Venture capital activities remain closely tied to the altcoin cycle, primarily focusing on mature and well-regarded areas such as exchanges, core infrastructure, and scaling solutions.

Written by: Glassnode

Translated by: AididiaoJP, Foresight News

In the context of the current market experiencing a pullback and macro pressures, we have jointly released a collaborative report with Fasanara Digital, analyzing the evolution trends of core ecosystem infrastructure, including spot liquidity, ETF fund flows, stablecoins, tokenized assets, and decentralized perpetual contracts in the fourth quarter.

Digital assets are at one of the most structurally significant stages of this cycle. Driven by deep spot liquidity, historic capital inflows, and demand for regulated ETFs, Bitcoin has crossed the expansion phase of the past three years. The market focus has shifted: capital flows are becoming concentrated, trading venues are maturing, and derivatives infrastructure is demonstrating greater resilience amid shocks.

Based on Glassnode's data insights and Fasanara's trading perspective, this report outlines the evolution of market structure by 2025. We focus on the liquidity reconstruction of spot, ETF, and futures markets, the scale changes in the leverage cycle, and how stablecoins, tokenization, and off-chain settlement are reshaping capital flows. These trends collectively outline a market structure that is significantly different from previous cycles and continues to evolve. Here are the key content summaries:

Key Points

Bitcoin has attracted over $732 billion in new funds, surpassing the total of all previous cycles, pushing its realized market cap to approximately $1.1 trillion, with a price increase of over 690% during this period.

Bitcoin's long-term volatility has nearly halved, dropping from 84% to 43%, reflecting a continuous increase in market depth and institutional participation.

In the past 90 days, the total settlement value of Bitcoin has been approximately $6.9 trillion, comparable to the quarterly transaction volumes of traditional payment networks like Visa and Mastercard. As trading activity shifts towards ETFs and brokers, on-chain activity has seen some transfer, but Bitcoin and stablecoins still dominate on-chain settlements.

The daily trading volume of ETFs has grown from a base level of less than $1 billion to over $5 billion, peaking at over $9 billion in a single day (for example, after the deleveraging event on October 10).

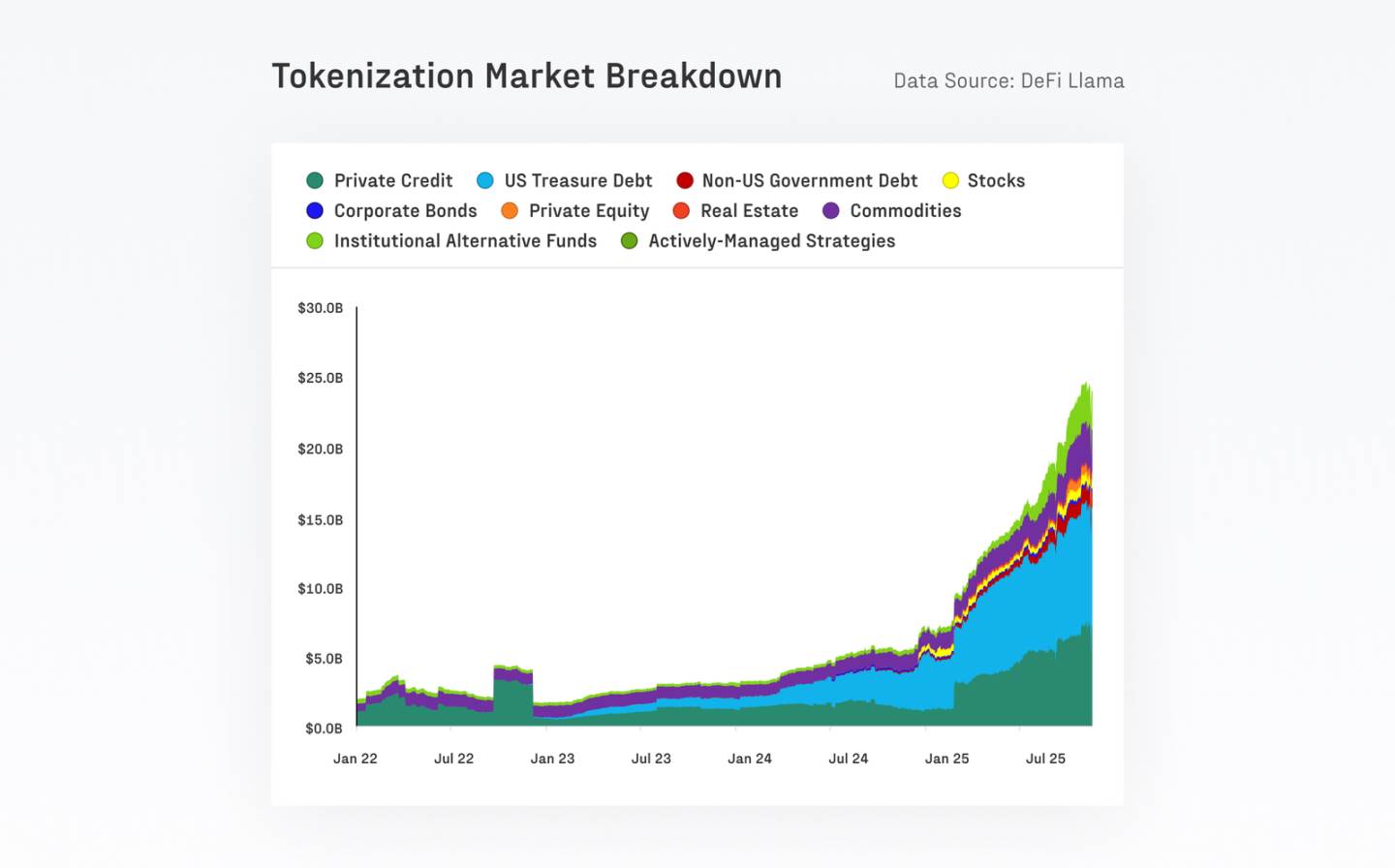

The scale of tokenized real-world assets (RWA) has grown from $7 billion to $24 billion within a year, showing a lower correlation with traditional crypto assets, which helps enhance the stability and capital efficiency of DeFi.

The decentralized perpetual contract market has experienced explosive growth and continues to gain momentum: the market share of DEX perpetual contracts has increased from about 10% to 16-20%, with monthly trading volumes surpassing $1 trillion.

Venture capital activities remain closely tied to the altcoin cycle, primarily focusing on mature and well-regarded areas such as exchanges, core infrastructure, and scaling solutions.

This cycle is dominated by Bitcoin, driven by spot markets and supported by institutional funds

Bitcoin's market share is approaching 60%, indicating a return of funds to high liquidity mainstream assets, while altcoins have correspondingly pulled back. Since November 2022, Bitcoin's share has risen from 38.7% to 58.3%, while Ethereum's share has dropped to 12.1%, continuing its trend of underperforming Bitcoin since the 2022 merge.

Bitcoin has attracted $732 billion in new funds from the cycle's low to high, surpassing the total of all previous cycles. Ethereum and other altcoins have also performed strongly, with some increasing by over 350%, but they have not outperformed Bitcoin as in previous cycles.

Liquidity deepens, long-term volatility decreases, but leverage shocks still exist

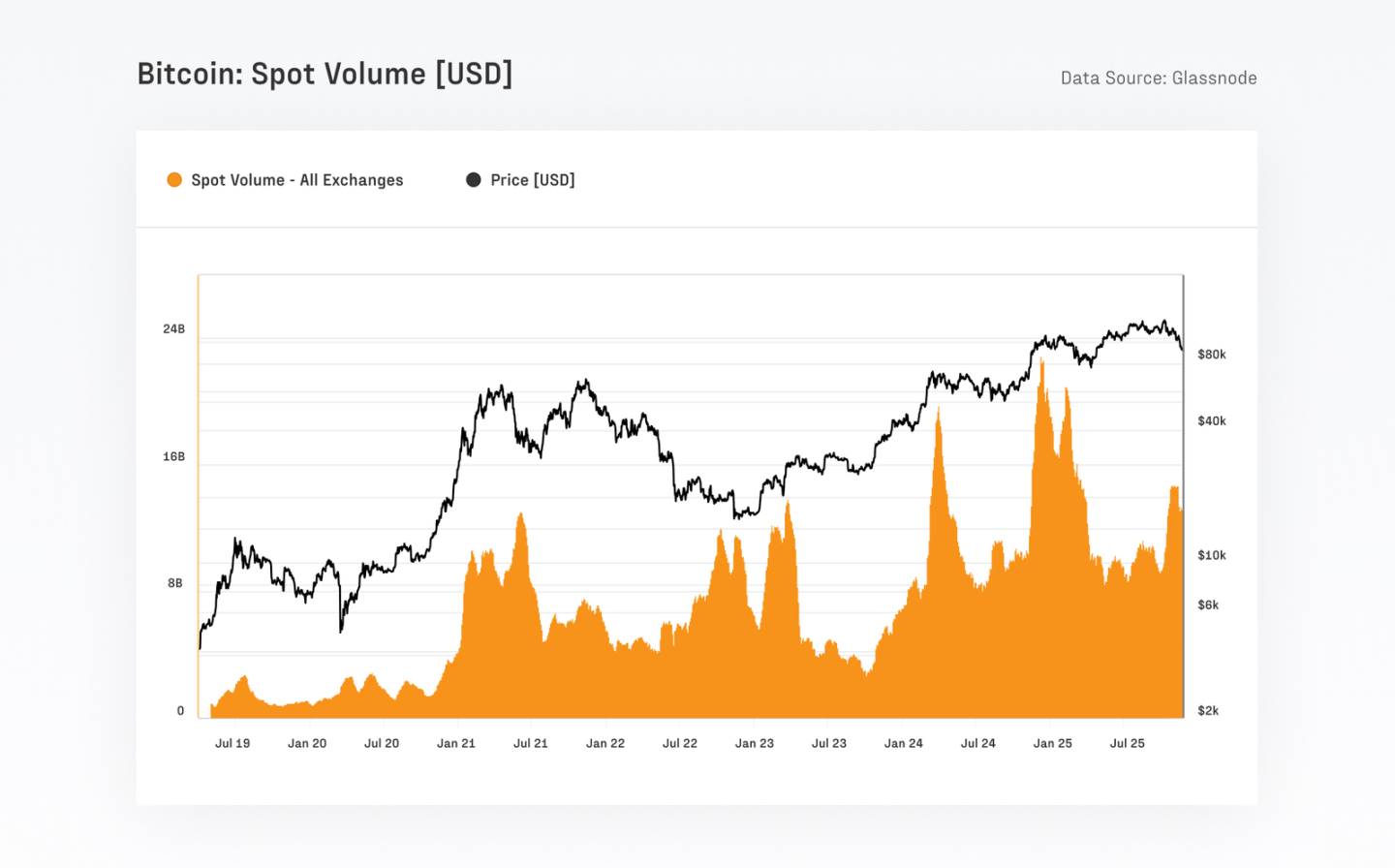

The market structure of Bitcoin has significantly strengthened, with daily spot trading volumes increasing from $4-13 billion in the previous cycle to the current $8-22 billion. Long-term volatility continues to decline, with the one-year realized volatility dropping from 84.4% to 43.0%. Meanwhile, the size of open interest in futures has reached a historical record of $67.9 billion, with CME accounting for about 30%, reflecting significant institutional participation.

On-chain activity shifts to off-chain, but Bitcoin and stablecoins remain the mainstay of on-chain settlements

After the approval of the US spot ETF, the number of active entities on the Bitcoin blockchain has decreased from about 240,000 to 170,000, primarily reflecting a shift in activity towards brokers and ETF platforms rather than a decline in network usage. Despite this migration, Bitcoin has still settled approximately $6.9 trillion in value over the past 90 days, comparable to the quarterly processing volumes of mainstream payment networks like Visa and Mastercard. After adjusting for Glassnode entities, the actual economic settlement volume still reaches about $0.87 trillion per quarter, equivalent to $7.8 billion daily.

Meanwhile, stablecoins continue to provide liquidity support for the entire digital asset ecosystem. The total supply of the top five stablecoins has reached a historical high of $263 billion. The combined daily transfer volume of USDT and USDC is approximately $225 billion, with USDC showing a significantly higher circulation velocity, reflecting its greater use in institutional and DeFi-related capital flows.

Tokenized assets are expanding market financial infrastructure

Over the past year, the scale of tokenized real-world assets (RWA) has significantly increased from $7 billion to $24 billion. Ethereum remains the primary settlement layer for these assets, currently hosting about $11.5 billion of such assets. The largest single product, BlackRock's BUIDL, has grown to $2.3 billion, with its scale increasing more than fourfold this year.

As capital continues to flow in, tokenized funds have become one of the fastest-growing asset classes, opening new distribution channels for asset management institutions. This reflects the expanding range of assets being tokenized and the increasing acceptance of tokenization as a distribution and liquidity channel by institutions.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。