The data from the market prediction platform Polymarket is continuously fluctuating, with the probability of Kevin Hassett being elected as the next Federal Reserve Chairman exceeding 80% at one point, while the price of Bitcoin has climbed back to $93,000 amid expectations of interest rate cuts.

The winter night wind is biting outside the Federal Reserve building, but the global cryptocurrency trading terminals are heating up due to a piece of news. The current Chairman Powell's term will end in May 2026, and the White House has stated that it will announce the nominee before Christmas 2025.

The market is not only focused on personnel changes but also on the potential shift in U.S. monetary policy and global liquidity. The Federal Reserve Chairman directly influences the survival environment of the crypto industry and the flow of trillions of dollars through monetary policy and regulatory frameworks, the two "visible hands."

I. Strategic Significance of the Federal Reserve Leadership Change

● The replacement of the next Federal Reserve Chairman is considered a decisive factor in reshaping the macro environment of the cryptocurrency industry for the next four years. This personnel change will not only affect short-term price fluctuations and market liquidity but is also crucial for the crypto industry’s transition from "marginal asset" to "mainstream finance."

● According to public information, the Trump administration plans to announce the nominee before Christmas 2025. Although the current Chairman Powell's term does not end until May 2026, the market's judgment on the new Chairman's policy inclination will occur well before actual policy adjustments take place.

● The market's reaction is swift. Following the news about popular candidate Hassett, U.S. Treasury yields fell, reflecting the market's expectation of improved liquidity.

II. Policy Shift: Liquidity Expectations and Regulatory Restructuring

● The Federal Reserve Chairman has a decisive influence on the direction of monetary policy through guiding the consensus of the Federal Open Market Committee and making public statements. As of early December 2025, the Federal Open Market Committee has voted to lower the federal funds target rate range to 3.75%–4.00%, entering a rate-cutting phase.

● Historical data shows a high correlation between the performance of the crypto market and the Federal Reserve's interest rate policies. When the Federal Reserve entered a rate-hiking phase in 2018, the price of Bitcoin plummeted by about 80%; conversely, the aggressive rate cuts and quantitative easing policies adopted by the Federal Reserve after the pandemic in 2020 propelled Bitcoin's price from around $7,000 to a historic high of $69,000.

● The true drivers of liquidity are closely related to the movements of the U.S. dollar index. Every major Bitcoin bull market has occurred during periods of a declining dollar index, while bear markets have coincided with rising dollar indices.

III. The Policy Spectrum from Hassett to Walsh

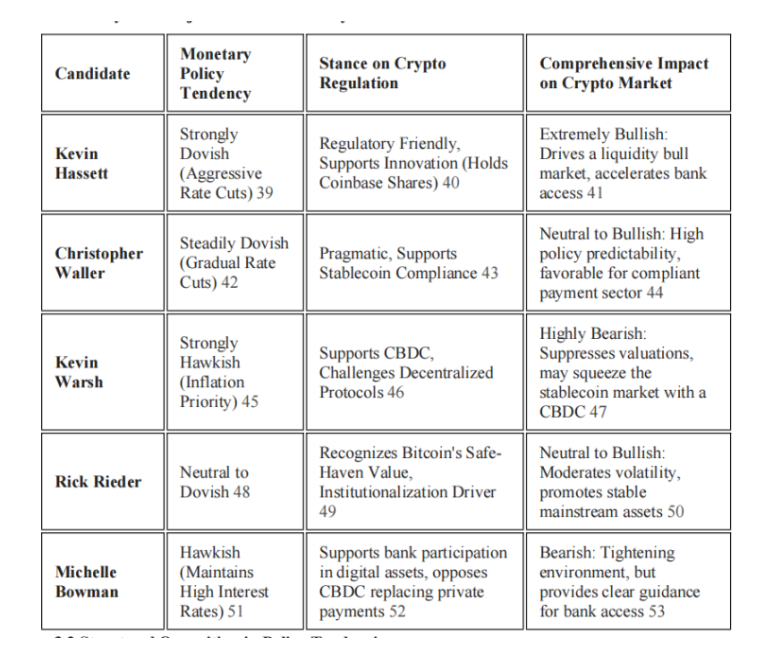

The differences among the five main candidates regarding monetary policy and digital asset regulation constitute the core variables for the future development path of the market. The table below compares the policy positions of the main candidates:

● Hassett is seen as the most favorable candidate for the crypto industry. He has publicly stated that if he were to become Chairman, he would "immediately cut interest rates." As a core economic advisor to Trump, he advocates for leaving room for innovation in regulation and has served as an advisor to Coinbase, holding stock in the exchange.

● In contrast, Kevin Walsh represents the most hawkish stance. He prioritizes preventing inflation and supports tightening interest rates and reducing the central bank's balance sheet.

IV. The Far-Reaching Impact of the GENIUS Act

The GENIUS Act was signed into law by the President in July 2025, establishing the first federal regulatory framework for payment stablecoins in the U.S.

● The act requires stablecoin issuers to hold U.S. Treasury securities, bank deposits, or similar short-term high-liquidity assets equal to the amount issued as 100% reserve backing, and they must publicly disclose the composition of reserve assets monthly and submit an annual independent audit report.

● One of the most structurally impactful provisions is that the act explicitly prohibits stablecoin issuers from paying interest or returns to holders in any form. This provision aims to prevent stablecoins from being viewed as "shadow deposit" products, which could trigger financial stability risks or circumvent bank regulations.

● Since the GENIUS Act requires stablecoins to be backed by U.S. Treasury securities or dollars, the stablecoin market has become an undeniable participant in the U.S. Treasury market.

V. End of Quantitative Tightening and Market Response

● On December 1, 2025, the Federal Reserve officially ended its quantitative tightening program, freezing its balance sheet at $6.57 trillion. This decision marks a critical turning point in monetary policy that could reshape the Bitcoin and cryptocurrency market.

● Market analysts are comparing the current situation to August 2019, when the Federal Reserve last ended quantitative tightening. That policy shift coincided with a major bottom for altcoins and foreshadowed Bitcoin's rise from about $3,800 to $29,000 within 18 months.

● The current environment differs from 2019. Interest rates have been lowered to a range of 3.75% to 4.00%, providing more accommodative conditions. The overnight reverse repurchase facility has decreased from $2.5 trillion to nearly zero, removing a key liquidity buffer that once supported the market.

VI. Acceleration of ETF and Traditional Financial Integration

● Institutional adoption has significantly accelerated. Spot Bitcoin ETFs have accumulated over $50 billion in assets, creating a sustained demand channel that did not previously exist. Companies like BlackRock and Fidelity continue to expand their exposure to cryptocurrencies through regulated instruments.

● Positive regulatory dynamics have also fueled Bitcoin's rise. The SEC Chairman announced plans to develop new "innovation exemptions" aimed at modernizing the digital asset framework and clarifying the rules for issuance, custody, and on-chain transactions.

● The policy shift at Vanguard Group may have accelerated this inflow momentum. Bitcoin's rebound coincided with the CBOE VIX index remaining around 16.54, indicating that despite increased trading activity, market conditions remain calm.

VII. From Short-Term Volatility to Long-Term Trends

● The price of Bitcoin traded at $92,949 on December 4, 2025, rising 4.1% in the past 24 hours, significantly rebounding from a low of $84,000 on Monday.

● From a technical perspective, Bitcoin faces a direct resistance zone between $94,000 and $98,000, where the previous distribution area overlaps with the 200-hour moving average. A breakout above this range could trigger an extension towards $100,000, a psychological barrier that previously limited the rise in August.

● Analyst Matthew Hyland has identified a historical trend where altcoins have continued to rise for 29 to 42 months after periods of no quantitative tightening. The OTHERS.D/BTC.D ratio is currently trading at 0.36, indicating room for consolidation before altcoins typically regain momentum.

The curve on the Bitcoin price chart is being redrawn, and as it breaks through the $100,000 psychological threshold again, the global cryptocurrency market cap has quietly surpassed $3.3 trillion. Wall Street traders are adjusting their portfolios while keeping an eye on the countdown to the Federal Reserve's interest rate decision.

Institutional funds continue to flow in through the ETF channel, with millions of dollars seeping into this once-marginalized market from the traditional financial system every day. Inside the Federal Reserve building, the selection of the next Chairman has entered its final stage, and his monetary policy inclination will determine the opening and closing of the global liquidity valve for the next four years.

The cryptocurrency world stands at the crossroads of tradition and innovation, centralization and decentralization, and the change in the Federal Reserve Chair may become the hand that pushes it in one direction.

Join our community to discuss and grow stronger together!

Official Telegram community: https://t.me/aicoincn

AiCoin Chinese Twitter: https://x.com/AiCoinzh

OKX benefits group: https://aicoin.com/link/chat?cid=l61eM4owQ

Binance benefits group: https://aicoin.com/link/chat?cid=ynr7d1P6Z

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。