Technical breakdown accelerates despite institutional product rollouts as XRP tests critical support amid broader market weakness.

News Background

- Multiple XRP ETFs launched throughout November, including Franklin Templeton’s EZRP on Nov. 18, joining Canary Capital’s XRPC and several Bitwise products.

- Combined first-week ETF flows exceeded $245 million, signaling substantial institutional interest during the rollout.

- Despite strong inflows, ETF trading volumes slid 55% from peak levels, reflecting diminishing retail enthusiasm.

- Broader crypto markets weakened as Bitcoin volatility increased ahead of its Death Cross event, dragging altcoins lower.

- ETF narratives created optimism, but market liquidity remained fragmented, limiting momentum for XRP despite increased institutional access.

Price Action Summary

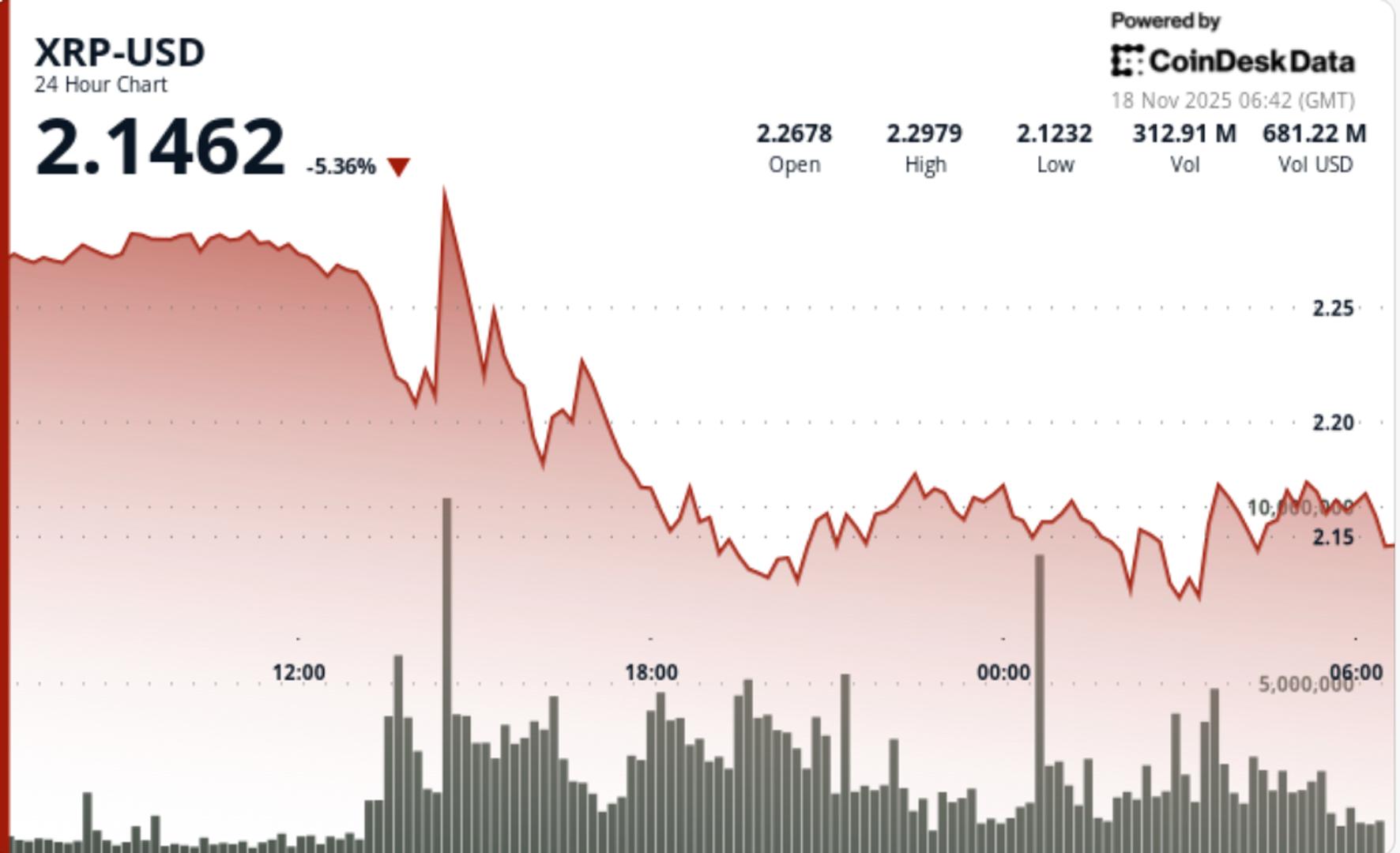

- XRP fell 4.96% from $2.27 → $2.16, breaking below the $2.20 support level.

- Total session volume surged 54.56% above monthly averages, reaching 236.6M XRP traded.

- Breakdown triggered a slide to intraday low of $2.11 before recovering to the $2.15–$2.17 zone.

- Resistance formed at $2.28, while stabilization attempts clustered around $2.155–$2.166.

- Post-breakdown consolidation printed a tight range, indicating temporary seller exhaustion but no confirmed reversal.

Technical Analysis

- XRP’s reversal from $2.27 into a sharp decline toward $2.16 confirmed a full breakdown of its short-term bullish structure.

- The failure to reclaim the $2.28 resistance zone—coinciding with early-session ETF excitement—revealed that institutional product launches were insufficient to offset technical fragility in the underlying spot market.

- Volume expansion of 54.56% above monthly norms validated the selloff, particularly as the breach of $2.20 unleashed cascading stops and forced long liquidations.

- The intraday rebound from $2.11 demonstrated that buyers remain active beneath key support levels, but the recovery lacked volume conviction, stalling almost immediately at $2.18.

- This lack of follow-through underscores the current imbalance: strong ETF flows create structural demand, yet broader crypto risk-off conditions overpower near-term bullish catalysts.

- A bearish pennant formed through compression between $2.155 support and descending resistance at $2.18, suggesting that the market is coiling for another directional move.

- Momentum indicators remain bearish with price trading below key EMAs and showing no signs of trend reversal.

- The inability to lift beyond $2.18–$2.20 keeps XRP vulnerable to further decline, while the tightening range reflects market indecision rather than accumulation.

- For bulls to regain control, price must break above the pennant's upper boundary and reclaim $2.28—a threshold that now represents structural confirmation of regained upward momentum.

What Traders Should Watch Out For

- Traders must monitor whether XRP’s consolidation above $2.155 represents stabilization or simply a pause before continuation lower.

- The next catalysts remain ETF-related, with additional Bitwise launches scheduled through Nov. 25, though recent declines in ETF trading activity suggest diminishing short-term impact unless broader market sentiment improves.

- The $2.15 pivot is critical: holding the level offers potential for a bounce toward the $2.28–$2.30 corridor, while a decisive break below opens the door to a rapid selloff toward the $1.98 structural support cluster.

- XRP’s near-term trajectory will also depend on Bitcoin’s volatility regime—particularly whether BTC stabilizes after its Death Cross event or drags altcoins into deeper retracement phases.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。