Facing the choice of financing, whether to take the broad road to an IPO or embrace the innovative path of RWA, there is no standard answer, only the choice that best suits the enterprise.

Traditional IPOs (Initial Public Offerings), as the "regular army" of corporate financing, have always been the preferred route for companies entering the capital market due to their mature regulatory framework and broad investor base.

In recent years, with the development of blockchain technology, RWA (Real World Asset tokenization) has emerged as a new star in the fintech field, opening up new paths for financing small and medium-sized enterprises with its unique advantages of "breaking down, making active, and lowering thresholds."

1. A New Perspective on Financing: Clarifying the Core Concepts of RWA and IPO

Before discussing the two financing methods, we first need to understand their essential definitions and operational mechanisms.

● RWA (Real World Assets) refers to the process of converting traditional financial assets into digital assets that can circulate on the blockchain through blockchain technology.

This process not only enhances asset liquidity but also reduces transaction costs and increases transparency. For example, a fund company can package the income rights of real estate projects it holds into a virtual currency on the blockchain, allowing global investors to participate in transactions with a lower threshold.

● IPO (Initial Public Offering) is the act of a company issuing shares to public investors for the first time and listing on a stock exchange.

It is the most formal, longest-standing, and most maturely regulated financing method in the capital market, requiring the participation of accounting firms, law firms, and brokerages, and undergoing strict financial audits, legal compliance checks, and the preparation of prospectuses and other documents.

Fundamentally, RWA targets specific assets, while IPO targets the entire company. RWA enables assets that are not easily tradable to achieve global transactions on the blockchain, while IPO helps companies transition from private to public, opening the door to the capital market.

2. Analyzing the Essential Differences Between the Two Financing Methods

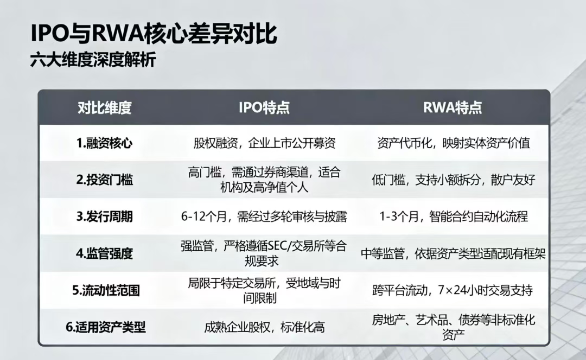

To make an informed choice between these two financing methods, we need to conduct a comprehensive comparison from multiple dimensions.

● In terms of issuance efficiency, RWA has a faster issuance speed, does not rely on traditional brokerage processes, and can be quickly issued once the technology matures. In contrast, the IPO process is complex, lengthy, and requires strict financial audits and legal compliance checks.

● Regulatory requirements are another significant difference between the two. RWA has relatively loose regulations, and the framework is still being established.

In comparison, IPOs are strictly regulated and mature, adhering to a rigorous securities regulatory framework.

● Regarding investment thresholds, RWA has a lower threshold, allowing for the splitting of investment amounts as needed, making it suitable for a broader range of investors. In contrast, IPOs have a higher investment threshold, typically targeting qualified investors or the public.

● In terms of liquidity, RWA can be traded globally, while IPOs are limited to specific exchanges.

● The investor protection mechanisms also differ. RWA's protection mechanisms are not yet well-developed, while IPOs have a mature investor protection system.

● Additionally, the information disclosure requirements differ. RWA has relatively fewer disclosure requirements, while IPOs require comprehensive and detailed disclosures.

● Finally, in terms of asset types, RWA can involve a diverse range of real-world assets, while IPOs primarily involve company equity.

3. Identifying Each's Core Competitiveness

Differentiated Advantages of RWA

The appeal of RWA lies in its flexibility and inclusiveness.

● It allows for the splitting of investment amounts as needed, significantly lowering the investment threshold and enabling a broader range of investors to participate. This "breaking down" characteristic allows assets that are not easily tradable to achieve global transactions on the blockchain, significantly enhancing asset liquidity.

● From an issuance perspective, RWA does not rely on traditional brokerage processes and can be quickly issued once the technology matures, resulting in high issuance efficiency. All transaction records are traceable on the blockchain, and this transparency effectively enhances market trust mechanisms.

● More importantly, RWA provides new financing channels for small and medium-sized enterprises, enhancing financial inclusivity.

Traditional Advantages of IPO

As a mature financing channel, IPOs have their irreplaceable advantages.

● The most prominent is their high financing capacity, with successful listings achieving hundreds of millions or even billions in financing.

● After strict regulatory review, a company's brand and reputation can be greatly enhanced. After going public, companies can utilize tools such as additional offerings, mergers and acquisitions, and equity incentives, providing ample capital operation space.

● In terms of investor protection, IPOs have a comprehensive protection mechanism, and a regulated environment and rule of law can effectively safeguard investor rights. Additionally, IPOs cover a wide range of investors, including institutions and retail investors, resulting in broad investor base and ample market liquidity.

4. Distinct Regulatory Approaches

Taking Hong Kong, an international financial center, as an example, we can clearly see the differentiated regulatory approaches to these two financing methods.

● For IPOs, Hong Kong emphasizes rigorous compliance, information disclosure, and investor protection. The IPO system follows a strict framework under the Securities and Futures Ordinance, with the listing process jointly regulated by the Hong Kong Stock Exchange and the Securities and Futures Commission.

● For RWA, Hong Kong adopts an "inclusive and prudent" experimental mindset, gradually establishing a regulatory sandbox, a licensing system for virtual asset service providers, and including RWA-type tokens in the category of qualified investment products for regulatory experimentation.

This difference reflects the balance that regulatory agencies seek between encouraging innovation and controlling risks.

As the RWA market develops, international securities regulators are also beginning to pay attention to this field. The International Organization of Securities Commissions (IOSCO) has pointed out that crypto tokens linked to traditional assets may pose new significant risks to investors.

5. Case Studies: Successful Examples in Market Practice

Figure Technologies: A Benchmark in the RWA Field

● In September 2025, Figure Technologies successfully listed on NASDAQ, becoming the "first RWA stock in the U.S. market." The company completed its IPO at a price of $25 per share, raising $788 million, and opened with a 36% increase on the first day, with a market capitalization exceeding $6.6 billion.

● Figure's core business is Home Equity Line of Credit (HELOC), which uses blockchain technology to shorten the traditional approval process from about 42 days to as fast as 5 minutes for approval and 5 days for disbursement. As of June 2025, Figure has issued over $16 billion in loans, becoming one of the largest non-bank HELOC providers in the U.S.

Huajian Medical: RWA Exploration in the Innovative Drug Field

● In July 2025, Huajian Medical announced a strategic cooperation framework agreement with BGI to jointly establish the "Huajian-BGI Co-Winning Innovative Drug Intellectual Property Tokenization Fund." This fund will invest in Huajian Medical's "NewCo+RWA" Web3 exchange ecosystem projects in Hong Kong, China, and the U.S.

● This innovative attempt aims to address a long-standing industry pain point—allowing 80% of funds invested in the clinical stage of new drug development to be opened to ordinary investors.

● Through RWA technology, high-value medical assets will be converted into tradable digital certificates, such as ADC drugs in Phase II clinical trials and gene therapy patents, which will be tokenized and enter the circulation market.

6. How Enterprises Can Address Their Needs

Choosing between RWA and IPO largely depends on the enterprise's development stage, asset characteristics, and financing needs.

RWA is more suitable for the following situations:

● Small and medium-sized enterprises with relatively small financing needs

● Specific asset holders, such as real estate developers and accounts receivable holders

● Innovative enterprises looking to leverage the advantages of blockchain technology

● Enterprises needing quick financing that traditional channels cannot meet

IPO is more suitable for these enterprises:

● Mature enterprises with stable cash flow and profitability

● Large enterprises needing substantial financing

● Enterprises seeking brand effects that wish to enhance their company image through listing

● Enterprises with long-term development plans that intend to utilize the capital market for sustainable growth

It is worth mentioning that RWA and IPO are not mutually exclusive but rather complement and reshape the traditional financing system. For enterprises, it is essential to choose or combine these two methods based on their development stage and financing needs.

As financial technology develops, large institutions on Wall Street have shown differing attitudes toward tokenization. The International Organization of Securities Commissions (IOSCO) has pointed out that tokenization exposes investors to new risks, while many large asset management institutions believe that "the actual efficiency gains are not balanced."

RWA provides new financing channels for small and medium-sized enterprises and asset holders, enhancing financial inclusivity; while IPOs remain a key path for enterprises to mature and embrace the public market and global capital.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

In the future, as regulatory mechanisms mature, RWA and IPO are expected to jointly build a more diverse, transparent, and efficient financing ecosystem.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。