Written by: Glendon, Techub News

Today, Bitcoin has once again broken through the key resistance level of $93,000, reaching a high of $93,958.58. Looking back to December 1, the overall cryptocurrency market experienced a significant decline, with Bitcoin falling below $84,000. However, within less than two days, Bitcoin rebounded strongly, with an increase of nearly 12%. Meanwhile, the cryptocurrency fear and greed index has also shown a significant easing, rising to 28 today, indicating a shift in market sentiment from "extreme fear" back to "fear." Coupled with several positive data points, does this mean that the cryptocurrency market has successfully curbed the downward trend and completed its bottom reconstruction? What bullish and bearish factors still exist in the industry?

Initial Signs of Stabilization in the Cryptocurrency Market

Based on multiple analyses and data, although it cannot be definitively stated that the cryptocurrency market has completely exited the "bear market," it is clear that the market is entering a phase of stabilization and waiting for recovery.

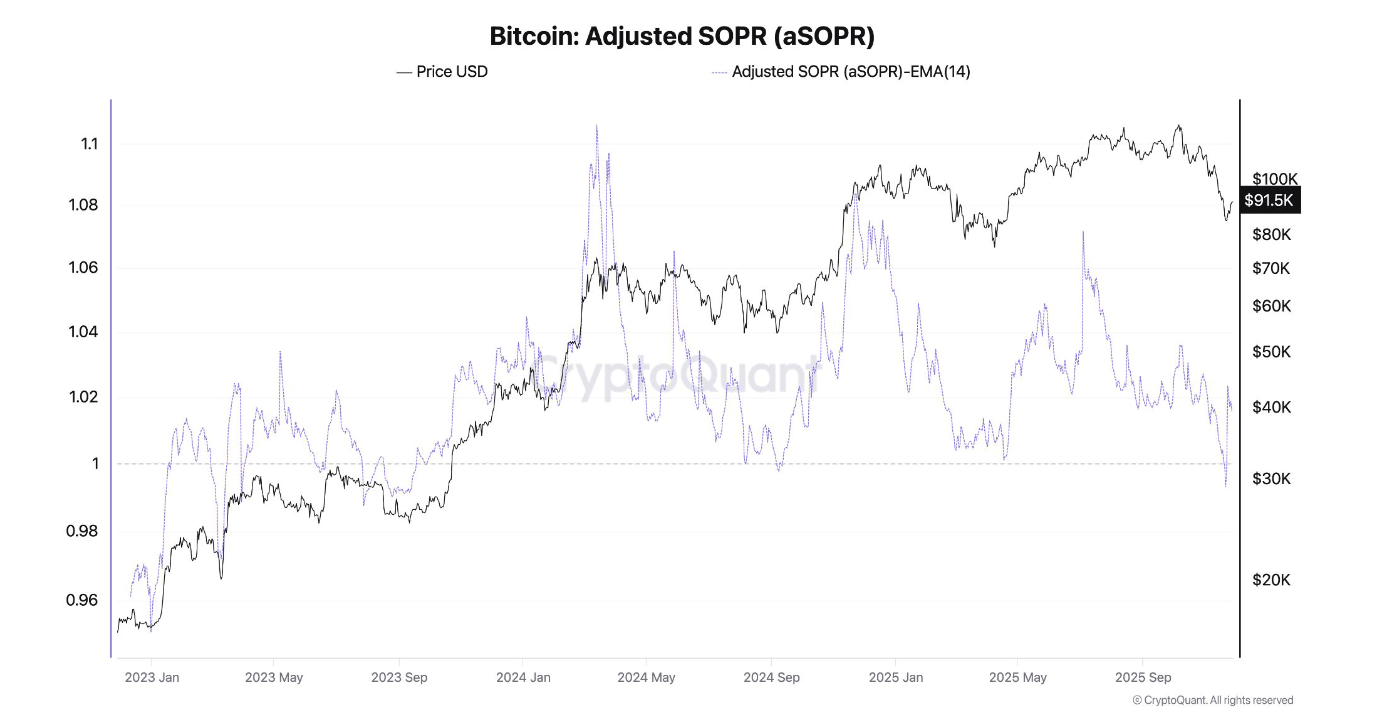

Bitfinex Alpha pointed out in its latest report that, from a temporal perspective, the cryptocurrency market has approached a local bottom. Given the extreme deleveraging, panic selling by short-term holders, and signs of diminishing selling pressure, the market has the conditions to enter a stabilization phase. Additionally, on-chain data indicators corroborate this assessment, as the "Adjusted Spent Output Profit Ratio" has fallen below 1 for the third time since the beginning of 2024, aligning with the loss realization dynamics observed at previous cycle lows in August 2024 and April 2025.

Furthermore, the "realized losses after adjustment" indicator has surged to $403.4 million per day, exceeding the loss scale measured during previous significant lows. Typically, a substantial increase in this indicator suggests that panic selling is nearing its end, making it unlikely for the market to enter a new round of deeper declines.

In the derivatives sector, the total open interest (OI) of Bitcoin futures has dropped to $59.17 billion, a significant decrease compared to the peak of $94.12 billion, indicating that leveraged funds have been orderly cleared. Bitfinex Alpha believes that while open interest continues to contract, spot prices are showing an upward trend, suggesting that what is truly happening in the market is short covering rather than a new round of speculative risk behavior. This phenomenon further proves that the market is transitioning towards a more stable consolidation phase, reducing market vulnerability and potentially laying the groundwork for sustained recovery in the fourth quarter.

Additionally, Bitcoin is exhibiting a noteworthy phenomenon: its price has fallen approximately 31% from the historical high of $126,000, marking the first time in two years that it has dropped below its network value. According to Metcalfe's Law, Bitcoin's price is positively correlated with the growth of active addresses and transaction volume (i.e., network value), meaning that the more wallets and transactions there are, the higher its fair price. This divergence between price and network value indicates that Bitcoin is undervalued relative to its expanding network value, a situation that typically arises after excessive market speculation.

Economist Timothy Peterson believes that while this does not mean Bitcoin's price has bottomed out, it at least indicates that most leverage has been cleared, and the "bubble" has burst. Historically, this is often a signal that Bitcoin is about to recover.

The recent market rebound has been driven by multiple factors, among which the rising expectations of a Federal Reserve interest rate cut are undoubtedly significant. John C. Williams, a member of the Federal Open Market Committee (FOMC), recently stated that monetary policy remains tight; meanwhile, the global research division of Bank of America directly predicts that the Federal Reserve will cut rates by 25 basis points this month, a shift from its previous prediction of no rate cut, which has further boosted market expectations for a rate cut this month. As of the time of writing, data from CME's "FedWatch" indicates that the probability of a 25 basis point rate cut in December has gradually risen to 89.1%; the probability of a December rate cut on Polymarket has increased by 5% to 93%, with the total trading volume in this prediction market rising to approximately $224 million.

In addition to macroeconomic influences, progress in U.S. cryptocurrency legislation is also ongoing. On December 2, Travis Hill, acting chairman of the Federal Deposit Insurance Corporation (FDIC), revealed during a congressional hearing that the FDIC will publish its first draft of the GENIUS Act, which outlines the federal regulatory application process for stablecoin issuance, within this month, and plans to propose subsequent regulatory requirements for capital and liquidity early next year. Furthermore, the FDIC is also developing regulatory guidelines for tokenized deposits. Paul S. Atkins, chairman of the U.S. Securities and Exchange Commission (SEC), has clearly stated that the "innovation exemption" for cryptocurrency companies under review will officially take effect in January next year.

Under the dual influence of favorable policies and market expectations, institutional investors on Wall Street are also continuing to ramp up their efforts. According to data from CoinShares' latest weekly report, the total inflow of funds into digital asset investment products reached $1.06 billion last week, ending a brutal four-week streak of outflows (which totaled $5.47 billion). Among them, net inflows for Bitcoin, Ethereum, and XRP investment products reached $461 million, $308 million, and $289 million, respectively, with XRP setting a record for its largest single-week inflow ever.

At the same time, the mainstream cryptocurrency ETF market achieved net inflows over the past week. According to SoSoValue data, the U.S. Bitcoin spot ETF saw a net inflow of $70.05 million last week, ending four consecutive weeks of net outflows; the U.S. Ethereum spot ETF had a net inflow of $313 million, ending three consecutive weeks of net outflows; the U.S. Solana spot ETF recorded a net inflow of $108 million, continuing five weeks of net inflows; and the U.S. XRP spot ETF had a net inflow of $157 million, also maintaining four consecutive weeks of net inflows.

Recently, a key positive development reinforcing institutional investment momentum is Texas's launch of a Bitcoin reserve program, which has completed its first allocation of funds, purchasing approximately $5 million worth of BlackRock's Bitcoin spot ETF (IBIT) last week. Although the scale of this allocation is not large, this move carries significant symbolic meaning, marking the beginning of a new phase where Texas will hold Bitcoin once the infrastructure is ready.

The head of business development at BlackRock has also revealed that Bitcoin ETFs have become the company's most profitable product line, with asset allocations nearing $100 billion. The spot Bitcoin ETF IBIT has reached an asset scale of $70 billion within 341 days since its launch in January 2024, currently holding over 3% of the circulating Bitcoin supply.

Interestingly, during the recent market downturn, the performance of cryptocurrency companies has differed from past cycles, showing a "still strong" development trend as they actively adjust their business models and explore new revenue sources. For example, Kraken plans to acquire the tokenized asset platform Backed Finance, focusing on long-term investment; Binance has launched a digital financial education platform for teenagers called "Binance Junior," and its self-custody cryptocurrency wallet Trust Wallet has introduced a prediction market; Circle has established a foundation funded by its "1% Commitment" equity donation program; and Coinbase is continuously expanding its product line, token issuance activities, and emerging consumer applications.

Analysts at Bernstein, a research and brokerage firm, point out that the operational performance of the entire cryptocurrency industry stands in stark contrast to market prices, with ongoing business model reforms and favorable regulatory factors serving as strong evidence of the industry's resilience.

This indicates that the industry is entering a new phase, with companies beginning to execute strategies that were previously constrained by regulatory uncertainty, and their business scope is no longer limited to cyclical trading income.

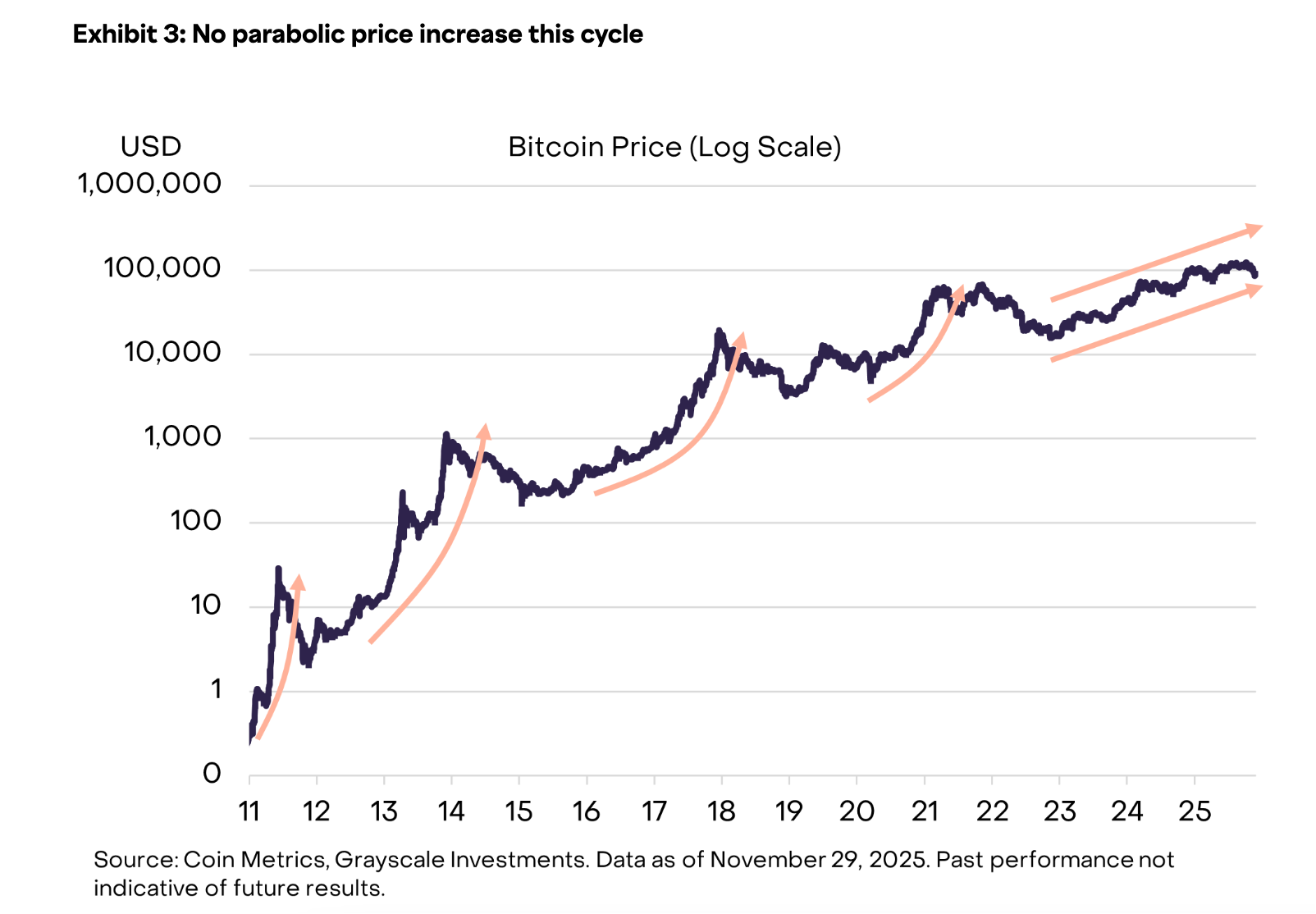

The actions of Wall Street institutions and cryptocurrency companies may stem from an optimistic outlook on the long-term prospects of the cryptocurrency market. Grayscale has explicitly stated that Bitcoin is unlikely to fall into a deep cyclical downturn, with its price expected to reach new highs next year. Grayscale analysts note that unlike previous bull markets, this cycle has not seen the parabolic rises typical before significant reversals; moreover, the current market structure is markedly different from the past, with institutional funds primarily concentrated in exchange-traded products (ETPs) and digital asset reserves (DAT), rather than retail trading activities on spot exchanges.

Based on these various factors, the industry generally expects the cryptocurrency market to welcome a new round of upward momentum early next year. However, for now, there are still some uncertainties in the cryptocurrency market in the short term.

Short-term Bearish Factors Intertwined, Market May Continue to Fluctuate

On-chain data shows that for several weeks, the pace of accumulation by long-term holders and large wallet groups has significantly slowed, especially during the period when Bitcoin fell below $84,000 on December 1. In stark contrast, small wallet groups accelerated their buying during the price decline. Timothy Misir, research director at BRN, analyzes that the market structure is in a delicate phase, and this divergence has already become apparent. Whales are slowing their buying pace, while retail wallets continue to accumulate, which is a typical late-cycle pattern that will exacerbate short-term market vulnerability. The recent sell-off is a classic liquidity and position adjustment event; the market has not signaled a trend change but rather released pressure signals. He emphasizes that exchange balances and stablecoin inflows indicate that the market has both purchasing power and potential selling liquidity.

Moreover, the uncertainty surrounding Federal Reserve policy remains a sword hanging over the cryptocurrency market. Although the market expects the Federal Reserve may initiate a rate cut this month, the positive impact of the rate cut expectations has already been partially absorbed by the cryptocurrency market, as evidenced by the recent market rebound. Even if the Federal Reserve does cut rates, it typically takes months for liquidity to transmit to the cryptocurrency market, making it difficult to rapidly drive up Bitcoin prices in the short term. Furthermore, a Federal Reserve rate cut is not a certainty; if this expectation falls through, the impact on the market could be even more severe.

Recently, the decline in the cryptocurrency market is widely believed to be closely related to a series of bearish events in Asia. Among them, signals of tightening monetary policy in Japan have heightened market anxiety, with the yield on 2-year Japanese government bonds surpassing 1% for the first time since 2008. Coupled with rising expectations of interest rate hikes by the Bank of Japan, investors are beginning to reassess the consistency of major central banks' easing rhythms globally. In this context, even if the Federal Reserve cuts rates, it will be difficult to offset the negative impacts brought about by tightening expectations in other economies.

Additionally, the funding situation is not optimistic. Although there has been a certain amount of inflow into cryptocurrency investment products and related ETFs since last week, the overall funding situation remains weak compared to several months ago, which cannot support the view that institutional funds are flowing back in large amounts.

Worse still, at this stage, most altcoins are deeply trapped in a liquidity drought. Ki Young Ju, founder and CEO of CryptoQuant, pointed out on Twitter that projects able to access new liquidity channels such as DAT (Digital Asset Reserve) and ETFs have a greater chance of long-term survival. Conversely, if an altcoin does not participate in this liquidity competition, its long-term risks are likely to be high.

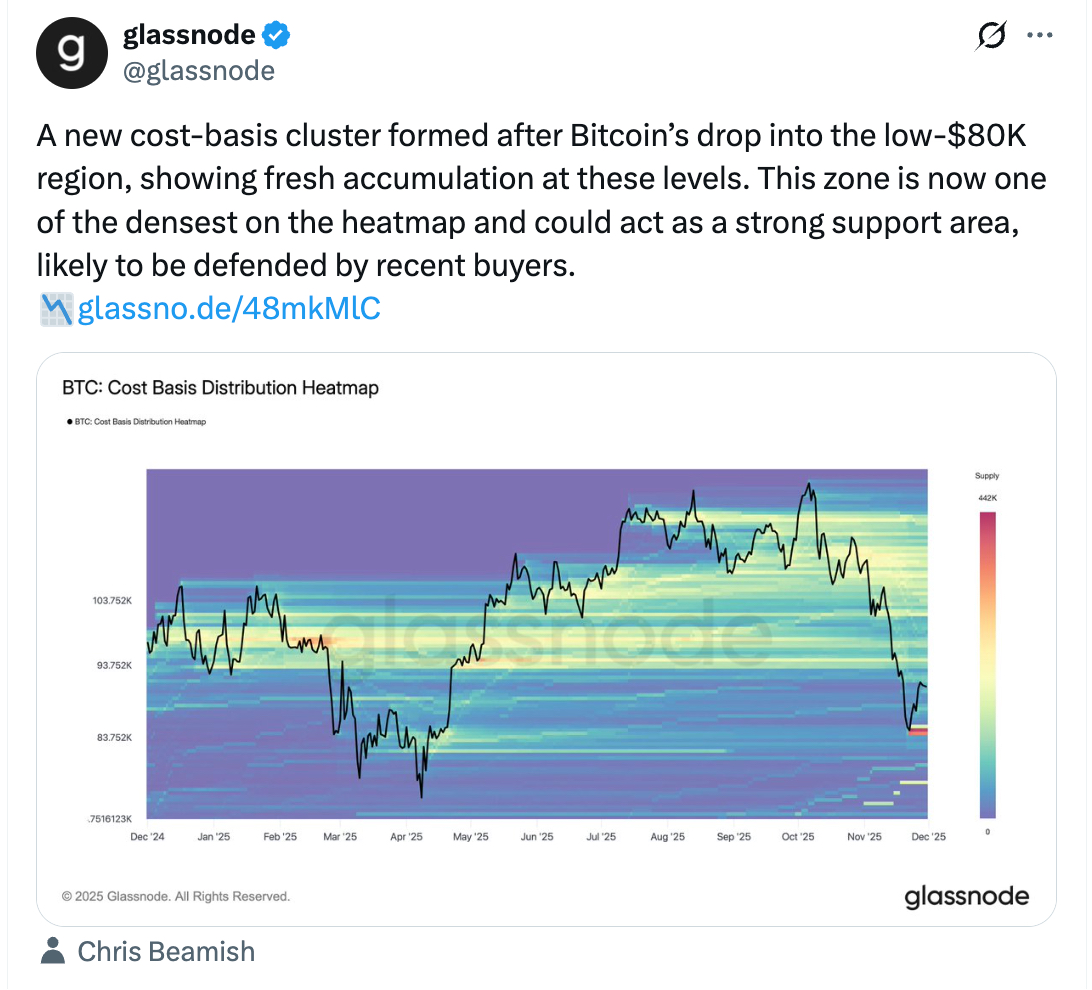

So, do the aforementioned bearish factors mean that the cryptocurrency market will continue to decline or even crash further? Not necessarily. Currently, Bitcoin is building strong support in the area just above $80,000. Glassnode indicates that a new cost basis accumulation zone has formed above the $80,000 area for Bitcoin, suggesting that new capital accumulation has occurred at these price levels. This area has now become one of the most densely packed segments on the heatmap, and recent buyers are likely to "hold the line" here.

It is worth mentioning that Ethereum is also approaching a critical upgrade milestone. The Ethereum Foundation plans to activate the Fusaka upgrade on December 4 to achieve scalability. Not long ago, the block gas limit for Ethereum was significantly raised from 45 million to 60 million, enhancing the network's transaction capacity. The Ethereum mainnet set a historical record for throughput in November, with its peak TPS (transactions per second) breaking new highs, reaching 32,950 transactions. This series of developments in Ethereum may also provide a certain boost to the overall cryptocurrency market.

In summary, the current cryptocurrency market is generally in a phase of range-bound fluctuations driven by news. Bitcoin is unlikely to break through the key resistance level of $98,000 in the short term, but it is also unlikely to fall below the support level of $80,000. Based on current data and trend analysis, the cryptocurrency market is gradually entering a stabilization phase. Unless significant bearish events occur, Bitcoin may consolidate around $90,000 and is expected to slowly break upward. Thanks to the industry's highly optimistic attitude towards the long-term prospects of the cryptocurrency market, the likelihood of the market entering a true "bear market" cycle may have diminished significantly.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。