**Written by: **Jack Kubinec, Unchained

Translated by: Yangz, Techub News

At the end of 2024, thousands of party enthusiasts flocked to a nightclub in Singapore to attend a party co-hosted by a blockchain project called Berachain, themed around bears and yet to be launched. The line waiting to enter snaked through a shopping mall in Singapore, its length even exceeding the range of vision of some onlookers.

At that time, Berachain had evolved from an NFT project depicting a bear smoking marijuana in 2021 to one of the hottest new blockchains in the cryptocurrency space. The startup had raised at least $142 million in venture capital, and in its last funding round, its token was valued at 1.5 billion dollars. This round of financing was co-led by Framework Ventures and Nova Digital, the latter being a fund under the $34 billion hedge fund Brevan Howard's crypto division%2C%20subject%20to%20regulatory%20approval.).

The key to this financing was the brand effect of one of the world's most renowned investment institutions, which brought credibility to Berachain. A former employee, who wished to remain anonymous, recalled that Berachain's anonymous co-founder, Papa Bear, had pointed out that Brevan's investment could help the project gain recognition.

However, what is not widely known is that the terms of the Series B financing were particularly favorable for Nova, a fund under Brevan.

Documents obtained by Unchained show that Berachain granted the fund a refund right, allowing it to return the principal of its $25 million Series B investment within one year after the Berachain token generation event (TGE) on February 6, 2025. This refund clause means that, unlike traditional venture capital, Brevan's fund bears no risk to its principal. If Berachain's BERA token performs well, the fund will reap returns; if BERA performs poorly, the fund can demand a full refund.

Four lawyers focused on the crypto field stated that it is extremely unusual for a crypto project to grant investors a refund right after the TGE. Two of the lawyers noted that in token financing, even if a refund right clause does exist, it typically only triggers if the project fails to successfully issue tokens.

Given that the token price has dropped about 66% from its $3 investment price, it would be financially wise for Nova Digital to exercise the refund right. However, once it requests a refund, it could force Berachain to cough up $25 million in cash to repay one of its own supporters. According to the project's documentation, the tokens purchased by Berachain investors are subject to a one-year lock-up period. Therefore, if Nova chooses to exercise the refund right, it would likely forfeit its allocated BERA tokens.

It remains unclear whether this refund right held by the Nova fund is legal—especially if the existence of this clause was not disclosed to other investors. The deadline for Nova Digital to exercise this refund right is February 6, 2026.

Nova's Optimistic Bera Bet

The deal between Brevan Howard Digital and Berachain was facilitated by the Nova Digital Master Opportunities Fund Limited, which Brevan acquired from the crypto venture capital firm Dragonfly in 2023 here. According to a source familiar with the matter, Nova's operations within Brevan Howard Digital are led by Kevin Hu here, who personally invested in Berachain's seed round.

Documents show that as part of the Series B financing for the chain, the Nova fund invested $25 million in Berachain in exchange for BERA tokens priced at $3 each. Other investors include Polychain, Hack VC, Arrington Capital, and Tribe Capital. The refund right agreement is outlined in a side letter dated March 5, 2024, attached to the investment term sheet from Brevan Howard Digital, titled "Nova Side Letter."

A copy of the Nova Digital investment term sheet obtained by Unchained can be viewed here. The SAFT (Simple Agreement for Future Tokens) from Nova Digital can be found here, and the side letter containing the refund right can be viewed here.

Sources indicate that other venture investors within Brevan Howard Digital, aside from the Nova fund, have not requested refund rights from their portfolio companies, further highlighting the uniqueness of this arrangement.

Smokey the Bera, Berachain's anonymous co-founder, stated in an email: "The relevant reporting from (Unchained) is neither accurate nor complete. Brevan Howard remains one of Berachain's largest investors. Their investment involves multiple complex business agreements, but they participated in the Series B financing based on the same documents as all other investors." The project declined to answer specific questions, and Smokey the Bera did not elaborate on these business agreements.

According to the terms of the side letter, Nova Digital must deposit $5 million with Berachain within 30 days after the token generation event (TGE) to exercise its refund right. Unchained could not verify whether Nova has deposited this $5 million or whether the fund has exercised its refund right for the BERA tokens. Ashwin Ramachandran, co-founder of Brevan Howard Digital and Nova, declined to comment on the refund right. Hu also did not respond to multiple requests for comment.

Additionally, sources revealed that due to differences in risk tolerance and strategy, Nova Digital is currently spinning off from Brevan Howard. The Nova fund will operate independently, and once the spin-off is complete, Brevan will no longer have any association with Berachain. At the time of this article's publication, Brevan Howard Digital was still listed as a supporter on Berachain's official website here.

A Rare Proposal

Gabriel Shapiro, co-founder of MetaLeX Labs and a veteran crypto lawyer, estimated that he has participated in over 50 token financing deals, but he stated that he has never heard of a precedent for granting a refund right after the TGE in any financing round. He said, "A company would reach an agreement with leading investors to grant them unconditional rights to demand a full refund of their investment, most likely because… (the company) can use this to tell other investors… this round is led by this institution, which would make other investors more likely to invest or trust the security of this chain."

In a recent rare case where token investors were granted a refund right, all parties involved received this clause. The Flying Tulip project, announced earlier this year by DeFi developer Andre Cronje, granted all investors an unconditional refund right in its $200 million funding round, providing downside protection for the investment. Moreover, unlike the situation with Berachain, this "perpetual put option" was publicly advertised.

In the history of cryptocurrency development, SAFT investors occasionally receive refunds due to reasons such as the project failing to issue tokens on time. However, even in those cases, refunds are not provided simply due to poor token price performance.

Is Important Information Missing?

Two lawyers familiar with capital market regulations stated that whether Berachain had a legal obligation to disclose this redemption right to other Series B investors remains an open question. One lawyer pointed out that typically, under the SEC's Regulation D anti-fraud requirements, companies seeking financing must disclose "material information" to all investors, but the rules do not define what constitutes "material."

Two anonymous Series B investors in Berachain indicated that Berachain did not inform them that another investor had a refund clause.

Shapiro stated, "If I were an investor approached to participate in this funding round and told 'this round is led by Brevan Howard,' but was not informed that Brevan Howard had a full refund right as part of the deal, I would likely feel misled in making my investment."

Specifically, this refund right may also face the risk of violating the Most Favored Nation (MFN) clause, which grants early venture investors the right to receive the same favorable terms as subsequent investors. According to multiple informed sources, at least one other Berachain investor, besides Nova Digital, has an MFN clause applicable to the Series B financing.

Aaron Brogan, founder and managing attorney of Brogan Law, stated, "It depends on the specific wording of the MFN clause, but (Nova's refund right) is likely to trigger the standard version of that clause." Brogan also mentioned that the applicability of MFN rights may depend on whether the investor received tokens or equity.

According to a venture capital lawyer who wished to remain anonymous, the triggering of the MFN clause may also depend on other factors, such as whether Brevan Howard Digital's fund agreed to provide services beyond the investment, which could justify its acquisition of additional rights. (This could provide a reasonable explanation for the "business agreements" mentioned in Smokey's statement.) However, the lawyer noted that without such arrangements, or if the investment amounts do not differ significantly, refund rights in SAFT token sales are generally applicable.

Neglected Investors

Regardless of the legality of this refund right clause, the plummeting token price since the TGE has been a blow to all venture capital firms investing in Berachain, especially to Framework Ventures, which co-led the Series B financing round alongside the Nova fund.

Unchained learned that as of the end of the second quarter of 2025, Framework held 21,145,476 BERA tokens, with a total acquisition cost of approximately $72.4 million. The average purchase price of these tokens was $3.42, meaning that at current prices, Framework's unrealized loss on this batch of BERA would exceed $50.8 million. Framework Ventures did not respond to multiple requests for comment.

Assuming other investors invested in Berachain's $100 million Series B financing at the reported $1.5 billion valuation, they would also incur losses. As of the time of publication, the fully diluted valuation (FDV) of BERA was approximately $526.7 million.

Underperforming BERA

If BERA had performed well after its launch, this refund right might have become irrelevant, as retaining BERA would then align with Nova Digital's interests. Unfortunately for Berachain, that has not been the case so far.

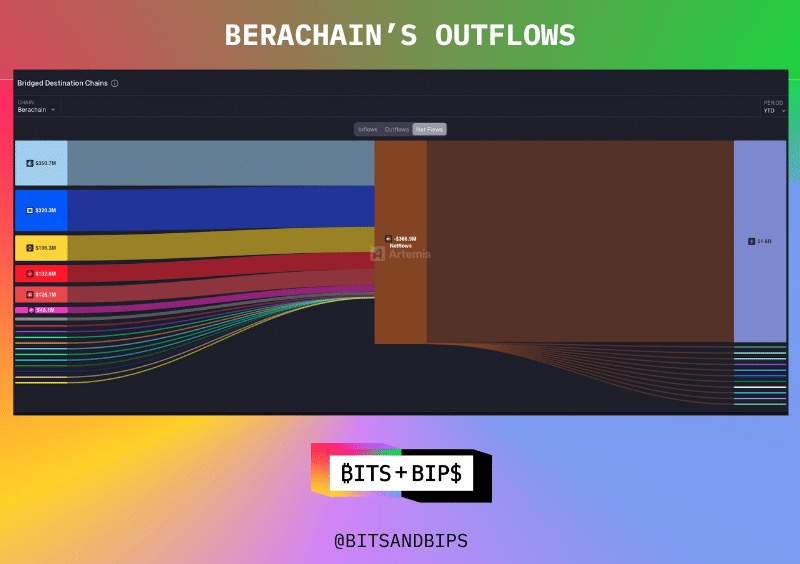

Currently, BERA's trading price is close to its historical low of $1.02, only one-third of the $3 price at which Nova Digital invested. According to data from Artemis, as of last Friday, Berachain has experienced approximately $367 million in net outflows in 2025.

According to two informed sources, Berachain's technical co-founder, Dev Bear, is no longer involved in the project. However, Dev Bear did not respond to requests for comment.

Additionally, on November 3, due to a code vulnerability in the DeFi protocol Balancer that put some funds in Berachain's native decentralized exchange BEX at risk, Berachain's validators paused network operations. Berachain resumed operations a day later, successfully recovering $12.8 million in threatened funds from a white-hat hacker here.

Ioachim Viju, co-founder of BlockHunters (who previously made a documentary titled "Straight Outta Berachain"), told Unchained that in recent months, some applications launched on Berachain have shut down or migrated to more popular blockchains, such as Hyperliquid. He cited IVX and Memeswap as examples.

Viju stated, "The Berachain community is now very, very small." He added that once-active Berachain-related X Spaces now struggle to attract more than a few dozen people. "I want to make it clear that Berachain, especially Smokey, has had a huge impact on my personal growth and career development. Without Berachain, there would be no me today," Viju said. "Of course, they made mistakes; even Smokey admits they probably shouldn't have sold so many tokens to venture capital firms. But in the end, he is still here, serving the community and working hard to bring real businesses to Berachain."

The Road to Redemption?

As user metrics stagnate and with only a few months left until Nova Digital's deadline to exercise the refund right in February 2026, Berachain is attempting to turn public opinion around.

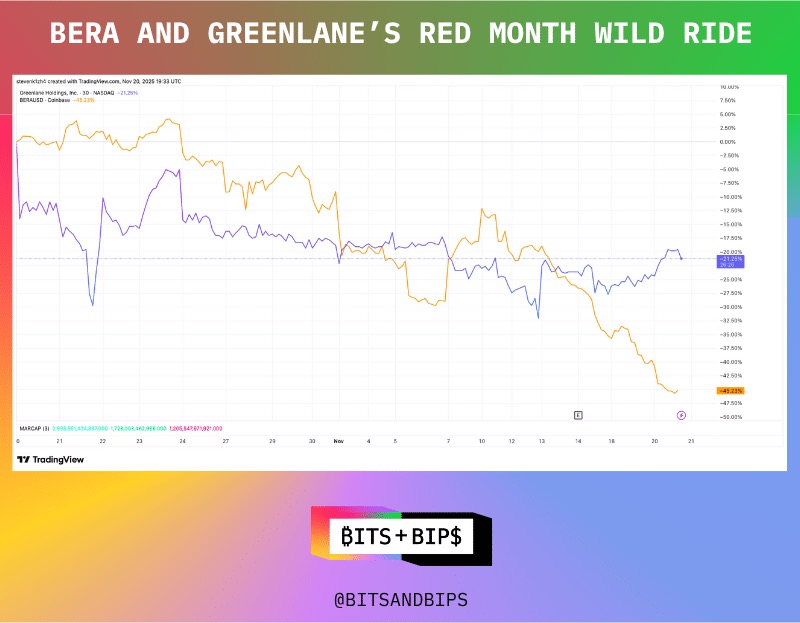

On October 20, Greenlane Holdings, a company specializing in tobacco accessories, vaping devices, and lifestyle products, announced the completion of a $110 million private placement to implement the BERA treasury strategy. According to the press release, the investors in this DAT financing include Polychain, Blockchain.com, Kraken, North Rock Digital, CitizenX, and dao5.

Additionally, one of Berachain's venture capital supporters, Polychain, announced in a filing to the SEC its intention to add two members to the company's six-member board at the end of the transaction, along with two additional members pending shareholder approval. According to promotional materials attached to the SEC filing here, Berachain's co-founder Papa Bear will serve as an advisor to the company.

SmokeyTheBera recently wrote on X that the founders of Berachain possess "a strong sense of responsibility and pride," and therefore will not "quietly exit" after the TGE. He added, "The road to Bera's redemption is loading."

Following the brief boost from the BERA DAT news, Greenlane's stock price rose above $4.50, but by Friday afternoon, it had fallen back to around $3.19, with the BERA token price also declining during the same period.

During a stage interview at this year's Token2049 conference, Smokey the Bera was asked how applications and founders can succeed in the crypto industry. His advice? Don't chase narratives; create your own narrative.

"So what is a narrative?" Smokey continued, "To be honest, I think it's basically nonsense. It's just a group of people saying the same thing over and over again."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。