The Federal Reserve will shed the cautious technocratic attitude of the Powell era and shift to a new mission that clearly prioritizes lowering borrowing costs to advance the president's economic agenda.

Written by: Alex Krüger

Translated by: Block unicorn

Introduction

The Federal Reserve as we know it will come to an end in 2026.

The most significant driver of asset returns next year will be the new Federal Reserve, particularly the regime change brought by Trump's new Federal Reserve Chair.

Hassett has become Trump's preferred candidate to lead the Federal Reserve (with a 71% probability on Polymarket). Currently serving as the Director of the National Economic Council, he is a supply-side economist and a long-time loyal supporter of Trump, advocating for a "growth-first" philosophy. He believes that maintaining high real interest rates in the context of a largely won anti-inflation war is a political stubbornness rather than an economic prudence. His potential appointment marks a decisive regime change: the Federal Reserve will move away from the cautious technocratic attitude of the Powell era and adopt a new mission that clearly prioritizes lowering borrowing costs to advance the president's economic agenda.

To understand the policy framework he will implement, let’s accurately assess his statements this year regarding interest rates and the Federal Reserve:

"The only reason to explain the Fed not cutting rates in December is anti-Trump partisan bias." (November 21).

"If I were on the FOMC, I would be more likely to take measures to cut rates, while Powell would be less likely." (November 12).

"I agree with Trump that rates can be much lower." (November 12).

"The expected three rate cuts are just the beginning." (October 17).

"I want the Fed to continue to cut rates significantly." (October 2).

"The Fed cutting rates is the right direction towards significantly lowering rates." (September 18).

"Waller and Trump are right about rates." (June 23).

On a scale of 1-10 from dovish to hawkish (1 = most dovish, 10 = most hawkish), Hassett scores a 2.

If nominated, Hassett will replace Milan as a Federal Reserve Governor in January, when Milan's short term will be completed. Then in May, when Powell's term ends, Hassett will be elevated to Chair. Following historical precedent, Powell will resign from the remaining governor positions a few months in advance after announcing his intentions, paving the way for Trump to nominate Waller to fill that position.

Although Waller is currently the main competitor for Hassett's Chair nomination, my core assumption is that he will be included in the reform camp. As a former Federal Reserve Governor, Waller has been "campaigning" on a platform of structural reform, explicitly calling for a "new Treasury-Fed agreement" and attacking the Fed's leadership for succumbing to the "tyranny of the status quo." Crucially, Waller believes that the current AI-driven productivity boom is essentially deflationary, which means that the Fed maintaining restrictive rates is a policy error.

New Power Balance

This landscape will give Trump's Federal Reserve a strong dovish core, with credible voting influence on most easing decisions, although this is not set in stone, and the degree of dovish tilt will depend on consensus.

Dovish Core (4 members): Hassett (Chair), Waller (Governor), Bowman (Governor), Waller (Governor).

"Contested Centrists" (6 members): Cook (Governor), Barr (Governor), Jefferson (Governor), Kashkari (Minneapolis), Williams (New York), A. Paulson (Philadelphia).

Hawks (2 members): Harmack (Cleveland), Logan (Dallas).

However, if Powell does not resign from the Board (which is highly likely; historically, all former Chairs have resigned, for example, Yellen resigned 18 days after Powell's nomination), it would be extremely bearish. This move would not only block the vacancy Waller needs but also make Powell a "shadow Chair," creating another potential power center outside the dovish core that may be more loyal.

Timeline: Four Phases of Market Reaction

Considering all the above factors, the market reaction should be divided into four distinct phases:

People will immediately be optimistic about Hassett's nomination (December) and the bullish sentiment in the weeks following confirmation, as risk assets will love having a high-profile dovish loyalist in the Chair position.

If Powell does not announce his resignation from the Board within three weeks, people will become increasingly anxious, as each day of delay raises the question, "What if he refuses to leave?" Tail risks will resurface.

The moment Powell announces his resignation, a wave of joy will ensue.

The first FOMC meeting led by Hassett in June 2026 will be approaching, and the market will again be tense, paying close attention to every word from the FOMC voting members (who regularly speak to give insights into their views and thought processes).

Risks: A Divided Committee

Since the Chair does not possess the "deciding vote" that many imagine (in reality, there is none), Hassett must win debates within the FOMC to achieve a true majority. Every 50 basis point change could result in a 7-5 split, which would create corrosive damage institutionally, signaling to the market that the Chair is a political operator rather than an impartial economist. In extreme cases, a 6-6 tie or an 8-4 opposition to rate cuts would be a disaster. The exact voting results will be published in the FOMC minutes three weeks after each FOMC meeting, turning these releases into significant market-moving events.

The developments after the first meeting are the biggest unknown. My basic prediction is that if Hassett secures 4 votes of firm support and has a reliable path to 10 votes, he will achieve a dovish consensus and execute his agenda.

Inference: The market cannot fully preempt the Federal Reserve's new dovish stance.

Interest Rate Repricing

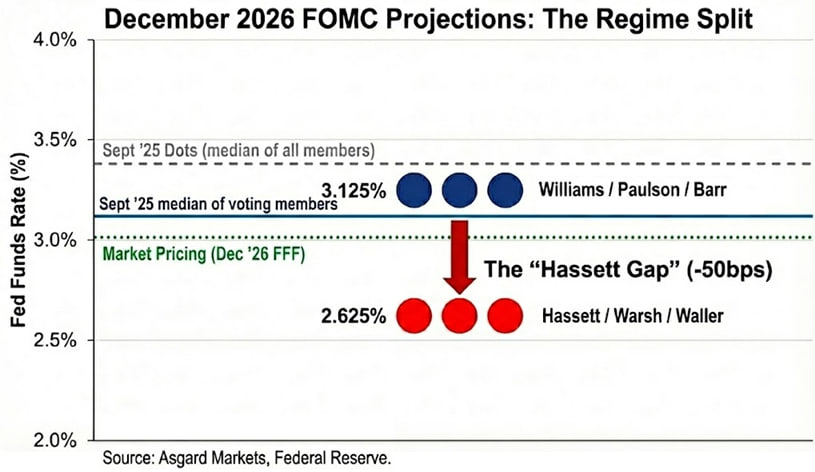

The dot plot is merely an illusion. Although the dot plot from September predicts a rate of 3.4% for December 2026, this number represents the median of all participants, including those hawkish but not voting. By anonymizing the dot plot based on public statements, I estimate that the median for voters is much lower, at 3.1%.

When I replace Powell and Milan with Hassett and Waller, the situation changes further. If Milan and Waller represent the new Federal Reserve's aggressive rate-cutting stance, the voting distribution for 2026 remains bimodal, but the peaks are lower: Williams / Paulson / Barr at 3.1%, Hassett / Waller at 2.6%. I anchor the new leadership's interest rate at 2.6%, consistent with Milan's official forecast. However, I note that he has indicated a preference for an "appropriate rate" of 2.0% to 2.5%, suggesting that the new mechanism's inclination may be even lower than they predict.

The market has partially recognized this, with expectations for the December 2026 rate at 3.02% as of December 2, but has not fully digested the magnitude of this regime change. If Hassett successfully guides rates lower, the short-term yield curve will need to drop another 40 basis points. Additionally, if Hassett's prediction about supply-side deflation is correct, inflation will decline faster than the market generally expects, prompting larger rate cuts to prevent passive tightening.

Cross-Asset Impact

While the initial reaction to Hassett's nomination should be "increased risk appetite," the exact manifestation of this regime change is "inflation steepening," betting on aggressive easing in the short term while expecting higher nominal growth (and inflation risks) in the long term.

Interest Rates: Hassett wants the Federal Reserve to take aggressive rate cuts during economic downturns while maintaining growth above 3% during periods of economic prosperity. If he succeeds, the 2-year Treasury yield should drop significantly to reflect rate cut expectations, while the 10-year Treasury yield may remain elevated due to structurally higher growth and persistent inflation premiums.

Stocks: Hassett believes the current policy stance is actively suppressing the AI-driven productivity boom. He will significantly lower the real discount rate, driving up the valuation multiples of growth stocks. The danger lies not in an economic recession but in the turmoil in the bond market caused by long-end yields surging due to protests.

Gold: A politically unified Federal Reserve that clearly prioritizes economic growth over inflation targets is undoubtedly a textbook bullish scenario for hard assets. Due to the market hedging against the risk of the new government repeating the policy mistakes of the 1970s through excessive rate cuts, gold should outperform U.S. Treasuries.

Bitcoin: Under normal circumstances, Bitcoin would be the purest embodiment of the "regime change" trading strategy. However, since the shock on October 10, Bitcoin has shown severe downside skew, with weak macroeconomic rebound momentum, and it plummets on any negative news, primarily due to heightened market concerns about the "four-year cycle" and a crisis in Bitcoin's own positioning. I believe that by 2026, Hassett's monetary policy and Trump's deregulation agenda will overcome the currently dominant self-fulfilling bearish sentiment.

Technical Note: "Tealbook"

The Tealbook is the official economic forecast of the Federal Reserve staff and serves as the statistical benchmark for all Federal Open Market Committee (FOMC) discussions. This report is produced by the Research and Statistics Division, led by Director Teflin, which has over 400 economists. Teflin and most of her staff are Keynesians, and the Fed's main model (FRB/US) explicitly adopts New Keynesian principles.

Hassett could appoint a supply-side economist to lead this division through Board votes. Replacing a traditional Keynesian economist (who believes economic growth leads to inflation) with a supply-side economist (who believes the AI boom will bring deflation) would significantly alter the forecast outcomes. For example, if the division's model predicts that inflation will drop from 2.5% to 1.8% due to productivity improvements, then less dovish FOMC members may be more willing to vote in favor of significant rate cuts.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。