The past several weeks have turned the crypto market into a pressure cooker, and traders are scrambling to explain why bitcoin has spent November pinned down below the psychological $100,000 range with barely a reflexive bounce.

What’s emerged is a cocktail of theories — some structural, some conspiratorial, some well-supported, and a few that sound like they were born from pure caffeine and a wild imagination. But taken together, they paint a picture of a market dealing with overlapping shocks rather than one clean narrative.

One of the most widely discussed catalysts is the Oct. 10 liquidation cascade — the largest single-day wipeout in crypto history. Nearly $19 billion in leveraged positions were vaporized in under 24 hours after a surprise announcement of 100% tariffs on Chinese imports. Market makers, already thinly capitalized from months of low volume, pulled back sharply. Once these liquidity anchors step aside, every move gets amplified.

Fundstrat’s Tom Lee stressed this week that this event “really crippled market makers,” leaving them with less capacity to stabilize order flow. A market without deep liquidity is a market that falls faster than expected, and that’s exactly what happened. The long positioning across the market only intensified the slide.

Making matters worse, Lee highlighted an exchange-side code issue that briefly mispriced a stablecoin at $0.65 — a glitch that triggered automated liquidations across multiple venues. It wasn’t a blockchain failure. It was a systems failure, and it accelerated the flush.

Read more: Fundstrat’s Tom Lee Says October Liquidation Event Still Haunts Crypto Markets

Then came the Binance saga. An alleged display error that showed some tokens at “0 USD” and the temporary depegging of assets like USDe, BNSOL, and wBETH reportedly forced Binance to pay out $283 million in user compensation. While Binance insisted this was a front-end issue and not an attack, others argue the vulnerability window created by an upcoming oracle upgrade gave opportunistic actors an opening to exploit the pricing system. Because these tokens were heavily used as collateral, the forced selling snowballed into fresh liquidations.

Another theory gaining momentum: the digital asset treasury (DAT) company overhang. Firms like Strategy (formerly Microstrategy), Bitmine, and others have been major spot buyers throughout this cycle. But MSCI’s October notice questioning whether these firms should be classified as “companies” or “funds” has rattled traders, according to Ran Neuner’s theory. A ruling set for Jan. 15 could decide whether DATs remain eligible for major indices. If they’re removed, pension funds and passive trackers would be required to dump their shares automatically.

“Smart money” saw that risk immediately, Neuner’s theory concludes — and didn’t wait for the verdict.

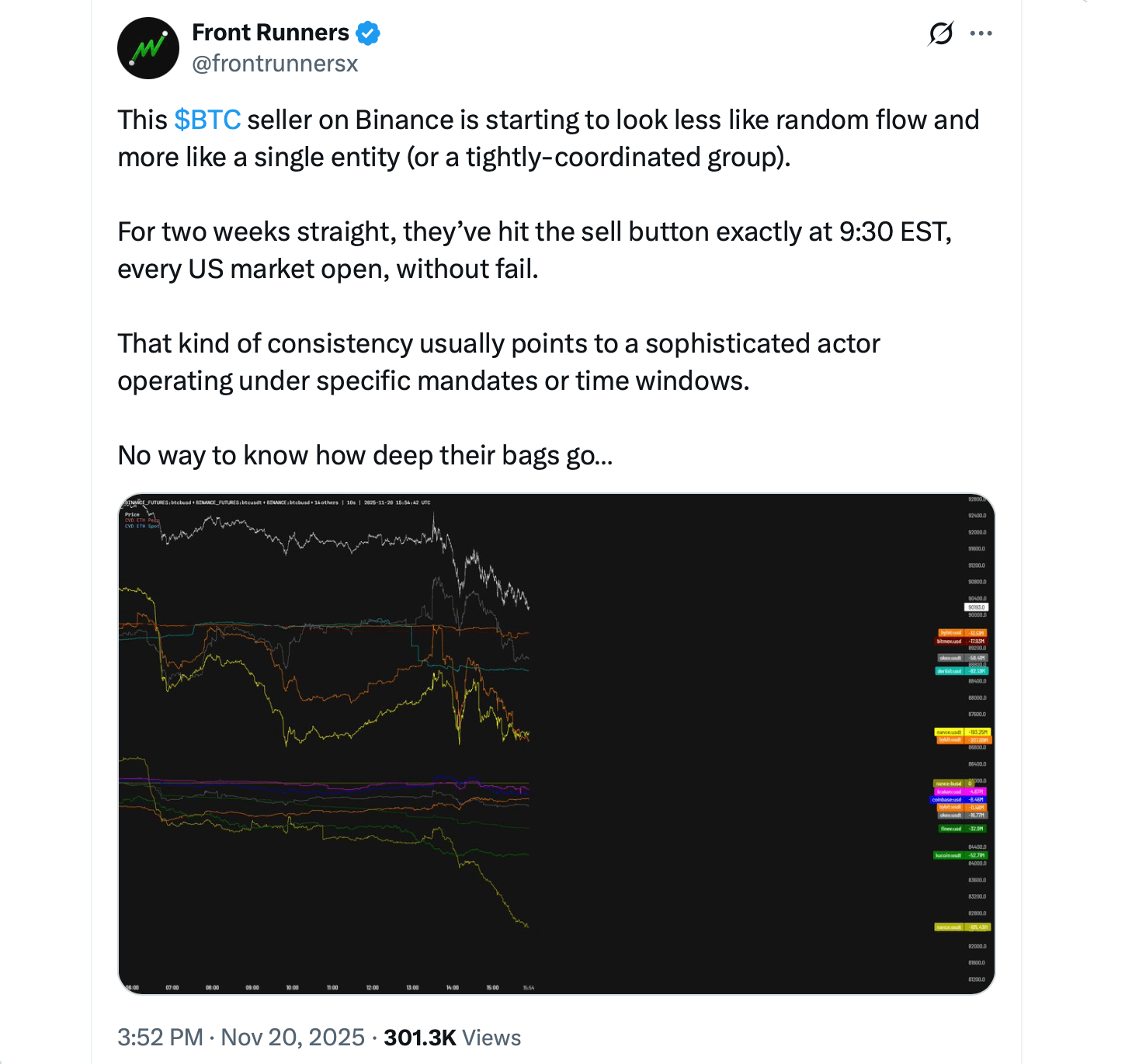

Technical indicators point to something even stranger: bitcoin’s chart is flashing some of the most extreme structural readings ever recorded. The X account Sightbringer notes a new all-time low daily MACD, an RSI near 21, and forced-flow-style selling that appears mechanically timed — all while bitcoin is down only about 33% from its all-time high. These indicators typically appear after 50% to 70% drawdowns, not moderate pullbacks.

That divergence has fueled a growing belief that someone — or several entities — is unwinding risk in a thin market with broken execution. It fits the rhythm: identical selling windows, thin liquidity breaks, and a lack of normal bounce behavior. In addition to the broad spectrum of market crash theories, there are valid concerns over an artificial intelligence (AI) bubble bursting, Japan’s long-term bonds exploding, Trump‘s trade war, and a stock market correction and incoming U.S. recession.

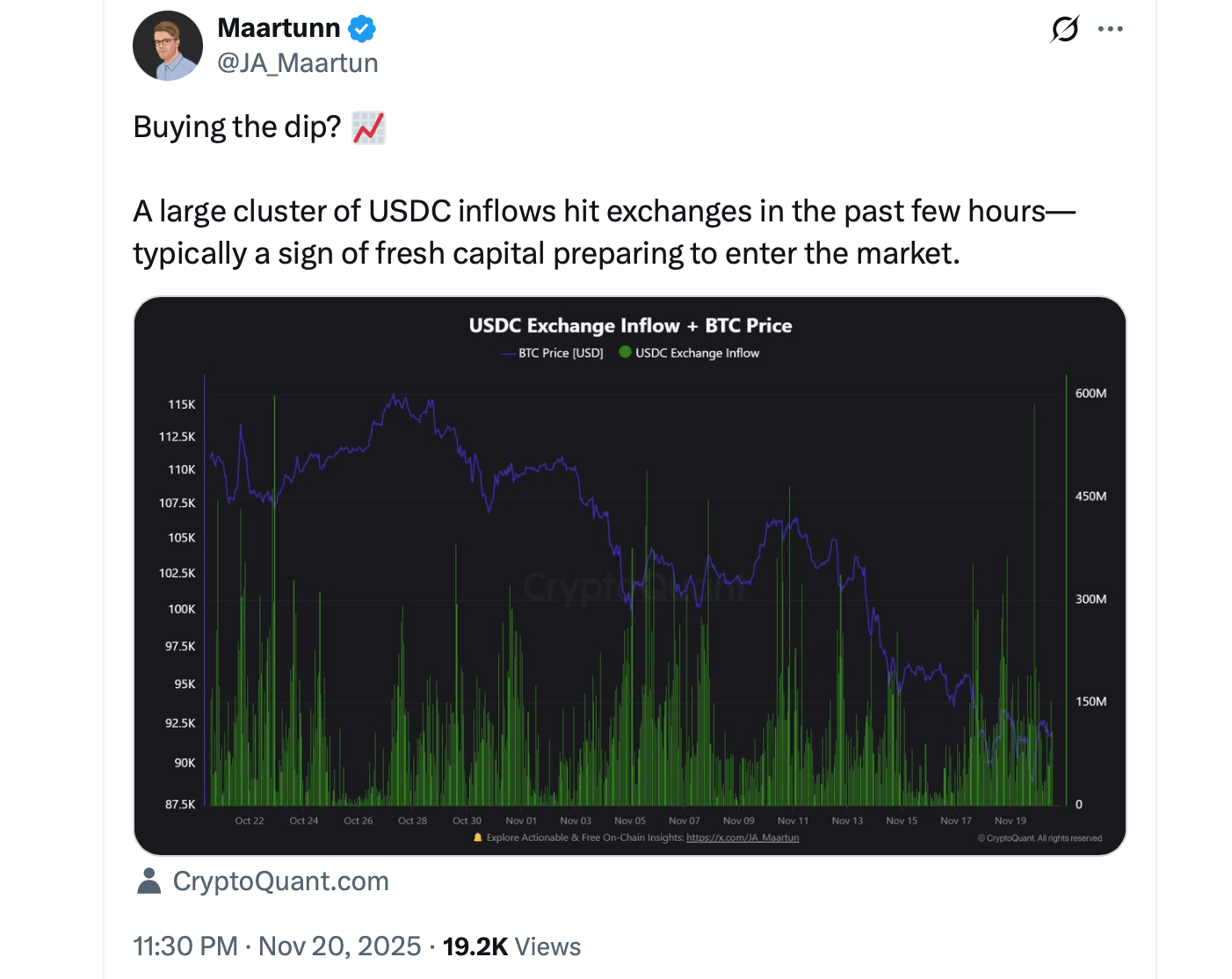

And yet, despite the chaos, not everything points to doom. USDC inflows have jumped, suggesting new capital is preparing to buy. Permanent holders have absorbed tens of thousands of bitcoin in six weeks. Solana exchange-traded fund (ETF) flows remain green daily, and institutional adoption continues quietly in the background. Even on the macro front, bitcoin’s historical comparisons remind traders that brutal mid-cycle drawdowns are normal — the 55% plunge in 2021 still ended with an all-time high at $69,000.

Put simply: multiple bearish forces collided at once. But long-term structural demand hasn’t disappeared, and the forced-seller narrative implies one thing — when the unwinding ends, the rebound could be violent.

- Why did the crypto market crash in October?

A massive liquidation event on Oct. 10, amplified by tariff news, thin liquidity, and automated selling. - Did technical failures make the crash worse?

Possibly — Reportedly, a pricing issue associated with a stablecoin and a temporary depegging created additional forced selling. - Why are traders worried about DAT firms?

Ran Neuner thinks a January ruling could decide whether DATs remain eligible for major indices, potentially forcing large passive funds to exit. - Is a recovery still possible?

Cryptoquant data shows USDC inflows, long-term holder accumulation, and ETF demand all point to improving conditions once forced selling ends.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。