Author: Allen Ding, President of New Fire Technology Research Institute

In recent times, the pullback of Bitcoin and market sentiment have reached the most "extreme" positions since 2022. While the market is generally filled with panic and skepticism, New Fire Technology (1611.HK) has chosen to increase its Bitcoin (BTC) holdings against the trend. According to an announcement at the end of November, the group has initiated a purchase plan totaling no more than $5 million and has completed nearly half of the allocation in the first phase, with an average purchase price of approximately $82,338.

This action has sparked widespread attention in the market. Many are asking whether this is merely a speculative behavior of "betting on a rebound" in the context of a new round of bull market narratives being thwarted.

The answer is no. Our decision is not based on short-term emotions but is built on a professional foundation of systematic review of macroeconomic trends, market structural resilience, sentiment indicator corrections, and industry fundamentals. The core of this strategic deployment is based on four key judgments from our New Fire Research Institute.

1. The short-term decline of Bitcoin has reached historical extremes, and prices have entered the "wrongly killed zone."

Looking back at this round of adjustments, its nature is more akin to an "emotional stampede" driven by sentiment and liquidity panic, rather than a simple technical correction or fundamental deterioration.

From a price performance perspective, BTC has seen a monthly decline of about 25% in the past month, with a cumulative pullback of about 35% from its peak. Such a decline clearly falls within an extreme range in the historical context of the past three years. Prices have already preemptively discounted a large amount of pessimistic expectations in the market, significantly narrowing the space for further declines. For long-term allocators, this "emotionally amplified" deep adjustment provides the most cost-effective buying range when viewed over an extended time dimension, which we refer to as the "wrongly killed zone" or "oversold zone."

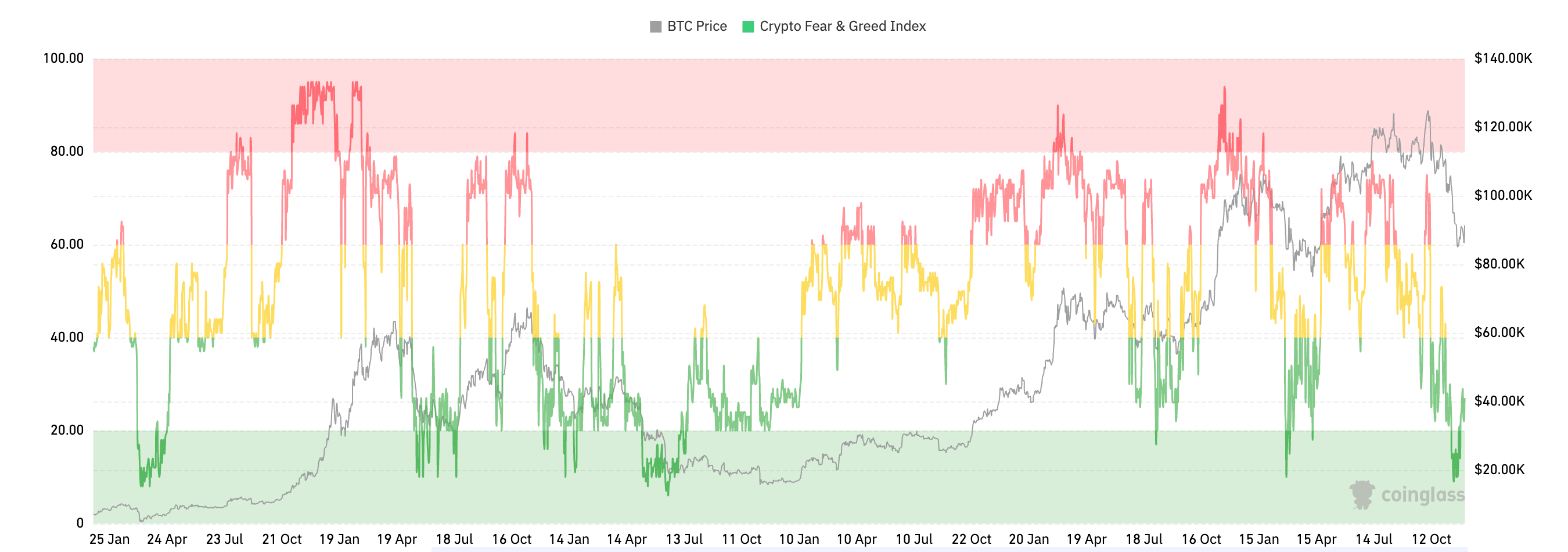

(Coinglass data from December 3, the greed and fear index recently fell below 10)

In line with price movements, market sentiment has also dropped to historical extremes. According to Coinglass data, the fear and greed index recently hit a new low in three years, and is the second lowest in the past five years, only behind the 2022 LUNA crash, which was referred to as the "Lehman moment" in the crypto space. However, this decline has not seen a systemic black swan event similar to the LUNA collapse, as the industry's compliance and institutionalization foundation remains solid.

This structural mismatch of "both price and sentiment have dropped extremely, but the fundamentals have not deteriorated to the same extent" is the core logic behind New Fire Technology's decisive intervention and strategic allocation at an average price of approximately $82,338.

2. The macro direction remains accommodative, and "the snake and the mouse at both ends" have led to amplified pessimistic expectations.

Another important background for this round of adjustments is the market's extreme pessimism regarding the global liquidity direction, especially the Federal Reserve's policy expectations. However, the New Fire Research Institute believes that short-term noise and fluctuating expectations have not changed a more important direction: the macro direction still leans towards accommodation.

We prefer to attribute the market's previous pessimistic sentiment to the expectation amplification caused by the "snake and mouse at both ends" of policy signals: on one hand, there is wavering within the Federal Reserve regarding the path and timing of interest rate cuts; on the other hand, instantaneous fluctuations in geopolitical and macro data make it difficult for the market to form a stable consensus, exacerbating investors' panic.

Although the Federal Reserve's Beige Book shows no significant changes in the economy, with weakened labor demand and moderate price pressures, this "neither hot nor cold" state precisely limits the Fed's ability to continue taking aggressive tightening measures. Recent releases of various macro indicators point to inflation pressures not being out of control.

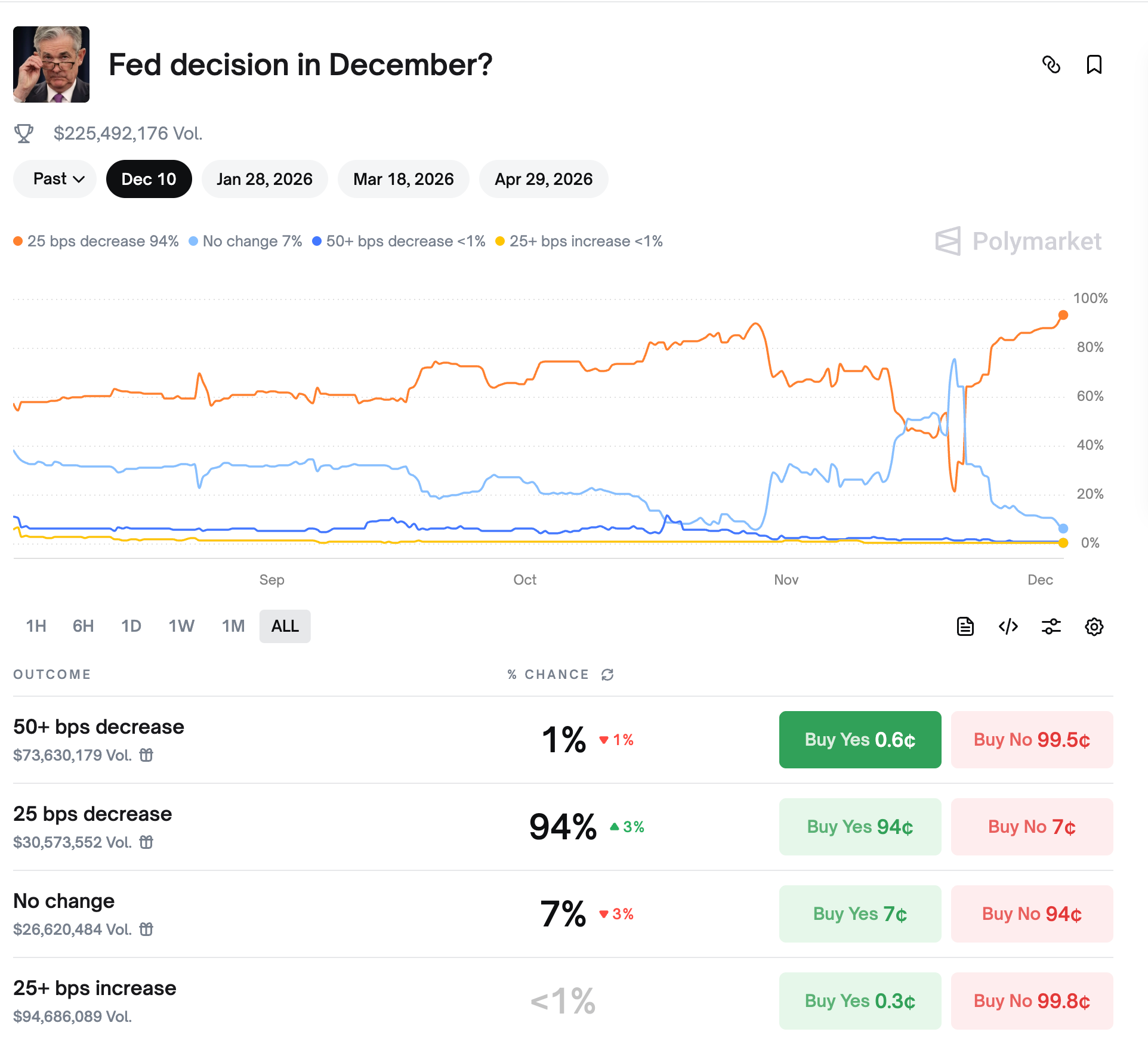

(Polymarket's latest prediction shows a 94% probability of a 25 basis point rate cut in December)

Most importantly, once employment data confirms weakness, the rise in unemployment will determine that monetary policy cannot remain "tight and high" for long. On Polymarket, the probability of a rate cut in December has reached 94%, indicating that the market is re-establishing a consensus on a "gradually loosening" path for global liquidity.

In addition to the Federal Reserve's policy expectations, the global compliance process is accelerating, providing solid external incremental certainty for the crypto asset ecosystem. Positive signals from the institutional level are also continuously emerging: first, Bitcoin ETFs have shifted from three consecutive weeks of net outflows to inflows, indicating that institutional funds are beginning to replenish. Second, BMNR continues to buy and its mNAV has risen above 1.1, showing that smart institutional funds are actively entering the market. Third, there were concerns that Strategy (MSTR)'s mNAV might fall below 1, raising the risk of BTC sales mentioned by its CEO. However, MSTR subsequently announced a cash reserve of $1.44 billion, sourced from the sale of Class A common stock, successfully alleviating panic and bringing its mNAV back above 0.9, proving that leading institutions in the industry possess strong self-rescue and financing capabilities.

In the medium to long term, the end of balance sheet reduction (QT) indicates that the overall environment is "more accommodative rather than tightening again." In this macro environment, choosing to gradually allocate high-elasticity assets during the worst emotional and largest price pullback phase is a risk-return ratio we are more inclined to accept.

3. Industry Responsibility: Expressing Long-Termism with Real Capital

Finally, New Fire Technology's actions also embody a sense of industry responsibility and value anchoring. As one of the earliest and currently most established digital asset listed companies in Hong Kong, we understand that discussing "long-termism" is easy when the industry is thriving, but the true test of attitude comes during significant valuation corrections, extreme pessimism, and the loudest voices of doubt. New Fire Technology has chosen to increase its BTC holdings with real capital at this stage, aiming to send a clear signal through practical actions:

- Rationality and Long-Term: The group's allocation is based on three rational judgments of "extreme decline, excessive emotion, and promising macro outlook," leading to strategic decisions.

- Confidence and Responsibility: We remain firmly optimistic about the medium to long-term prospects of Bitcoin and the entire industry, willing to stand alongside the industry during difficult times. This move aims to form an important part of the group's diversified asset allocation, and future purchases will be flexibly decided based on market performance and price conditions, but the core strategy is to steadfastly practice long-termism.

In summary, New Fire Technology chose to counter-trend buy BTC when it fell to around $80,000 at the end of November, and the core logic can be condensed into one sentence:

In the "dual extremes" of price and sentiment, the fundamentals and compliance trends have not faltered, the macro direction remains accommodative, and for long-term capital, this now resembles a "strategic allocation window after being wrongly killed," rather than the end of the exit. Although any asset carries volatility risks and short-term prices may continue to fluctuate, if we extend our perspective from weeks to years, New Fire Technology is more willing to make strategic decisions that can still be justified in the future during such "universal pessimism," continuously solidifying the foundation for our vision.

(The above content is merely a market observation and research viewpoint sharing, and does not constitute any investment advice.)

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。