On December 4, 2025, the Japanese government bond market suddenly entered an abnormal state. The 30-year yield broke through the historical high of 3.445%, the 20-year government bond returned to levels seen at the end of the last century, and the 10-year yield, which serves as a policy anchor, rose to 1.905%, marking the first time it has reached this range since 2007.

Surprisingly, this loss of control over long-term rates was not triggered by a sudden change in macro data, but rather by the market's accelerated pricing of an interest rate hike at the Bank of Japan's meeting on December 18-19.

Currently, the implied probability of a rate hike in interest rate derivatives has risen to over 80%, with market sentiment entering a "countdown mode" ahead of official policy statements.

The Invisible Channel of YCC: The Yen Engine Behind Global Liquidity

To understand this round of turmoil, we must return to the Bank of Japan's core policy framework over the past decade—Yield Curve Control (YCC). Since 2016, the Bank of Japan has forcefully fixed the 10-year government bond yield range in a very clear manner, maintaining financing costs close to zero through continuous bond purchases.

According to the Macquarie MSX Research Institute, it is this "anchoring" interest rate policy that has allowed global investors to borrow yen at almost no cost for an extended period, then swap it for dollars through foreign exchange swaps to invest in high-yield assets such as U.S. stocks, tech stocks, U.S. long bonds, and even cryptocurrencies. The massive liquidity over the past decade has not solely come from the Federal Reserve but has also stemmed from this invisible funding channel provided by the Bank of Japan to the world.

However, the essence of YCC is the "artificial stability" maintained by the central bank's continuous bond purchases. As soon as there is any ambiguity in the central bank's willingness to buy, the scale of purchases, or the policy tone, the market will attempt to test the strength of this "invisible interest rate anchor" in advance.

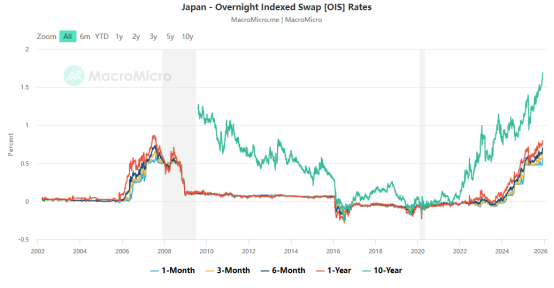

In recent weeks, changes in the yen interest rate swap market have revealed market sentiment earlier than government bonds: the yen OIS rates for terms from 1 week to 1 year have continued to rise, with market expectations for the terminal policy rate over the next year quickly increasing from 0.20% to around 0.65%, reflecting a widely accepted signal that "policy is about to change." The large amount of long-term assets held by Japanese life insurers and large domestic institutions also adds structural pressure to this policy change—every 10 basis point increase in yield for government bonds with a duration of over 20 years means a significant paper loss.

Policy Signals Advance, Communication Tweaks Ignite Long-End Selling Pressure

As a result, the market has turned its attention to the central bank's communication details. On December 1, Governor Ueda Kazuo, in a routine speech in Nagoya, unusually mentioned the next policy meeting and hinted that decisions would be made "at their discretion," suggesting that the policy is no longer in an observation phase. For the Japanese market, which has relied on the central bank's wording to judge policy paths, such a tone is enough to serve as a trigger. Against the backdrop of typically weak liquidity at the end of the year, any minor policy hints will be magnified by the market, and long-term government bonds naturally become the first outlet for pressure release.

Complicating matters, a 700 billion yen auction of 30-year government bonds held by the Japanese Ministry of Finance today was viewed by the market as another "stress test." With declining participation from overseas investors and local institutions becoming increasingly sensitive to duration risk, if the bid-to-cover ratio unexpectedly drops, it will further exacerbate technical selling pressure on the long end. Unlike the mild market reaction during the first adjustment of YCC in December 2022, investors are now significantly more sensitive to policy exits, and the surge in long-term rates reflects this unease.

The Fragile Loop of Carry Trade: This December is Different

Compared to the policy changes themselves, global markets are more concerned about the potential chain reaction from the re-emergence of carry trades. Borrowing yen—swapping for dollars—investing in high-beta assets has been the largest cross-asset strategy over the past decade. Once the Bank of Japan expands the fluctuation range, reduces bond purchases, or directly raises rates, the cost of yen financing will quickly rise. Arbitrage positions will have to be closed early, buying back yen, leading to a sudden appreciation of the yen. The yen's appreciation will put pressure on unclosed yen shorts, further triggering more forced liquidations. The result of this entire chain is a rapid withdrawal of liquidity and a simultaneous decline in high-volatility assets.

The situation in August 2024 is still fresh in memory. At that time, a seemingly mild statement from Ueda was interpreted by the market as a signal of a shift, causing the yen to surge over 5% in a week, while tech stocks and cryptocurrencies plummeted almost in sync. CFTC yen short positions were reduced by 60% in just three days, marking the fastest leverage liquidation in the past decade. This year, the negative correlation between the yen and risk assets has further strengthened, with Nasdaq tech stocks, the crypto market, and Asian high-yield bonds all showing unusual sensitivity to yen fluctuations over the past year. The funding structure is changing, but vulnerability is increasing.

Here, the Macquarie MSX Research Institute also reminds readers that in January 2025, the Bank of Japan raised rates, but the policy action was a controllable "tweak" that did not disturb the market's core judgment of the interest rate structure, nor did it trigger the traumatic memory of the August 2024 event. However, this month's situation is entirely different; the market fears that the Bank of Japan may transition from symbolic adjustments to a real rate hike cycle, which would reshape the funding structure of global carry trades. Increased duration exposure, more complex derivatives chains, and narrowing interest rate spreads are occurring, and these factors combined make the market's sensitivity to the December policy path much higher than at the beginning of the year.

It is worth noting that the structural vulnerability of crypto assets has increased compared to the beginning of the year. The flash crash on October 11 led to a significant reduction in exposure among leading market makers, with the depth of the spot and perpetual markets at historically low levels. Against the backdrop of unhealed market-making capacity, the crypto market's sensitivity to cross-asset shocks has significantly increased. If yen volatility triggers passive deleveraging of global leverage chains, crypto assets may experience amplified reactions due to a lack of support.

The Fed Meeting's Disruptive Variables and Future Outlook

Additionally, this year's situation is compounded by another uncertainty: the misalignment of meeting times between the Federal Reserve and the Bank of Japan. The Federal Reserve will hold its meeting on December 11. If it conveys a hawkish signal at that time, weakening expectations for rate cuts in 2026, the interest rate spread will briefly shift back to support the dollar. Even if Japan raises rates as expected, there may be an awkward situation where "the yen does not appreciate but depreciates." This not only leaves arbitrage trades lacking direction but also complicates what could have been an "orderly deleveraging" process. For this reason, the policy rhythm over the next two weeks is more worthy of vigilance than the apparent market fluctuations.

From a longer historical perspective, Japan's policy turning points exhibit a high degree of path dependence. December 2022 was a turning point, August 2024 was an explosion point, and December 2025 seems more like a rehearsal before the final act. Gold prices have quietly surpassed $2,650 per ounce, and the VIX has continued to rise without significant events. The market is preparing for some structural change but has not yet fully adjusted its mindset.

The Macquarie MSX Research Institute believes that if the Bank of Japan implements a 25 basis point rate hike at the December meeting, global markets may experience a three-stage reaction that starts fast and then slows down: (1) In the short term, the yen rapidly appreciates, U.S. bond yields rise, and volatility spikes; (2) In the medium term, there will be a systematic withdrawal of arbitrage funds from high-beta assets; (3) The long-term impact will depend on whether Japan establishes a clear rate hike path or if this is merely a symbolic adjustment. In such an environment, the global liquidity structure supported by "cheap yen" is difficult to sustain, and more importantly, investors need to reassess their portfolios' implicit dependence on the yen financing chain.

Conclusion

The storm may be unavoidable, but whether the chaos can be managed will be determined by the Federal Reserve meeting on December 11 and the Japanese government bond auction on December 18, two key time points.

The global market is at the critical line between the old and new patterns, and the violent fluctuations in Japan's long-term rates may just be the prologue.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。