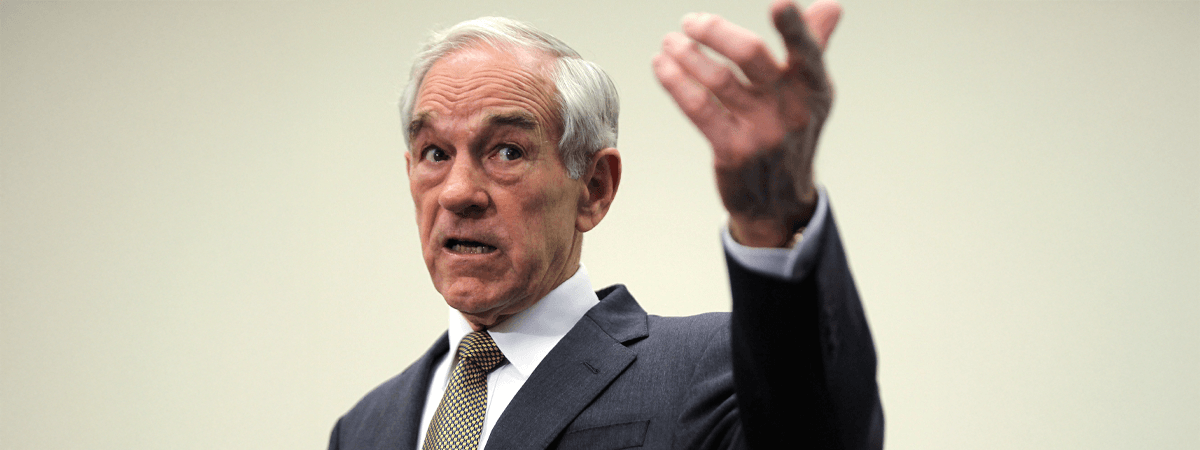

In the latest Liberty Report, Ron Paul and co-host Chris Rossini argue that the U.S. economy is not just entering a bubble but is spinning inside an interconnected cluster of them — a condition longtime market watchers have dubbed the “everywhere bubble” or “everything bubble.”

Paul opened with a look at markets he says clearly reflect public anxiety. Gold has held steady at around $4,000 an ounce, bitcoin has experienced sharp whipsaws, and investors are scrambling for safe ground. For Paul, these are signs that people no longer trust the dollar’s long-term stability. “Gold really is money,” he reminded viewers, noting that its purchasing power has outlasted every major fiat system in modern history.

“The AI Bubble is a perfect example of why the Fed should not exist,” Paul says. “Give human beings the ability to counterfeit money, and their delusions of grandeur are going to take over. Economic laws become a relic of the past. The free will of every single person on earth is ignored as if it doesn’t exist. Rational valuation becomes impossible and is shoved aside in favor of fabricated narratives. And, of course, the line that accompanies every single bubble: ‘This time is different.’”

The conversation quickly shifted to the booming AI sector — a frenzy Rossini says mirrors previous bubbles fueled by the Federal Reserve’s loose monetary policies. The United States has more than 5,000 data centers, he noted, while the next closest country, Germany, has just 500. Rising electricity costs, rapid construction, and lofty earnings expectations have inflated what Rossini calls an “Alice in Wonderland” economy built on subsidized credit and distorted incentives.

Rossini pointed to recent comments from major tech leaders predicting an end to global poverty and claiming their companies are too important to fail. Nvidia’s CEO even suggested the world would have “fallen apart” if its latest earnings had disappointed — rhetoric Rossini compared to the pre-2008 assurances that housing prices would “only go up.”

Paul emphasized that runaway credit growth, political incentives, and aggressive monetary intervention have produced a cycle in which governments encourage risky behavior, then bail out the consequences. From the dot-com era to the housing crash to crypto’s volatility, Paul said bubbles form when easy credit gives the illusion of wealth while savings and production fail to keep pace.

“The receivers of The Fed’s counterfeit money believe that reality will conform to their imaginations,” Paul told his 1.2 million followers on X. “It won’t. End the Fed…and we end this repeated madness.”

Where he sees the biggest danger today is not just in tech, markets, or housing — but in what he calls “bubble money” itself. Washington’s war spending, global military commitments, and long-term debt obligations, he said, have created an economic structure that depends on perpetual money creation. “Government spending is doomed to be monetized,” Paul said, arguing that inflation and currency debasement are unavoidable under the current system.

Read more: Fundstrat’s Tom Lee Says October Liquidation Event Still Haunts Crypto Markets

The Liberty Report hosts also highlighted what they view as structural distortions: government subsidies for electric vehicles, the collapse of commercial office demand, and corporate circular-investment schemes in the AI sector involving major firms such as Microsoft, Oracle, and Nvidia. These cycles, the duo argued, thrive only because the price system no longer reflects real supply and demand.

As an alternative, Paul advocated a return to sound money — a system grounded in gold and silver with voluntary transactions and consistent units of account. He pointed to the Byzantine bezant, a gold coin that circulated internationally for centuries, as an example of monetary stability without a central bank. Modern systems, he said, rely on money creators who behave more like counterfeiters than guardians of value.

Paul concluded by warning that every reserve currency in history has eventually failed, and he believes the U.S. dollar is no exception. Yet he also noted that younger generations are increasingly interested in monetary reform, gold, bitcoin, and alternatives to the current system. For the Liberty Report hosts, that curiosity may be the most encouraging sign of all.

FAQ ❓

- Why does Ron Paul believe the AI sector is a bubble?

He argues that easy credit, inflated valuations and rapid data-center expansion mirror previous Fed-fueled bubbles. - What role does gold play in Paul’s analysis?

Paul says gold’s rise reflects declining trust in fiat money and persistent inflation concerns. - How does the Liberty Report view Federal Reserve policy?

Both hosts argue the Fed distorts prices, fuels bubbles and encourages risky economic behavior. - Why is sound money a central theme of the discussion?

Paul says stable units of account and voluntary exchange are essential to restoring economic balance.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。