Original source: WEEK

In the current pessimistic and bearish market, prediction markets have become an "information safe haven"—traders are tired of the volatility caused by sell-offs and are more eager to bet on event-driven certainty. Prediction markets are taking over from memes as a popular area for monetizing attention in the economy.

Prediction Markets: Attention Storm in a Dull Market

The cryptocurrency market is in a slump, with prediction markets and ZK, Perp DEX being the only highlights, and their common feature is betting on the future of crypto narratives.

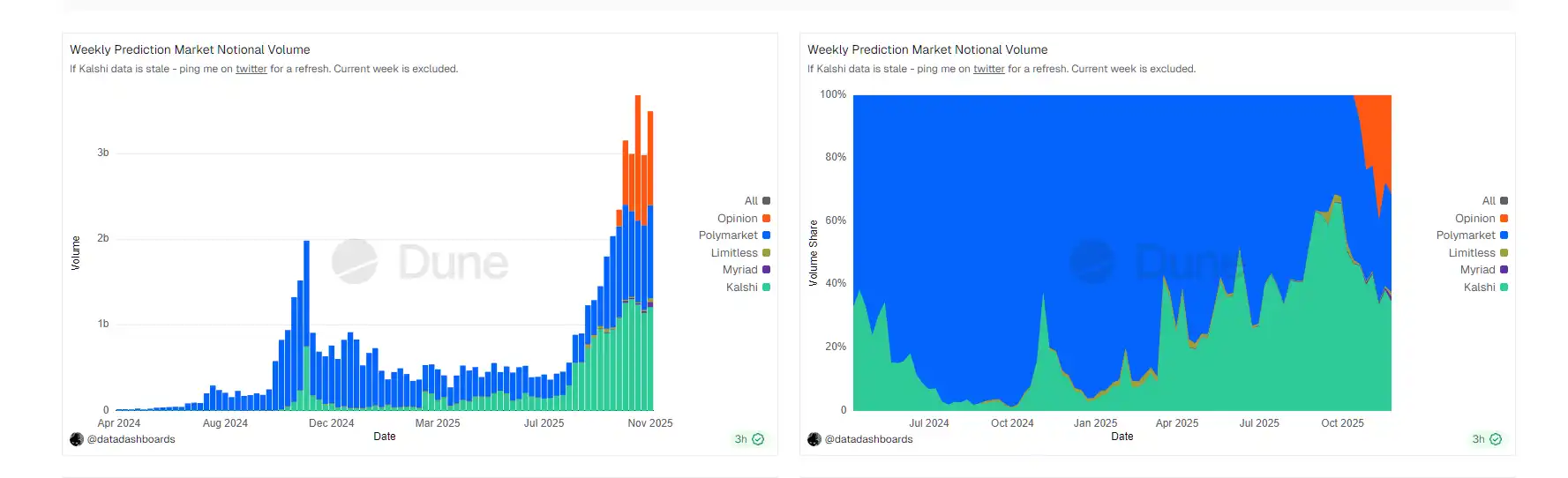

In particular, prediction markets are igniting a trillion-dollar narrative: in the past week, the total nominal trading volume across the market surged to $3.5B, with weekly active users exceeding 290,000, and open interest nearing last year's peak of $900M during the U.S. election betting.

Figure 1 Source: https://dune.com/datadashboards/prediction-markets

This is not a coincidence.

During the 2024 U.S. election, Polymarket's prediction accuracy outperformed polls, with trading volume skyrocketing from $62M in May to $2.1B in October—an increase of over 32 times. After the election, the heat did not diminish: on the day the Nobel Peace Prize was announced, single market trading exceeded $21.40M.

Compliance + Capital, Driving Narrative Upgrade

The resurgence of prediction markets is driven by a narrative upgrade fueled by capital influx under relaxed regulations.

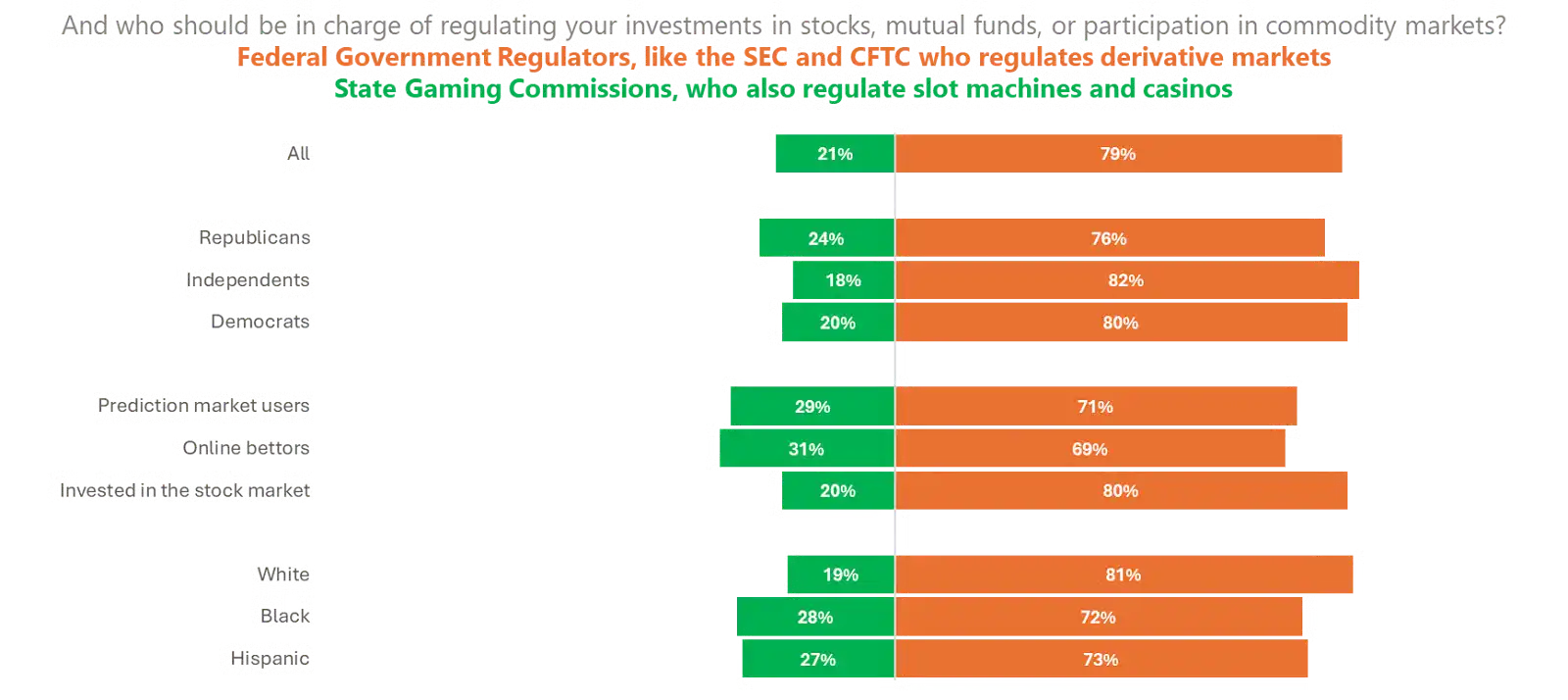

• Regulatory Relaxation: Against the backdrop of the Trump administration's crypto-friendly policies, negative regulation is shifting towards cautious openness. The CFTC dropped its appeal against the political event contracts of prediction platform Kalshi, Polymarket was approved to operate as a market intermediary, and Kalshi claimed "legal betting in 50 states" under CFTC regulation.

• Capital Influx: ICE invested $2B in Polymarket, setting a record for the largest amount in crypto financing history, boosting its valuation to $9B; Kalshi recently raised $1B at an $11B valuation; Solana, BNB Chain, and others have also begun to support prediction products on their respective public chains.

• Narrative Upgrade: The narrative shift in prediction markets has led to increased user participation and dissemination. As @multicoin investment partner @eliqiann stated, beyond cash flow assets (like stocks and bonds) and supply-demand assets (like commodities and foreign exchange), crypto prediction markets are giving rise to "assets measured by attention," rather than binary options or gambling.

Figure 2 Source: https://news.kalshi.com/p/nationwide-poll-shows-broad-support-for-prediction-markets

Notable Players to Watch

The landscape has begun to take shape; due to space limitations, WEEX Labs will discuss a few leading platforms here.

Figure 3 Source: https://x.com/dylangbane/status/1969129269940142528

• @Polymarket—Polymarket is a veteran prediction platform established in 2020, with cumulative financing exceeding $2.2B, dominating political and economic event markets. Polymarket supports USDC settlement and operates on the Polygon chain, with over 1.5 million users.

• @Kalshi—Kalshi emphasizes KYC and institutional-level liquidity as a compliant prediction market in the U.S., founded in 2018, focusing on sports and macro events, integrated with Robinhood. If Polymarket is akin to Tether, then Kalshi is more like Circle, although Kalshi's market share has begun to surpass Polymarket.

• @opinionlabsxyz—Opinion is an emerging prediction platform supported by YZi Labs, focusing on Eastern narratives such as celebrity popularity, currently hovering in the top three in market share.

• @trylimitless—Limitless is a high-frequency short-cycle prediction platform established in 2023, with cumulative financing of $18M, operating on Base and Arbitrum chains.

• @MyriadMarkets—Myriad is a social embedded platform based on Abstract L2, positioned as a low-threshold social prediction tool covering a variety of event themes.

• @soraoracle—Unlike the above prediction protocols directly targeting end users, Sora focuses on oracle services for developers, being the first multimodal AI intelligent oracle project for prediction markets on the BNB Chain. The protocol governance token $SORA has also been listed on the WEEX trading platform.

Conclusion

Prediction markets are not about gambling or trading memes, but rather the collective brain's pricing and speculation on events.

As Polymarket hints at launching a token next year, prediction markets may usher in a wave of wealth creation through information asymmetry and insight monetization, and we will be watching closely.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。