The futures market is running hot, even as bitcoin loiters in a narrow band. Coinglass.com stats show total futures open interest (OI) sits at 688,880 BTC, equal to $58.24 billion, showing that traders haven’t backed away from leverage despite the week’s pressure.

The trading platform leaderboard is tight at the top: CME controls 135,900 BTC, with Binance barely behind at 135,490 BTC, each claiming just under one-fifth of the market. CME’s institutional crowd has seen OI slip 2.56% over 24 hours, while Binance’s book is off 1.95%, hinting at cautious rotations rather than outright retreat.

OKX follows with 42,550 BTC in OI, down 1.88% daily, and Bybit shows 77,560 BTC, nursing a 3.05% drop over the same period. Among the mid-tier exchanges, Gate stands out: the platform posted a +1.36% jump in OI over 24 hours, the only green shot in a field of red. BingX, meanwhile, suffered the worst bruising with a brutal 37.06% OI drawdown, the kind of move that looks like forced exits.

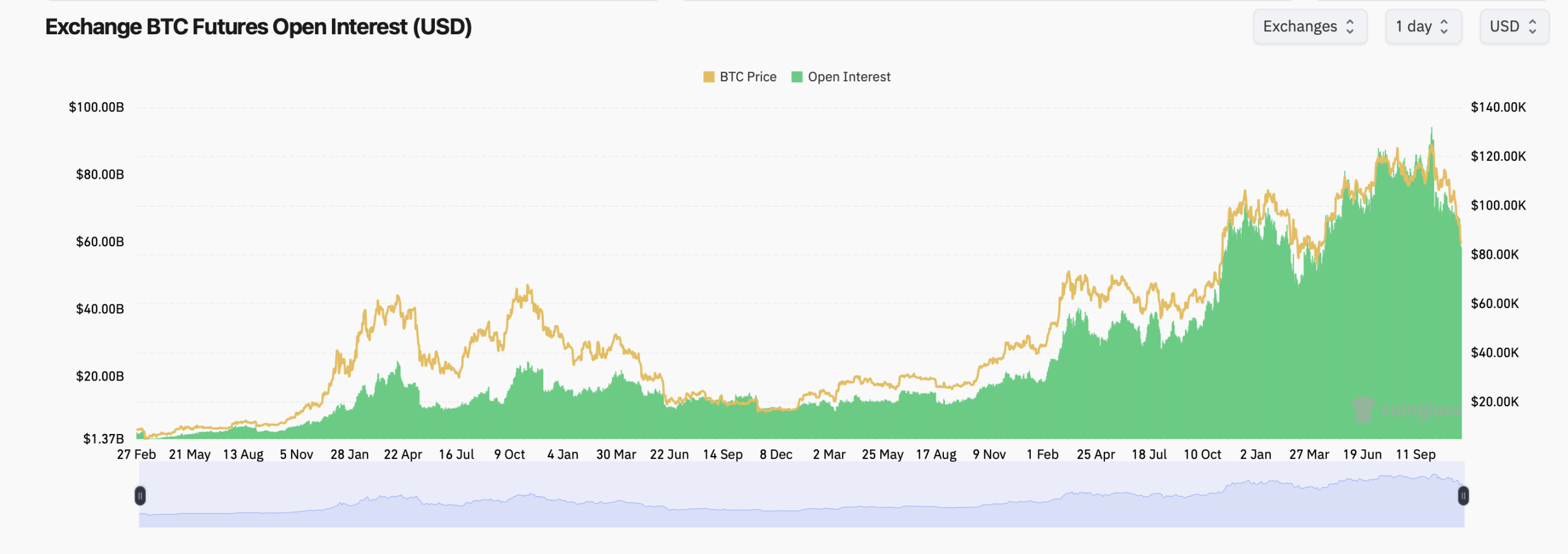

When zooming out, the futures OI chart shows just how tightly linked bitcoin’s run has been with the buildup of leverage. Open interest trailed price almost perfectly from late 2023 through mid-2025, hitting new peaks as bitcoin climbed above six figures before this season’s retracement took the shine off speculative positions.

Bitcoin’s options sector tells a different story — one filled with hedging, fear, and some ambitious December plays. Total bitcoin options open interest skates near all-time highs, with the split showing 60.24% calls vs. 39.76% puts, suggesting traders haven’t abandoned their upside fantasies yet. Calls dominate with 322,221 BTC, while puts sit at 212,708 BTC.

Volume in the past 24 hours leans slightly call-heavy as well (51.52% vs. 48.48%), hinting that traders are nibbling at upside exposure even as price stalls. Deribit continues to dwarf every other venue, with its largest positions stacked around heavy December expirations: the BTC-26DEC25-85,000 put, the 140,000 call, and the 200,000 call hold the highest open interest. It’s a cocktail of deep hedges and moon-shots — a classic Deribit cocktail.

Max pain levels across exchanges show a market torn between reality and optimism. As of 1 p.m. Eastern time on Saturday, statistics show:

- Deribit’s max pain for key expiries clusters in the $85,000–$105,000 zone.

- Binance’s max pain curve suggests gravity around $90,000–$100,000, depending on the expiry.

- OKX paints a similar target, with most expiries dragging toward the mid-$80,000s to low-$90,000s.

With bitcoin holding the low-$80,000s, many contracts are flirting dangerously close to max-pain magnetism — a zone where market makers would love to keep price pinned to wring out both call and put buyers.

As consolidation drags on, open interest remains rich, options traders are actively defending downside risk, and max pain hovers close enough to the current price to make next week’s moves feel like they’re operating under the watchful eye of derivatives gravity. For now, bitcoin is quiet — but the derivatives market is anything but.

- What is futures open interest in this context?

It’s the total number of outstanding bitcoin futures contracts across exchanges, reflecting how much leverage remains in the system. - Why are CME and Binance so important to futures OI?

They hold the largest share of the market, with institutions flocking to CME and retail-heavy flow driving Binance. - What does the call-to-put ratio suggest right now?

Calls make up a larger share of options OI, showing traders still hold some appetite for upside exposure. - What does “max pain” mean for bitcoin traders?

It’s the price where the most options expire worthless, often a magnet during major expiries.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。