Original | Odaily Planet Daily (@OdailyChina)

Since the price of BTC fell below $100,000, market panic has been spreading. Alternative data shows that the cryptocurrency fear and greed index is at 14. Just yesterday, it even dropped to 10, marking the lowest level since February 27, with the market remaining in a state of "extreme fear."

CryptoQuant stated that long-term holders of Bitcoin have recently significantly reduced their positions, selling a total of approximately 815,000 BTC. This is the highest level since January 2024. Against the backdrop of weakening demand, the ongoing selling pressure is exerting downward pressure on prices. However, if we only focus on the panic created by these numbers, the market may overlook a more subtle yet equally critical fact: Bitcoin is also being absorbed by another force.

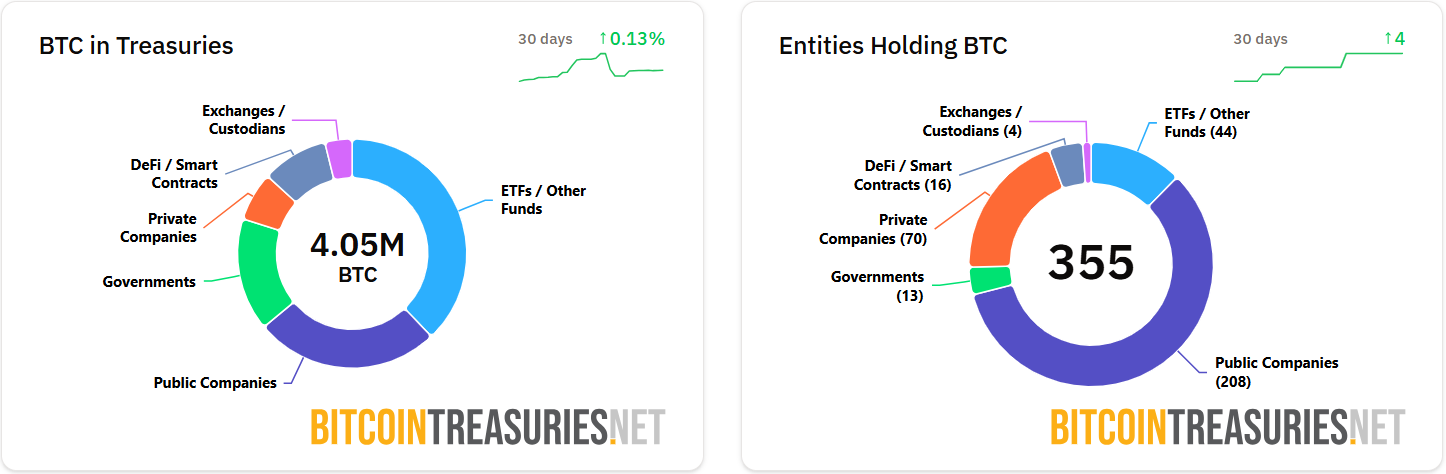

Data from bitcointreasuries.net indicates that in the past month, 4 new entities have added Bitcoin to their reserves, bringing the total number of entities holding BTC globally to 355. Institutional holdings have increased by 4.05 million BTC, valued at approximately $400 million in the past month. Looking at a longer time frame, in the third quarter, publicly listed companies net purchased 195,000 BTC, with an investment scale reaching $20.5 billion.

Notably, BTC steadfast believer Strategy currently holds a total of 641,000 BTC, valued at approximately $67 billion, far exceeding the second-largest holder, MARA Holding, with a profit of 41%. Strategy's core strategy is to: hold Bitcoin indefinitely, never sell, and use Bitcoin as the primary reserve asset against fiat currency inflation. The company purchases Bitcoin almost every week, with nearly 1,442 BTC acquired in the past month.

On November 14, according to Lookonchain monitoring, Strategy transferred 58,915 BTC (valued at $5.77 billion) to a new wallet, sparking market speculation about whether they were preparing to sell, which even had some impact on Polymarket. The probability of MicroStrategy selling Bitcoin in 2025 surged on Polymarket, but the company's management clarified that the wallet switch was merely to transfer Bitcoin to another custodian and did not involve selling. Strategy's leverage is actually quite low, currently holding Bitcoin valued at $64 billion, with liabilities of only $8 billion, resulting in a leverage ratio of about 13%, and all of its debt is long-term, meaning there is no need for short-term repayment.

Japanese listed company Metaplanet holds 30,000 BTC, ranking as the fourth-largest Bitcoin reserve entity globally. In September of this year, the company announced plans to invest $1.25 billion to increase its Bitcoin holdings before October. Since September 20, Metaplanet has accelerated its buying pace, with weekly purchases exceeding 5,000 BTC. The most recent purchase was on October 1, acquiring 5,268 BTC. However, it has not increased its holdings for nearly a month, currently fulfilling only about one-tenth of its commitment. Compared to the market's general understanding of "stopping purchases = bearish," another possibility is: large institutions are entering the next phase of observation, waiting for the optimal entry window.

American Bitcoin, a Bitcoin mining company related to the Trump family, released its Q3 2025 financial report on November 15, disclosing an increase of about 3,000 BTC during the quarter. As of September 30, 2025, its Bitcoin holdings were approximately 3,418 BTC, and as of November 13, its Bitcoin holdings had increased to 4,090 BTC, with a mining output of 563 BTC in the third quarter, and 2,385 BTC pledged or otherwise collateralized during the same period.

Data from the El Salvador Ministry of Finance shows that El Salvador continues to add 1 BTC daily, currently holding 6,380.18 BTC, valued at approximately $630 million, with an increase of 8 BTC in the past 7 days. In a globally depressed market, this continuous and small investment appears particularly steadfast.

In addition to institutional buying, some investors are also starting to look for opportunities at the emotional low point. On November 16, Equation News founder Vida stated that he increased his BTC holdings as a long-term allocation and added a small-cap meme coin for short-term speculation, with the investment size only accounting for 0.7% of his personal net worth, considered a "light position trial." He believes that the current market sentiment has deviated from the fundamentals and is in a state of obvious excessive panic; the controllable adjustment of the U.S. stock market, BTC being near the key support of the 1-week supertrend, and some altcoins often having a higher probability of rebound during moments of despair are all short- to medium-term signals worth paying attention to.

However, he also emphasized that the ideal "deep buying point" usually occurs during a phase when large institutions are forced to liquidate, and the probability of such a situation occurring in the next year remains low.

Bernstein analysts in their latest research report stated that Bitcoin has fallen about 25% since its peak in early October, resembling a "short-term correction, rather than the top of this cycle." In the past six months, long-term investors holding for over a year have cumulatively sold about 340,000 BTC (approximately $38 billion), but this has almost been absorbed by the approximately $34 billion from spot ETFs and corporate treasuries. The proportion of institutional holdings in Bitcoin ETFs has also increased from 20% at the end of 2024 to the current 28%, indicating a more stable holding structure.

CryptoQuant analyst Axel Adler Jr also believes that after a brief slowdown and absorption of recent volatility, the overall structure is becoming healthier. After experiencing a significant bearish pressure, the Bitcoin position index (used to measure the aggressiveness of long and short forces in the futures market) has returned to a neutral range.

Meanwhile, QCP stated in its latest market update that after BTC first fell below $100,000 and lost the 50-week moving average, sentiment indeed turned bearish. Currently, it is crucial to focus on whether the $92,000 support and the $88,000 CME gap can bring a short-term rebound. If these key positions stabilize, the market may welcome the "final confirmation" of this round of decline; conversely, it may enter a deeper cycle reset phase. QCP also reminded that the U.S. government's resumption and delayed release of a large amount of economic data could keep market volatility high in the short term, with BTC implied volatility rising above 50, and option skew continuing to lean bearish.

Finally

The market is undergoing a "major reshuffling of emotions" — panic sellers are choosing to exit, while the true bottom is often built quietly amidst this seemingly weak chaos by the most patient and deep-pocketed buyers.

We clearly cannot hastily declare that "the bottom has been reached," but we can confirm that: this is not a hollow downward cycle without buyers, support, or inflows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。