When 45% of fund managers view AI as the biggest tail risk in the market, the "twin brother" of cryptocurrency is forming a symbiotic relationship with AI between computing power and liquidity. A Bank of America global fund manager survey in November shows that as many as 45% of respondents see the "AI bubble" as the biggest tail risk in the current market, a significant increase from 33% last month.

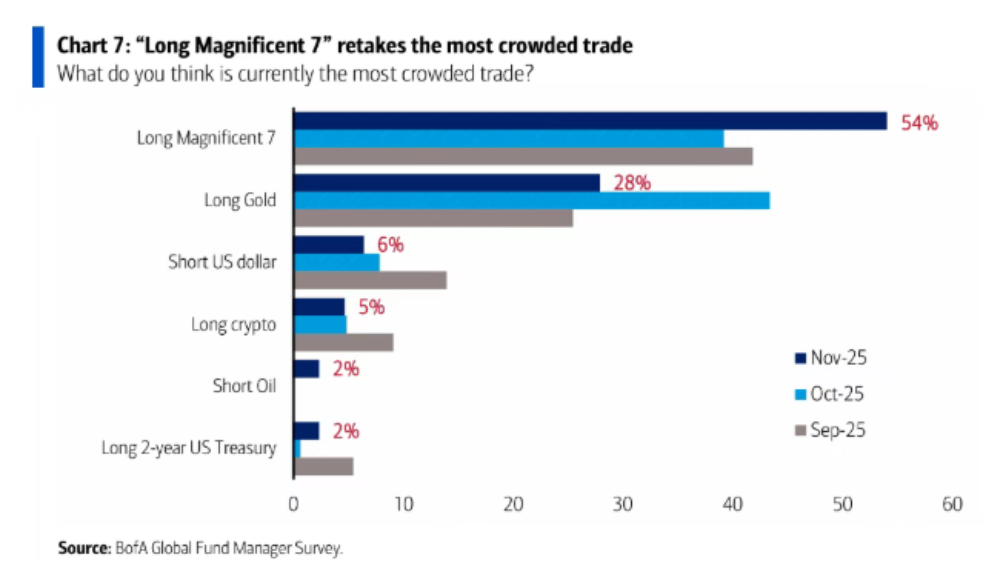

At the same time, 54% of fund managers believe that "going long on the seven tech giants in the U.S." is the most crowded trade currently. In this AI-driven investment frenzy, a historic warning signal has emerged—this is the first time since August 2005 that a net 20% of fund managers believe there is "over-investment" in companies.

As the AI boom sweeps through traditional financial markets, its twin effect is triggering a chain reaction in the cryptocurrency world.

1. The Mutual Nourishment of AI and Crypto

● AI and cryptocurrency, two seemingly independent fields, are penetrating and nourishing each other in an unprecedented way. New financial channels are directly funneling crypto assets into AI infrastructure. Some projects are attempting to use stablecoins and DeFi credit for GPU and computing power financing, aiming to convert crypto liquidity into hardware investments needed for model training and inference.

This trend shows a strong demand for computing power from the capital side and reflects the flexibility of on-chain settlement in global capital flows.

● Large tech companies and crypto platforms are advancing integration at the payment and settlement level. Some open protocols are promoting an "agent-to-agent" automatic payment mechanism between AI applications and supporting stablecoins as a settlement option.

This opens up more convenient channels for value flow, micropayments, and decentralized services within AI applications.

● In terms of industrial strategy, Bitcoin mining companies and custodians are also seeking transformation paths. They are hedging against the volatility of the crypto market by expanding computing power sites and redirecting idle data centers and power resources towards AI and high-performance computing businesses.

Some publicly listed mining companies have seen significant changes in market valuation and investment narratives after business adjustments.

2. The "AI Bond Issuance Wave" of Tech Giants

While the cryptocurrency market participates in the AI boom in its own way, traditional tech giants have chosen a debt-driven path. Currently, a "bond issuance frenzy" is unfolding in the U.S. AI sector. Tech giants including Google, Meta, and Oracle are raising massive funds in the bond market.

● Meta issued $30 billion in bonds at the end of October, marking the largest corporate bond transaction since 2023. This massive bond issuance drove the U.S. investment-grade bond issuance in October to set a monthly record.

● Additionally, Google's parent company Alphabet also sold $25 billion in bonds in early November. The core driving force behind this "bond issuance craze" among AI companies is the intensive investment phase in AI infrastructure. The current AI computing power race requires substantial capital expenditures as support.

● The capital expenditure forecasts for major AI companies in the U.S. continue to be revised upward, but the free cash flow of these companies, after accounting for large-scale stock buybacks and dividends, can no longer cover AI-related capital expenditures, thus actively turning to the debt market for financing.

● Compared to traditional equity financing, issuing bonds has certain advantages for these rapidly growing tech companies. Debt financing helps improve ROE and is beneficial for enhancing valuations.

3. When the AI Bubble Meets Crypto Volatility

The deep intertwining of AI and the crypto market amplifies risks in both markets.

● On the market side, AI-driven automated trading is reshaping the volatility structure of the crypto market. Although some traders attempt to use AI models to optimize strategies or execute high-frequency trading, industry test results show that such algorithms may amplify risks in extreme market conditions.

● Security is also facing new challenges. Attackers are using AI tools to automate vulnerability scanning, generate attack templates, and accelerate penetration processes, significantly speeding up the attack and defense rhythm of blockchains and smart contracts. This requires exchanges, node operators, and smart contract developers to establish an "AI-aware" continuous security audit system.

● According to the 2024 Web3 Security Report released by Hacken, smart contract vulnerabilities account for only 14% of all incidents but have caused over $2 billion in losses.

● Regulation and governance have become key variables for future development. The combination of AI and crypto has brought new issues such as cross-border capital flows, anti-money laundering, and the identification of algorithmic accountability, while also providing potential governance tools.

4. Valuation Dilemma: Rational Bubble and Over-Investment

● As capital continues to flow in, the valuation dilemma in the AI sector is becoming increasingly prominent. Allianz's chief economic advisor Mohamed El-Erian has issued a stern warning about the AI boom. He pointed out that "investors should prepare for significant personal losses in the AI sector", and he also expects a large number of "credit accidents."

● El-Erian, in collaboration with Nobel laureate Michael Spence, assessed the AI boom and concluded that the market is experiencing a "rational bubble." Further inflating the bubble is the fact that some "foundational companies" have attracted substantial investments, but "not all companies will succeed."

● A recent report from venture capital firm Accel indicates that the capacity of newly built AI data centers is expected to reach 117 gigawatts by 2030, which means approximately $4 trillion in capital expenditures over the next five years. According to Accel's report, about $3.1 trillion in revenue will be needed to offset this capital expenditure.

5. From Extreme Optimism to Cautious Retreat

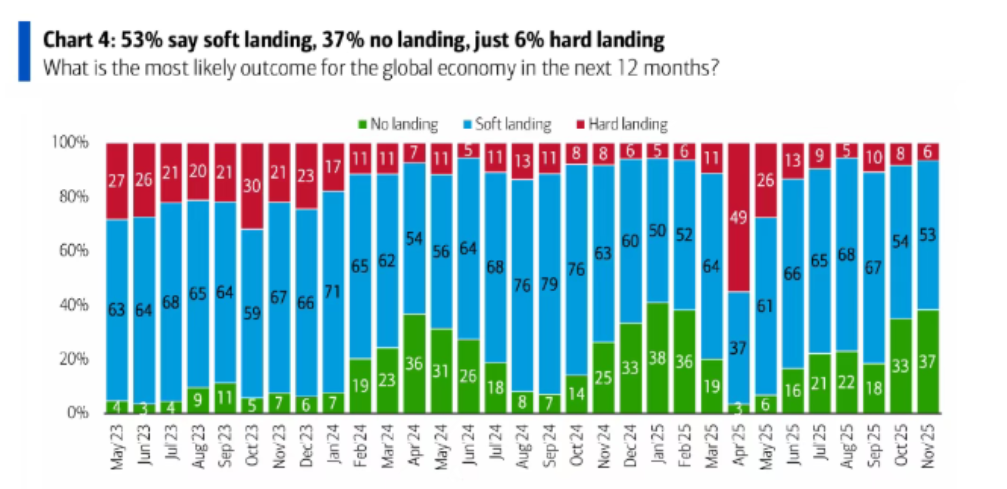

Market sentiment is undergoing a subtle shift. The Bank of America survey shows that fund managers' stock allocation has risen to a net overweight of 34%, the highest since February 2025. The net expectation for global economic growth has turned positive, reaching 3%, marking the first time within 2025.

● Additionally, 53% of respondents predict that the global economy will experience a "soft landing" in the next 12 months, far exceeding the 6% who believe it will experience a "hard landing."

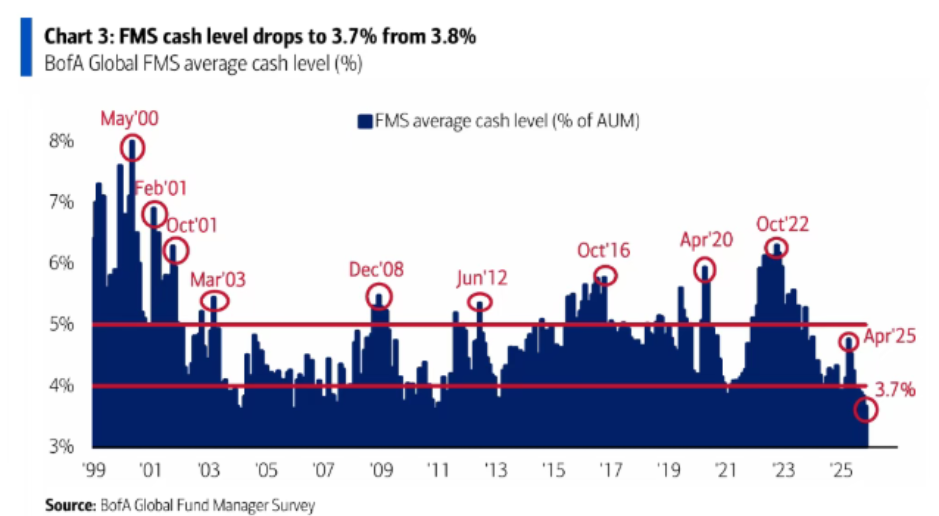

● However, at the same time, a key contrarian indicator is sounding the alarm. The average cash level of fund managers has dropped from 3.8% to 3.7%.

● According to Bank of America's "cash rule," when the cash level falls below 4.0%, it triggers a "sell" signal. Historical data shows that in the 20 instances since 2002 when the cash level was at 3.7% or below, stocks subsequently declined over the following 1-3 months.

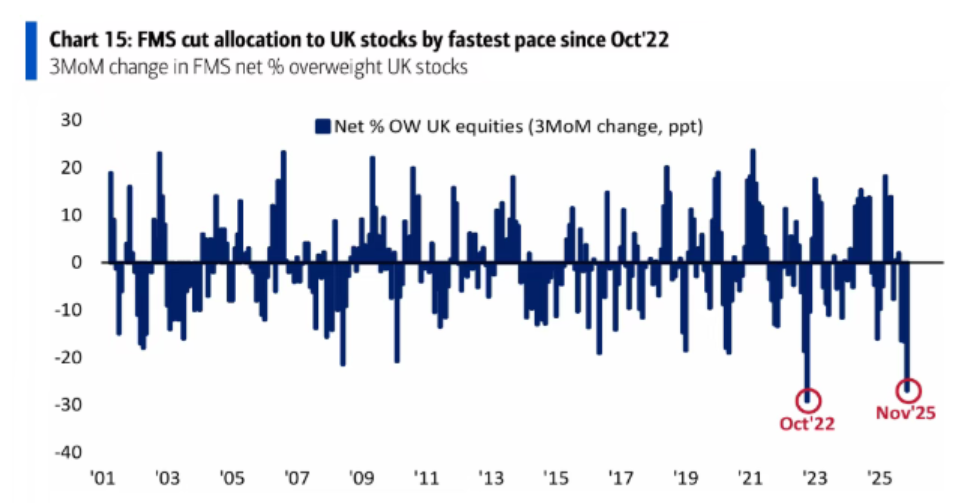

● Foreign enthusiasm for Asian AI concept stocks is waning. So far this month, foreign investors have withdrawn nearly $4.6 billion from the South Korean stock market, making it one of the most severely sold-off markets in the region. Additionally, according to data from the Japan Exchange Group, foreign investors have net sold $2.3 billion worth of Japanese domestic stocks.

6. The Path of Integration Between Crypto and AI

Despite facing challenges, the combination of AI and crypto continues to advance and shows various possibilities. The path for AI to empower trusted digital assets is already clear.

● Smart DeFi (DeAI), which brings AI into decentralized finance, is giving birth to smarter liquidity management, personalized investment strategies, dynamically adjusted lending rates, and fraud-resistant credit scoring.

This allows DeFi protocols to move from "code is law" to "smart code is better law," with the protocol itself and the rights it generates being the core trusted digital assets.

● AI-native assetization, which includes AI models themselves, AI-generated content, and AI computing resources, constitutes a new type of asset native to AI technology in the digital economy era.

AI models can represent their usage or ownership rights through specific tokens, AI-generated content can be tokenized as NFTs to ensure its uniqueness and provenance, while AI computing resources can be tokenized through computing power.

● AI-driven compliance and governance are also important directions. Automating KYC (Know Your Customer), AML (Anti-Money Laundering), and transaction monitoring using AI clears obstacles for trusted digital assets to integrate into the mainstream financial system.

At the same time, it enhances the intelligence level of decentralized governance. Future focus should be on three aspects:

● First, enhancing the transparency of funds and computing power, and building a robust risk control framework;

● Second, establishing an AI-driven security and compliance response system;

● Third, promoting cross-industry standardized governance to reduce gray areas brought about by technological integration.

Goldman Sachs CEO David Solomon warned that a market correction may occur within the next 12 to 24 months. Meanwhile, Peter Thiel's recent liquidation of Nvidia shares also reflects concerns within Silicon Valley about the overheating of AI.

The fear and greed index on Wall Street has dropped to 15, entering the "extreme fear" zone. In the symbiotic relationship between AI and the crypto market, instability in one side can quickly transmit to the other. When the AI bubble bursts, the closely connected crypto market is likely to struggle to remain unscathed.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。