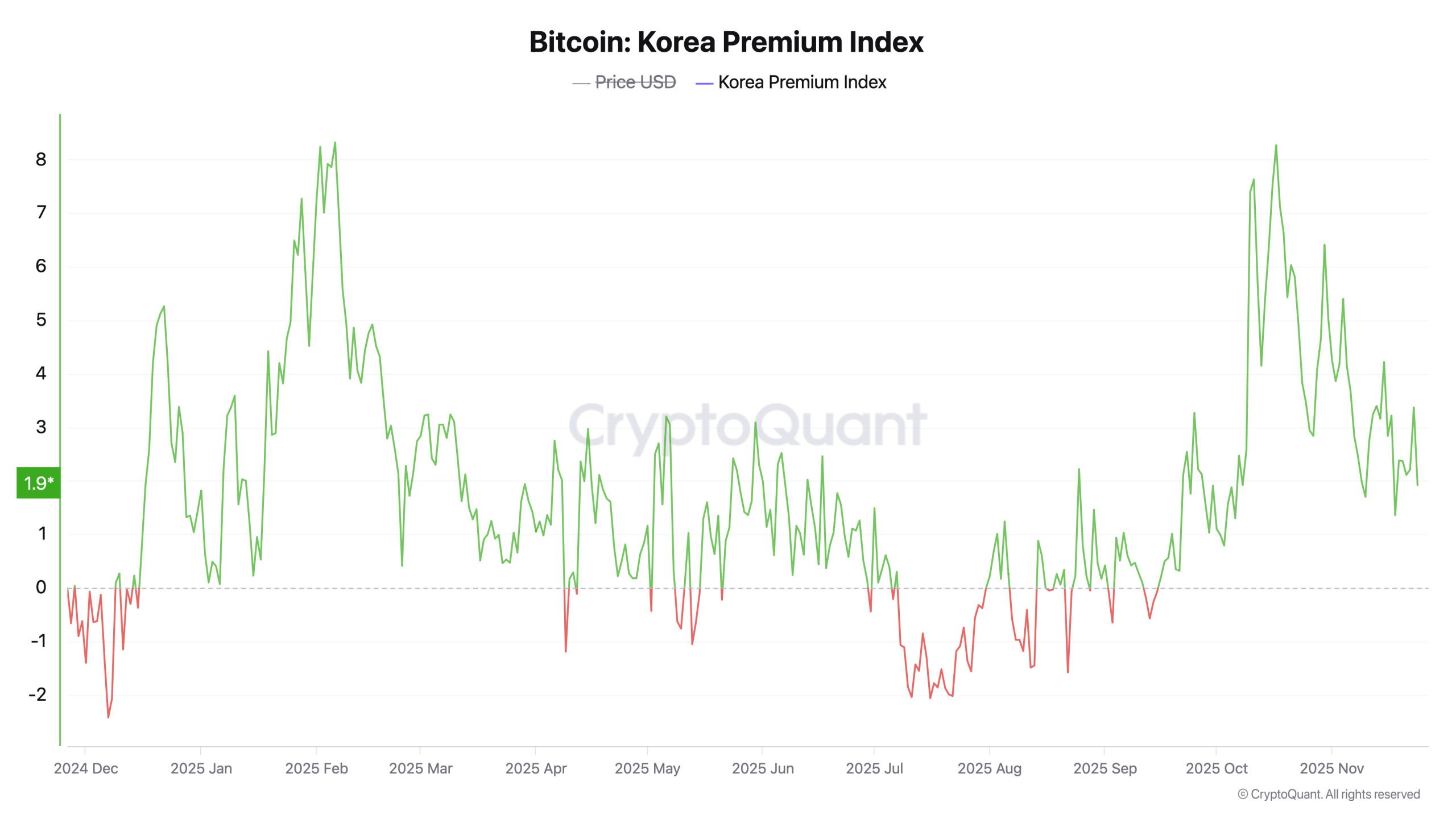

At 9:45 a.m. Eastern time on Nov. 25, bitcoin’s global weighted average sits at $86,900, yet traders in South Korea are paying noticeably more — $89,114 on Upbit and $89,199 on Bithumb.

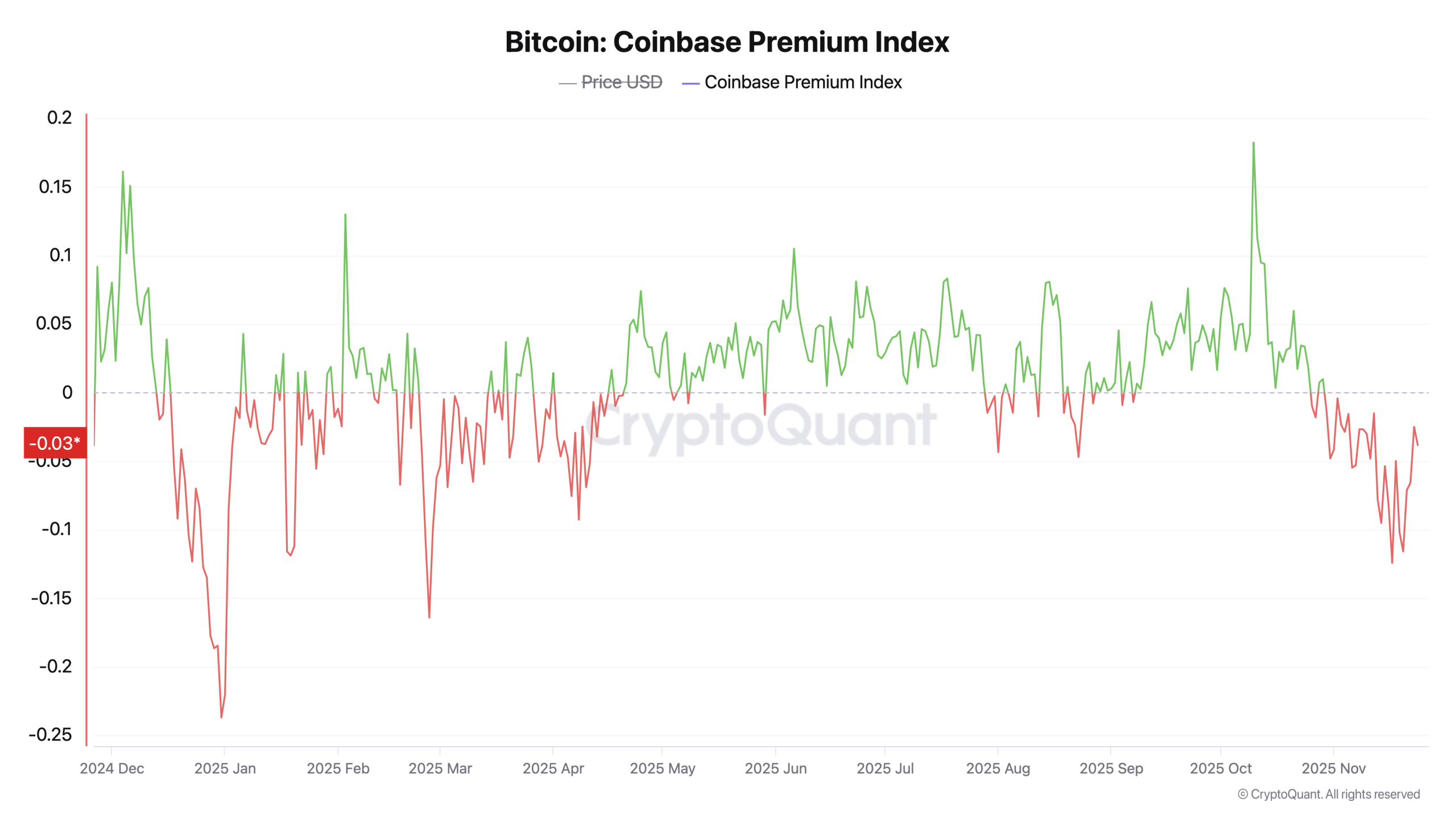

Metrics from Cryptoquant.com show that South Korea’s bitcoin premium has been holding its ground since Sept. 16, and this week the gap has floated between 4% and 1.3%. At the same time, Cryptoquant’s Coinbase Premium Index, which tracks the price gap between bitcoin on Coinbase (a U.S.-focused exchange popular with institutions) and Binance (a global proxy), is in decline.

Source: Cryptoquant’s South Korea Premium Index.

Today, on Nov. 25, the Coinbase Price Index stands at 0.0382% lower. This divergence—high South Korean retail enthusiasm paired with low U.S. institutional interest via Coinbase—points to a regional split in market sentiment. Sentiment has been split across the crypto crowd, with some staying bullish and others sliding into bearish territory.

Source: Cryptoquant’s Coinbase Premium Index.

The Crypto Fear and Greed Index (CFGI) has spent the past two weeks stuck in “extreme fear,” adding to the jittery mood. And although bitcoin is currently trading at $86,900, the top crypto dipped as low as roughly $80,500 per coin last week. The widening gap between South Korea’s premium and the Coinbase Price Index data highlights just how unsettled the community really is.

Read more: Metaplanet Expands Bitcoin-Backed Borrowing With New $130M Loan

Taken together, the contrast paints a clear picture: South Korean traders are still willing to pay a premium for bitcoin, which is a good sign. At the same time, U.S. institutional desks appear far less energized, which is a negative.

With Seoul’s premium holding steady and the Coinbase Price Index slipping into the red, bitcoin’s demand profile is looking more like a tale of two markets than a synchronized global push. Traders will ultimately have to let time do its work before the outcome becomes clear.

- What is the South Korean bitcoin premium? It’s the higher price traders in South Korea pay for bitcoin compared with the global average.

- Why is the Coinbase Premium Index important? It reflects U.S. institutional demand by comparing bitcoin prices on Coinbase and Binance.

- What does the data show right now? South Korea’s premium is holding steady while the Coinbase Price Index is dipping, revealing a regional sentiment divide.

- What’s the takeaway for traders? Market momentum is split, and only time will show which side proves right.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。