Original Title: Stables are not Stable

Original Author: @yq_acc

Translated by: Peggy, BlockBeats

Editor's Note: Over the past five years, decentralized finance (DeFi) has gone through cycles of frenzy and collapse, with stablecoins repeatedly proving to be "unstable."

This article uses the collapse of Stream Finance in November 2025 as a starting point, combining historical cases such as Terra, Iron Finance, and USDC to reveal the structural flaws that repeatedly appear in the DeFi ecosystem: unsustainable high yields, circular dependencies, lack of transparency, partial collateralization, oracle vulnerabilities, and the complete failure of infrastructure under pressure.

The following is the original text:

In the first two weeks of November 2025, decentralized finance (DeFi) exposed fundamental flaws that academia has warned about for years. The collapse of Stream Finance's xUSD, followed by Elixir's deUSD and numerous synthetic stablecoins, was not merely an isolated incident of mismanagement but revealed structural issues in the DeFi ecosystem regarding risk control, transparency, and trust mechanisms.

In the collapse of Stream Finance, I did not see traditional smart contract vulnerabilities or oracle manipulation, but rather a more concerning fact: a fundamental lack of financial transparency wrapped in "decentralization." When an external fund manager loses $93 million with almost no effective oversight, triggering a $285 million cross-protocol chain reaction; when the entire "stablecoin" ecosystem sees a total value locked (TVL) evaporate by 40%-50% within a week while maintaining its peg, we must acknowledge a basic fact: the current decentralized finance industry has made no progress.

More accurately, the current incentive mechanisms reward those who ignore lessons, punish those who act cautiously, and socialize losses when inevitable failures occur.

There is an old saying in finance: "If you don't know where the returns come from, then the returns are you." When certain protocols promise an 18% return without disclosing strategies, while mature lending markets only offer 3%-5%, the source of those returns must inevitably be the principal of the depositors.

Mechanism and Risk Transmission of Stream Finance

Stream Finance positions itself as a yield optimization protocol, promising users an annual return of 18% on USDC deposits through its yield-bearing stablecoin xUSD. Its publicly stated strategies include "Delta-neutral trading" and "hedged market making," terms that sound sophisticated but provide almost no substantive information about actual operations.

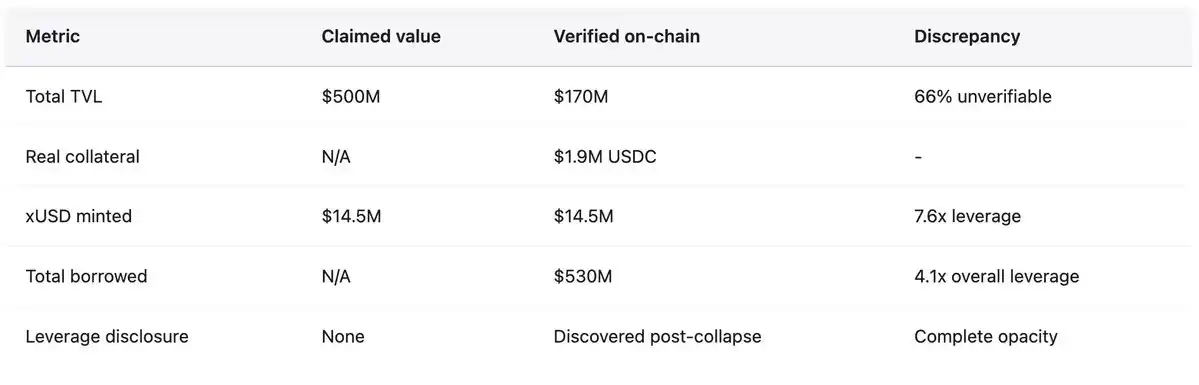

In contrast, at that time, mature protocols like Aave offered an annual yield of only 4.8% on USDC deposits, while Compound was slightly above 3%. While basic financial common sense should remind people to be skeptical of returns three times the market level, users still invested hundreds of millions of dollars. Before the collapse, the trading price of 1 xUSD reached 1.23 USDC, reflecting the so-called compound returns. xUSD once claimed to manage assets as high as $382 million, but DeFiLlama data showed its peak TVL was only $200 million, meaning over 60% of the assets were in unverifiable off-chain positions.

After the collapse, Yearn Finance developer Schlagonia revealed the actual mechanism, showing it to be a systematic fraud disguised as financial engineering. Stream created uncollateralized synthetic assets through recursive lending, with the process as follows: users deposit USDC, Stream exchanges it for USDT via CowSwap, then uses USDT to mint deUSD on Elixir, which was chosen due to high yield incentives. Subsequently, deUSD was bridged to chains like Avalanche and deposited in lending markets to borrow USDC, completing a cycle.

Up to this point, the strategy still resembled standard collateralized lending, but the complexity and cross-chain dependencies were concerning.

However, Stream did not stop there; it used the borrowed USDC not only for additional collateral cycles but also to remint xUSD through its StreamVault contract, causing the supply of xUSD to far exceed actual collateral support. Ultimately, Stream minted $14.5 million of xUSD with only $1.9 million of verifiable USDC collateral, expanding the synthetic asset relative to the underlying reserves by 7.6 times. This is a "fractional reserve banking" behavior without reserves, without regulation, and without a last resort lender.

The circular dependency with Elixir made the structure even more fragile.

In the process of inflating the xUSD supply, Stream deposited $10 million USDT into Elixir, expanding the supply of deUSD. Elixir then exchanged that USDT for USDC and deposited it in Morpho's lending market. By early November, USDC deposits on Morpho exceeded $70 million, with loans exceeding $65 million, with Elixir and Stream being two of the major players.

Stream held about 90% of the total supply of deUSD (approximately $75 million), while Elixir's collateral mainly came from loans issued by Morpho to Stream. These stablecoins were mutually collateralized, destined to collapse together. This is a form of "financial inbreeding," creating systemic fragility.

Industry analyst CBB publicly warned on October 28: "xUSD has about $170 million in on-chain collateral but has borrowed about $530 million from lending protocols, with a leverage ratio of 4.1 times, and a large number of positions have extremely poor liquidity. This is not yield farming; it is outright gambling." Schlagonia had warned the Stream team 172 days before the collapse that it would take just five minutes to review their positions to see that failure was inevitable. These warnings were public, specific, and accurate, but ultimately ignored by users' profit-seeking mentality, curators pursuing fee income, and protocols that enabled the entire structure.

On November 4, Stream announced that an external fund manager had lost approximately $93 million in asset management, and the platform immediately suspended all withdrawals. Due to the lack of a redemption mechanism, panic quickly spread, and holders rushed to sell xUSD in a secondary market with extremely low liquidity. Within hours, xUSD plummeted 77%, falling to about $0.23. This stablecoin, which had promised stability and high yields, evaporated three-quarters of its value in a single trading day.

Digital Representation of Risk Transmission

According to DeFi research institution Yields and More (YAM), the direct debt exposure related to Stream reached $285 million across the entire ecosystem, involving: TelosC loans of $123.64 million (the single largest curator exposure), Elixir Network borrowing $68 million through Morpho's private vault (accounting for 65% of deUSD collateral), MEV Capital $25.42 million, of which about $650,000 in bad debts stemmed from oracles freezing the xUSD price at $1.26 while the real market price had dropped to $0.23; Varlamore $19.17 million, and Re7 Labs holding $14.65 million and $12.75 million in two vaults, along with smaller positions from Enclabs, Mithras, TiD, and Invariant Group. Euler faced about $137 million in bad debts, with various protocols freezing over $160 million in funds. Researchers pointed out that this list is not exhaustive and warned that "there may be more stablecoins and vaults affected," as the full extent of interconnected exposures remained unclear weeks after the collapse.

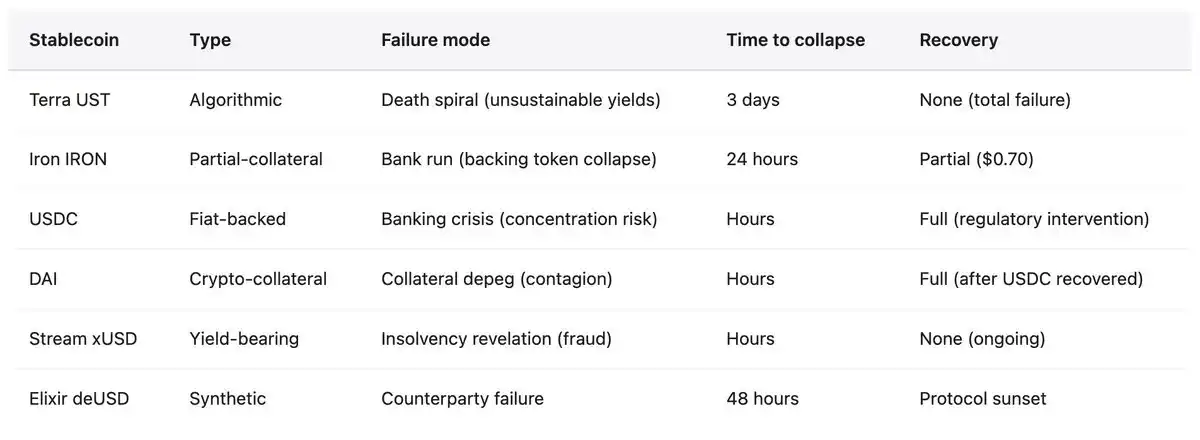

Elixir's deUSD, after concentrating 65% of its reserves in loans issued to Stream through Morpho, plummeted from $1.00 to $0.015 within 48 hours, becoming the fastest large stablecoin collapse since Terra UST in 2022. Elixir provided 1:1 USDC redemptions for about 80% of non-Stream holders, protecting most of the community, but this protection came at a significant cost, with losses being distributed to Euler, Morpho, and Compound. Subsequently, Elixir announced a complete termination of all stablecoin products, admitting that trust could not be restored.

The broader market response reflected a systemic loss of confidence. According to Stablewatch data, yield-bearing stablecoins saw a TVL drop of 40%-50% within a week after the Stream collapse, although most still maintained their dollar peg. This meant about $1 billion flowed out of protocols that had never encountered issues, as users could not distinguish between robust projects and fraudulent ones, opting for a complete withdrawal. The total TVL of the entire DeFi sector decreased by $20 billion in early November, reflecting a general contagion risk rather than the failure of a single protocol.

October 2025: $60 Million Triggers Chain Liquidation

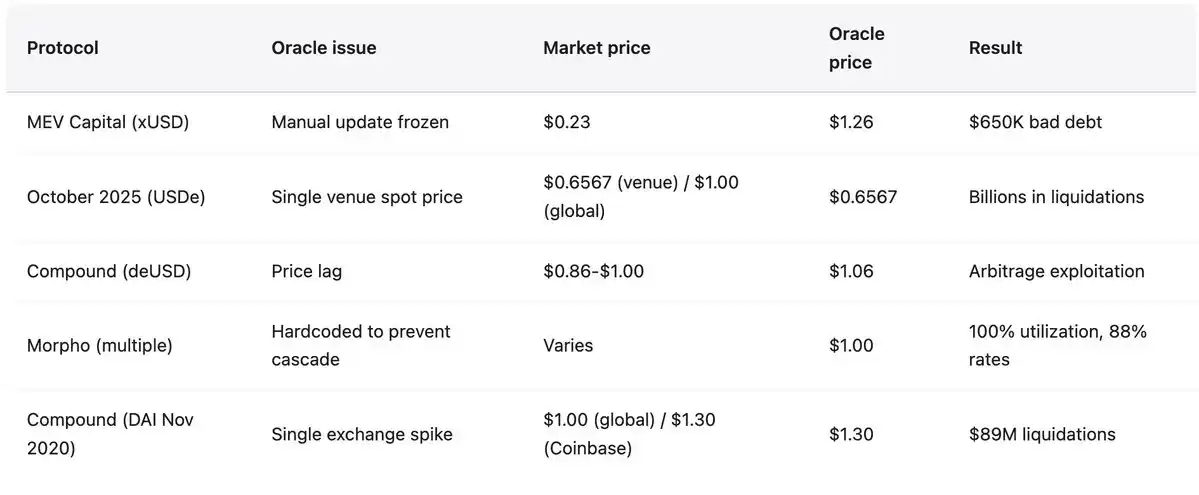

Less than a month before the collapse of Stream Finance, the cryptocurrency market experienced a "precision attack" revealed by on-chain forensic analysis, rather than an ordinary market collapse. This attack exploited known vulnerabilities in the industry and was executed on an institutional scale. From October 10 to 11, a carefully orchestrated $60 million sell-off triggered oracle failures, leading to large-scale chain liquidations across the entire DeFi ecosystem. This was not due to excessive leverage on genuinely impaired positions but rather a failure of oracle design at the institutional level, replaying attack patterns that had been recorded and publicly documented since February 2020.

The attack began at 5:43 AM UTC on October 10, with $60 million of USDe being concentratedly sold on a single trading platform. In a well-designed oracle system, such behavior should be absorbed by multi-source pricing and time-weighted mechanisms, with minimal impact. However, the oracle adjusted the collateral value (wBETH, BNSOL, and USDe) in real-time based on the manipulated spot price from the trading platform, triggering large-scale liquidations immediately. The infrastructure was instantly overloaded, with millions of liquidation requests overwhelming system capacity. Market makers were unable to place orders in time due to API interruptions, withdrawal queues formed, liquidity vanished in an instant, and the chain reaction became self-reinforcing.

Attack Methods and Historical Precedents

The oracle faithfully reported the manipulated price from a single trading platform, while prices in other markets remained stable. The main trading platform showed the USDe price dropping to $0.6567, and wBETH falling to $430, while prices on other trading platforms deviated by less than 30 basis points, and on-chain pools were almost unaffected. As Guy Young, founder of Ethena, pointed out: "During the event, there were over $9 billion in stablecoin collateral that could be redeemed immediately," proving that the underlying assets were not impaired. However, the oracle reported the manipulated prices, and the system liquidated based on these prices, destroying positions that did not exist in other markets.

This pattern is reminiscent of the disaster at Compound in November 2020, when DAI surged to $1.30 on Coinbase Pro within an hour while other markets maintained a price of $1.00, leading to $89 million in liquidations.

The venue for the attack has changed, but the vulnerabilities remain. The methods are identical to those used in the bZx attack in February 2020 (which manipulated the Uniswap oracle to steal $980,000), the Harvest Finance attack in October 2020 (which manipulated Curve to steal $24 million and triggered a $570 million run), and the Mango Markets attack in October 2022 (which manipulated across multiple platforms to extract $117 million).

Between 2020 and 2022, 41 oracle manipulation attacks collectively stole $403.2 million. The industry's response has been slow and fragmented, with most platforms still relying on oracles that are overly dependent on spot prices and lack redundancy. The amplification effect shows that as market size increases, these lessons become even more critical. In the 2022 Mango Markets incident, a $5 million manipulation leveraged $117 million, amplifying it by 23 times; in October 2025, a $60 million manipulation triggered a massive chain reaction. The attack patterns have not become more complex; the system's scale has increased while retaining the same fundamental vulnerabilities.

Historical Patterns: Failure Cases from 2020 to 2025

The collapse of Stream Finance is neither new nor unprecedented. Over the past five years, the DeFi ecosystem has repeatedly experienced stablecoin failures, each time exposing similar structural vulnerabilities, while the industry continues to repeat the same mistakes on a larger scale. The patterns are highly consistent: algorithmic stablecoins or partially collateralized stablecoins attract deposits through unsustainable high yields, which do not come from real income but rely on token issuance or new capital inflows. Protocols operate under excessive leverage, with opaque real collateralization rates and circular dependencies—Protocol A supports Protocol B, which in turn supports Protocol A. Once any shock reveals that the underlying assets are insolvent or that subsidies cannot be maintained, a run begins. Users rush to withdraw, collateral values collapse, liquidation chains trigger, and the entire structure disintegrates within days or even hours. Risk transmission spreads to protocols that accept failing stablecoins as collateral or hold related positions.

May 2022: Terra (UST/LUNA)

Loss: $45 billion in market value evaporated within three days. UST is an algorithmic stablecoin supported by LUNA through a mint-and-burn mechanism. The Anchor protocol offered unsustainable yields of up to 19.5% on UST deposits, with about 75% of UST deposited in the protocol to earn rewards. The system relied on continuous capital inflows to maintain its peg. Triggering factor: On May 7, $375 million was withdrawn from Anchor, followed by a large sell-off of UST that led to a depeg. Users exchanged UST for LUNA to exit, causing the LUNA supply to surge from 346 million to 6.5 trillion within three days, triggering a death spiral that nearly brought both tokens to zero. The collapse not only destroyed individual investors but also led to the failure of major crypto lending platforms like Celsius, Three Arrows Capital, and Voyager Digital. Terra founder Do Kwon was arrested in March 2023, facing multiple fraud charges.

June 2021: Iron Finance (IRON/TITAN)

Loss: $2 billion in TVL went to zero within 24 hours. IRON was partially collateralized, consisting of 75% USDC and 25% TITAN. The protocol attracted funds with incentives offering annual yields of up to 1700%. When large holders began redeeming IRON for USDC, the selling pressure on TITAN self-reinforced, causing its price to plummet from $64 to $0.00000006, destroying IRON's collateral. Lesson: Partial collateralization is insufficient under pressure, and arbitrage mechanisms fail in extreme situations, especially when the collateral token itself enters a death spiral.

March 2023: USDC

Depeg: The price dropped to $0.87 (a 13% loss) due to $3.3 billion in reserves being trapped in the collapsed Silicon Valley Bank. This was supposed to be an "impossible event," as USDC is a "fully collateralized" fiat stablecoin with regular audits. The peg was only restored after the FDIC initiated a systemic risk exception and guaranteed SVB deposits. Risk transmission: This led to DAI losing its peg, as over 50% of its collateral was USDC, triggering over 3,400 automatic liquidations on Aave, totaling $24 million. This demonstrated that even compliant stablecoins face concentration risks, relying on the stability of the traditional banking system.

November 2025: Stream Finance (xUSD)

Loss: $93 million in direct losses, with a total ecosystem exposure of $285 million. Mechanism: Recursive lending created uncollateralized synthetic assets (real collateral expanded by 7.6 times). 70% of funds flowed into anonymous externally managed off-chain strategies, with no proof of reserves. Current status: xUSD trading price ranges between $0.07 and $0.14 (down 87%-93% from the pegged price), with almost no liquidity and indefinite withdrawal freezes. Multiple lawsuits have been filed, Elixir has exited completely, and there has been a massive withdrawal of funds from yield-bearing stablecoins in the industry.

All cases present a common failure pattern.

- Unsustainable high yields: Terra (19.5%), Iron (1700% annual), Stream (18%) all offered returns disconnected from actual income.

- Circular dependencies: UST-LUNA, IRON-TITAN, xUSD-deUSD all exhibited mutually reinforcing failure patterns, where the collapse of one would inevitably drag down the other.

- Lack of transparency: Terra concealed the costs of Anchor subsidies, Stream hid 70% of its operations off-chain, and Tether has repeatedly faced scrutiny over its reserve composition.

- Partial collateralization or self-issued collateral: Relying on volatile or self-issued tokens can trigger a death spiral under pressure, as collateral values plummet precisely when they are most needed for support.

- Oracle manipulation: Frozen or manipulated price sources hinder normal liquidations, turning price discovery into a trust game, with bad debts accumulating until the system becomes insolvent.

The conclusion is clear: stablecoins are not stable. They are merely "seemingly stable" until they are not, and this transition often occurs within hours.

Oracle Failures and Infrastructure Collapse

At the onset of the Stream collapse, oracle issues were immediately exposed. As the actual market price of xUSD fell to $0.23, many lending protocols hard-coded oracle prices at $1.00 or higher to prevent chain liquidations. This practice, intended to maintain stability, resulted in a fundamental disconnect between protocol behavior and market reality. This is not a technical failure but a human policy. Many protocols adopted manual updates for oracles to avoid triggering liquidations due to temporary fluctuations. However, when price declines reflect real insolvency rather than temporary pressure, this practice can lead to catastrophic consequences.

Protocols face an unsolvable choice:

Use real-time prices: The risk is that during volatility, prices can be manipulated, triggering chain liquidations, as demonstrated in October 2025, with enormous costs.

Use delayed prices or time-weighted average prices (TWAP): This cannot address real bankruptcies, leading to the accumulation of bad debts, as exemplified by Stream Finance—where the oracle showed $1.26 while the real price was only $0.23, resulting in $650,000 in bad debts for MEV Capital alone.

Use manual updates: This introduces centralization and discretionary intervention, and can cover up bankruptcies by freezing oracles. All three options have led to losses of hundreds of millions or even billions of dollars.

Infrastructure Capacity Under Pressure

After the infrastructure collapse of Harvest Finance in October 2020, TVL dropped from $1 billion to $599 million due to a $24 million attack triggering user panic withdrawals, making the lesson clear: oracle systems must consider infrastructure capacity under stress events, and liquidation mechanisms need to set rate limits and circuit breakers, while trading platforms must maintain redundancy capacity ten times normal load.

However, October 2025 proved that this lesson has still not been learned at the institutional level. When millions of accounts faced liquidation simultaneously, billions of dollars in positions were closed within an hour, order books went blank due to exhausted buy orders, and system overload prevented order placements, the failure of infrastructure was as complete as that of the oracles. Technical solutions exist but have not been implemented because they reduce normal efficiency and increase costs, which could have been converted into profits.

If you cannot identify the source of returns, you are not earning returns; you are paying for someone else's profits. This principle is not complex, yet billions of dollars continue to be poured into black-box strategies because people prefer to believe comfortable lies rather than face uncomfortable truths. The next Stream Finance is currently in operation.

Stablecoins are not stable. Decentralized finance is neither decentralized nor secure. Returns without a clear source are not profits; they are predatory with a countdown. This is not an opinion but a fact validated at great cost. The only question is whether we will take action or repeat the same mistakes at the cost of another $20 billion. History suggests the answer is the latter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。