This article is from: Binance Blockchain Week

Translation|Odaily Planet Daily (@OdailyChina); Translator|Ethan (@ethanzhangweb3)_

On December 4th at Binance Blockchain Week, Michael Saylor reiterated his core judgment on Bitcoin's future over the next decade in a speech titled "Why Bitcoin Remains the Ultimate Asset: The Next Chapter of Bitcoin": Bitcoin is transitioning from an investment asset to the "foundational capital" of the global digital economy, and the rise of the digital credit system will reshape the traditional $300 trillion credit market.

From policy shifts and changes in bank attitudes to the institutional acceptance of ETFs and the explosive growth of digital credit tools, Saylor paints a picture of a new financial order that is accelerating into existence: digital capital provides energy, digital credit provides structure, and Bitcoin will become the underlying asset that supports all of this.

Below are the highlights of the speech organized by Odaily Planet Daily, enjoy~

Michael Saylor: Thank you for the invitation. Whether it’s an honor or an expectation, this is indeed my first time attending Binance Blockchain Week. The atmosphere here has left a deep impression on me and has made me very excited. I noticed the yellow elements everywhere; it seems today belongs to the world of orange and yellow, thanks to the organizers for making "Bitcoin orange" particularly prominent here.

I want to start with what I believe is the most exciting change over the past year: the world is rapidly embracing digital capital, digital currency, digital finance, and digital credit. Binance plays an important role in this process, and everyone here is one of the drivers. Next, I will share some trends I have observed, starting with a very direct phenomenon.

By the way, there was supposed to be a countdown timer here, but it seems there’s a problem. It currently shows I have 12 hours and 40 minutes to speak. If I really had that long, I could probably fill it, but let’s get back to the topic.

Macro Shift: From "Bitcoin President" to Full Acceptance on Wall Street

The capital markets are undergoing a structural reshaping. This transformation is affecting global currency markets and is also spreading to stock markets, credit markets, and derivatives markets. The core driving force behind these changes largely comes from the rise of Bitcoin and the global financial system's acceptance of it. Bitcoin is becoming a new form of digital capital.

Why do I say this? Because U.S. President Donald Trump has publicly positioned himself as the "Bitcoin President." He aims to make the U.S. the global crypto capital and establish leadership in areas such as digital assets, digital capital, digital finance, and digital intelligence. This is not just a campaign slogan. The composition of his cabinet gives a glimpse of the direction: U.S. Vice President, Treasury Secretary Scott Bessent, SEC Chairman Paul Atkins, and others are clear supporters of digital assets. The support extends beyond the financial regulatory system to other departments, including Tulsi Gabbard, Kelly Loeffler, Robert F. Kennedy, and key officials in intelligence and commerce systems.

In other words, Bitcoin as an asset class has received unprecedented endorsement from the highest levels of the U.S. federal government. This is a significant turning point, and all of this has happened in just 12 months.

U.S. Treasury Secretary Scott Bessent discussing Dogecoin, taxes, and the Federal Reserve (Odaily Planet Daily note: image source: Bloomberg)

For Bitcoin to truly become digital capital, the second key condition is the full acceptance of the global banking system. Just a year ago, traditional financial institutions maintained a high level of hostility towards the crypto industry. Even at the beginning of the new U.S. government, the market still questioned whether regulators would truly fulfill the promises of the Trump team.

However, the facts have proven otherwise. Over the past year, the Treasury, OCC, FDIC, and the Federal Reserve have successively issued statements and joint guidance, with the core message being: cryptocurrencies are acceptable assets; Bitcoin is a quality asset; banks can engage in crypto business, can use Bitcoin as collateral, and can provide custody services. The previous administration took a punitive stance towards banks involved in crypto business, but this policy has been completely reversed.

This is a 180-degree policy shift. Banks are typically the most conservative, bureaucratic, and risk-averse institutions globally, and even if the top-level stance changes, the implementation at the operational level often takes years. However, the changes over the past 12 months have far exceeded expectations. (Odaily Planet Daily note: for readability, the content has been structured)

- Institutional Entry: Institutions such as BNY Mellon, PNC Bank, Citi, J.P. Morgan, Wells Fargo, Bank of America, and Vanguard have shifted from skepticism to support.

- Service Implementation: Schwab announced it will provide Bitcoin custody and credit services, and Citi is also advancing similar businesses.

In the past, I could not obtain a Bitcoin mortgage from any mainstream bank, but now, eight of the top ten banks in the U.S. are involved in crypto lending projects, and almost all of these changes occurred within the last six months. Wall Street has accepted Bitcoin as collateral and a form of capital.

Looking back, we were the first publicly traded company to include Bitcoin on our balance sheet. At that time, we were the only one, and then it grew to a dozen, twenty or thirty, and now that number far exceeds what we imagined back then. The first Bitcoin ETFs were not approved until January 2024, but now there are 85 BTC ETFs globally, with BlackRock's IBIT becoming the fastest-growing ETF in history. Bitcoin has completely ignited the fund industry and has been accepted by hundreds of publicly traded companies. Over the past year, this ecosystem has transitioned from "a very small number" to "scale," which is an extremely rare growth curve.

Bitcoin is the economic cornerstone, moral cornerstone, and technological cornerstone of today's financial system. There are several reasons for this (Odaily Planet Daily note: for readability, the content has been structured):

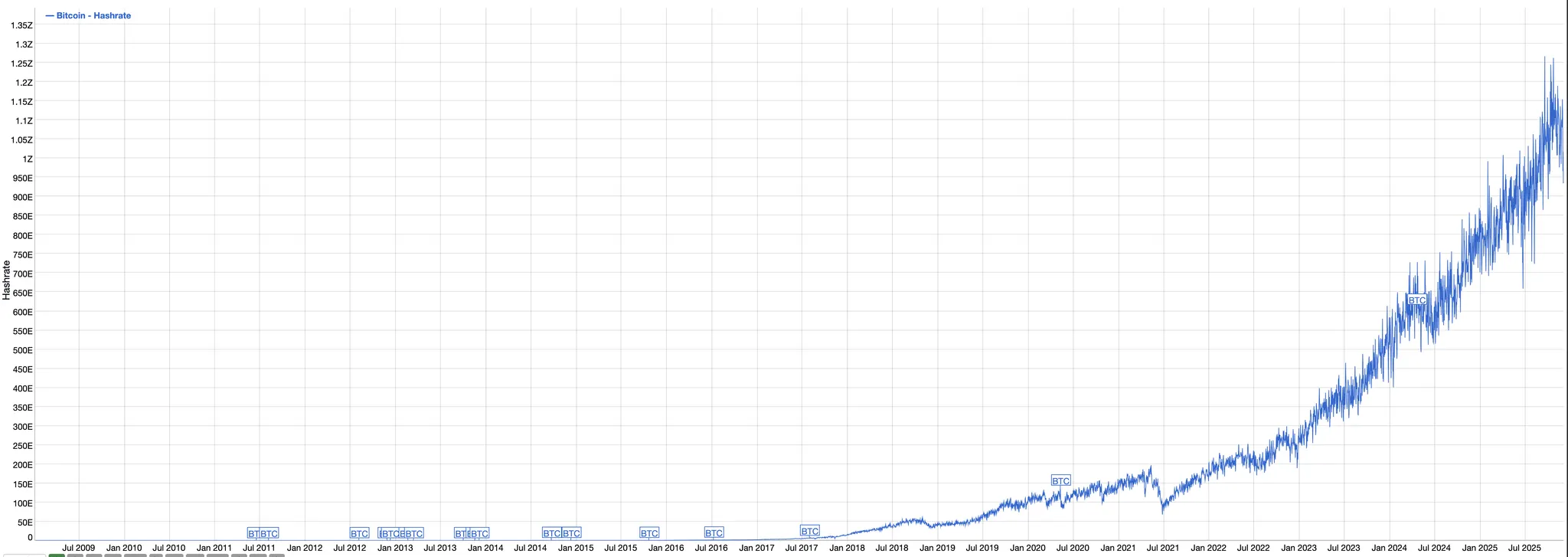

- Energy Level: Bitcoin operates with a computing power consumption of about 24 gigawatts, equivalent to 24 full-power nuclear reactors, which is more energy than that used to power the entire U.S. Navy.

- Computing Power Level: The global network's computing power exceeds 1,000 EH/s, which is more powerful than the combined computing power of all data centers of Microsoft and Google.

- Infrastructure Level: Thousands of exchanges worldwide allow anyone to trade, custody, or transfer Bitcoin anytime, anywhere.

- Political Power: Hundreds of millions of crypto users globally, with 30% of registered voters in the U.S. supporting cryptocurrencies.

- Real Capital: Over a trillion dollars of funds are being injected into the Bitcoin network.

Our company has invested about $48 billion, holding a cumulative 3.1% of circulating Bitcoin. You can infer from this how much real capital is flowing into this network. Thus, the first important conclusion is: we have already acquired "digital capital," a new foundation for value storage. And this is just the beginning. It will become the foundational cornerstone of the digital finance and digital credit industry, upon which all new financial innovations will be built.

Historical chart of Bitcoin hash rate (Odaily Planet Daily note: image source: bitinfocharts.com)

Strategy Unveiled: Building a Digital Treasury for MicroStrategy through "Polarization"

You can reshape the insurance industry, banking, trading models, and various funding structures. However, we choose to focus on the credit field and are committed to becoming the first true "digital treasury." What have we done? We have built a capital reserve system, currently holding about 650,000 Bitcoins, which is the result of continuous accumulation over the past five years. In terms of reserve size, we rank fifth among S&P 500 constituents, and I believe we will rise to second in a few years and reach first within four to eight years.

This stems from our "polarization" strategy. Traditional companies rely on the money market for capitalization, while the annual return of the money market is only about 3%. When your capital cost is 14% (the average S&P return), supporting a 14% capital cost with 3% assets is equivalent to continuously destroying shareholder value. However, if you capitalize with Bitcoin, the historical annual return rate is 47%. This means any company that uses Bitcoin as a capital base can continuously create shareholder value.

The meaning of "polarization" is: companies that use digital capital can continuously grow stronger, while companies that rely on fiat currency or traditional money markets become weaker as their capital scale increases. Traditional wisdom leads companies to "de-capitalize," while digital wisdom leads companies to "re-capitalize."

Our model is also very simple: raise funds at a debt cost of 6%-12% or an equity cost of 14%, and then purchase an asset that appreciates at a rate of 47%. This achieves an approximate 65% overall return.

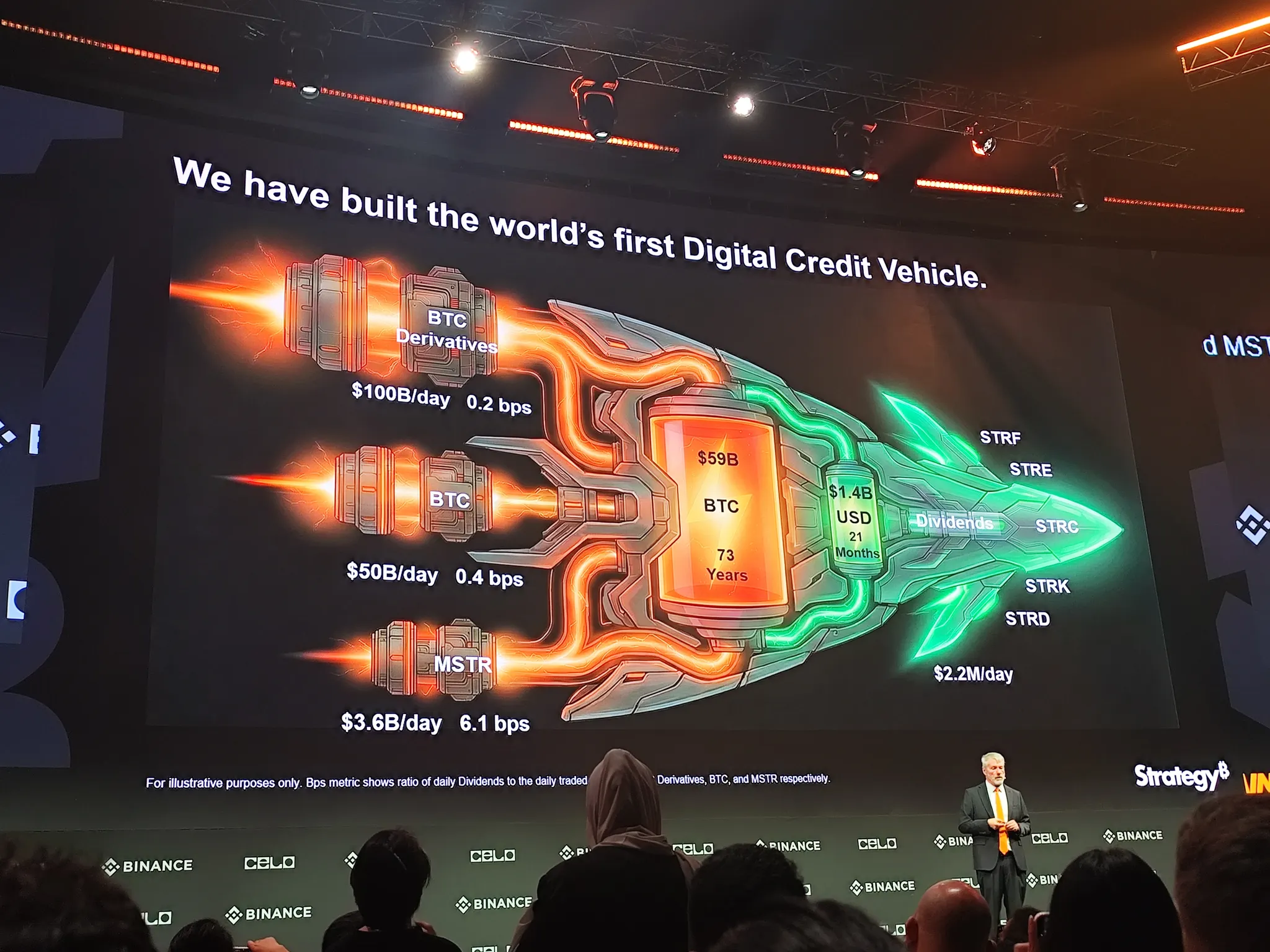

Last year we raised $22 billion, and this year another $22 billion, all flowing into the crypto economy. The fundraising methods include equity financing ($16 billion last year, $13 billion this year), about $7 billion in digital credit, and a series of public tools and debt products like STRF, STRK, STRD, STRC, etc. The company's mission is to continuously enhance the "Bitcoin per share." For long-term Bitcoin believers, they buy our stock because we are increasing the amount of Bitcoin corresponding to each share every year; if they only want to hold the asset itself, they can choose an ETF, as the Bitcoin content per share in an ETF is fixed. Currently, our capital structure is roughly: about $60 billion in BTC reserves corresponding to about $8 billion in debt, with very low leverage. The reserve value is equivalent to 73 years of dividend expenditure. The company pays about $800 million in dividends (or equivalent interest expenses) each year.

To maintain net worth growth, Bitcoin only needs to rise at a rate of 1.36% per year to cover costs. This is our "cruising speed." In other words, we are betting that Bitcoin's long-term annualized growth rate will exceed 1.36%; as long as this is achieved, both the company and shareholders will win.

This week, we raised another $1.44 billion in cash reserves, equivalent to 21 months of future expenditures. This means we can continue to operate robustly without the need to sell equity, BTC, or derivatives. Even if the financing market completely shuts down, we can "hold our breath" and persist for nearly two years. This is the "dollar battery" we have built.

To summarize the company's strategy: when the stock price is above the net asset value (NAV), we sell equity to create incremental value; when the stock price is below NAV, we sell derivatives or Bitcoin to maintain value growth. The entire system operates like a spaceship, revolving around core momentum.

From Capital to Credit: Creating a "Digital Bank Account" with an Annualized 10% Return

Our ultimate goal is to create the world's best digital credit product, one that can provide users with 10% interest, unlike traditional banks that can only offer 4%, 3%, 2%, or even lower rates. This is STRC (Digital Credit Vehicle), structured like a "Bitcoin reactor" at its core, continuously charging the "dollar battery." As long as Bitcoin appreciates at an annualized rate exceeding 1.3%, the reactor can operate stably, keeping the battery charged in the long term. Even if Bitcoin does not increase in value at all, this system can sustain itself for up to 73 years.

Next, we will continuously inject "fuel" into the entire system through the equity capital market, the BTC spot market, and the BTC derivatives market. If I were to elaborate on this part, it would take quite some time, so I will emphasize just one point: we have publicly released a complete credit model on our official website, which is updated in real-time approximately every 15 seconds. You can input any assumptions about token price or ARR fluctuations, and the model will provide corresponding risk assessment results.

Not long ago, we received a credit rating from S&P. Our goal is to become the first large Bitcoin holder to obtain an "investment-grade" rating and the first crypto company capable of issuing "investment-grade" debt. Of course, this must start from the basics and progress step by step, so at the initial stage, we received an S&P rating of B or B-.

This rating was obtained before we raised that $1.4 billion in reserves. Over time, we hope to gradually improve the rating. But even at this current stage, it has opened an important door for us, allowing us to sell credit products to professional credit investors who must allocate "rated assets." After obtaining the rating, the potential market size for our credit products has nearly doubled, which is crucial. So, what are we specifically doing with this capital?

In short, what we are doing is: converting "capital" into "credit." Imagine you have a five-year-old child, and you can buy an acre of land for him in New York City; that is capital. You tell him that in 10 to 30 years, this land will either be sold or refinanced, and before that, it will generate almost no cash flow, which is typical capital investment logic. Another approach is to buy him an annuity contract that promises to pay him $10,000 every month for life; that is credit. If you want him to receive a stable $10,000 every month, you would choose a credit instrument; if you want him to have the opportunity to gain a large fortune in 30 years, you would choose to give him capital.

Bitcoin is capital. It is highly volatile but offers high long-term returns. Many people are unwilling to endure this volatility. The underlying order of the world is driven by capital, while the daily operation of the world relies on the credit system. Therefore, to convert capital into credit, we hold BTC as "currency-type capital" on one hand, and on the other hand, we convert it into dollars, euros, and even issue yen-denominated versions. In this process, we isolate risks through over-collateralization, compress volatility by setting face values and liquidation priorities, and establish dividend rates through active management and "yield refinement." You can set the target yield at 10% or other levels and adjust the duration through structural design.

For capital investors, if you ask me "how long to hold Bitcoin," my answer is usually: at least 10 years, and you will become richer, but during those 10 years, you may not receive any cash flow. For credit investors, we need to provide "instant gratification": starting next month, there will be cash dividends every month. Both types of demand exist simultaneously in the market. In reality, most people actually need two parts of allocation: one part of funds for credit allocation to obtain cash flow; the other part directed towards capital assets to pursue long-term appreciation.

What we are doing is converting digital capital into digital credit and systematizing and productizing it. We have launched various digital credit tools: STRK is a structured Bitcoin product that pays you interest while retaining some upside potential, allowing you to share part of the appreciation during the "waiting time"; if you want to further amplify returns, STRD is a high-yield, long-duration credit tool, currently with an effective yield of about 12.9%; if you prioritize safety margins and stable cash flow, you would prefer STRF, which belongs to super-priority credit, positioned at the forefront of the capital structure, with the highest governance rights and liquidation priority.

These designs are intended to provide clear choices for investors with different risk preferences: if you want higher protection, the yield is about 9%; if you are willing to give up some protection, the yield can be increased to 12.9%. Those who buy the former are rarely inclined to buy the latter; conversely, the same applies. We intentionally cover two completely different investor profiles through two product structures. STRC is our designed "highest-level" tool.

In designing STRC, our goal was to create a "high-yield bank account-style product": the principal fluctuates around $100, remaining very stable, while paying monthly dividends. To achieve this, the interest rate must have the ability to adjust monthly. STRC is the industry's first "treasury-level" digital credit tool and, in fact, the first "variable-rate preferred stock" product ever issued in the history of the entire capital market. This is feasible because we possess digital capital; without digital capital, this structure could not exist at all; at the same time, we also have digital intelligence, and I relied on AI to complete the design of this product.

MicroStrategy Product Matrix (Odaily Planet Daily note: image source: on-site demonstration)

Without AI, it would not have come into existence. The reason is simple: lawyers would say, "No one has ever done this," investment banks would say, "We have no precedent," and everyone repeats "never done, can't do." But I asked, "Can it really not be done?" AI provided the answer: "Absolutely, it is structurally very clear; it just needs to be built step by step." So we used AI's reasoning and validation to persuade lawyers, investment banks, and market participants in reverse, using modern technology to truly bring this product to market. I will show some results shortly. As for Stream, it is the fifth product we launched, essentially the euro-denominated version of STRF.

If you are an investor priced in euros and do not want to bear exchange rate risks, hoping that both the asset value and cash flow are settled in euros, then this is the solution designed for you. This is the performance of STRC over the past five months since its issuance on August 1: the issuance price was about 90, and it is now stable around 97, while we have also continuously raised the dividend level. I want to visually demonstrate the difference between capital and credit.

Assuming you have $100 and bought $100 worth of Bitcoin on August 1, over the past four to five months, you would have lost about $27 and received no dividends; but if you had bought STRC, you would now have made about $7 and additionally received $3.70 in dividends. During this period, STRC's credit investors have significantly outperformed capital investors in a bear market environment. So, why do people still choose to buy Bitcoin? The answer lies in the time dimension: over the past five years, Bitcoin's average annualized growth rate has approached 50%, while STRC's steady-state yield is about 10.75%. To achieve the former capital appreciation, you must endure high volatility and deep drawdowns.

Therefore, if your investment horizon is 4 to 10 years or even longer, you should hold capital assets like Bitcoin; if your funds will be needed in the next four months, four weeks, four days, or even four years, or if you are extremely averse to volatility, you are more suited to choose credit instruments. To complete the transition from "high-volatility capital" to "predictable credit," the market needs a "treasury-type company" to undertake the design and operation of the intermediate layer: stripping volatility and risk from capital to extract stable cash flow, which is exactly what we are doing, and we will delve deeper into it.

When we launched this digital credit business line in January of this year, this category started almost from zero; yet in just nine short months, it has grown to nearly $8 billion in scale. Liquidity is also very ample; on certain trading days, the transaction volume of these digital credit tools can reach hundreds of millions or even billions of dollars.

Let me explain all of this in a more intuitive way. Ordinary preferred stocks mostly trade over-the-counter (OTC), with an average daily trading volume of about 100,000 shares. Even for mainstream preferred stocks that have successfully gone public, the average daily transaction volume is usually around $1 million. However, the digital securities we initially issued, including STRF, STRK, and STRD, far outperformed traditional products at launch: their average daily trading volume reached $30 million, about 30 times that of traditional preferred stocks.

Subsequently, we found the most successful structural solution to date, STRC. This product hit all the pain points of demand, causing its average daily trading volume to rapidly rise to $140 million, a 100-fold increase over traditional products. In the financial field, the hallmark of whether an innovation is truly effective is not a "slight improvement," but a leap in performance and adoption by an order of magnitude, which STRC has achieved.

Dimensionality Reduction Attack: How the "Triple Tax Deferral" Structure Reshapes Global Yields

More importantly, we inadvertently triggered an important discovery: demand is indeed the source of innovation. We noticed that if a company pays dividends to investors by raising capital (whether from equity, derivatives, or BTC), then these dividends are, by nature, "capital returns" rather than taxable income. This means investors do not have to pay taxes immediately, effectively receiving a "tax deferral," with their actual tax rate approaching zero, rather than 20%, 30%, or 50%. This is a structurally significant discovery, as we found a way to pay investors dividends with "tax rates close to zero."

Of course, the company will continue to sell credit products and use the proceeds to purchase Bitcoin, creating an acceleration effect. Thus, an important question arises: why does equity have value? The answer is: because we can create credit. The more credit we issue, the higher the BTC returns from the collateral capital, and the greater the value of the equity.

Next, I want to quickly break down this logic from several dimensions.

First, the credit market itself is undergoing a revolution, a global market worth $300 trillion. Why is digital credit more advantageous? The key lies in its construction on a long-term appreciating asset, Bitcoin, rather than on depreciating assets or traditional collateral such as physical storage, production facilities, or service contracts.

Secondly, digital credit is highly transparent, liquid, and homogeneous. Our credit model updates every 15 seconds, with real-time risk assessments visible. Unlike the complexity of bundling ten thousand mortgage loans into a mortgage-backed security (MBS), it does not have the structural heterogeneity of corporate or sovereign credit. Essentially, it is more like equity rather than debt. Traditional bank credit is debt, corporate credit is debt, and bank deposits are also the bank's debt, which amplifies risk for the issuing institution. Equity does not. Equity never matures, does not force the issuer to repay principal, and only pays dividends if it does not affect solvency. This "permanence" means we can pay dividends to investors indefinitely because we invest the funds permanently in the crypto economy. Furthermore, we have brought credit securities into the public market, giving them global liquidity, brand recognition, and simplified structures. STRC is such a product, which investors around the world can buy directly. Digital credit allows us to achieve unprecedented scale and speed: if you give me $500 million, I can complete a matching collateral position in a day. Imagine the financing—construction—asset generation cycle that a traditional real estate company would take five years to complete; we can accomplish it in one day.

More importantly, this entire structure inherently possesses the characteristic of "tax deferral." You will notice that traditional credit can only provide returns of 2%–4%, while we can offer yields of 10%–12%. We can pay higher dividends because we have innovated in the underlying capital and credit structure, which comes from the business model of Bitcoin treasury companies.

What is a Bitcoin treasury company? Our model can be summarized in three points: we sell securities to obtain capital; we issue digital credit, placing it in a tax-deferral state; and then we pay dividends in the form of "capital returns," while the underlying capital itself also grows under the premise of tax deferral.

This forms a "triple tax deferral" structure, which is currently the most efficient and scalable fixed-income generation model globally. Traditional energy, real estate, and consumer goods companies cannot replicate this structure; it can only be driven by digital capital.

From this perspective, we are a "digital credit factory": we permanently exchange dollar yields for credit investors while continuously creating Bitcoin capital gains for equity investors. This system is adaptable to multiple currencies, including dollars, euros, and yen.

The end result is very clear: the "capital return" structure allows investors to achieve higher actual yields. For example, in the United States, banks typically offer a savings account interest rate of 0.4%, and money markets provide 0.4%–4%, but all must pay taxes. STRC offers an approximate yield of 10.8%, with a tax-equivalent yield close to 17%, four times that of money markets and twenty times that of bank rates. This gap is too significant to ignore.

The same is true in Europe: money market rates are only 1.5%, while Stream's effective yield reaches 12.5%, with a pre-tax equivalent yield close to 20%; for investors in Vienna or Brussels, this is equivalent to a bank account paying you 27% interest. The effect is revolutionary.

In short, we are digitally reshaping the banking industry, money markets, and credit systems. Moreover, not just STRC, every digital credit tool outperforms its corresponding traditional credit tool. Junk bonds ("high-yield bonds") give you 6%, while our products can achieve post-tax equivalents of 14%–20%; private credit averages 7% and is opaque; money market yields in major developed markets range from 0%–4%, while STRC's tax-equivalent yield is 17%.

From a macro perspective, the transformation brought by digital credit is a systematic rewriting of "how money works," "how banks operate," and "how the credit system supports the economy." The world relies on credit to function, but when banks offer you no returns, how do you leave a lifelong annuity for your child in Switzerland or Japan? How do you achieve a 10% return in Swiss francs or yen? The answer is digital credit. In the future, Bitcoin treasury companies like MetaPlanet will enter Japan, Switzerland, and South Korea. If we don't do it, local companies will. Because every country in the world has the same demand: people want a "bank account that pays 10% returns."

Finally, I want to emphasize a simple reality. If you ask 100 ordinary people, "Would you be willing to endure 40% volatility for a potential 30% or 40% annualized return?" their answers will vary; some will be willing to take the risk, but more will choose to avoid it. But if you ask them, "Would you like an account that pays 10% annually and is in a tax-deferral state?" the answer is almost unanimous: everyone wants it.

This is the significance of STRC's existence. If you think about the next phase of the digital economy, it means that based on the digital capital formed by Bitcoin, digital credit will permeate every market sector, repairing the banking system, reconstructing money markets, and resetting the capital costs of corporate credit, private credit, and other debt instruments.

The ultimate beneficiaries are the investors, the digital economy itself, and the holders and community of Bitcoin. The losers are those bureaucratic, outdated oligarchic institutions that take your money without providing any returns. The entire system is being restructured for the benefit of humanity, and you are witnessing this transformation and moving forward with us. Thank you all.

Conclusion: Volatility is Energy, Don't Avoid the "Flame"

Q: The community has a question. You have fully elaborated on the durability of Bitcoin. If you were to leave one last piece of advice for audiences from around the world, why Bitcoin? Why now?

Saylor: Yes, the core message I want to convey is that digitalization is reshaping the world, and this is indisputable. Digital intelligence will be deeply embedded in your cars, robots in factories, your phones, and all systems in daily life. In the future, we will face an era of "a billion AIs," with self-driving cars and robots taking on most of the production and manufacturing processes.

If you want to continue creating new things and achieve goals that were previously hard to imagine through action, you must think about problems in a digital way. Digital assets will also reshape the world, whether it is digital currency, digital equity, digital credit, digital financial tools, or digital securities; everything is being redefined.

There is a very simple yet often underestimated fact about digitalization: almost everything can be done better through digitalization. Digital photography, digital video, digital education, and digital entertainment have already provided clear examples. And now, this wave of digitalization is beginning to directly impact capital markets and banking systems. My advice to you is to quickly figure out how to leverage digital technology to digitize and structure your goods, services, and products, creating better returns for investors while better serving your citizens, your customers, and even your family.

Of course, the market will have volatility, but this logic is self-consistent. With any technological change, there will always be voices of doubt. People once questioned electricity, questioned cars, and questioned airplanes. For the past 50 years, people have even hesitated to accept nuclear energy. From 1973 to 2023, we almost pressed the "pause" button on nuclear energy development, but now everyone is realizing that this nearly limitless clean energy may not be a bad idea. Therefore, skepticism towards new things is normal, but it does not trouble me.

I do not feel fear because of volatility. On the contrary, volatility often means: this is one of the most dynamic, energetic, and useful assets in the entire capital market. It is precisely because it gathers tremendous energy that prices fluctuate dramatically. If you learn not to be intimidated by this volatility, you can learn to harness it. Do not instinctively flee from the "flame," but learn how to move forward within the flame; this is the attitude I want to convey. If you find yourself unable to endure a 50% price fluctuation, unable to withstand the ups and downs of capital, there is a very direct solution: turn to credit. If you are a builder, you can create credit tools; if you are an investor, you can purchase credit products. By purchasing digital credit, you can participate in the growth of the crypto economy while significantly reducing your exposure to volatility. If you do not want to participate in this way, you can also choose to become a creator of credit. And if you desire this "raw growth engine," then directly connect digital capital to your country, your business, your family asset allocation, and your product system.

I believe this is one of the most extraordinary opportunities our generation can encounter.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。