Original Title: "Ethereum 2025 Major Upgrade Completed, Faster and Cheaper Mainnet Has Arrived"

Original Author: Cookie, Rhythm BlockBeats

On December 4, Ethereum's second major upgrade of the year, Fusaka, was officially activated on the Ethereum mainnet (corresponding to Epoch 411392). This upgrade was implemented simultaneously on both the Ethereum consensus layer and execution layer, enhancing Ethereum's capacity to handle large-scale transactions from various Layer 2 networks, increasing the block gas limit to 60 million, and paving the way for subsequent blob parameter adjustments through BPO forks, which is expected to reduce L2 fees by 40% to 60%.

Before the upgrade was officially completed, it received positive attention from some well-known figures in the industry. For instance, Bitwise Chief Investment Officer Matt Hougan stated on November 23, "The current market correction has led to many pieces of information being overlooked, such as the increasingly outstanding value capture capabilities of UNI, ETH, and XRP. I believe the market will soon start to reprice around the positive impacts of the Ethereum Fusaka upgrade, especially if it can deliver as expected on December 3. This is an undervalued catalyst and one of the reasons Ethereum may lead the rebound in this round of the crypto market."

The Fusaka upgrade actually includes a total of 13 EIPs, and introducing all of them may not be very intuitive. What changes have occurred after the completion of this Ethereum upgrade?

Faster, Cheaper

Let's take a look at the current gas levels:

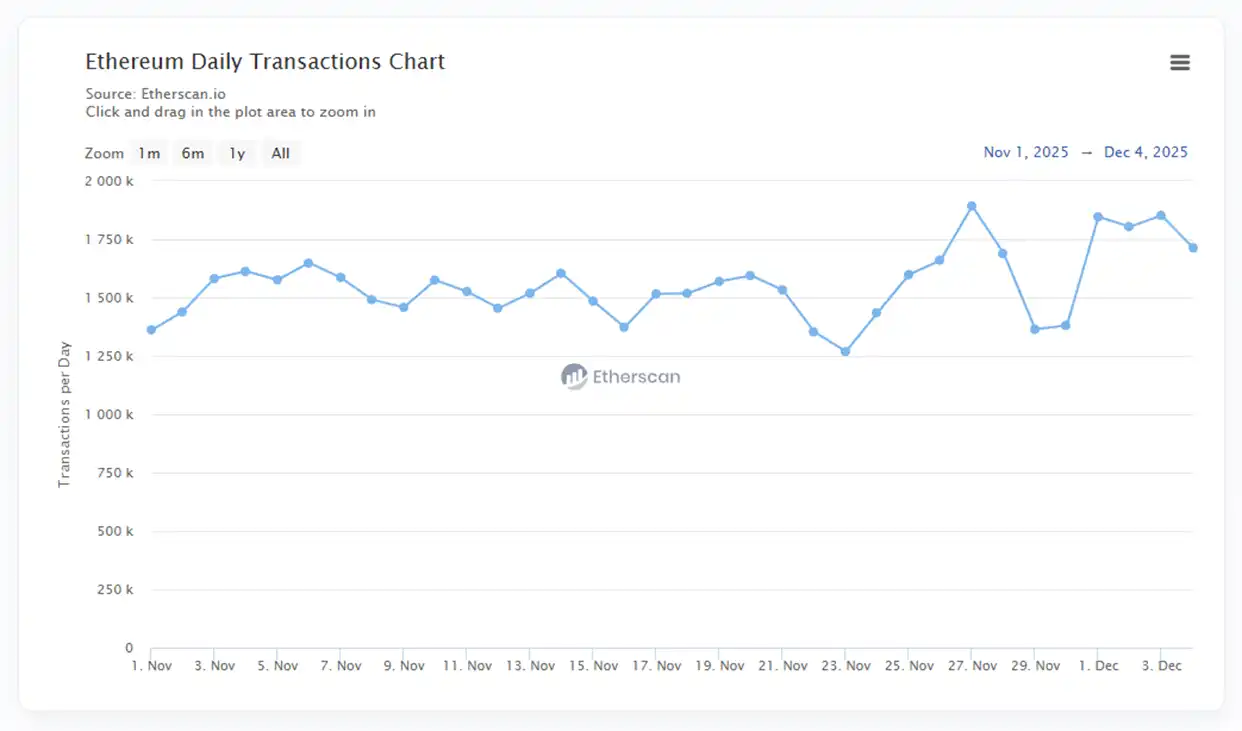

In the past 7 days, the average Gwei value was about 0.1, while the average Gwei value over the past 30 days was about 0.3. At the same time, compared to the number of transactions in early November, the change is not significant.

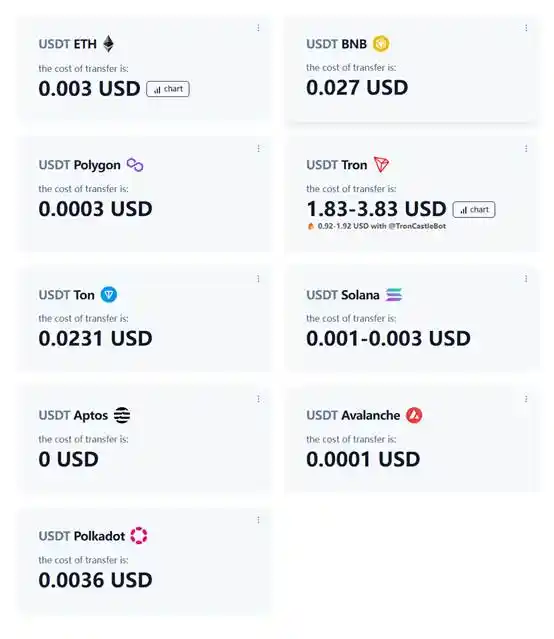

Currently, the gas fee for a single USDT transfer on the Ethereum mainnet has dropped to as low as $0.01. I attempted such a transfer at a block with approximately 0.029 Gwei, and it took less than 1 minute to complete.

According to data from GasFeesNow, the current gas cost for transferring USDT on the ETH mainnet is only about 0.016% of that on the Tron chain:

Following the EIP-7783 from the Pectra upgrade, the EIP-7935 from the Fusaka upgrade further raised the default gas limit, increasing it to 60 million. A higher gas limit means that each block can handle more transactions, reducing both block congestion and transaction fees.

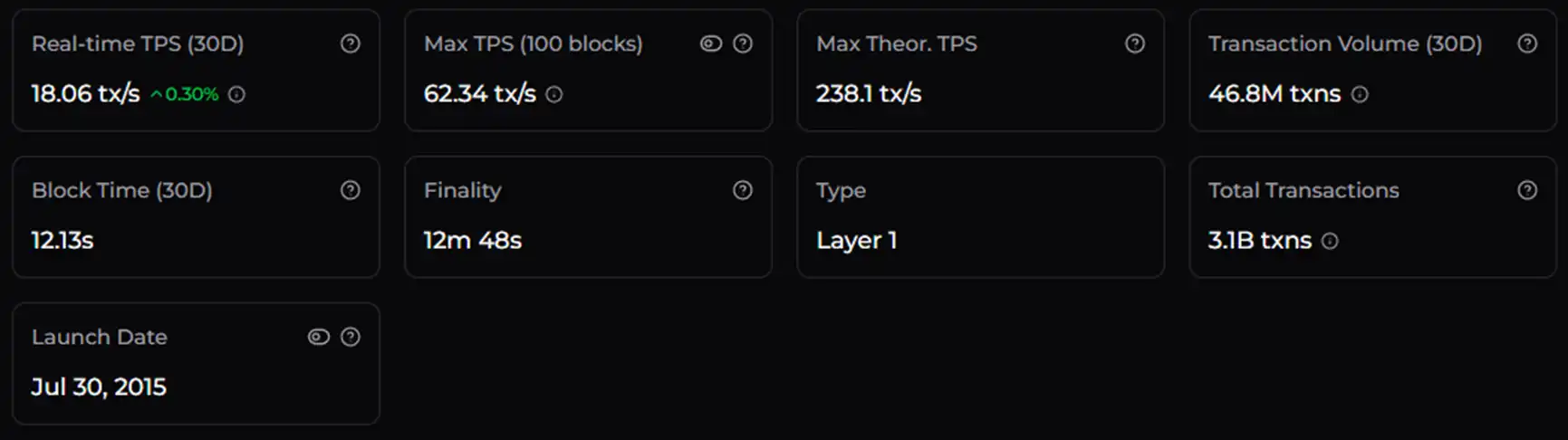

According to Chainspect data, the theoretical TPS peak of the Ethereum mainnet has reached 238.1, while Ethereum's early theoretical TPS peak was only 15. In 10 years, this is nearly a 16-fold increase, akin to a significant upgrade after a decade of development.

PeerDAS, an Important Advancement in Sharding

"PeerDAS in Fusaka is significant because it essentially represents sharding. Ethereum can achieve block consensus without any single node needing to view even a small portion of the data. Moreover, it can resist 51% attacks—it uses client probabilistic verification rather than validator voting. Sharding has been Ethereum's dream since 2015, and data availability sampling has been in progress since 2017; now we have finally realized it."

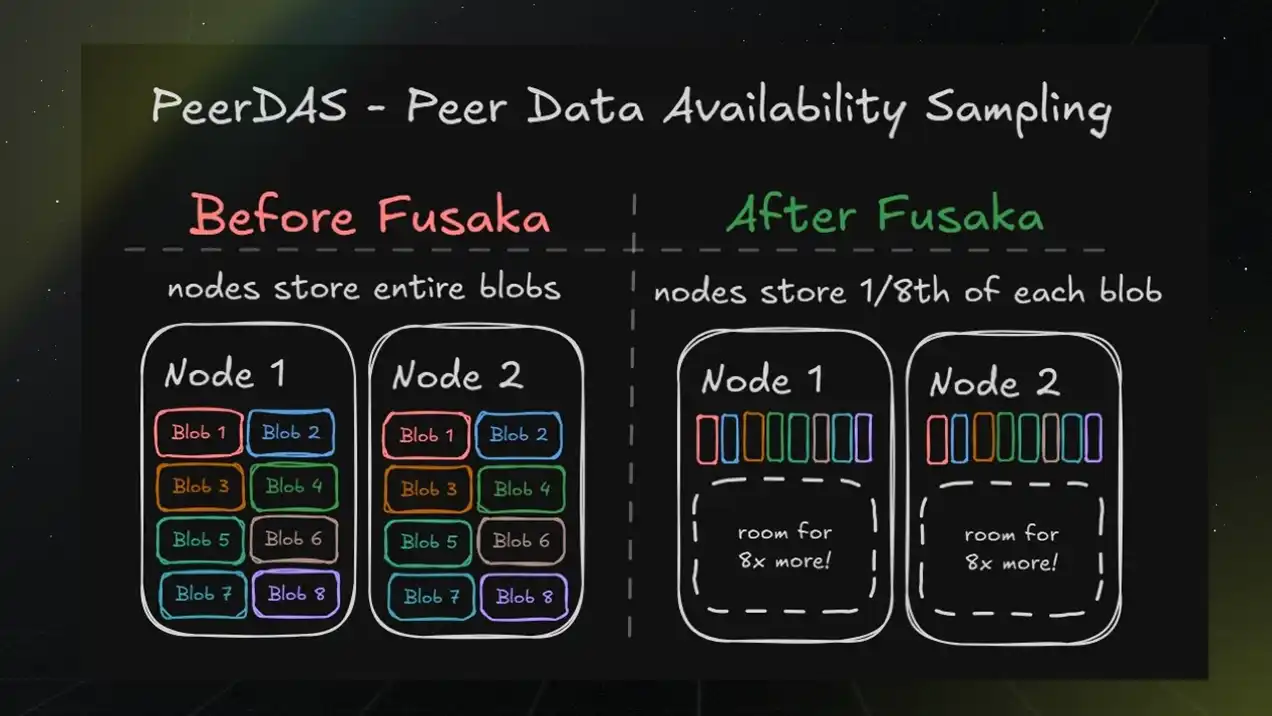

From Vitalik's tweet above, we can sense why PeerDAS is the most focused aspect of the Fusaka upgrade. PeerDAS (EIP-7954) introduces a data availability sampling mechanism that uses KZG proofs, allowing nodes to sample a small portion (1/8) of blob data and compare it with the data held by peer nodes.

This enables Ethereum to increase the blob capacity of each block without increasing the number of nodes, allowing only partial data downloads to verify the validity of L2 transactions. For L2, this not only means a theoretical 8-fold increase in data throughput but also lower blob fees and user costs.

(Image source: @jarrodwatts)

However, Vitalik also pointed out that the sharding mechanism in Fusaka is still imperfect in three aspects:

It can handle O(c^2) transactions at the L2 layer (where c is the computational load per node), but this cannot be achieved on the Ethereum mainnet. To directly enhance scalability for the mainnet, in addition to improvements achievable through constant factor upgrades like BAL and ePBS, a mature ZK-EVM is also needed.*

Proposer/developer bottleneck. Currently, developers need to have all the data and build the entire block. It would be great if distributed block construction could be achieved.

We still need a sharded memory pool.

Vitalik stated that the next two years will continue to refine the PeerDAS mechanism, cautiously scaling it while ensuring its stability, and using it to expand L2. Once ZK-EVM matures, it will be directed towards the Ethereum mainnet to expand the mainnet and continue to improve L1 gas.

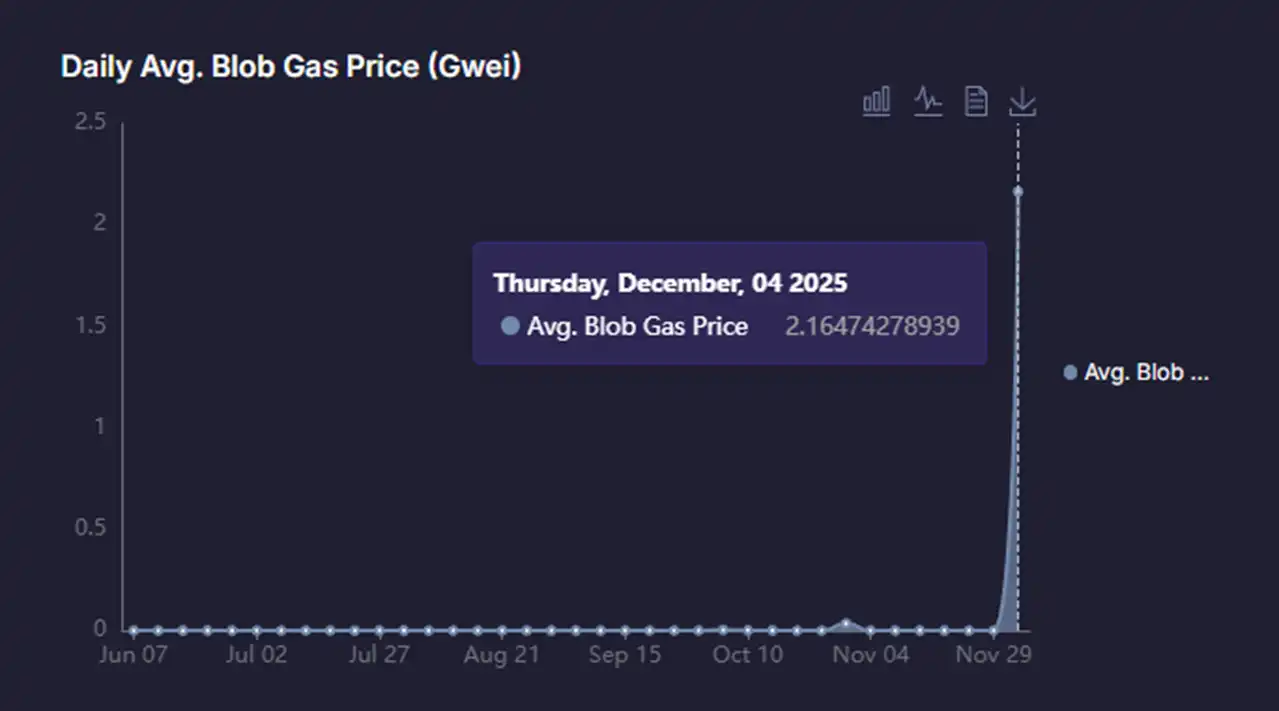

Soaring Blob Fees

Blob gas fees have skyrocketed by tens of thousands of times:

Before the Fusaka upgrade, blob gas was essentially free, as L2s submitting blob data to the mainnet were not set with a minimum fee. When mainnet gas increased, L2s would also stop sending blob data to the mainnet. This meant that the Ethereum mainnet was "working for free" to ensure the security of L2s.

Taking Lighter as an example, they accounted for about 92% of all Rollup L2 TPS in the past day but paid less than $100 in fees to the mainnet. If calculated over a year, their average daily payment to the mainnet was only about $670.

Therefore, it can be said that there was an "incentive misalignment" regarding blob gas fees between the mainnet and L2s. L2s wanted blobs to be as small as possible to reduce user gas fees, while the mainnet wanted blob gas fees to be as high as possible because the mainnet provided security guarantees for L2s.

The EIP-7918 proposal from the Fusaka upgrade linked blob gas fees to the mainnet's gas fees, providing a floor for blob gas fees and making them more stable and predictable. Bitwise analysts stated that after the Fusaka upgrade, the minimum limit for blob gas fees is roughly the mainnet's execution base fee divided by 16, which will create a more stable income and burn flow for the mainnet.

Of course, the actual increase in income and burn for the mainnet will ultimately depend on the specific growth situation of each L2.

This article is from a submission and does not represent the views of BlockBeats.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。