Original Title: Crypto Exodus: Why Capital Is Leaving Bitcoin

Original Author: @PillageCapital

Translation: Peggy, BlockBeats

Editor's Note: If the first decade of Bitcoin addressed the "right to exist," the next decade will address the "ownership of value."

In the early days of the crypto world, Bitcoin represented rebellion and freedom, a comprehensive assault on a rigid financial system. However, as the rebels won the battle, a new era quietly arrived: regulation began to embrace innovation, capital migrated to more efficient tracks, the expansion of stablecoins and the tokenization of real assets rapidly grew, and the mythos of Bitcoin faded.

This article incisively points out the new turning point in the crypto industry, from Bitcoin's historical mission and the disintegration of its network effects to the rise of stablecoins, regulation, and the tokenization of real assets.

The following is the original text:

Bitcoin was never the future of currency. It is a battering ram in the regulatory war. Now that this war is nearing its end, the capital that once propelled it is quietly withdrawing.

For the past 17 years, we have convinced ourselves that "magical internet money" is the ultimate form of finance. This is not the case. Bitcoin is a regulatory siege engine, a single-function assault weapon created to destroy a specific high wall—the wall of the state's absolute intolerance towards "digital bearer assets."

This mission is now essentially complete.

The tokenization of U.S. stocks has begun; gold tokenization is also legal and growing; the market capitalization of dollar tokenization (stablecoins) has reached hundreds of billions of dollars.

In wartime, a battering ram is invaluable; in peacetime, it is just a heavy and expensive antique.

As financial infrastructure is upgraded and legitimized, the narrative of "Gold 2.0" is collapsing, reverting to what we truly wanted in the 1990s: a tokenized certificate of real assets.

I. Prehistoric Era: E-gold

To understand why Bitcoin is becoming outdated, one must first understand why it was created. It was not "born flawless," but rather a product of a series of digital currency experiments that were similarly destroyed.

In 1996, E-gold went online. By the mid-2000s, it had about 5 million accounts and processed billions of dollars.

It proved one thing: the world indeed needs digital bearer assets backed by real value.

Then, the state intervened and destroyed it. In December 2005, the FBI raided E-gold. In July 2008, the founder pleaded guilty.

The message could not be clearer: a centralized digital gold currency is too easy to destroy—knock on a door, shut down a server, prosecute a person, and it’s all over.

Three months later, in October 2008, Satoshi Nakamoto published the Bitcoin white paper.

Before this, he had been contemplating these issues for years. In his writings, he stated that the fundamental flaw of traditional currencies and early digital currencies was their excessive reliance on trust in central banks and commercial banks. Experiments like E-gold also demonstrated how easy it was to attack these "trust nodes."

Satoshi had just witnessed a genuine digital currency innovation being decapitated.

If you want digital bearer assets to survive, you cannot allow them to be destroyed simply by "knocking on a door."

Bitcoin was engineered for this purpose—it was designed to eliminate the attack vectors that destroyed E-gold.

It was not created for efficiency, but for "survival."

II. War: A Necessary Illusion

In the early days, bringing a newcomer into the Bitcoin world was almost like magic. We would have them download a wallet on their phone. When the first coins arrived, you could see the moment on their faces—they had just opened a financial account and instantly received value, without permission, without forms, without regulation.

That was a slap in the face. The traditional banking system seemed so outdated at that moment, and you suddenly realized that you had been under an invisible oppression without ever noticing.

At the Money 20/20 conference in Las Vegas, a speaker projected a QR code onto a giant screen, and a Bitcoin lottery began. The audience started sending coins into it, and the grand prize was generated on the spot. A traditional finance professional next to me leaned over and said this guy was probably violating fifteen laws at once. He might have been right. But no one cared—that was the point.

This was not just finance; it was rebellion. A post on Reddit's Bitcoin board once went viral, perfectly expressing the sentiment of the time: buy Bitcoin because "this is a big 'F you' to those scammers and robbers who suck my blood by being in the middle."

This "self-starting" mechanism was almost perfect. As long as you fought for this cause, posting, promoting, debating, and bringing newcomers in, you were directly increasing the value of the coins in your wallet and your friends' wallets. Rebellion would reward you.

Because this network could not be shut down, it continued to expand after every crackdown and every negative report. Over time, everyone began to see this "magical internet money" as a true destination rather than a stopgap.

This collective illusion was so powerful that the system itself began to join the game. BlackRock started applying for ETFs; the U.S. president discussed whether Bitcoin should be considered a reserve asset; pension funds and university endowments bought related exposure; Michael Saylor convinced convertible bond investors and shareholders to fund billions of dollars in corporate Bitcoin purchases; Bitcoin mining expanded, with overall electricity consumption approaching that of medium-sized countries.

Ultimately, when more than half of the campaign funds came from the crypto industry, the demand for "legitimized infrastructure" was finally heard. Ironically, it was all quite simple: the government's strong crackdown on banks and payment institutions created a $3 trillion battering ram, forcing them to choose to concede.

III. Defeat: When Victory Ends Transactions

Channel upgrades, monopolies broken

Bitcoin's advantage was never just its censorship resistance. Its real advantage was its monopoly position.

For many years, if you wanted a "holdable, transferable tokenized value," Bitcoin was the only choice. Bank accounts were shut down, and fintech companies were too scared to act due to regulation. If you wanted to enjoy the benefits of "instant, programmable money," you had to accept the entire Bitcoin solution.

So we accepted it. We supported it, embraced it, because we had no other choice.

But that era is over.

As long as there is more than one available "value channel" (rail), things will immediately change—just look at Tether's migration trajectory. USDT was initially issued on the Bitcoin chain; later, Ethereum became cheaper and more user-friendly, and most of the circulation moved to Ethereum. When Ethereum's gas fees spiraled out of control, retail and emerging markets pushed demand towards Tron. The dollars are still the same dollars, the issuer is still the same, just a different "pipeline."

Stablecoins have no loyalty to any chain. They treat blockchains as interchangeable pipes. What truly matters are the assets and the issuers; the chain itself is merely a combination of fee structures, stability, and connectivity to the entire system. In this sense, those who once shouted "blockchain, not Bitcoin" ultimately won.

In the early days, images of horse-drawn carriages were widely circulated to mock banks' reports on blockchain technology.

Understanding this, your view of Bitcoin's position changes completely. When there is only one available "rail," all value is forced to flow on that rail, making it easy to confuse "the value of the asset itself" with "the value of the pipeline." But when the available rails become multiple, value will naturally flow to the one that is cheaper and better connected.

We are now in such an era.

Today, most people outside the U.S. can hold tokenized claims to U.S. stocks. What was once the "killer app" of the crypto industry, perpetual contracts, is now being directly replicated by local institutions like CME. Banks are starting to support the deposit and withdrawal of USDT. Coinbase is gradually becoming an account that combines banking and brokerage: you can wire money, write checks, and buy U.S. stocks and crypto assets. The network effects that once protected Bitcoin's monopoly position are dissipating into an indiscriminate underlying pipeline.

Once the monopoly no longer exists, Bitcoin is no longer the only way to access these financial effects. It becomes one of many products, competing with those that are closer to users, more compliant, and of higher quality.

Technical Reality Check

In the "war" years, we overlooked a simple fact: Bitcoin is a terrible payment system.

We still need to scan QR codes and copy and paste a string of incomprehensible characters to transfer funds. There are no unified usernames. Cross-chain and cross-layer transfers feel like a level in a video game. If you mix up the address, you can permanently lose your money.

The money of the future world

By 2017, the cost of transferring a Bitcoin had soared to nearly $100. A Bitcoin café in Prague had to accept Litecoin to continue operating. I once had a meal in Las Vegas where everyone struggled for thirty minutes to pay with Bitcoin; mobile wallets froze, transactions got stuck, and it was chaotic.

Even today, various wallets still fail on basic functionalities: balances don’t display, transactions hang, addresses are filled incorrectly, and funds disappear into thin air. Almost everyone who was "sent coins" in the early days has lost coins. I personally lost over a thousand Bitcoins—this is very normal in the crypto world.

Pure on-chain finance is terrifying when used at scale. People click "sign" in their browsers, facing a string of incomprehensible gibberish, with no idea what they are authorizing. Even mature institutions like Bybit can be easily hacked for a billion dollars, with no effective recourse.

We tell ourselves these user experience issues are just "growing pains."

Ten years later, the reality proves that what truly improves user experience is not some elegant protocol, but centralized custodial institutions. They provide people with passwords, recovery features, and fiat entry points.

The technical conclusion is very ironic: Bitcoin never learned how to achieve usability without rebuilding the intermediary structures it claimed to want to overthrow.

Transactions are no longer worth the risk

As other rails upgrade, Bitcoin's remaining advantage is only "the tradability of the asset"—and this part can no longer hold up.

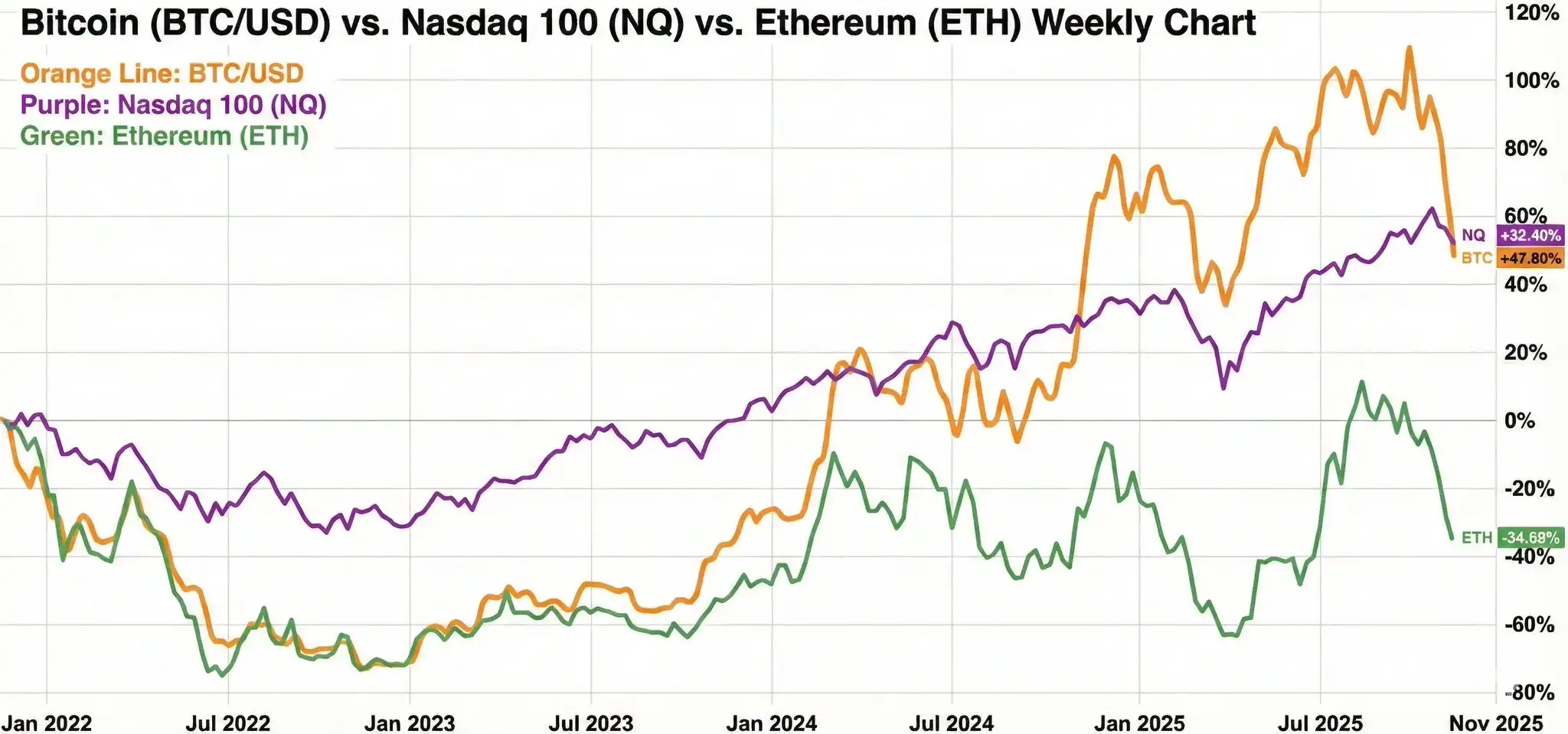

Look at the returns over a complete four-year cycle. The performance of the Nasdaq has already outperformed Bitcoin.

You have taken on existential regulatory risks, endured brutal drawdowns, experienced countless hacks and exchange collapses, and yet the returns are not as good as a regular tech index. The risk premium has disappeared.

Ethereum performs even worse.

In theory, as a "high-risk, high-reward layer," it should provide you with higher returns; but in reality, it feels more like a continuous tax, while the boring index line steadily rises.

Part of the reason is structural.

A large number of early holders have all their net worth in crypto; they are now older, have families, and real expenses, naturally wanting to reduce risk. To maintain a "normal life for the wealthy," they sell coins every month. With tens of thousands of coin holders, this results in a monthly "living sell pressure" of billions of dollars.

The new sources of capital are completely different. ETF buyers and wealth management clients mostly allocate just 1%–2% as a "compliance process." This money is stable but not aggressive. These mild inflows must simultaneously hedge against the ongoing sell-off by early OGs, exchange fees, miner issuance, and the endless scams and security incidents, just to barely prevent prices from falling.

The era of "gaining huge Alpha by bearing the regulatory gunpoint" is over.

Builders Smell Stagnation

Builders are not foolish. They are very sensitive and can smell when technology begins to lose its edge.

Developer activity has dropped back to 2017 levels.

Weekly developer submissions across ecosystems

Meanwhile, the codebase has effectively "frozen." Distributed systems are inherently difficult to change. Those ambitious engineers who once viewed crypto as the cutting edge of technology have gradually turned to more exciting fields like robotics, aerospace, and AI—rather than continuing to move numbers here.

When "trading is no longer profitable, user experience is worse, and talent is leaving," the future direction is actually very clear.

IV. Error Correction Ability is More Important than "Pure Decentralization"

The "decentralization worship" tells a simple story: code is law; money is untraceable; no one can stop or reverse a transaction.

But most people actually do not want this kind of world. They want a functioning track and someone to fix it when things go wrong.

This is most evident in Tether's handling of issues. For example:

When funds are stolen by North Korean hackers, Tether will freeze those balances.

When someone mistakenly transfers a large amount of USDT into a contract or burn address, as long as they can still sign from the original wallet, go through KYC, and pay fees, Tether will blacklist those stuck tokens and issue newly minted tokens to the correct address.

The process is cumbersome, involves paperwork, and requires waiting, but it is an operable repair mechanism. It is a "human layer" that can acknowledge "mistakes" and fix them.

This is certainly counterparty risk, but it is precisely the counterparty risk that people are willing to bear: if you lose money due to a technical accident or a hack, at least there is a chance of recovery.

In the on-chain Bitcoin world, this possibility is zero.

If you paste the wrong address or sign the wrong transaction, that is a permanent loss. There are no appeals, no customer service, no second chances.

Our entire legal system is built on the completely opposite intuition: courts can be appealed; judges can revoke rulings; governors and presidents can grant pardons.

The existence of bankruptcy systems is to prevent "one mistake from ruining a lifetime."

We want to live in a world where obvious mistakes can be corrected.

No one really wants a system where bugs like the Parity multi-signature vulnerability can permanently freeze $150 million in DOT treasury, and everyone can only shrug and say, "code is law."

Today, our trust in issuers is much higher than in earlier years.

In the past, "regulation" meant that crypto companies could lose their bank accounts at any time because banks feared being sanctioned by regulators.

In recent years, we have even watched entire "crypto-friendly" banks get taken down in a weekend.

At that time, the state felt more like an executioner than a referee.

Today, the same regulatory mechanisms have become a safety net: they require disclosure; they box issuers into auditable structures; they empower politicians and courts to deal with public theft.

As "cryptocurrency" and "political power" become deeply intertwined, regulators can no longer easily destroy the entire industry; they must choose to "tame" it.

In such a world, bearing the risks of issuers and regulators is much more rational than bearing the risk of "losing everything with a single lost mnemonic."

No one truly wants a completely unregulated financial system.

Ten years ago, a broken regulatory system made "unregulated chaos" seem like a better alternative.

But as regulatory tracks continue to upgrade and add functions, this comparison has flipped.

The real preference is clear: people want powerful tracks, but they also want referees on the field.

V. From "Magical Internet Money" to "Tokenization of Real Assets"

Bitcoin has completed its mission.

It was that battering ram that broke down the wall that had caused E-gold and similar projects to fail. It made the political and social prohibition of tokenized assets impossible.

But victory brings a paradox: when the system finally decides to upgrade, the value of the battering ram itself will quickly collapse.

The crypto world still has roles to play. But we no longer need a $3 trillion "rebel army." Teams like Hyperliquid can quickly prototype new features with just 11 people, forcing regulators to respond.

Once a mechanism runs successfully in a "sandbox," traditional finance will replicate it within a regulatory framework.

The mainstream trading logic is no longer: to bet the bulk of your net worth on "magical internet money" for ten years and then pray for it to soar. That only made sense in an era when "the track was broken, and the upside potential was extremely large."

"Magical internet money" itself is a strange compromise: a perfect track, but it carries assets supported only by stories.

In the future, we will discuss what happens when the same track carries truly scarce things from the real world.

Capital is already adjusting.

Even the "unofficial central bank" of the crypto world is turning to Tether, where the balance sheet of gold has surpassed that of Bitcoin. The tokenization of gold and other real-world assets is rapidly growing.

The era of "magical internet money" is coming to an end. The era of "tokenization of real assets" is beginning.

Now that the door has been opened, we no longer need to continue worshiping that battering ram; we should turn our attention to the truly important assets and transactions that lie beyond this door.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。