The volatility of the cryptocurrency market has been evident since the start of the week, with bitcoin ( BTC) and other high‑cap altcoins experiencing sharp price swings. BTC fell below $90,000 twice before quickly reversing losses. However, since early November, when it traded above $110,000, BTC has dropped 16%, with its market capitalization sliding from nearly $2.2 trillion to $1.84 trillion.

Analysts attribute bitcoin’s downturn to the collapse of macro factors that previously supported its rally, along with growing concerns that the artificial intelligence (AI) bubble may be nearing a burst. The same pressures have weighed heavily on the altcoin market, where some assets have posted even steeper declines.

Read more: The BTC Narrative Collapse: Why Bitcoin’s Price Drop Was ‘Inevitable’ Despite ETF Hype

Ethereum ( ETH), which traded above $3,800 on Nov. 1, slipped below $3,000 twice this week, hitting a low of $2,870 on Nov. 19 — its weakest level since July 11. Although ETH recovered to just above $3,000, it remains nearly 40% below its all‑time high of $4,946 and far from Bitmine Immersion Technologies Chairman Tom Lee’s year‑end target of $12,000.

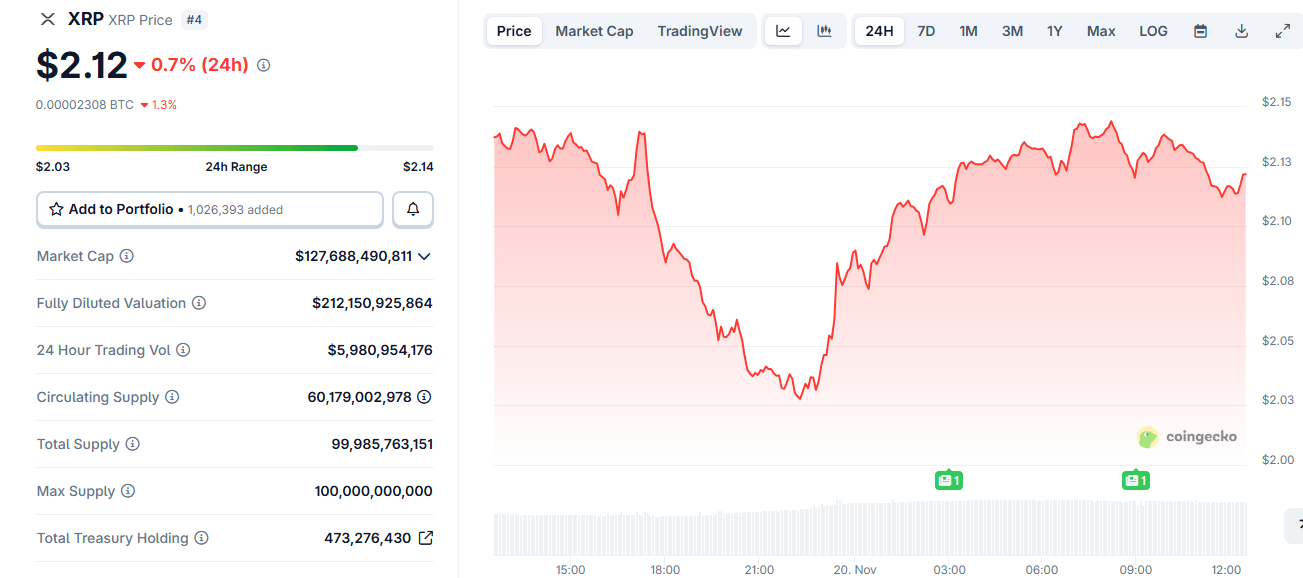

XRP mirrored the trend, dropping from just under $2.30 to $2.08 late on Nov. 17. It rebounded to $2.24 within 24 hours before another sell‑off pushed it down to $2.02, its lowest since June 23. On Nov. 20 at 4:30 a.m. EST, XRP had climbed back above $2.10. Meanwhile, similar declines were seen across most high‑cap altcoins, many of which posted double‑digit losses over a seven-day period.

Despite the bearish sentiment, market intelligence platform Santiment said the market value to realized value (MVRV) ratio indicates buying opportunities. In a Nov. 17 post on X, Santiment noted that most cryptocurrencies “are now flashing extreme pain for average trading returns.”

BTC and XRP, down 11.5% and 10.2% respectively over 30 days, were described as being in a “good buy zone.” Cardano ( ADA), down nearly 20%, was in the “extreme buy zone,” along with Chainlink (LINK) and ETH.

The market intelligence platform, meanwhile, argues that MVRV is a stronger metric for predicting recovery after sharp declines:

“Use MVRV to find out what a ‘buy low’ zone actually is, as opposed to simply looking at trendlines and support. In a zero‑sum game, buy assets when average trade returns of your peers are in extreme negatives. The lower MVRV goes, the higher the probability of a rapid recovery,” Santiment explained in the post.

- How has bitcoin performed globally? BTC fell below $90K twice this week and is down 16% since early November.

- What’s driving the downturn? Analysts cite collapsing macro factors and fears of an AI bubble bursting.

- How are altcoins reacting worldwide? ETH slipped under $3K, XRP hit $2.02, and many high‑caps saw double‑digit losses.

- Are there buying opportunities now? Santiment says BTC, XRP, ADA, LINK, and ETH are in strong “buy zones” based on MVRV data.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。