While most people are still anxious about short-term market fluctuations, a true financial transformation has quietly begun. With favorable policies continuously emerging, stablecoins are slowly stepping into the spotlight, becoming the core player in this revolution.

In July this year, the U.S. officially enacted the GENIUS Act, effectively bringing stablecoins into the "national team." This means that crypto assets are now set to enter the mainstream global financial arena. Riding this wave of policy momentum, a project named Solulu has quietly set its sights on this core track. It is targeting a massive market with an annual transaction volume exceeding $36.5 trillion. Instead of chasing wealth myths or speculative gimmicks, Solulu has chosen a more challenging yet impactful path in today’s volatile market—building the infrastructure for stablecoin services and paving a truly seamless "financial highway" for global value flows.

Why is Stablecoin Services the Next Golden Track?

Let’s look at some numbers: By 2024, the annual on-chain transaction volume of stablecoins has surged to $36.3 trillion. What does this mean? This figure already surpasses the combined transaction volumes of traditional payment giants Visa and Mastercard. The market size has also expanded significantly, with a total market capitalization exceeding $270 billion and an annual growth rate still maintaining a high level of 28%. However, behind this excitement lies a critical detail that most people overlook: the penetration rate of stablecoins in real-world payment scenarios is only a meager 6%. What does this indicate? The vast majority of stablecoins are still circulating within the financial system without genuinely entering the daily lives of crypto-native users. This massive untapped potential has long been eyed by institutions.

Solulu is targeting precisely this underdeveloped blue ocean. More importantly, the enactment of the U.S. GENIUS Act has explicitly required that stablecoins must be issued by licensed institutions and backed by U.S. dollar assets. This effectively clears the obstacles for compliant players like Solulu, elevating it from an industry “trailblazer” to a “co-builder of the compliance ecosystem.”

A Blue Ocean in Chaos: How Will Solulu Stand Out?

While the track is broad, competition is fierce. When we compare Solulu with several major players, its differentiated strategy becomes clear:

Dimension | Solulu | Circle (USDC) | Binance/Binance Card | Paxos |

Core Positioning | Full-stack stablecoin service infrastructure | Stablecoin issuance and B2B financial protocols | Ancillary services of exchange ecosystem | Compliance-focused blockchain platform for institutions |

Business Focus | End-to-end exchange, payment, and settlement | Stablecoin issuance, institutional services | Trading, exchange, exchange ecosystem benefits | Asset tokenization, broker-dealer services |

Payment Capability | self-built virtual U-cards | Relies on third-party integration | Closed-loop within exchange ecosystem | Not retail payment-oriented |

Compliance Strategy | Multi-license global layout, proactive compliance | Global compliance benchmark | Country-specific strategies | Strong institutional compliance |

User Coverage | Serves both retail and enterprise users | Developers, financial institutions | Existing exchange users | Large enterprises and institutions |

From this horizontal comparison, Solulu’s unique positioning is immediately apparent—it relies on full-stack services, top-tier compliance, and an independent ecosystem to establish itself as a stablecoin infrastructure provider. It goes beyond simply offering exchange or payment functions. Solulu aims to build a comprehensive ecosystem: integrating Visa cards, social transfers, and global settlement into one seamless experience. The goal is to ensure stablecoins can flow smoothly and compliantly across every link, from everyday consumption to cross-border trade.

How Will Solulu Realize This Ambitious Vision?

The answer lies in Solulu’s meticulously designed four-layer business matrix—these four interconnected components all work toward one goal: enabling stablecoins to truly flow.

Layer 1: The Foundation of Liquidity—Stablecoin Swaps

Solulu supports instant exchanges for all major stablecoins, aiming to become the world's largest multi-currency stablecoin exchange hub. This is not just about technical connectivity but also liquidity aggregation, providing the foundational support for all subsequent scenarios. Currently, Solulu has secured commitments from major financial institutions to provide liquidity support, with daily exchange demands reaching hundreds of millions of dollars.

Layer 2: Entering the Real World—Everyday Payments

Leveraging MSB/MTL licenses as a compliance foundation, combined with deep partnerships with merchants and payment networks, Solulu directly connects stablecoins to everyday consumption scenarios. This transforms stablecoins from abstract on-chain numbers into “digital cash” that users can activate and use instantly.

Layer 3: Closing the Value Loop—Global Fiat Channels

Breaking the boundary between on-chain assets and the real economy requires more than just the ability to “spend.” A complete financial experience also demands seamless entry and exit. Solulu has built global fiat on-and-off ramps (excluding China), enabling users to convert fiat currencies into stablecoins seamlessly. Additionally, it collaborates virtual U-cards that support global spending—not only with ultra-low fees but also with face-recognition registration. Physical cards are also planned for future release. This isn’t just about piling on features; it’s about significantly enhancing user experience.

Layer 4: Targeting a Trillion-Dollar Market—International Trade Settlement

Solulu’s ultimate ambition is to target the $24.44 trillion global goods trade market. By building a professional trade settlement platform, it aims to solve the century-old pain points of inefficiency and high costs in traditional cross-border settlements.

Through these steps, Solulu is gradually turning its blueprint for a "financial highway" into reality—from foundational exchanges to everyday payments, to the seamless flow of global fiat, and ultimately empowering top-tier international trade.

How Does Solulu Achieve Ecosystem Sustainability?

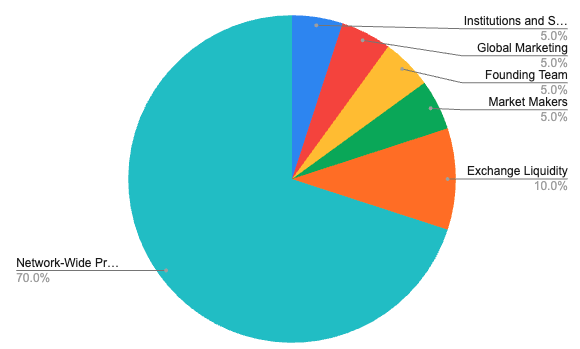

The secret to Solulu’s sustainable ecosystem lies in its tokenomics, designed to ensure that every ecosystem participant grows alongside the platform. The most striking feature of this model is that 70% of the total token supply (1 billion tokens)—equivalent to 700 million tokens—is allocated to the community. These tokens are distributed to early supporters and active users through “network-wide promotional incentive airdrops.” Even more ingeniously, Solulu commits all fee revenues to a monthly buyback and burn mechanism, creating a robust deflationary engine. As the ecosystem expands, the tokens become increasingly scarce, solidifying their value foundation and allowing holders to directly share in the platform’s growth dividends. This is Solulu’s key promise for sustainable development and shared prosperity with its community.

From “Co-Builder” to “Leader”: What’s Next for Solulu?

2026 will be a pivotal year for Solulu. According to its development roadmap, the platform will transition from being a “co-builder of the compliance ecosystem” to an “ecosystem leader,” advancing ecosystem implementation through two key directions: product refinement and global expansion. It plans to fully launch retail payment services, publicly issue U-cards, complete token deployment, and list on leading exchanges. Simultaneously, it will strengthen its community foundation through airdrop incentives. Even more exciting is the planned launch of an “instant messaging + payment” feature in the same year.

Globally, Solulu has a clear and focused strategy. It will prioritize license applications in key markets such as the UAE (VARA) and Singapore, doubling the number of countries supporting fiat channels. It will also initiate settlement trials with small and medium-sized traders, a critical step in entering the $24 trillion global trade market.

Looking ahead to 2027 and beyond, Solulu faces even greater challenges: it plans to launch a dedicated on-chain trade settlement network, integrate DeFi lending and wealth management products, and ultimately become the core bridge connecting traditional finance with the crypto world.

The stablecoin track is undoubtedly a recognized golden field, but Solulu has deliberately chosen the most challenging path within it. On this journey, it must contend with potential competition from traditional financial giants, overcome complex compliance hurdles, and strike a precise balance between user experience and security. Yet, as with all significant infrastructure projects, true value always takes time to mature. Perhaps the significance of Solulu lies not only in whether it can grow into an industry unicorn but also in the new possibilities it explores for the entire field—when compliance and innovation go hand in hand, and when infrastructure development takes precedence over short-term gains, the crypto world may finally open the door to mainstream finance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。