Abstract

At the end of October 2025, the Norwegian company 1X Technologies released the humanoid robot NEO, priced at $20,000. It can fold clothes, organize tableware, and serve tea and water, making the vision of "robots entering households" more tangible than ever. Immediately, a meme coin named $NEO appeared on Solana, with its market capitalization quickly surpassing $4 million, showcasing significant market interest and enthusiasm. The narratives of "Robotics" and "Decentralized Physical AI (DePAI)" rapidly became new focal points in the crypto space. This report aims to comprehensively analyze this emerging sector, exploring its market overview, core drivers, key projects, as well as future potential and risks.

The core of this narrative lies in utilizing Web3 technologies, such as Decentralized Physical Infrastructure Networks (DePIN) and AI agent payment protocols, to address ownership and control issues of robots in the future physical world, thereby constructing an open "machine economy." Although the total market capitalization of this sector has just exceeded $1 billion and is still in its early stages, its integration of AI, robotics, and blockchain technologies can be seen as the next market opportunity worth paying attention to. However, investors must also be aware of the multiple risks it faces, including technological immaturity, market volatility, and regulatory uncertainty.

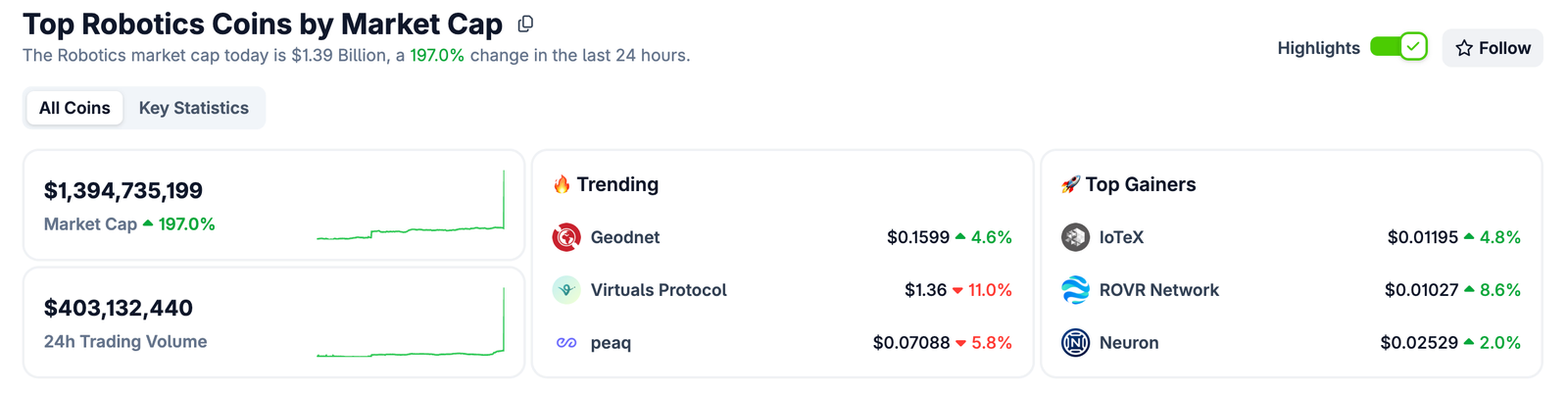

I. Market Overview

Although the robotics narrative is full of imaginative possibilities, its current overall scale in the crypto market is relatively small, leaving considerable room for growth. According to Coingecko data as of November 2025, the total market capitalization is nearly $1.4 billion, with a 197% increase in 24 hours, indicating that while this new sector is still in its infancy, it has already attracted significant investor attention.

According to Morgan Stanley's predictions, the number of humanoid robots worldwide will reach nearly 1 billion by 2050. Tesla CEO Elon Musk boldly stated that by 2040, the number of humanoid robots will exceed that of humans. NVIDIA CEO Jensen Huang asserted, "Every car will become a robot, everything that moves will be a robot, and in the future, you will definitely be surrounded by robots." Behind these predictions is the formation of a trillion-dollar machine economy.

If DeFi captured a token market value of over $100 billion through decentralized financial infrastructure while serving traditional financial markets, then Robotics × Crypto, as a combination of Decentralized Physical Infrastructure (DePIN) and Decentralized Physical AI (DePAI), has reason to achieve a token market value that reaches or even surpasses DeFi levels during bullish market cycles while serving a potentially larger "machine economy" (not only the $200 billion robotics industry but also machine-to-machine transactions, autonomous agent economies, etc.). If this narrative materializes in the next 2-3 bullish market cycles, the growth potential from $1.4 billion to over $100 billion represents a conservative 70 times growth potential. Of course, all of this hinges on the large-scale deployment of hardware, finding product-market fit for protocols, and regulatory frameworks that do not stifle innovation.

This raises a key question: How can the crypto market capture value?

The core logic is simple: use technology to solve ownership and control issues of robots in the future physical world, making an open "machine economy" possible.

II. Core Drivers

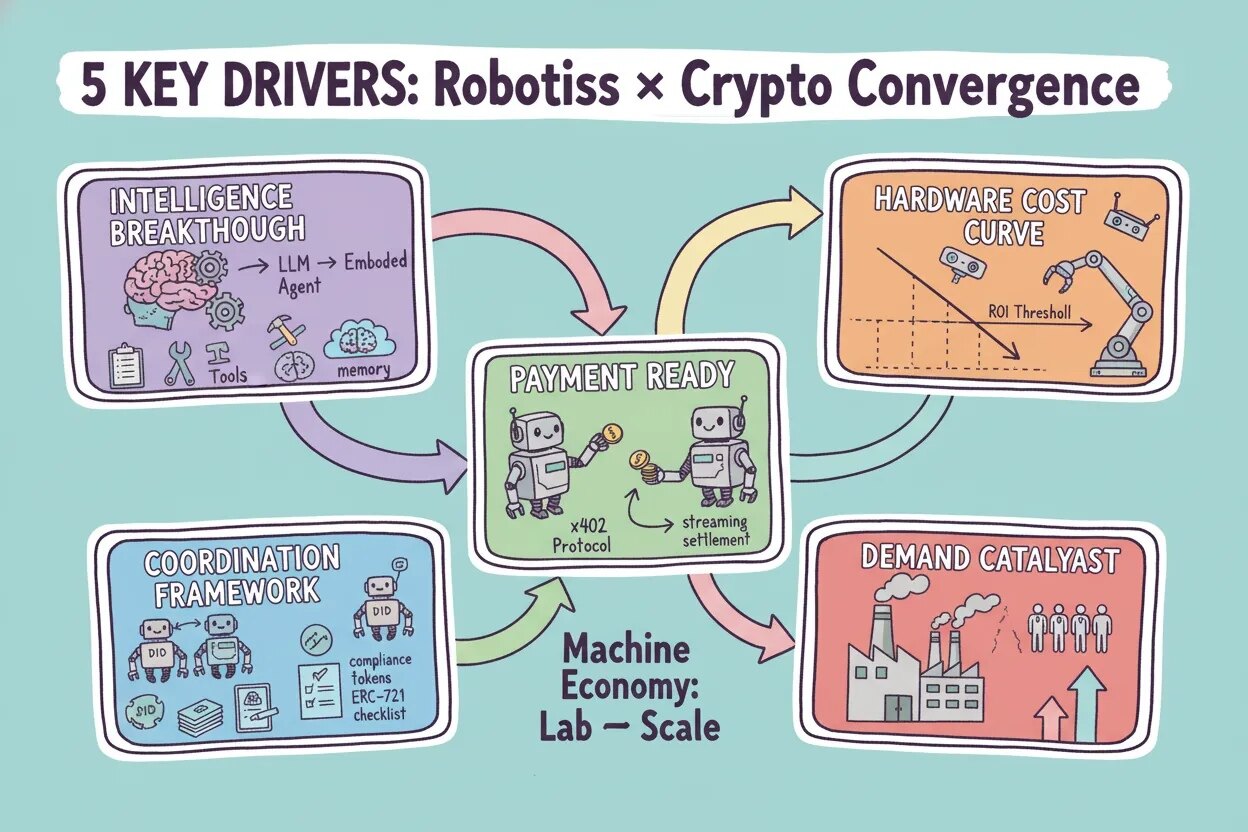

The collision of Robotics × Crypto is essentially a resonance of technological maturity, economic feasibility, and institutional restructuring occurring within the same time window— the machine economy is moving from the laboratory to scale, and crypto serves as a natural foundation for capturing this value.

Multiple S-Curve Inflection Points

The collision of Robotics and Crypto is not a single-point innovation but rather the superposition of multiple S-curves at this moment: intelligent evolution, hardware cost reduction, maturity of crypto settlement and collaborative frameworks, combined with external pressures from labor and compliance needs, pushing the "machine economy" from demonstrable to scalable.

- Intelligent Layer Inflection Point

General large language models are evolving from language understanding to embodied agents, possessing capabilities such as planning, tool invocation, and long-term memory; the narrowing of the gap between simulation and reality, along with declining reasoning costs, allows robots to transition from "demonstrable" to "deployable."

- Hardware and Cost Curve

Sensors, actuators, and edge computing continue to reduce costs and increase efficiency, while standardization and modularization enhance assembly and maintenance efficiency; unit economics are approaching the ROI threshold for enterprises, making more service scenarios commercially viable for large-scale deployment.

- Payment and Settlement Readiness

High-frequency, micro, cross-border, and programmable payments between machines have become foundational infrastructure capabilities. The x402 Protocol launched by Coinbase provides a native payment layer for AI agents, enabling low-cost operation of streaming settlements, conditional releases, and custodial mechanisms while naturally retaining the traceability required for auditing and compliance.

- Collaborative and Ownership Framework Formation

Trustless identities, verifiable execution, and spatial consistency provide consensus and records for "who is present, what was done, and whether standards were met"; the divisibility and combinability of asset and revenue rights shift expensive hardware from one-time CAPEX to pay-per-use and revenue sharing, lowering financing and social participation thresholds.

- Demand and Policy Catalysis

Structural labor shortages, automation pressures in the service industry, and demands for supply chain resilience elevate the marginal returns of "using machines"; regulatory and auditing preferences for "verifiable and traceable" accelerate the adoption of on-chain clearing and settlement as a foundation.

The superposition of these five major drivers indicates that the technological, economic, and institutional conditions for the machine economy are fundamentally in place. At this historic inflection point, crypto technology has constructed a foundational architecture for value capture at three levels—payment, coordination, and ownership—from micro-payment settlements between machines to cross-platform collaborative networks, and to the tokenization of assets and revenue distribution, each layer nurtures new business models and investment opportunities.

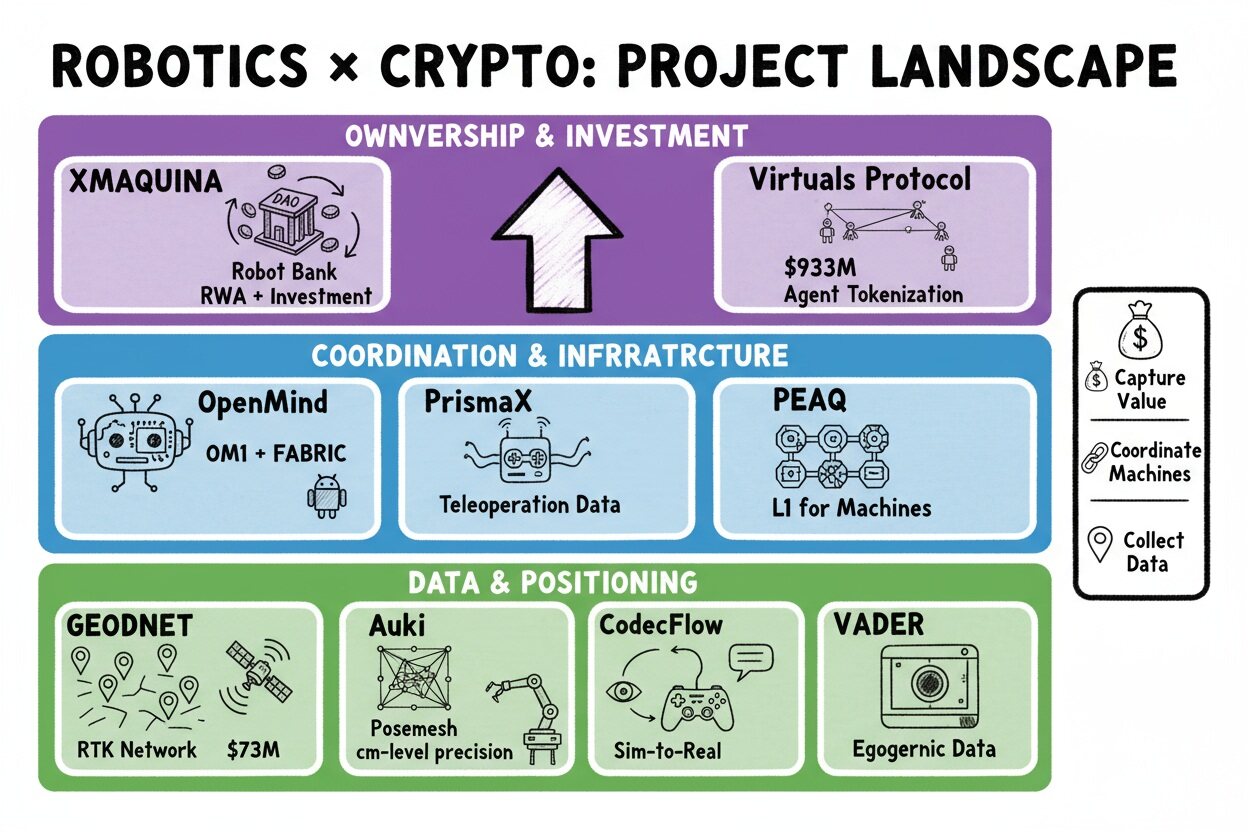

III. Projects to Watch

What projects in the current market are turning these possibilities into reality? In this section, we will outline projects related to the Robotics sector.

Openmind (Pending TGE)

OpenMind aims to build the "Android of the robot world," developing an open-source AI-native software stack for intelligent machines. Core products include:

- OM1: An AI-native operating system that provides a complete intelligent pipeline for perception, memory, planning, and execution for robots, supporting deployment across hardware platforms.

- FABRIC: A decentralized coordination protocol that provides a trust layer for identity verification, location positioning, and task coordination between machines, achieving centimeter-level precision positioning.

The project aims to address the fragmentation issue in the robotics industry, enabling robots from different manufacturers to collaborate, learn, and economically interact through a hardware-agnostic software layer and blockchain trust mechanisms.

Background: Established in 2024, raised $20 million.

Narrative Path: Open-source customer acquisition transitioning to enterprise subscriptions; micro-fees/platform cuts at the protocol and market layer; on-chain identity, staking, and reputation achieving tokenized value transmission.

PrismaX (Pending TGE)

PrismaX is a robotics intelligence platform based in San Francisco that integrates artificial intelligence (AI), blockchain (Web3 technology), and robotics to address the critical bottleneck in physical AI development—the scarcity of data for training foundational robot models. The project positions itself as the infrastructure layer of the robotics ecosystem, enabling decentralized and incentivized high-quality visual and sensor data collection through remote human-machine control. Core products include:

- Remote Control Platform: A web-based interface that allows users to remotely control robotic hardware for data collection.

- Data Marketplace and Collection Portal: A Web3-driven system that rewards high-quality data contributors with "Prisma Points."

- Foundational Model Development Tools: A collaborative toolkit that transforms collected data into AI models.

By improving AI models through remote-controlled data, the project aims to enhance control efficiency—aiming to accelerate the path to fully autonomous robots while ensuring human contributors are rewarded and empowered.

Background: Established in 2024, raised $11 million.

Narrative Path: Building a remote operation coordination layer that captures transactions, usage, and data within the network as much as possible into cash flow and assets at the platform or protocol layer.

XMAQUINA (Pending TGE)

XMAQUINA is a decentralized autonomous organization (DAO) and Web3 ecosystem aimed at democratizing access to automation technologies through community ownership, governance, and benefits from humanoid robots and physical AI growth. It positions itself as a "robot bank," pooling funds from token holders to invest in high-growth robotics startups, tokenizing real-world machine assets (RWA), and decentralized physical AI (DePAI) protocols.

Background: Established in 2024, raised approximately $5.5 million from VC and community (pre-seed + auction).

Narrative Path: By decentralizing the traditional centralized robotics value chain, DEUS serves as the fuel for governance and interaction, supporting the humanoid robotics industry to achieve investment returns and buybacks, establishing a sustainable community DAO to capture value.

Virtuals Protocol ($VIRTUAL, $731M)

Virtuals is a decentralized AI agent infrastructure platform built on the Base Layer-2 blockchain, focusing on the creation, tokenization, co-ownership, and monetization of autonomous multimodal AI agents. The project positions AI agents as producible entities capable of generating services or products, autonomously participating in on-chain commerce, owning assets, executing transactions, and interacting across gaming, entertainment, social platforms, and DeFi.

Background: Foundational infrastructure of the Virtuals ecosystem, ACP protocol/G.A.M.E. framework developer.

Narrative Path: Virtuals Protocol has a first-mover advantage in the tokenization of AI agents, and its value capture mechanism is expected to benefit significantly from the explosive growth of the robotics market.

PEAQ ($PEAQ, $83M)

peaq is a Layer-1 blockchain specifically built for the machine economy, designed based on the Substrate framework (Polkadot ecosystem), providing decentralized physical infrastructure network (DePIN) services for robots, IoT devices, vehicles, and AI agents.

Background: Established in 2017, raised $43.5 million (5 rounds).

Narrative Path: peaq aims to bring "the infrastructure of the machine economy" on-chain, productizing key capabilities such as identity, permissions, verification, and time, all of which require the use and governance of $PEAQ; then stabilizing liquidity with financial structures like VEO, ultimately allowing real application scales to continuously solidify token demand and network value.

Geodnet ($GEOD, $62M)

GEODNET is the world's largest decentralized physical infrastructure network (DePIN), specifically providing a real-time dynamic (RTK) global navigation satellite system (GNSS) reference station network. The project deploys over 20,000 satellite reference stations (miners) through crowdsourcing, offering centimeter-level precision positioning services for robots, drones, autonomous vehicles, and AI agents.

Background: Established in 2021, raised $15 million.

Narrative Path: GEODNET decentralizes traditional centralized RTK networks, providing essential precise positioning infrastructure for the machine economy at a 90% cost advantage. With the explosion of physical AI and embodied intelligence, the demand for sub-centimeter positioning is growing exponentially. The GEOD token serves as a payment medium for data access and a network incentive mechanism, directly capturing the value flow of the robotics market (projected to be $210 billion by 2026).

Auki ($AUKI, $43M)

A decentralized physical infrastructure network (DePIN) developed by Auki Labs, focusing on machine perception and collaborative spatial computing. The core product is the Posemesh protocol, which provides a trust layer for real-time spatial data sharing for robots, AR glasses, smartphones, and AI agents, addressing the limitations of traditional GPS in indoor/urban environments and offering centimeter-level precision positioning.

Background: Established in 2023, raised $10 million.

Narrative Path: Assetizing the "machine readability of real space" and financializing it through protocolized supply-demand settlements, ultimately binding network effects and cash flow together through tokens.

CodecFlow ($CODEC, $10.9M)

CodecFlow is an AI execution layer built on Solana, focusing on providing visual-language-action (VLA) AI operators for robots and software automation. The platform enables AI agents to perceive their surroundings (through screenshots, cameras, or sensors), reason using natural language instructions, and execute actions through UI interactions or hardware control in an isolated on-demand computing environment.

Background: Established in 2025, no VCs.

Narrative Path: Driving generalizable execution with VLA, converting execution into cash flow and forfeitable credit through decentralized computing power and on-chain settlements.

Neuron ($NRN, $10.6M)

NRN is the native token of the Neuron predecessor AI Arena ecosystem, developed by ArenaX Labs as a decentralized AI agent platform. The core concept is to use Web3 gaming as a "sandbox for AGI development," where players train AI agents (tokenized as NFTs) for PvP battles, employing imitation learning and reinforcement learning techniques to enable AI to learn behavioral patterns from human gaming data.

Background: Established in 2021, raised $11 million.

Narrative Path: Capturing the value flow of the trillion-dollar robotics market by using gaming as a training sandbox for robot AGI. As Sim-to-Real technology matures, AI agents trained in virtual environments can be directly applied to physical robots, with $NRN serving as a payment medium for data contribution, model training, and machine coordination, establishing sustainable value capture through deflationary mechanisms and network effects.

VADER ($VADER, $8.1M)

VADER is an AI agent token built on the Base blockchain, part of the Virtuals Protocol ecosystem, specifically creating a decentralized data layer for the robotics and embodied AI revolution. The project crowdsources the collection, processing, and monetization of first-person perspective (egocentric) video data, providing critical data support for training humanoid robots and physical AI systems for real-world tasks.

Background: Established in 2024, launched by Virtuals.

Narrative Path: Creating a flywheel effect for physical AI by bridging crypto incentives with robotics data demand. As the explosion of physical AI and embodied intelligence occurs, the demand for first-person data is growing exponentially, with $VADER serving as a payment medium for data access and a network incentive mechanism, establishing a sustainable value capture mechanism through the BCM model and network effects.

Due to space constraints, more tokens will not be elaborated on:

RICE AI ($RICE, $4.4M)

Predi by Virtuals ($PREDI, $3.0M)

RoboStack ($ROBOT, $1.9M)

VitaNova ($SHOW, $690K)

For more information, refer to Coingecko's dynamic listing: https://www.coingecko.com/en/categories/robotics

IV. Conclusion

The undeniable reality is that the current Robotics & Crypto sector is still in an extremely early stage. Most projects in the market resemble "vision white papers" rather than "real-world application cases"—the narrative component far exceeds actual value creation. Essentially, many projects are closer to narrative-driven meme coins, with their value primarily derived from community consensus, market enthusiasm, and emotional transmission, rather than verifiable business models or cash flow. Therefore, in selecting investment targets, we prioritize new projects or protocols that have not yet issued tokens, as they are more likely to capture market attention in the short term.

The integration of the robotics sector with the crypto economy is still in the "infrastructure building phase," needing to overcome multiple challenges such as technological integration, market education, and large-scale application. However, as one institutional investor stated: "This is not an experiment, but the early stage of a long-term structural transformation." It is worth continuously tracking projects that can effectively address core issues such as robot collaboration, data valorization, and the construction of open economic systems—these may experience a true value explosion during the technological maturation period in the next 3-5 years.

Article Date: November 17, 2025, 11:00

Disclaimer: This analysis is based on publicly available information and technical logical deductions and does not constitute investment advice. Cryptocurrency investment carries high risks; please make decisions cautiously based on your risk tolerance. Some token information is limited, and actual situations may differ from the analysis.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。