The world is bustling, all for profit; the world is bustling, all for profit to go! Hello everyone, I am your friend Lao Cui, focusing on digital currency market analysis, striving to convey the most valuable market information to the vast number of cryptocurrency enthusiasts. I welcome everyone's attention and likes, and I refuse any market smoke screens!

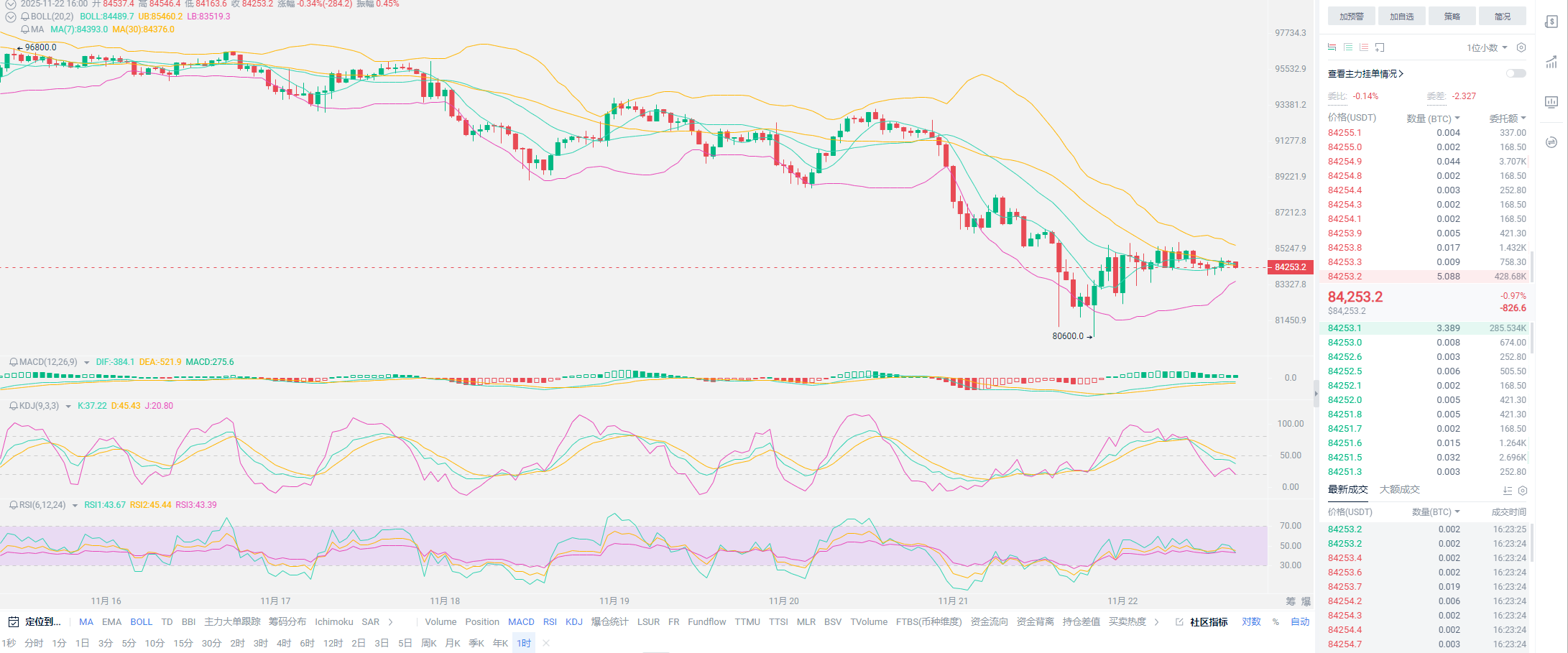

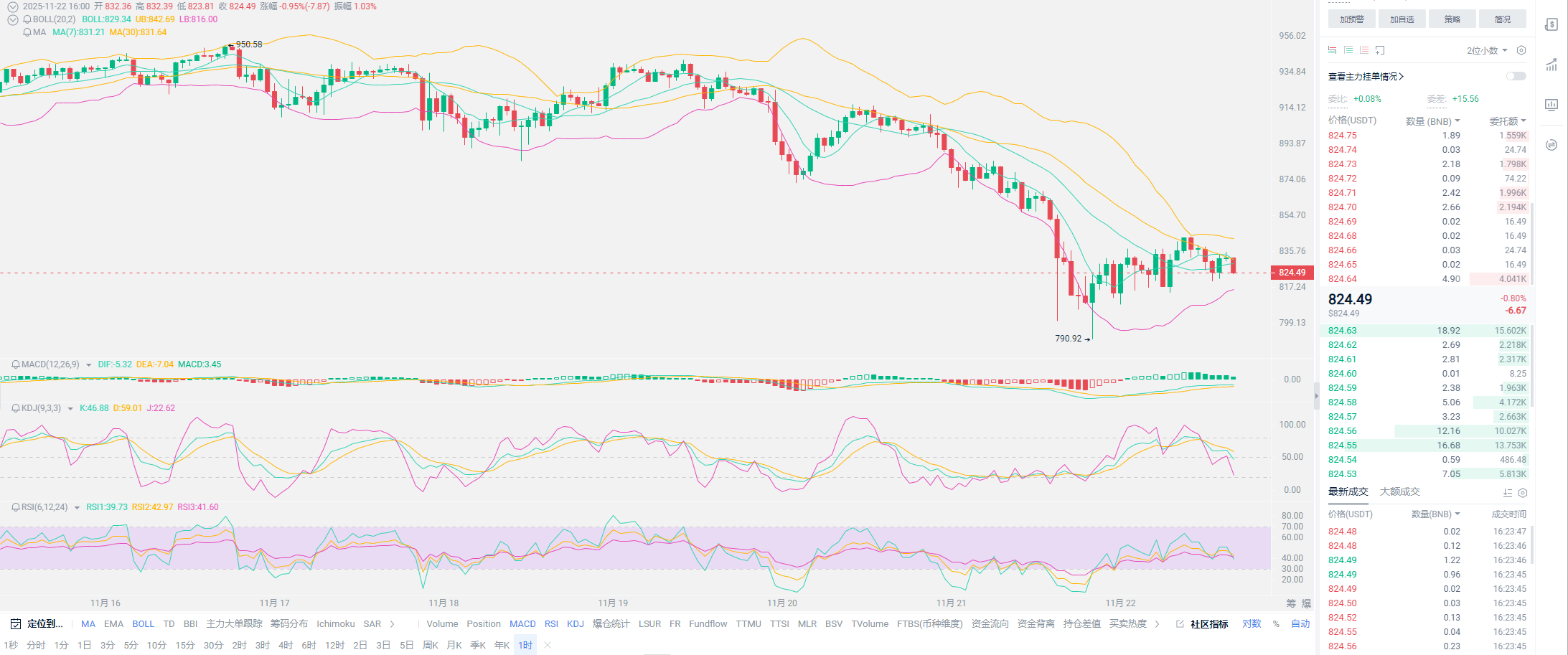

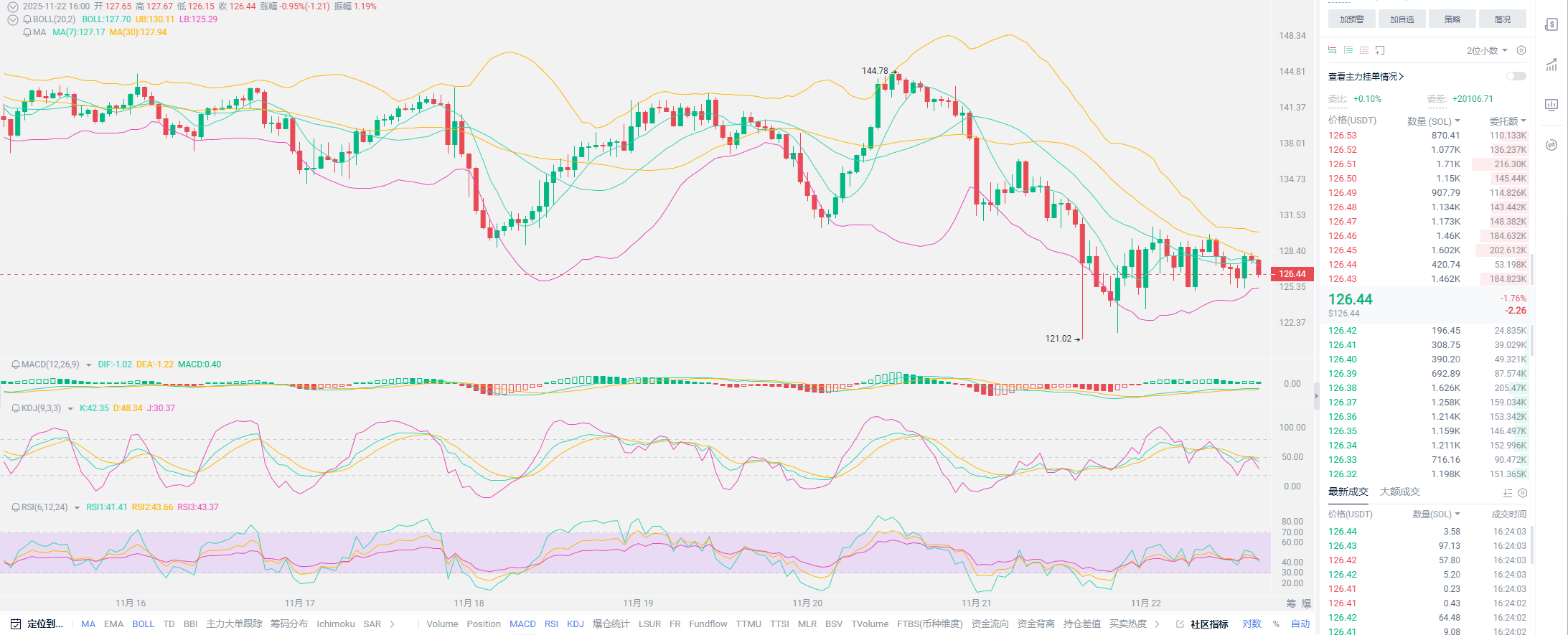

After being away for two days, Bitcoin has once again set a new low, and falling below 90,000 has become a foregone conclusion. Many friends are starting to hesitate; the deeper the drop, the more self-doubt arises. Most of these friends are newcomers to the crypto space and do not understand the history of the crypto market. Especially for those transitioning from stable investment markets like gold and forex to high-risk markets, it is difficult for their mindset to change in an instant. Many friends are also very concerned about the future trends; even though Lao Cui has explained multiple times, there are still friends who have doubts. The current drop has also surprised Lao Cui to some extent. Including SOL, Lao Cui's earlier estimate was that it would fluctuate between 160-180, but it has now returned to around 140. The volatility of Bitcoin is within a normal range, while Ethereum is somewhat weak, with insufficient recovery strength after falling below 3000. The downward trend throughout the month, although predicted earlier, was not accurately forecasted, especially for contract users, which has certainly caused some losses.

Recently, important news has emerged: BlackRock's reduction of holdings is very eye-catching, having reduced 12,000 BTC and 172,000 ETH. Everyone sees such data and panics; indeed, their holdings are only in the hundreds of thousands, and a sudden reduction of this magnitude raises questions about directional issues. However, from a capital perspective, this is not an active abandonment but a passive choice. The large holdings of Bitcoin previously have led to a cash crunch for BlackRock, especially with the impending end of quantitative tightening, which may force them to sacrifice some profits in the form of cash reserves. Additionally, as the year-end approaches, they indeed need to provide some benefits to shareholders. Based on the current trend, outflows are definitely greater than inflows; if the two are opposite, the current state should be one of growth. Regarding the data aspect, what everyone can see is limited; whether it is BlackRock or Grayscale, the information from both will only circulate after the events have concluded, which may also be a signal of reversal.

Earlier data showed that non-farm payrolls increased slightly by 119,000 jobs in September, but there has been little overall change since April. The unemployment rate is at 4.4%, showing little change compared to last month. One point of impact is the interest rate cut in December; current predictions suggest a 65% chance of only two rate cuts in 2025. Simply put, it is highly likely that there will be no rate cut in December. Lao Cui's thought is that the decision may be postponed to January; if it is confirmed that there will be no rate cut in December, the probability of a rate cut in January will increase, and it may even be a direct cut of 50 basis points. The key factor still lies in the impact of non-farm data. The most self-deceiving step for Americans is that the October data will not be revised because the overall state of October was stagnant, leading to extremely terrifying unemployment numbers. If this situation is premeditated, perhaps someone does not want to see a rate cut in December; who would benefit the most from this?

The article has a time limit, and the probability of a rate cut is gradually increasing, which is a normal topic of discussion; most friends' concerns, from Lao Cui's perspective, are actually unfounded. It is merely a contest between January and December, which will come sooner or later. It is just a test of the patience of contract users, and recently Lao Cui's energy has been quite limited, with some users overwhelming. Therefore, whether it is comments or private messages from everyone, responses will be given as time permits; I hope everyone can understand. Of course, Lao Cui will reply to every message he sees. Recently, the issue of capital flow has been significant; it can be seen that there may be a wave of dynamics about to erupt. Whether it is BlackRock or JPMorgan, both are injecting large amounts of Bitcoin and Ethereum reserves into Coinbase. This capital may likely be in a selling state; it has been mentioned before that BlackRock has clearly shown a significant inflow during this bull market, and everyone needs to pay attention to their positions.

Even with the current drop, Lao Cui still holds an optimistic view of the crypto space. The entire spot market is still in a state of replenishing positions, which has already begun to cause losses in the spot market. This is normal; regarding the bull market pattern in 2026, Lao Cui has also changed his view. In previous predictions, Lao Cui was not very optimistic about 2026, but this wave of decline has successfully laid the foundation for the next bull market. After the beginning of 2026, there may still be a growth pattern. The accumulation of capital in the chain is conducive to the issuance of the next bull market, and the technical aspects are supported. Of course, these are all future discussions; the current market is in a bearish range, which is understandable, but this does not result in significant losses for spot users. Because the profits from short positions in contracts have basically locked in the losses from the spot market. The operational form of contract users tests everyone's focus; the holding time is basically in and out every day.

Lao Cui summarizes: Overall, I won't be too verbose with everyone; it is clear that Bitcoin touching the 80,000 threshold is not good news. Integrating the current positive news, the only thing that can be confirmed is the end of quantitative tightening in December, including the listing of SOL's ETF, which has already shown Lao Cui the inflow of capital. Currently, there is no market initiation; as soon as there are signs of a bull market, the reference point may be SOL. The current downward trend has kept SOL fluctuating around 10 points; under the current conditions, do not think about selling SOL's spot. If there are losses, try to hold on; if possible, also try to replenish positions. For contract users, Bitcoin is likely to continue to move within the previous downward range; from a trend perspective, it has now become a state of exhausted bearish sentiment. The recovery strength is also very strong; if you want to enter the market, try to do so on the same day, and any issues should be consulted primarily. December will be better.

Original article created by WeChat Official Account: Lao Cui Talks About Coins. For assistance, please contact directly.

Lao Cui's message: Investing is like playing chess; a master can see five, seven, or even more than ten moves ahead, while a novice can only see two or three moves. The master considers the overall situation and strategizes for the big picture, not focusing on individual pieces or territories, aiming for the ultimate victory. The novice, however, fights for every inch of land, frequently switching between long and short positions, only seeking short-term gains, and often finds themselves trapped.

This material is for learning reference only and does not constitute trading advice. Trading based on this carries risks!

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。