Original|Odaily Planet Daily (@OdailyChina)

At 6 AM this morning, tech blogger @wongmjane revealed that Coinbase is partnering with Kalshi to develop a prediction market; Google recently announced it will integrate Polymarket and Kalshi's prediction data into Google Finance, allowing users to track the "wisdom of the crowd" in real-time regarding event outcomes. In an instant, both Web2 and Web3 giants are heavily investing in the prediction market space. What trend signals lie behind this? Why are these giants making their moves? Will prediction markets become a standard feature in future products? Odaily Planet Daily brings you an article to understand it all.

When Giants Set Their Sights on Prediction Markets: New Track, New Opportunities, New Cake

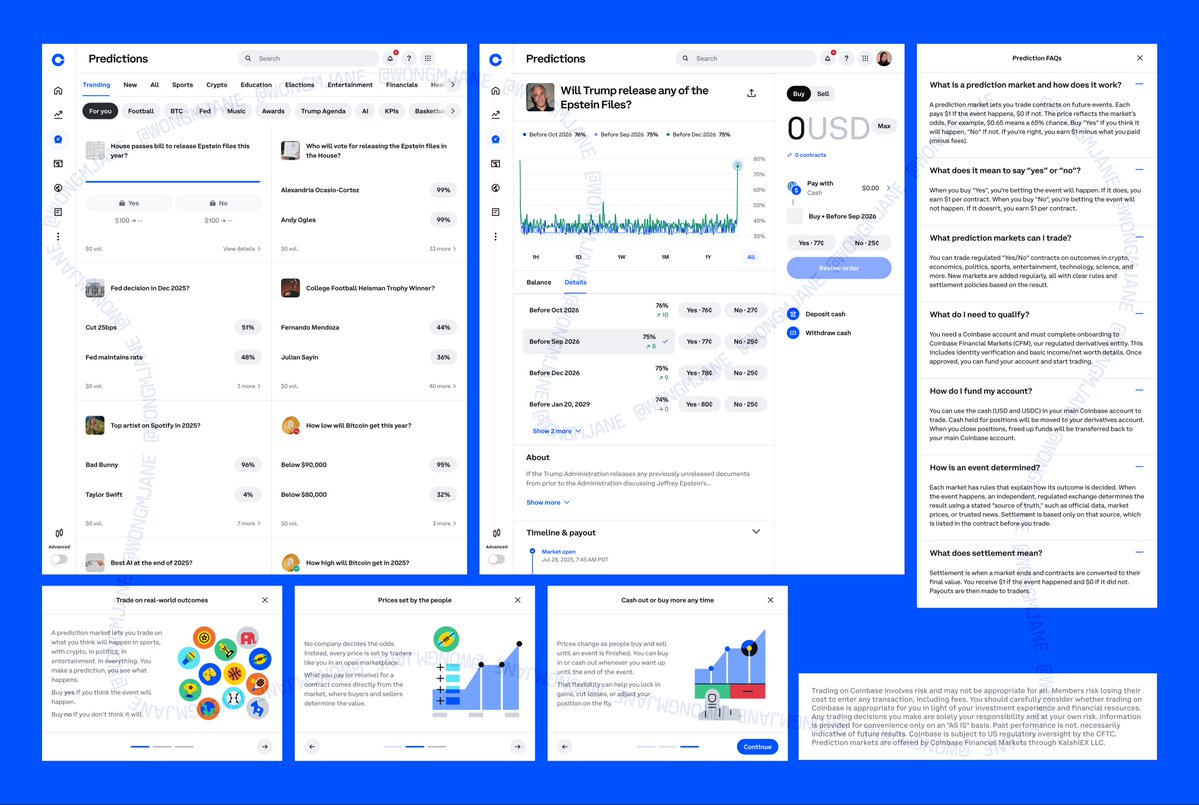

The news of Coinbase collaborating with Kalshi to develop a prediction market was initially revealed by tech blogger @wongmjane. In the accompanying image, we can clearly see that the prediction market page launched by Coinbase is similar to the Polymarket interface, also divided into different sections such as "Trends," "Latest," and "Crypto," where users can buy and sell corresponding chips. Moreover, this prediction market page has thoughtfully prepared a series of "Q&A" to help users quickly familiarize themselves with the platform's features and start trading.

In the lower right corner of the screenshot, we can clearly see that this prediction market is developed by Coinbase in collaboration with Kalshi.

It is worth mentioning that the blogger who revealed this information is a former Meta employee who gained some attention for discovering unreleased features of social media platforms through reverse engineering.

In addition to Coinbase, earlier this month, Google Finance announced plans to integrate Kalshi and Polymarket, which has already attracted close attention from the crypto market regarding prediction markets. The giants laying out in this field are not limited to these two.

In October this year, at the Token2049 event in Singapore, Robinhood CEO Vlad Tenev stated to the media that prediction markets are a significant innovation, sharing similarities with traditional lottery activities, active trading, and traditional media news products, but it is not one of these three; rather, it is a hybrid of all three. Conversely, prediction markets have enormous potential to transform these three massive industries. Additionally, Robinhood launched its prediction market business line before last year's presidential election, which is currently one of its fastest-growing segments and one of its nine business lines generating over $100 million in annual revenue. Robinhood's long-term vision is to create a super financial application, becoming a home for users' assets.

Everything stems from the fact that prediction markets are one of the few "market increments" available today.

Earlier this month, data analyst dash posted that October was the most active month for prediction markets in history, with:

- A total of 524,200 users, of which 40.4% are new users.

- A total of 30 million transactions.

- A nominal trading volume of $8.7 billion.

- Note from Odaily Planet Daily: Other data shows that Kalshi's trading volume in October reached $4.4 billion; Polymarket's trading volume in October was $3 billion, with the latter's active monthly user count exceeding 477,000, setting a new record.

Furthermore, Kalshi leads in both trading volume and transaction count, with a market share of 45% to 55% (excluding user count); Polymarket follows closely, while other smaller projects account for only about 7% to 10%.

Considering that Kalshi, as the largest domestic prediction market in the U.S., profits through trading fees, a fee ratio of 1% to 2% already indicates that this is a market with annual revenues in the tens of billions, and its trading scale is still rapidly growing. This is also why Polymarket and Kalshi have attracted significant capital interest.

Recently, Polymarket received a $2 billion investment from the parent company of the New York Stock Exchange, Intercontinental Exchange, with a valuation of approximately $9 billion; while Kalshi raised $300 million from supporters like Sequoia Capital and A16z at a valuation of $5 billion. Additionally, a report in October stated that Kalshi is receiving venture capital proposals with a potential valuation of up to $12 billion, doubling its valuation in less than two weeks.

It must be said that when it comes to betting on the future, capital institutions are never stingy with their funds.

The Future Direction of Prediction Markets: Standard Feature for Internet Products VS Battleground for Giant Liquidity

Currently, the primary goal of giants betting on prediction markets is to compete for "funding liquidity."

Prediction markets, which combine news events, financial trading, and betting functions, can not only serve as online platforms for users to profit through betting transactions but also play a role as "event prediction machines" to some extent. This was already evident in the outcome of the U.S. presidential election last year, where Trump's victory was predicted.

In terms of "everything can be bet on," the capacity for "betting events" in prediction markets represented by Polymarket and Kalshi far exceeds that of traditional lottery and gambling platforms. To some extent, the emergence of prediction markets is a dimensional reduction attack on past betting platforms.

As internet products have developed to a certain extent, AI and blockchain have become the undisputed "incremental markets" in the eyes of internet giants. As AI penetration increases, aside from stablecoins, Payfi, ETFs, and other avenues, another new path for widespread adoption of blockchain technology is through prediction markets.

After all, as we previously mentioned in “Odaily Interview with the First Person in the Chinese Region of Polymarket: A 225-fold Return Journey in 25 Days”: prediction markets are the shortest path to monetizing cognition.

Taking the latest “Solomon Fundraising Amount Betting Event” as an example, due to Solomon Labs raising $100 million in the public offering on MetaDao at the last moment, it became the second-highest fundraising project for MetaDao, second only to UmbraPrivacy. As a result, users betting on various ranges of Solomon's fundraising amount, such as $20 million, $40 million to $100 million, were all "killed." Meanwhile, a suspected insider address "KimballDavies" chose the low-probability "yes" for this event, collectively profiting over $500,000.

Previously, betting on "CZ receiving a pardon from Trump" was also a significant proof of cognitive monetization. Despite the possibility of insider information, the fact remains that some people profited by betting on the correct outcome.

This is also one of the examples where "wisdom of the crowd" can be reflected after betting real money.

In the near future, due to user attention competition or other considerations, prediction markets may become a standard feature for many internet information platforms, just like AI assistants and voice dialogue functions. After all, if you do not keep up with the integration of prediction markets while your competitors do, users will naturally vote with their feet, and traffic and other data will inevitably be affected.

For ordinary users, perhaps diving in early and adapting is the better solution.

Recommended Reading:

Polymarket Practical Guide: Finding and Following the "Smart Money"

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。