onchain Cloud Alpha Cohort and PL Genesis hackathon. The team also announced the FIL Dev Summit 7, scheduled to take place in November 2025 during DevConnect Argentina in Buenos Aires, to showcase Filecoin's evolution towards verifiable, programmable data infrastructure.

Overall, the third quarter reflected a consolidation phase, with the network becoming more streamlined and efficient, focusing on verified data, enterprise storage, and laying the groundwork for compute-over-data services.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。