One of the crypto industry's longtime Republican allies in Congress introduced a bill to allow individuals and businesses to pay taxes in bitcoin without triggering capital gains liability and also directing the funds to the U.S. Strategic Bitcoin Reserve — providing a new funding mechanism for the federal crypto stockpile that hasn't yet been established.

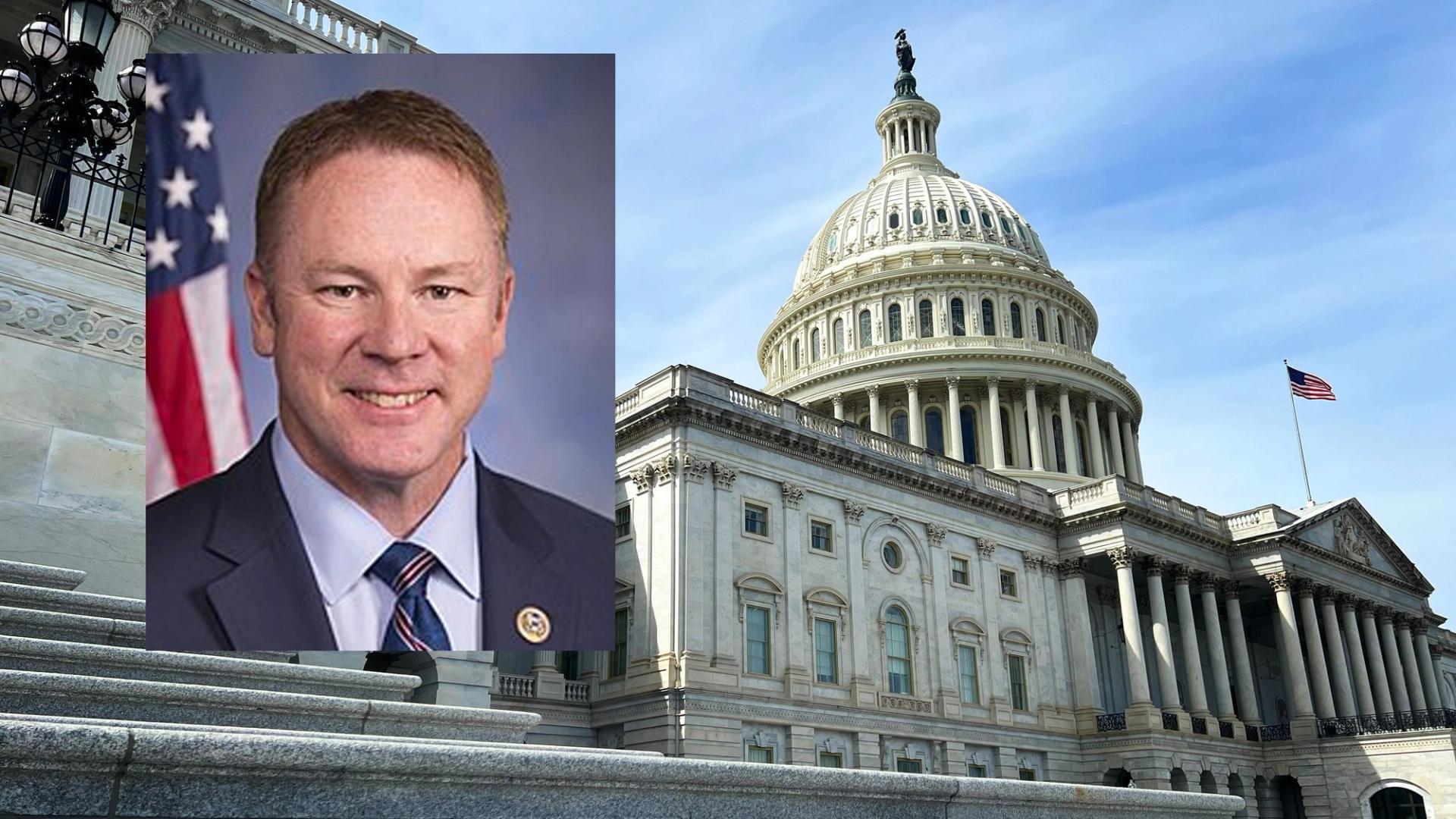

Rep. Warren Davidson (R-Ohio) introduced the Bitcoin for America Act to allow Americans to pay federal taxes in bitcoin, he said on his official website on Thursday.

Davidson, a bitcoin advocate since 2012, said the bill is aimed at strengthening the country’s economy and positioning it at the forefront of global digital asset leadership.

“The Bitcoin for America Act marks an important step toward modernizing our financial systems and embracing the innovation that millions of Americans already use every day,” he said in a statement.

“By allowing taxpayers to pay federal taxes in bitcoin and having the proceeds placed into the Strategic Bitcoin Reserve, the nation will benefit by having a tangible asset that appreciates in value over time — unlike the U.S. dollar, which has steadily lost value under inflationary pressures,” he stated.

He said in a talk with the Bitcoin Policy Institute, a research organization advocating BTC, that he regretsCongress did not listen to him back in 2016 when BTC was around $500 to $600.

“Think about the upside in terms of what it could do for a country that’s $38 trillion in debt,” the congressman said.

"The Bitcoin for America Act proves that a strategic Bitcoin reserve doesn’t need to be a top-down mandate,” said Conner Brown, Head of Strategy at BPI. “By letting Americans voluntarily contribute bitcoin through their tax payments, it creates the first truly democratic, market-driven model for national bitcoin accumulation.”

President Donald Trump’s Strategic Bitcoin Reserve became a possibility in early March, when he signed an executive order authorizing its creation.

However, those working on the project at the White House and Treasury Department haven't made the final leap into standing up the reserve, which they've said is likely to require congressional intervention.

When the president called for the reserve, he disappointed many of its advocates in the crypto industry when he said it would not tap taxpayer dollars to fund it. Davidson's bill could potentially run afoul of that concept, though it anticipates taxpayers knowingly putting their assets into the fund (and enjoying the capital-gains exemption on that amount).

Arkham’s U.S. federal reserve tracker is down currently, but according to the most recent estimates, the White House’s crypto vault holds an estimated 198,012 BTC, valued at approximately $17 billion.

Davidson's bill, which says it assumes bitcoin "is expected to appreciate due to its scarcity and growing adoption," lands in the middle of a major slide in the token's value.

A House bill introduced at this moment in the congressional session may act as more of a discussion point in future negotiations on various crypto tax provisions that industry lobbyists hope may find a legislative vehicle. Meanwhile, the lion's share of lobbyist attention is on the ongoing Senate work with the crypto market structure bill.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。