Author: AJC; Source: Messari's upcoming "2026 Crypto Themes"

Cryptocurrency Drives Industry Development

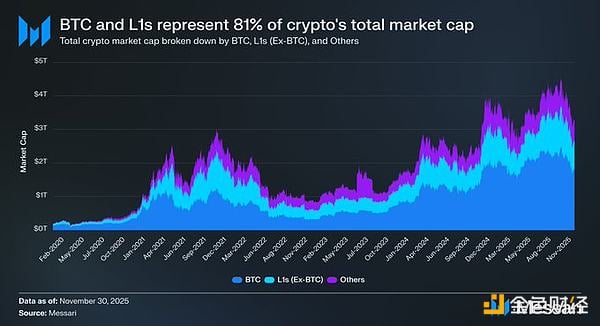

Refocusing on cryptocurrency is crucial, as it is the target that most capital in the industry ultimately seeks to invest in. The total market capitalization of cryptocurrency has reached $3.26 trillion. Among this, Bitcoin (BTC) accounts for $1.80 trillion, or 55%. Of the remaining $1.45 trillion, approximately $0.83 trillion is concentrated in altcoin L1s, totaling about $2.63 trillion (approximately 81% of all cryptocurrency capital), allocated to assets that the market already views as currency or believes may achieve a currency premium.

Given this, whether you are a trader, investor, capital allocator, or builder, understanding how the market allocates and withdraws currency premiums is essential. In the cryptocurrency space, nothing influences valuation more than whether the market is willing to view an asset as currency. Therefore, predicting where future currency premiums will accumulate can be said to be one of the most important factors in portfolio construction within the industry.

So far, we have primarily focused on Bitcoin, but the other $0.83 trillion worth of assets is also worth discussing, as they may or may not be considered currency. We expect Bitcoin to continue to capture market share from gold and other non-sovereign stores of wealth in the coming years. But where does this leave L1s? Does a rising tide lift all boats, or will Bitcoin partially close the gap with gold by extracting currency premiums from L1s?

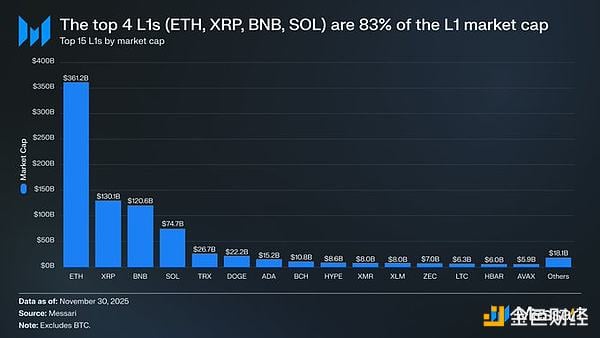

First, it is helpful to understand the current valuation levels of L1s. The top four L1s—Ethereum ($361.15 billion), XRP ($130.11 billion), BNB ($120.64 billion), and SOL ($74.68 billion)—have a total market capitalization of $686.58 billion, accounting for 83% of the L1 sector. After the top four, valuations drop rapidly (TRX has a market cap of $26.67 billion), but interestingly, the long tail remains quite substantial. The total market cap of L1s outside the top 15 is $18.06 billion, accounting for 2% of the total L1 market cap.

Importantly, L1 market cap does not fully reflect the implied currency premium. There are three main valuation frameworks for L1s:

- Currency premium,

- Real Economic Value (REV), and

- Demand for economic security,

Thus, a project's market cap is not merely the result of the market viewing it as currency.

Currency Premium, Not Revenue, is the Main Driver of L1 Valuation

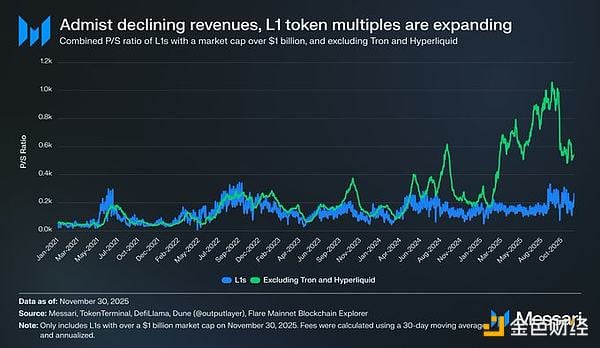

Despite these competing valuation frameworks, the market is increasingly inclined to assess L1 value from a revenue-driven perspective rather than a currency premium perspective. Over the past few years, the overall price-to-sales ratio (P/S) of all L1s with a market cap over $1 billion has remained relatively stable, typically between 150x and 200x. However, this overall figure is misleading as it includes TRON and Hyperliquid. In the past 30 days, TRX and HYPE generated 70% of the revenue for this group, but only accounted for 4% of the market cap.

Excluding these two outliers, the truth becomes evident: even as revenue declines, L1 valuations have been rising. The adjusted price-to-sales ratio has also continued to climb.

- November 30, 2021 - 40x

- November 30, 2022 - 212x

- November 30, 2023 - 137x

- November 30, 2024 - 205x

- November 30, 2025 - 536x

An explanation based on real economic value might argue that the market is simply pricing in future revenue growth. However, this explanation does not hold up under scrutiny. In the same L1 token group (still excluding TRON and Hyperliquid), revenue has been declining in all years except for one:

- 2021 - $12.33 billion

- 2022 - $4.89 billion (down 60% year-over-year)

- 2023 - $2.72 billion (down 44% year-over-year)

- 2024 - $3.55 billion (up 31% year-over-year)

- 2025 - Annualized $1.7 billion (down 52% year-over-year)

We believe that the simplest and most direct explanation is that these valuations are driven by currency premiums, not by current or future revenues.

L1 Tokens Continue to Underperform Bitcoin

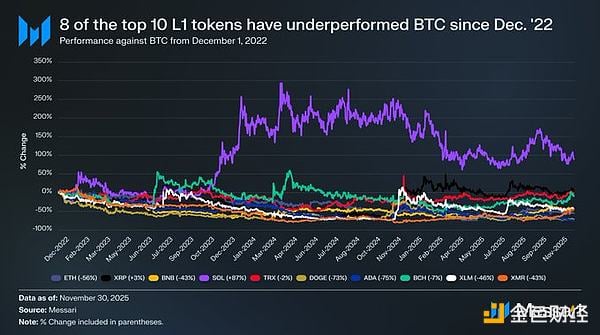

If L1 valuations are driven by expectations of currency premiums, the next step is to understand what factors shape these expectations. A simple test is to compare the price performance of L1s with BTC. If expectations of currency premiums primarily reflect BTC's price movements, then the performance of these assets should be similar to BTC's beta coefficient. On the other hand, if expectations of currency premiums are driven by factors unique to each L1 asset, we would expect their correlation with BTC to be much weaker, and their performance to be more idiosyncratic.

As a proxy for L1s, we examined the performance of the top ten L1 tokens by market cap (excluding HYPE) relative to Bitcoin (BTC) since December 1, 2022. These ten assets account for about 94% of the total L1 market cap, thus representing the overall situation of the sector. During this period, eight of these ten assets underperformed Bitcoin in absolute terms, with six lagging behind Bitcoin by 40% or more. Only two assets outperformed Bitcoin: XRP and SOL. XRP's excess return was only 3%, and considering that XRP's historical capital flows mainly come from retail investors, we do not overemphasize this return. The only asset that significantly outperformed Bitcoin was SOL, which had a return 87% higher than Bitcoin.

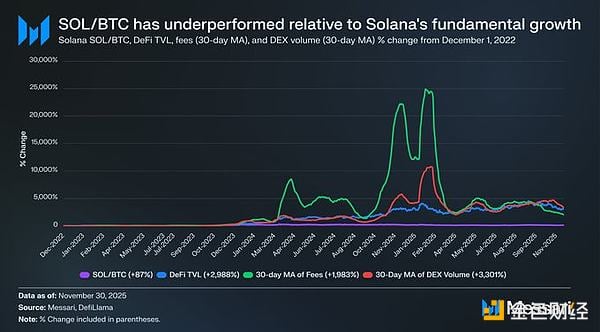

A deeper analysis of SOL's strong performance reveals that it may actually be underperforming. During the same period when SOL outperformed BTC by 87%, Solana's fundamentals exhibited parabolic growth. Total value locked in DeFi grew by 2988%, transaction fees increased by 1983%, and DEX trading volume surged by 3301%. From any perspective, Solana's ecosystem has grown 20 to 30 times since the end of 2022. However, as an asset aimed at capturing this growth, SOL's performance was only 87% higher than BTC.

Read that again.

To achieve significant excess returns in the game against BTC, the L1 crypto ecosystem needs to grow not just 200-300%. It needs to grow 2000-3000% to generate double-digit excess returns.

In summary, we believe that while L1 valuations are still based on expectations of future currency premiums, market confidence in these expectations is quietly waning. Meanwhile, the market has not lost confidence in Bitcoin's currency premium, and Bitcoin's lead over L1s is continuing to expand.

While cryptocurrencies technically do not require transaction fees or revenue to support their valuations, these metrics are crucial for L1s. Unlike Bitcoin, the core value of L1s lies in building an ecosystem that supports their tokens (including applications, users, throughput, economic activity, etc.). However, if the usage of an L1's ecosystem declines year after year, partly due to reduced transaction fees and revenue, that L1 will lose its unique competitive advantage relative to Bitcoin. Without real economic growth, the market finds it increasingly difficult to believe in the narratives surrounding these L1 cryptocurrencies.

Looking Ahead

Looking ahead, we do not expect this trend to reverse in 2026 and the following years. With few exceptions, we expect the market share of other L1 assets to continue to be eroded by Bitcoin. Their valuations are primarily driven by expectations of future currency premiums, and as the market increasingly recognizes Bitcoin as the most competitive among all cryptocurrencies, these valuations will steadily decline. Although Bitcoin will face challenges in the coming years, these issues remain unclear and are influenced by many unknown factors, insufficient to provide substantial support for the currency premiums of current other L1 assets.

For L1 platforms, the burden of proof has shifted. Their narratives are no longer persuasive compared to Bitcoin, and they cannot indefinitely rely on the market's general enthusiasm to support their valuations. The idea that "we may one day become currency" is fading, and the era of supporting trillion-dollar valuations is coming to an end. Investors now have a decade's worth of data showing that L1's currency premiums can only be maintained during periods of rapid platform growth. Outside of these rare explosive periods, L1s have consistently lagged behind Bitcoin, and when growth slows, currency premiums will disappear as well.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。