Prediction markets are sending a clear message ahead of the Federal Reserve’s Dec. 9–10 meeting: the smart money is leaning toward another 25-basis-point cut, even as officials continue to project anything but unity. Polymarket, Kalshi, and CME’s Fedwatch tool have all shifted toward expecting a modest cut, though each platform shows its own flavor of market anxiety.

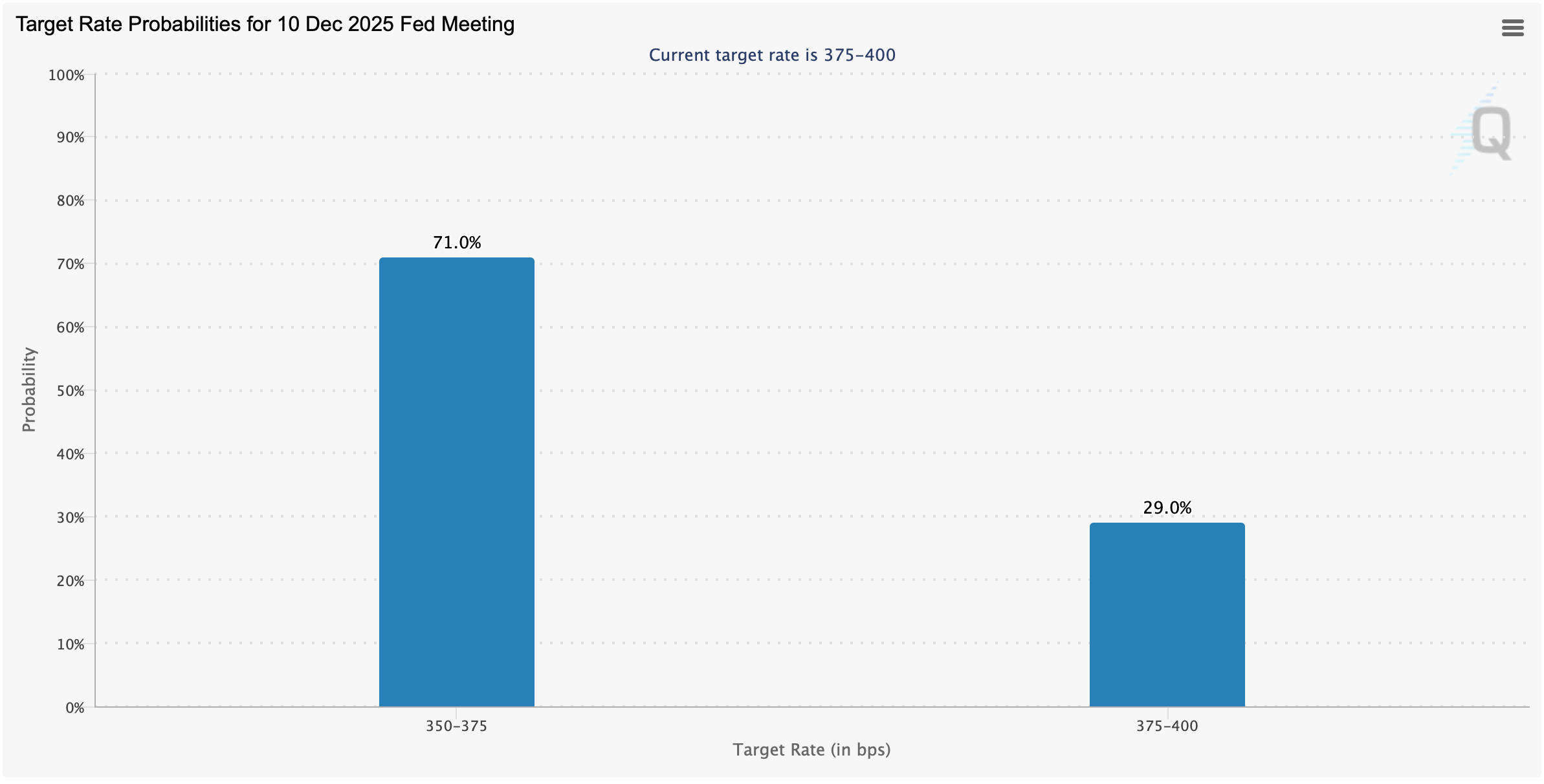

According to Polymarket data, bettors currently assign 66% odds to a 25 bps cut, compared with 32% expecting no change and just 2% pricing in a larger-than-usual 50 bps reduction. The “25+ bps increase” market is basically lifeless at under 1%, reflecting the near-universal view that the Fed is done tightening for now. Kalshi’s market echoes that sentiment, pricing the 25 bps cut at 64%, a hold at 36%, and anything larger at 3%. CME’s Fedwatch tool rounds out the trifecta, showing a 71% probability that the target range will drop to 350–375 bps — a clean 25 bps trim from the current 375–400 bps band.

Polymarket bets on Nov. 22, 2025.

Under the hood, however, the central bank is grappling with what internal minutes describe as “strongly differing views,” a rare rift that makes December’s meeting a genuine coin toss. October FOMC minutes revealed a “two-sided dissent,” with one official favoring a deeper cut and others opposing any easing at all. Analysts quoted in several reports note that Chair Jerome Powell is managing a “consensus problem,” and that discord has spilled into public remarks.

This friction is one reason prediction markets keep wobbling. Traders saw cut odds dip as low as 22% after the minutes were published — only for them to rebound after dovish comments from New York Fed President John Williams, who noted there is “room for rates to fall in the near term.” Conversely, Boston and Cleveland officials have argued there is “no urgency” to cut, citing still-elevated inflation and the risk of easing too soon. With those kinds of cross-currents, it’s no wonder bettors treat every speech like a market-moving event.

Economic data hasn’t made the situation any easier. Reports outline the fallout of a 44-day government shutdown, which delayed key labor and inflation releases and left policymakers with partial visibility heading into December. September’s long-delayed jobs report showed 119,000 jobs added but also a rise in unemployment to 4.4%, the highest since 2021. Wage growth held at 3.8%, and private-sector trackers point to softer hiring in October. With only fragments of data available before the meeting, traders are effectively pricing a decision based on incomplete evidence.

Inflation also remains sticky enough to embolden hawks. September CPI registered 3%, with core at 3.1%, and core PCE is still hovering around the 2.8–2.9% zone. Officials warn “progress has stalled,” reinforcing the argument that a wait-and-see stance may be the safer path. All of this sets up the December meeting as a balancing act between softening labor signals and inflation that refuses to cooperate.

Also read: Ron Paul Warns the Fed’s ‘Fantasy Money’ Is Fueling the AI Bubble

Even so, betting markets appear to believe the doves have the momentum. Both Polymarket and Kalshi show a strong tilt toward a 25 bps cut, and CME futures traders have followed suit. The notable divergence is in the “no change” category: while Polymarket prices it at 32%, Kalshi’s number has climbed to 36%, reflecting subtle differences in how retail bettors and event-contract traders interpret the Fed’s communications. The small but persistent premium on “no change” likely reflects the Fed’s recent reminders that further cuts are “not a foregone conclusion.”

CME Fedwatch tool on Nov. 22, 2025.

Market volatility has followed every twist. Stocks, bonds, gold, and bitcoin have all reacted sharply to Fed-related headlines, with rate-sensitive sectors bearing the brunt of each odds swing. Traders appear acutely aware that another cut could boost risk assets, while a hold would support the dollar and put more pressure on the economy. In other words: the December meeting is primed to deliver market fireworks regardless of the outcome.

Ultimately, the question isn’t just what the Fed will do — it’s how Powell will justify it. With data gaps lingering, inflation still warm, and officials contradicting one another in public, prediction markets may be the most consistent signal available right now. And at least for the moment, those markets say December is shaping up to be another 25-point shave.

FAQ ❓

- What are markets expecting the Fed to do in December?

Most prediction platforms show higher odds for a 25-basis-point rate cut. - Why are traders favoring a cut over a hold?

Soft labor data and recent dovish comments from key Fed officials have boosted expectations for modest easing. - How does CME FedWatch compare to betting markets?

CME futures show similar probabilities, with more than 70% expecting a 25 bps move. - Why is the December decision unusually uncertain?

Conflicting data, internal Fed disagreements, and delayed government reports have made visibility especially limited.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。