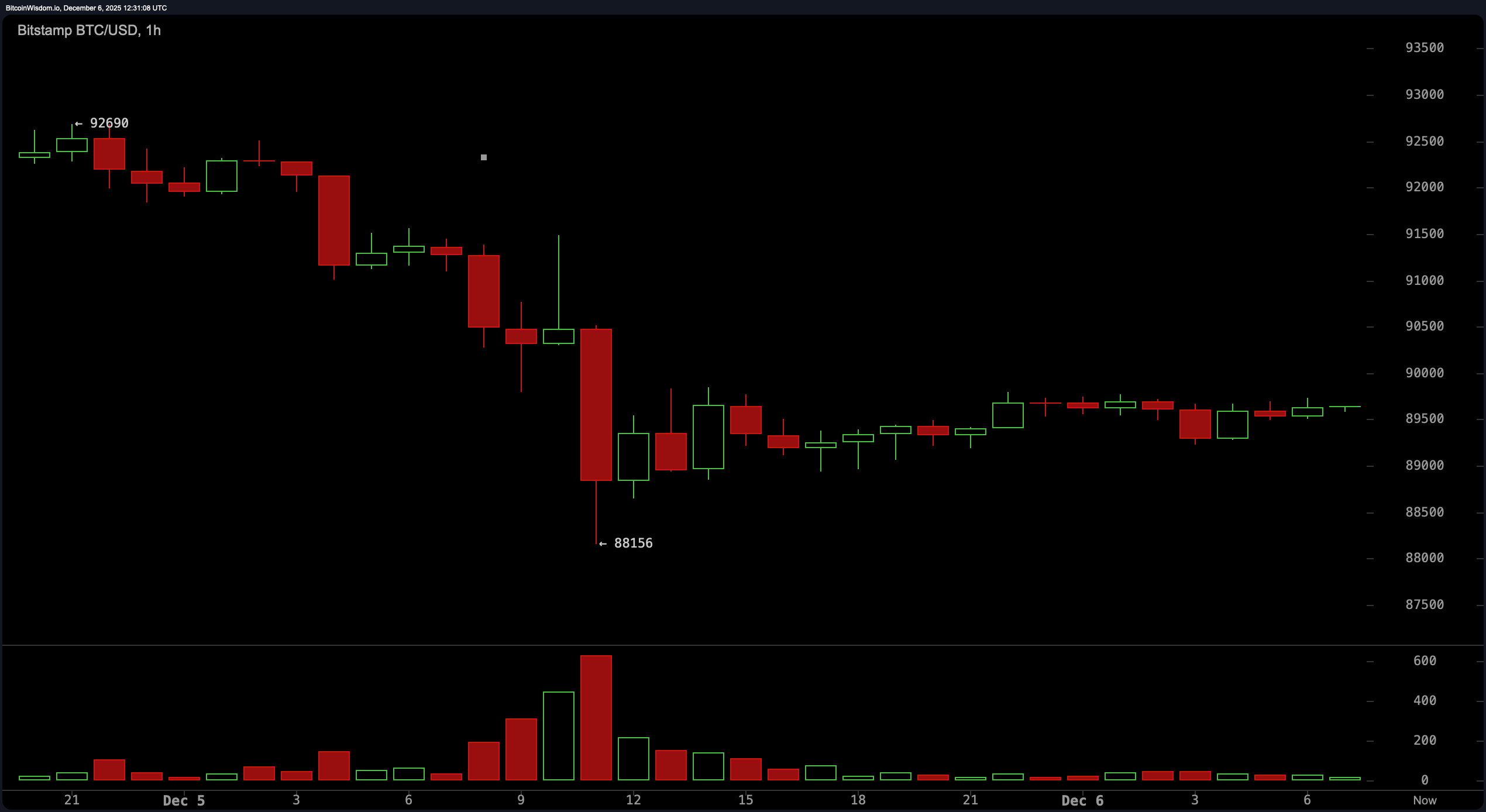

The hourly chart gives us a polite shrug. Bitcoin recently attempted to reclaim momentum after being rejected at $92,600, only to stumble back to $88,100. Since then, the price has meandered sideways between $89,200 and $89,900, with all the enthusiasm of a sleepy Sunday afternoon.

Volume is notably light, signaling indecision or possibly apathy. If price manages to break above $90,000 with volume, then a move toward $91,000 to $91,500 becomes more plausible. But if it slips below $88,000 with conviction, it could mean we’re in for another slide.

BTC/USD 1-hour chart via Bitstamp on Dec. 6, 2025.

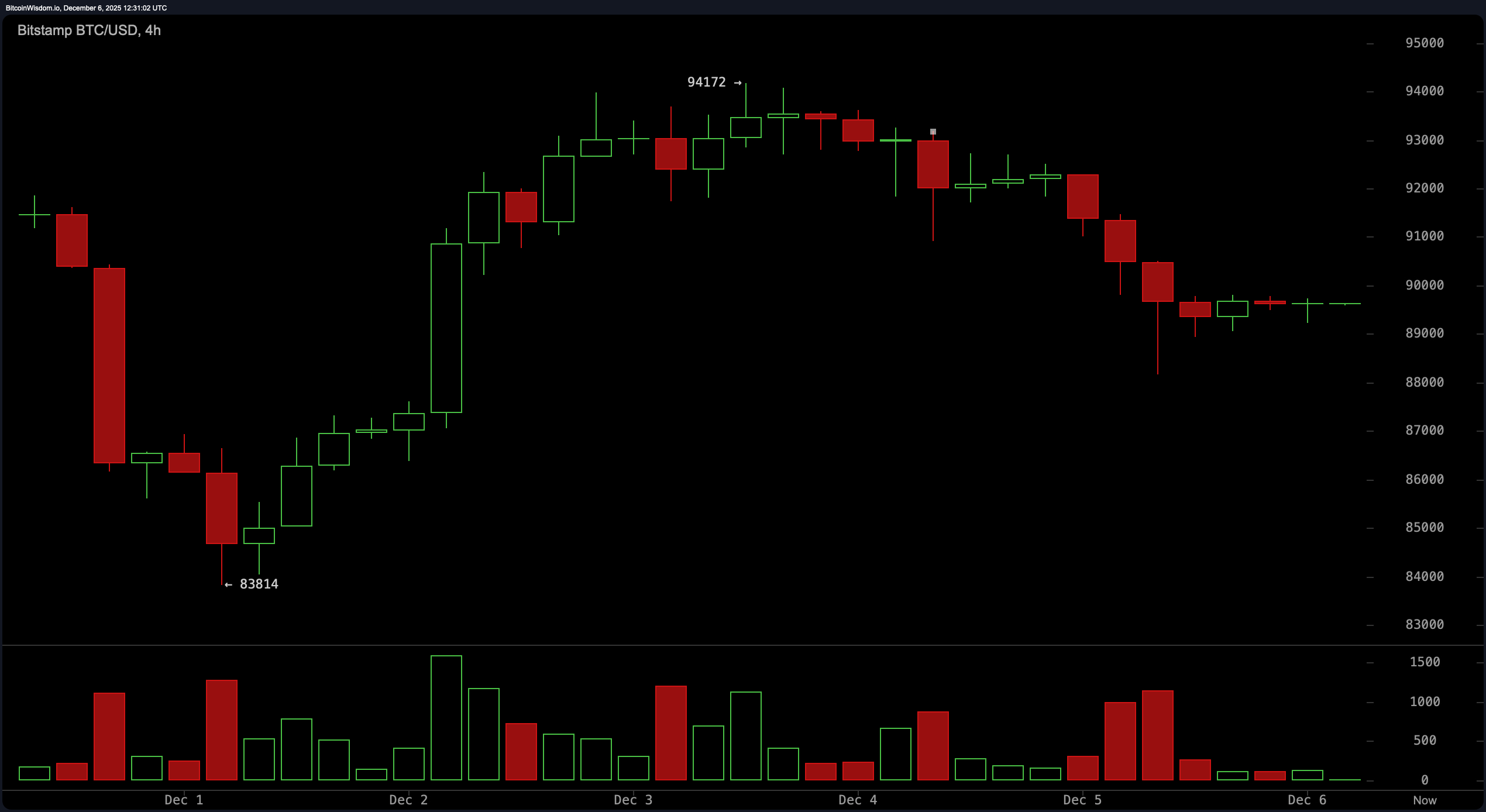

On the 4-hour chart, a rounded top has formed—never a good hairstyle, and rarely a good sign in price action. After rebounding from $83,800 to $94,000, bitcoin began a soft decline back to the $88,000 to $90,000 zone. While that sounds calm, the structure whispers “fatigue.” A break above $91,500 with accompanying volume would mark a shift toward optimism. But another rejection near $93,000 or a failure to hold above $88,500 could open the gates to revisit $85,000—or worse, $80,537, where capitulation was previously observed.

BTC/USD 4-hour chart via Bitstamp on Dec. 6, 2025.

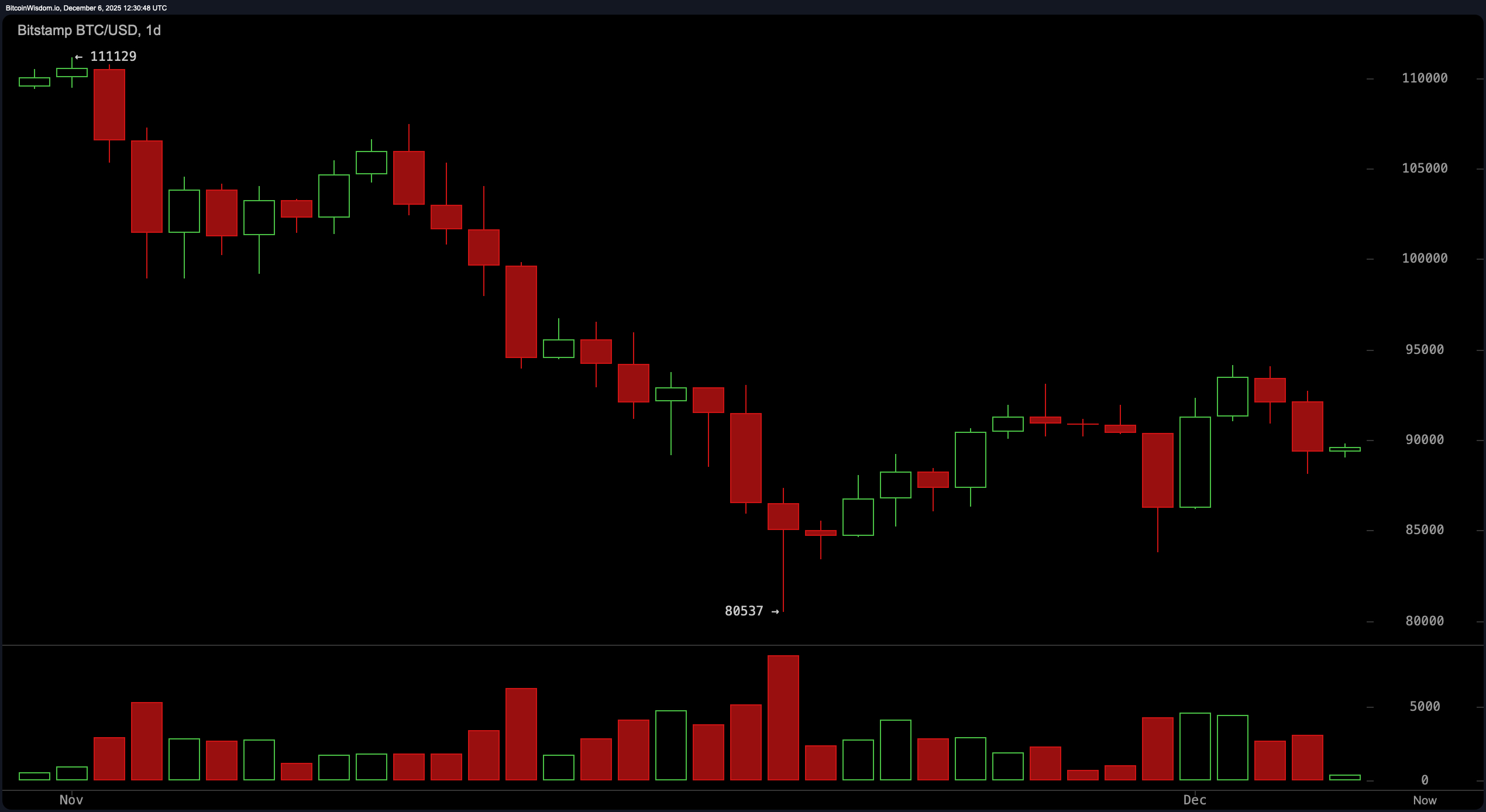

The daily chart doesn’t sugarcoat it: Bitcoin is still healing from a sharp downtrend that dropped it from around $111,000 to a low of $80,537. A modest relief rally ensued, but the latest price action around $90,000 reflects a consolidation phase, not a triumphant return. Rejection at $95,000, where the last upward push fizzled, has kept traders cautious. Until bitcoin closes above that level with strong volume, the trend remains technically unbroken. This is a market waiting for proof—not promises.

BTC/USD daily chart via Bitstamp on Dec. 6, 2025.

Oscillators are offering the emotional support of a lukewarm cup of coffee. The relative strength index (RSI) clocks in at 43, indicating neutral momentum. The Stochastic oscillator reads 65, also neutral. The commodity channel index (CCI) sits at a limp 0. Meanwhile, the average directional index (ADX) shows a value of 35—strong enough to suggest a trend exists, but without revealing who’s driving. The Awesome oscillator at -3,658 and the momentum indicator at -848 hint at fading strength. The moving average convergence divergence (MACD) is the lone optimist, registering a -2,422 level with a bullish signal.

Moving averages, on the other hand, have taken a decidedly skeptical stance. Every single exponential moving average (EMA) and simple moving average (SMA) from 10-period to 200-period—with the lone exception of the 20-day SMA—registers a bearish alignment. Notably, the 200-period SMA stands far above at $109,295, pointing to how far bitcoin has drifted below its long-term trajectory. The 10-day EMA and SMA hover just above $90,000, suggesting short-term resistance isn’t letting go without a fight.

So where does that leave us? Statistically, the probability of a bullish reversal from this structure, at least today, is about 35%—an underdog, but not without hope. Bears still hold the higher ground, with a 65% chance of forcing a retest of the recent lows if bitcoin fails to hold above key support at $88,000. Should the asset break $95,000 with strength, odds flip quickly in favor of a trend change. Until then, every candle tells the same story: hesitation, not conviction.

Bull Verdict:

If bitcoin holds the $88,000–$90,000 support band and breaks decisively above $91,500—followed by a volume-backed push past $95,000—it could signal the early stages of a trend reversal. Confirmation above $100,000 would cement a new bullish phase. Until then, the bulls are tiptoeing, not charging.

Bear Verdict:

Failure to defend the $88,000 level—especially on strong volume—opens the door to retests of $85,000 and potentially the previous low at $80,537. A break below that would solidify the continuation of the broader downtrend, with downside targets potentially extending toward $78,000 or even $74,000. The burden of proof remains squarely on the bulls.

- What is bitcoin’s current price?

As of December 6, 2025, bitcoin is priced at $89,618. - Is bitcoin in a bullish or bearish trend?

Bitcoin remains in a downtrend, with slight bullish signals emerging. - What are the key support and resistance levels for bitcoin now?

Support sits around $88,000; resistance holds near $95,000. - How likely is a bitcoin trend reversal soon?

Current technicals suggest a 35% probability of a bullish reversal.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。