This week's hottest Polymarket event is undoubtedly the sensational market "Who will be the number one person in Google's annual search ranking in 2025?" that took place yesterday. Since the market opened, Pope Leo XIV has consistently held the top position, with a probability stabilizing around 50%; meanwhile, globally recognized figures like Trump, Taylor Swift, and Musk have occupied the narrative center of the entire market—this should have been a list contested by "celebrities."

The vast majority of traders have never seriously looked at the nearly zero-weight options at the bottom of the market: Mikey Madison, Andy Byron, d4vd… Their presence seems to serve only to make the odds table appear richer, and no one would genuinely consider them as potential winners.

The "big player" operating against the trend that no one cares about

A week ago, when everyone was focused on the fluctuations of these star options, one address (0xafEe) began to buy a large position in "d4vd = Yes" at an extremely low price. In prediction markets, price equals probability—and at that time, d4vd's probability was not only extremely low but almost negligible.

To outsiders, this was just an insignificant "lottery position": options with a long-term probability close to zero can yield dozens of times returns if the probability rises to 10%. That trader invested only $20,000 in this position, while his historical trading volume was nearly ten million dollars, making the "lottery position" theory even more convincing.

The truly bizarre actions occurred a week later.

With no knowledge of when Google would release the trending search list, this trader suddenly began to build a large position two days ago. He was not buying "Yes" for popular figures but was frantically sweeping up their "No."

Pope Leo XIV, Trump, Taylor Swift, the newly elected mayor of New York… all the options deemed "likely to win" by the market were denied by him with over a million dollars in real cash.

This operation, completely devoid of hedging logic and ignoring price impact, was entirely inconsistent with the trading logic of a whale, and it didn't even resemble normal investment behavior. People in the market began to notice this counter-trend big player, but more simply regarded him as a "fool with too much money."

A jaw-dropping market reversal

However, just hours after he finished his buying spree, Google suddenly released the annual trending search list. The moment the rankings were announced, the entire market collectively froze—neither the Pope nor Trump topped the list, nor any of the popular options, but rather the name with a long-term probability close to zero, which the trader couldn't even be bothered to research: d4vd.

The market exploded in an instant. Within seconds, d4vd's probability shot up vertically from the bottom of the chart to 99.9%, while all other options instantly dropped to zero. While the market was still trying to understand whether this was a bug in Google's system, someone had already noticed: that trader who had been "randomly operating" made over a million dollars in profit in a single day.

His bet on "d4vd = Yes" won, yielding nearly 20 times returns. All his "popular figures = No" bets also won.

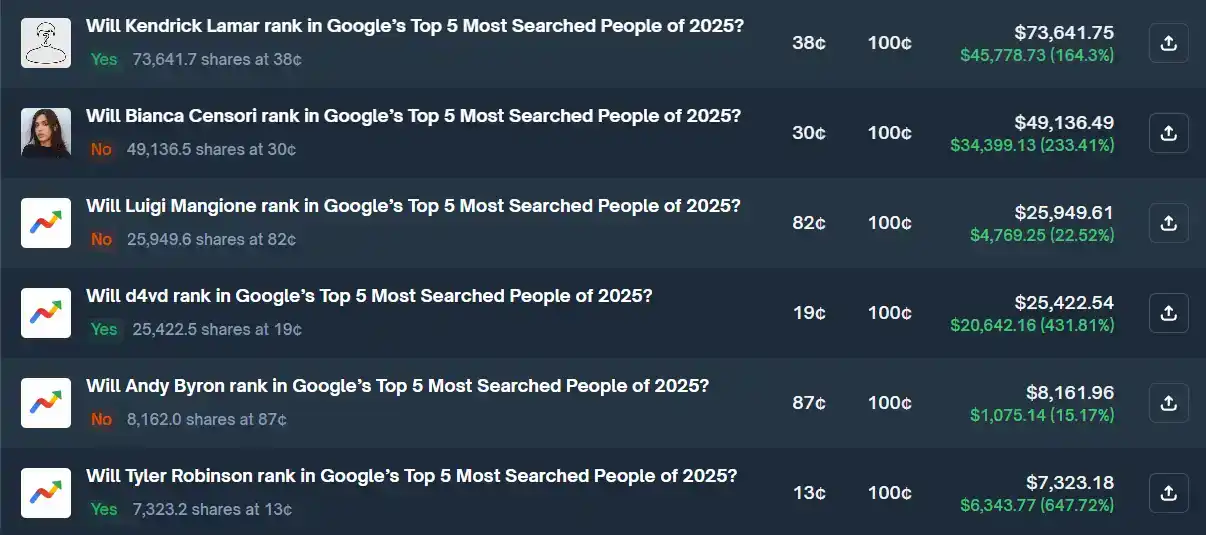

As people continued to scroll through his positions, they discovered: he also won all bets in another nearly identical market "Top 5 Google Annual Trending People in 2025," investing nearly $500,000 across ten positions, with unrealized profits reaching $292,000. He also participated in seven markets regarding the release date of the new Gemini version, investing over $1 million, and still made a profit on all.

In other words, as long as it was related to Google, he seemed to have never made a wrong bet.

The "rewriter" more terrifying than insider trading

As people began to characterize this incident as Google employees profiting from insider information, deeper on-chain tracking pushed this event in a more unsettling direction. Analysis showed that the trader's address was adorableraccoon.eth, and according to on-chain records, he had staked over $15 million in ETH on Aave before November 4.

With on-chain assets exceeding $15 million, this is clearly not the wealth level of an ordinary Google employee. Increasing signs indicate that this person is likely not just an ordinary engineer but a senior executive deeply embedded in Google's core system, possibly with decision-making power.

This raises a more dangerous question: what if he not only knew the results in advance but could also manipulate them?

Google's annual trending search list is not solely determined by the total search volume but relies on a set of internal algorithms highly sensitive to instantaneous search surges. Theoretically, as long as one understands the parameters, weights, and thresholds of the algorithm, they can easily push a name to "rise" on the list. For a truly authorized Google executive, making a name explode to the top is not an impossible task. Within this framework, prediction markets are not merely tools for forecasting the future but can be used by certain individuals to create future arbitrage instruments through a hidden decision-making chain.

If this high-ranking Google executive indeed possesses the ability to control the algorithm, then all prediction markets related to Google are not just channels for him to cash in on information asymmetry; if he wishes, he could even "fine-tune" the world line like adjusting an algorithm, steering it in the direction most favorable to himself.

Conclusion

A person with core decision-making power has publicly demonstrated for the first time in the open market that he can transform prediction markets from "settlement platforms for information asymmetry" into "tools for altering reality."

Prediction markets have always been viewed as a reverse search for truth, driven by collective wisdom; and in this event, it has been proven for the first time that they can be manipulated by certain individuals with system privileges to alter the world line.

He is betting not just on the future but on the future he can create.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。