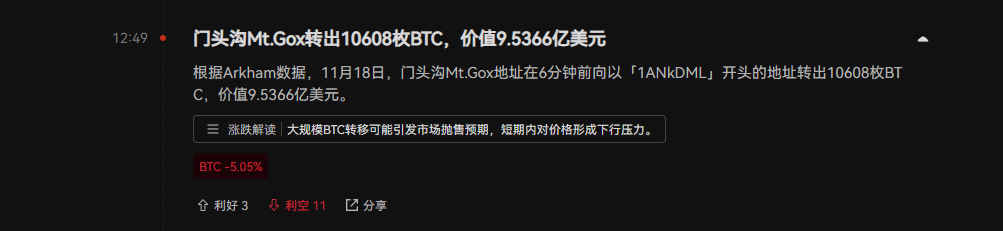

On November 18th at noon, the Mt. Gox cold wallet, which had been silent for 8 months, suddenly made a big move: it transferred out over 10,000 bitcoins (worth approximately $950 million) in one go.

The market instantly exploded:

"Is it going to crash again?"

"Is it going to drop further?"

"Is this preparation for repayment?"

Don't worry, let's take a look at what impacts this event might bring.

1. What happened?

The fund flow can be divided into two parts:

Large amount (10,422 BTC): Transferred to a brand new, unmarked address (starting with “1ANkD…ojwyt”), valued at approximately $936–950 million.

Small amount (185–186 BTC): Flowing back to Mt. Gox's own Hot Wallet, valued at approximately $16–17 million.

Although there has been no official statement, on-chain behavior and historical patterns point to one possibility: preparation for the next batch of creditors' repayments.

The timing is very delicate because:

The repayment deadline has been postponed three times, with the latest deadline being October 31, 2025.

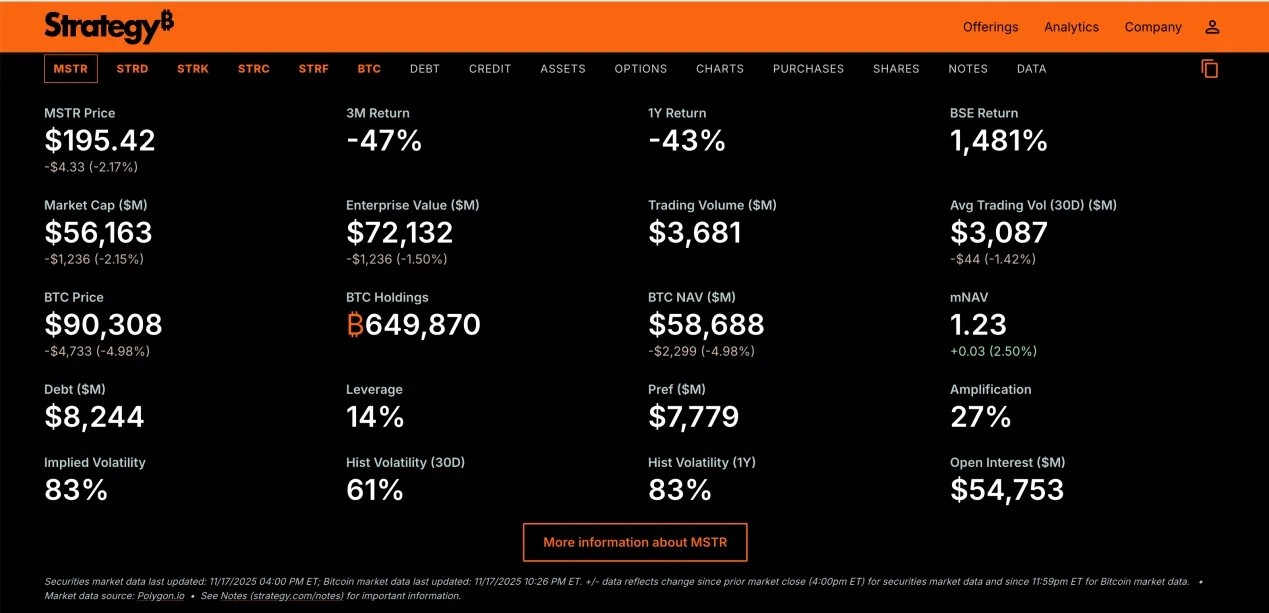

There are still 34,000–90,000 BTC of repayment tasks that remain unfinished.

📊 After the transfer, the Bitcoin balance held by Mt. Gox's trustee: approximately 34,689 BTC (about $3.1 billion).

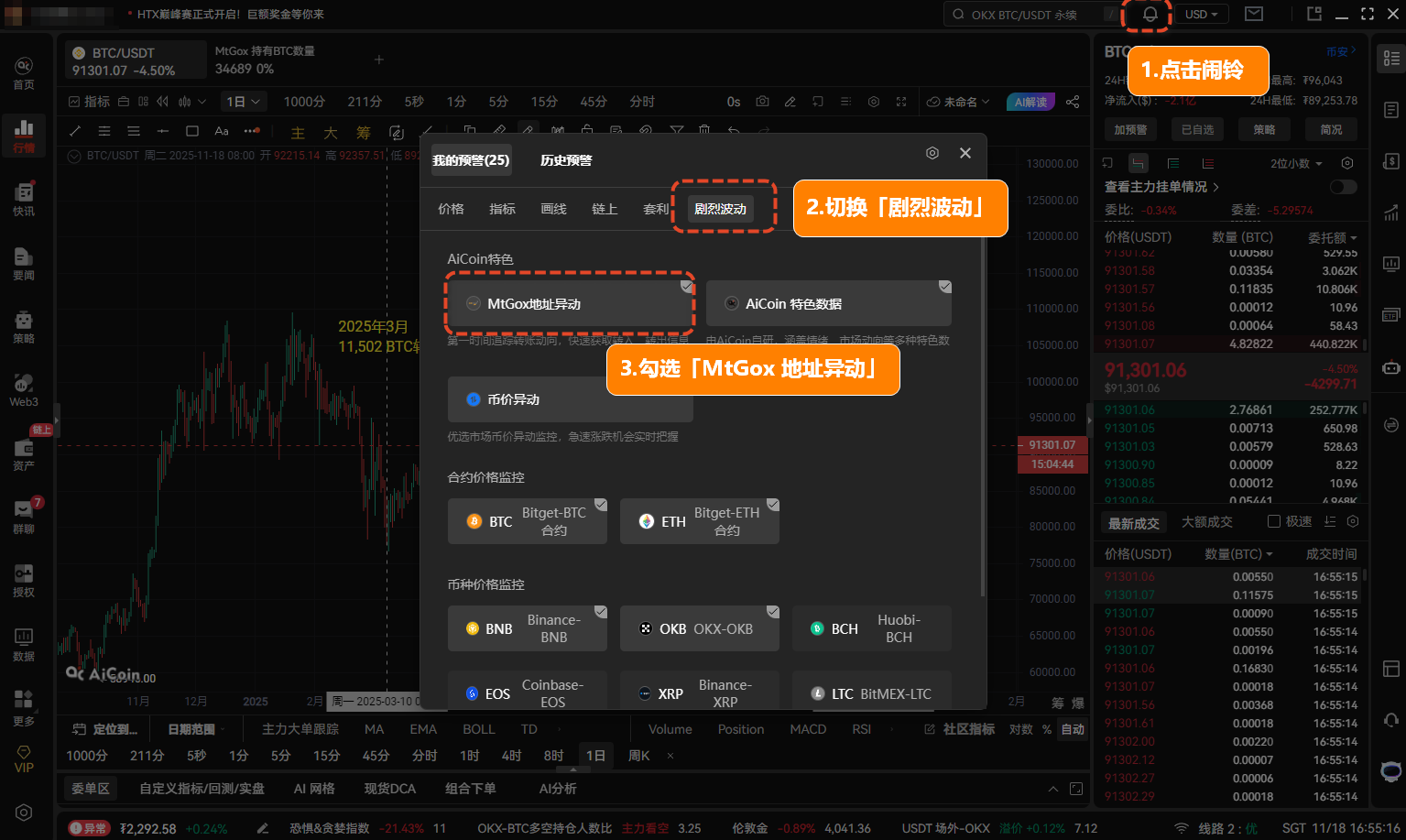

View path: AiCoin Index - MtGox BTC Holdings

2. How did the market react?

BTC price reaction: drop then panic

Before the event: BTC had already fallen below $90,000.

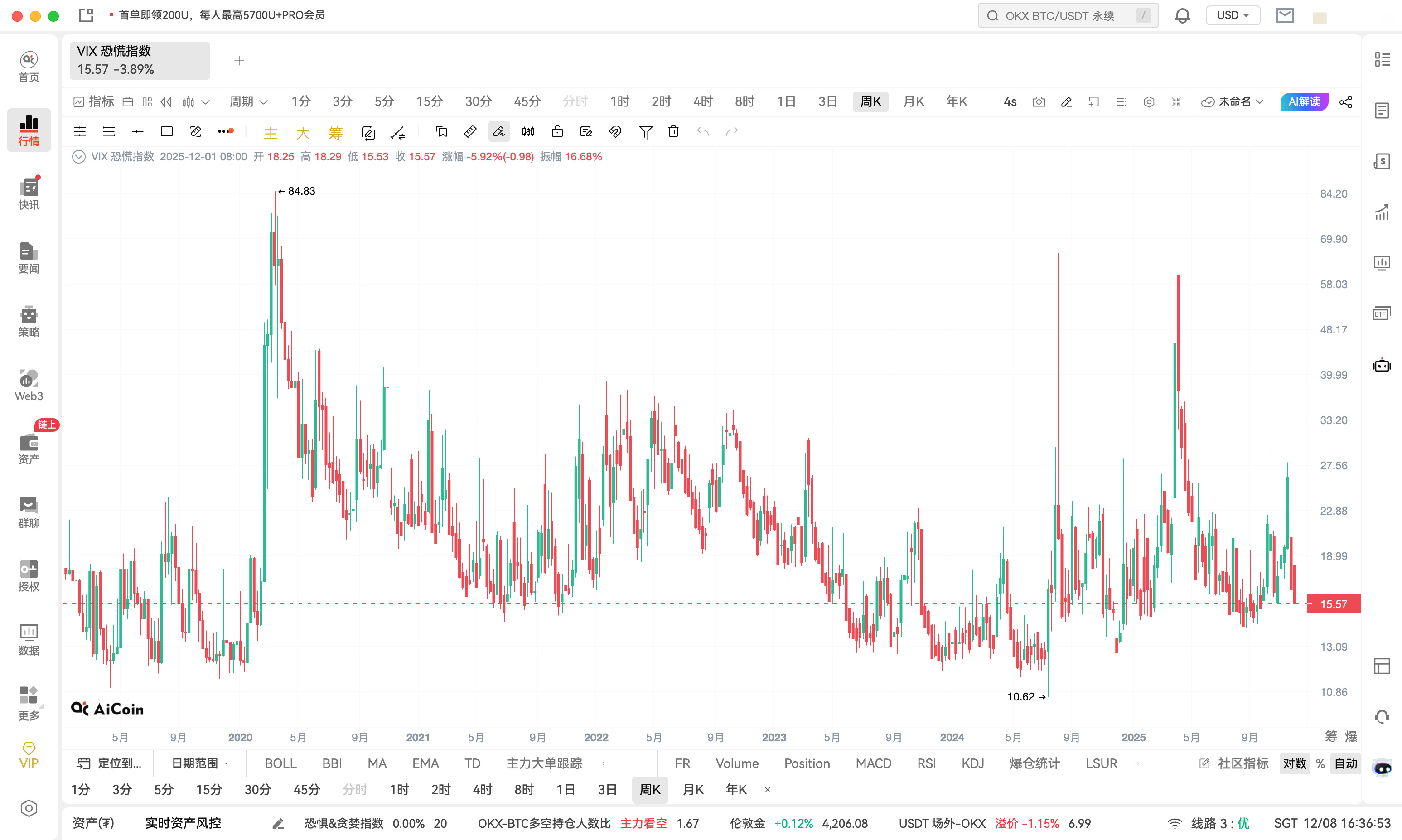

After the event was announced: Today's decline expanded to about -5.3%, with panic sentiment erupting, and the fear and greed index briefly dropped to 15 (extreme fear).

However, analysts pointed out:

This transfer did not flow into exchanges, it is not a sale! The main decline comes from overall market sentiment, rather than being triggered by the Mt. Gox single event.

(Compared to transfers in early 2024 and 2025)

3. Key observation points

✅ Positive signals

185 BTC flowing back to the hot wallet: Indicates that the trustee is still managing allocations, rather than directly liquidating.

Past experience: After the Mt. Gox incident triggered panic, BTC has rebounded multiple times.

⚠️ Pay attention to the following three key signals

Actual selling pressure: If there are "transfers to exchanges" (e.g., Binance, Coinbase) in the coming days, it may indicate actual selling pressure is coming.

Ongoing on-chain anomalies: Whether the “Mt. Gox Trustee” labeled wallet continues to show large anomalies; ongoing anomalies mean the manager is accelerating operations.

Official announcements: Currently, all judgments are based on on-chain inferences; whether the official releases a new round of repayment progress announcements.

Subscribe to MtGox address movements: AiCoin Alert - Severe Fluctuations - MtGox Address Movements

Join our community to discuss and become stronger together!

Official Telegram community: t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

Group chat - Wealth Group: https://www.aicoin.com/link/chat?cid=10013

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。