Written by: White55, Mars Finance

After experiencing two consecutive months of decline and market sentiment dropping to a freezing point, Bitcoin staged a dramatic comeback in the early hours of December 3. The price rebounded strongly by 9.5% from a low of $84,000, reclaiming the $92,000 mark, while Ethereum surged over 10% to break through $3,000.

Meanwhile, mid to small-cap tokens like Solana, Cardano, SUI, and LINK recorded double-digit gains.

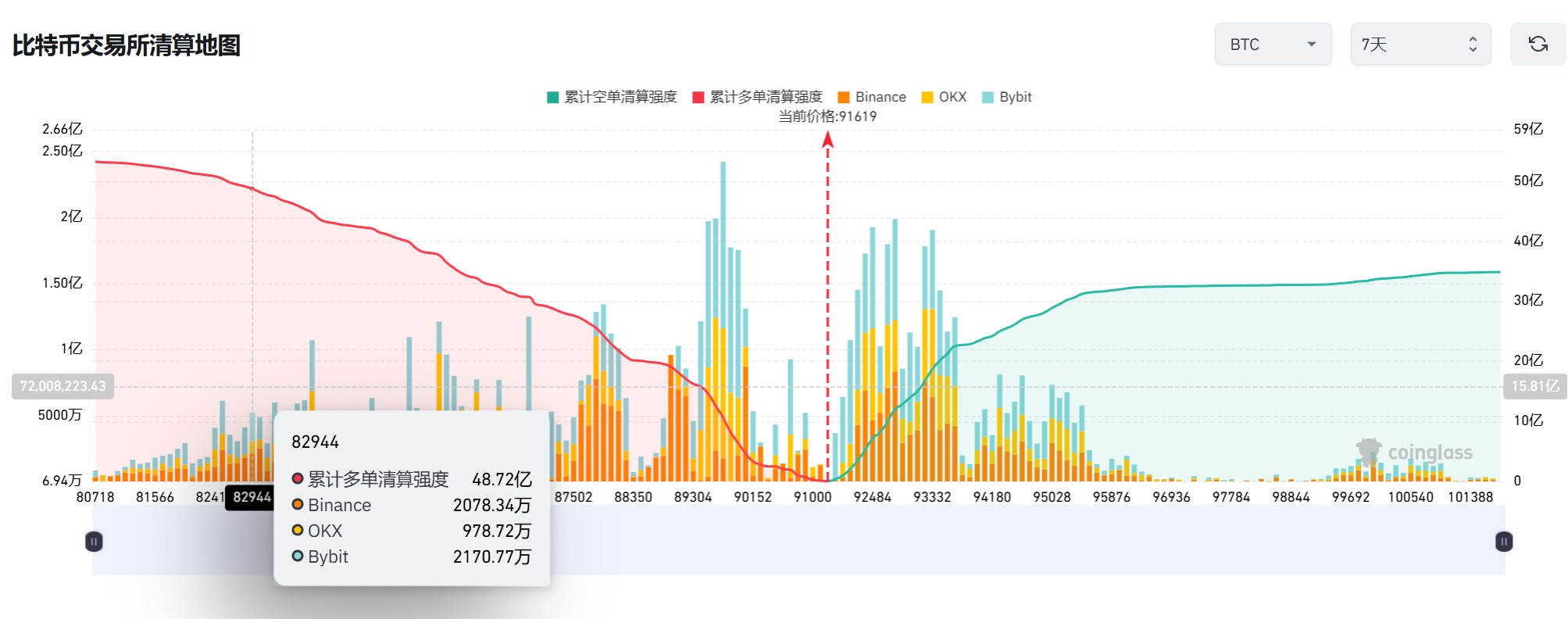

This reversal seems to have injected a strong dose of confidence into the market. In the past 24 hours, the total liquidation across the network still reached $400 million, primarily from short positions, with 110,000 traders being forcibly liquidated. The largest single liquidation occurred on Bybit, where a $13 million BTCUSD contract evaporated in an instant.

This rebound is not an isolated event but rather an inevitable result of multiple intertwined clues. From macro liquidity expectations, institutional fund movements, to on-chain data and policy signals, the market is searching for a new direction at a delicate balance point.

Three Catalysts Working in Sync: The Resonance of Liquidity, Technological Upgrades, and Policy Shifts

Surging Probability of Fed Rate Cuts Restructures Market Logic

According to the latest data from the CME FedWatch tool, the market's betting probability for a 25 basis point rate cut by the Federal Reserve on December 10 has soared from 35% a week ago to 89.2%.

The direct trigger for this dramatic shift was the November PPI data, which came in far below expectations, indicating a continued easing of inflationary pressures.

Although the Trump administration's tariff policies temporarily raised costs, Fed officials have repeatedly emphasized that a "soft landing" remains the core goal until 2026, avoiding a premature shift to tightening.

If the rate cut materializes, a weaker dollar and declining U.S. Treasury yields will directly benefit risk assets like Bitcoin. More importantly, this could open a window for consecutive rate cuts in the first quarter of 2026, prompting funds to position themselves early for "rate cut trades."

Ethereum Fusaka Upgrade: Technological Leap Activates Ecological Value

The Fusaka upgrade, set to activate on December 4, marks another milestone for Ethereum following the Merge.

Its core PeerDAS technology will increase the Blob capacity from 9 to 15, reducing Layer 2 transaction fees by an additional 30%-50%, and for the first time, allowing regular accounts to have "account abstraction" capabilities such as social recovery and batch operations. This upgrade not only optimizes data availability management but, more crucially, paves the way for Verkle Trees' stateless clients, compressing node synchronization time from weeks to hours. The technological benefits coincide with the market's low point, stabilizing and rebounding the ETH/BTC exchange rate, indicating that capital may rotate from Bitcoin to altcoins.

Fed Chair Transition: Hassett May Lead the "Super Easing" Era

Trump signaled during a cabinet meeting that Kevin Hassett, the director of the National Economic Council, is the frontrunner to succeed as Fed Chair.

As a representative of the rate-cutting faction, Hassett has publicly criticized Powell for excessive rate hikes and advocated for including Bitcoin in the national strategic reserves.

Polymarket predicts that his nomination probability has risen to 86%. If realized, Fed policy may shift towards comprehensive easing. Even if other candidates take office, those selected by the Trump team tend to favor friendly policies, potentially signaling the end of the Fed's confrontational cycle with cryptocurrencies.

Hidden Secrets in Fund Flows: Institutions Quietly Positioning and Retail Leverage Collapse

Whale Transfers and ETF Fund Reversal: Silent Accumulation Has Begun

On the morning of December 3, Arkham data showed that 1,800 BTC (approximately $82.1 million) were transferred from a Fidelity custody address to two anonymous wallets.

Such large transfers typically indicate institutional position adjustments, and concurrently, after the U.S. stock market opened, BlackRock's IBIT ETF saw over $1 billion in trading volume within half an hour, and Vanguard's lifting of the Bitcoin ETF ban led to an influx of funds on its first day.

This phenomenon contrasts with the recent trend of net outflows from ETFs: in November, there was a single-week withdrawal of $2 billion, but the current AUM still accounts for 6.6% of Bitcoin's total market cap. If it rises above 8%, it will signify a genuine restoration of institutional confidence.

Leverage Liquidation and Market Structural Fragility

In this round of rebound, the total liquidation reached $400 million, but the long-short structure has quietly changed: if BTC declines in the next seven days, the liquidation intensity for long positions will be greater; while over a 30-day timeframe, the pressure for short liquidations has significantly increased.

This indicates that although short-term leverage risks have not dissipated, the bearish forces are being weakened in the medium to long term.

Notably, MicroStrategy has newly established a $1.4 billion reserve to cover dividend expenses, avoiding the forced sale of Bitcoin holdings, which alleviates market concerns about institutional selling pressure.

Historical Patterns and Current Realities: Can the Christmas Rally Reappear?

Seasonal Patterns in Positive and Negative Competition

In the past eight years, Bitcoin has recorded gains in six of those years in December, with an average increase of 9.48%. In 2017 and 2020, it even surged by 46% and 36%, respectively.

The underlying logic of this "Christmas rally" lies in year-end bonuses flowing in, buying opportunities emerging after tax-loss harvesting, and reduced selling pressure due to institutions scaling back operations.

However, history does not simply repeat itself—currently, the Fear and Greed Index remains in the extreme fear zone at 20, and analysts' expectations for the probability of a Christmas rally have dropped from 70% to 30-40%.

Diverging Challenges in the Macro Environment

The correlation between Bitcoin and traditional risk assets continues to strengthen. Since October, Nvidia's earnings report exceeding expectations has driven a surge in U.S. stocks, while Bitcoin has conversely dropped by 3%, highlighting its sensitivity as a "high beta asset" in a high-interest-rate environment.

On the other hand, following the end of the U.S. government shutdown, if the Treasury General Account (TGA) balance of $959 billion is gradually released, it may recreate the liquidity bonus that led to a 35% increase in Bitcoin after the government reopened in 2019. However, this process will take time, and the TGA has not yet shown a significant decline, meaning the effects of liquidity injection may not be evident until mid-December.

The New Normal in the Crypto Market: From Retail Frenzy to Institutional-Led Structural Shift

Regulatory Compliance Reshaping Fund Dynamics

The U.S. Securities and Exchange Commission will meet on December 4 to discuss tokenized securities rules, Texas has taken the lead in allowing BlackRock's ETF to purchase Bitcoin, and Thailand has implemented a 0% capital gains tax on Bitcoin within exchanges.

These policy trends are accelerating the integration of traditional finance with the crypto world, but they also bring new sources of volatility—such as S&P downgrading Tether's rating to the lowest level, triggering a trust crisis in stablecoin anchoring.

Mining Company Transformation and Revaluation of Hash Power

With the explosion of AI computing demand, some mining companies like TeraWulf are beginning to transition to a "Bitcoin mining + AI processing" dual-track model. These companies, leveraging their power reserves and flexibility in computing power, have gained favor with tech giants like Google, and the trend of their stock prices decoupling from Bitcoin is becoming a new option for hedging market volatility.

Key Nodes in the Next 30 Days: Three Major Events in December Set Market Direction

December 4: The Ethereum Fusaka upgrade coincides with the SEC's tokenization meeting, potentially creating a resonance between technology and policy.

December 10: The Federal Reserve's interest rate meeting will decide whether to cut rates; if it happens, Bitcoin may quickly test the $100,000 resistance level.

December 16: The delayed release of November's non-farm payroll data will reveal the true state of the job market; if the data is weak, it may strengthen expectations for rate cuts in early 2026.

Conclusion: The Rational Rope Underneath the Frenzy

This rebound in Bitcoin feels more like a carefully orchestrated liquidity test—Fed's dovish leanings, Ethereum's technological upgrades, and Trump's political hints have woven together a narrative of hope for December. But the market remembers well: during the November crash, the same leverage frenzy led to 170,000 liquidations totaling $547 million in a single day.

Perhaps Galaxy Digital founder Mike Novogratz's observation is more sober: he firmly believes Bitcoin will return to $100,000 by the end of the year, while reminding the market to digest the mid-term psychological trauma from the "1011" crash.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。