Written by: diego_defai

Translated by: Baihua Blockchain

DeFi (Decentralized Finance) was the "next big trend" of 2020, attracting thousands of new users into the crypto space. Unfortunately, since then, we have yet to see another true moment of mass adoption in the industry.

You might say that prediction markets play a similar role today, but anyone who experienced 2020 knows that the fervor is nowhere near what it was back then.

My theory is that AI agents will be the next big trend because they will ultimately make cryptocurrency and DeFi more accessible to everyone, thereby lowering the barrier to entry into our industry.

In this article, I will explain why I firmly believe this and share with you the top AI agent projects for each specific use case.

Agents are what the crypto space needs

Aside from Bitcoin ($BTC) gradually becoming the "new gold" and a means of digital value storage, the rest of the blockchain technology has been struggling to achieve the long-awaited mass adoption.

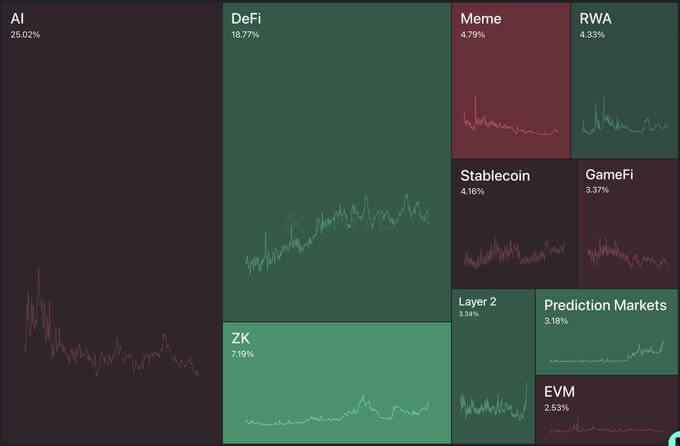

As mentioned in the introduction, we have not yet seen another moment of mass user influx since the birth of DeFi. However, if we had to identify categories that have performed well in recent months, they are:

Stablecoins: Centralized solutions like $USDT and $USDC have won the competition.

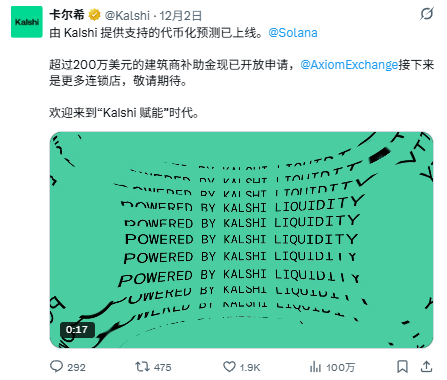

Prediction Markets: Dominated by @Polymarket and @Kalshi.

Understanding why and how these products have achieved a certain level of adoption will help us grasp why the crypto space needs agents.

The value proposition of stablecoins is clear: having a digital dollar accessible to everyone globally. More importantly, it's super easy to acquire them. Nowadays, fiat on-ramp solutions are everywhere, and stablecoins can even be used as savings accounts in mobile applications.

The situation with prediction markets is similar. If you've used them, you know they feel like a Web2 application. No Web3 wallets, no complex on-chain transactions, and no need to pay blockchain fees. Simplicity is key.

Solutions to democratize cryptocurrency – Simplifying user experience (UX) through AI agents

"DeFi should be finance for everyone. Open, permissionless, and fair. But that is not the reality of DeFi in 2025."

A term that became popular a few months ago is "AgentFi." This refers to a range of on-chain financial products that utilize agents to simplify processes.

An example? An stablecoin agent could transfer your $USDC across different blockchains to find you the best APY (Annual Percentage Yield) around the clock.

Another example? An AI agent helps traders find the best Alpha (excess returns) by analyzing on-chain trends, community sentiment (CT sentiment), token distribution, and technical analysis.

If we are to achieve mass adoption, we must simplify the crypto space, and we can do this by letting AI agents handle some of the work.

Top projects in the AgentFi narrative

"If you continue to operate manually, you will fail." Humans are simply not suited for a 24/7 market. Agents are. The sooner you accept this, the more profitable you will be.

Based on this idea, I would like to introduce you to the top projects in the AgentFi space, categorized by the use cases they aim to address:

Stablecoin agents for passive APY

Use case: Imagine an agent controlling your stablecoins and deploying them to different protocols and blockchains whenever new yield opportunities arise.

Top projects:

@ZyfAI_: Its multi-chain stablecoin agent can autonomously move stablecoins on Arbitrum and Base, optimizing APY to even reach +15% APY.

@SaildotMoney: Another multi-chain stablecoin agent operating on Base and Arbitrum, notable for its ability to split your stablecoin allocation across different protocols.

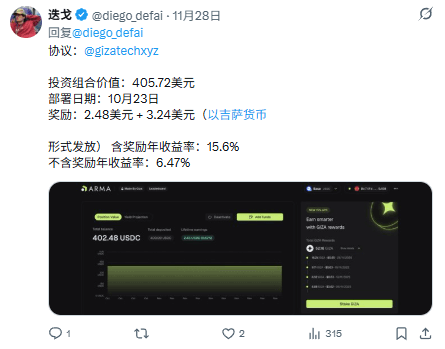

@gizatechxyz: One of the pioneers in this field, it is the first platform capable of managing institutional capital. They offer all users depositing $USDC a fixed 15% APY.

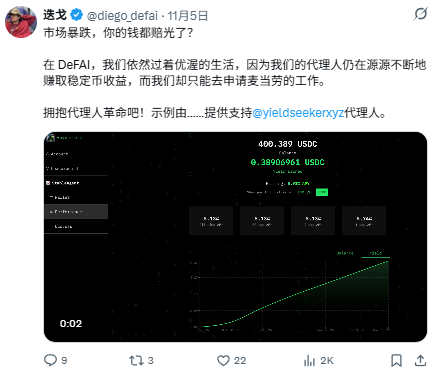

@yieldseekerxyz: The agent manages your $USDC on Base and provides passive APY. Currently, it distributes points to all deposit users, so you are also "farming a potential airdrop."

Creating complex DeFi strategies through agents

Use case: What if you could automate complex trading and DeFi strategies with the help of AI agents?

Top projects:

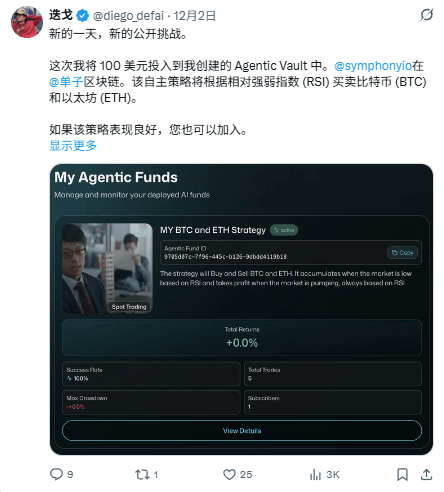

@symphonyio: A framework that allows you to create "Agent Vaults," where agents execute different on-chain strategies. Currently operating on @monad.

@HeyAnonai: An integrated terminal that allows users to chat with AI agents and automate complex on-chain processes (from trading to DeFi LP strategies) through ChatGPT-like interface prompts.

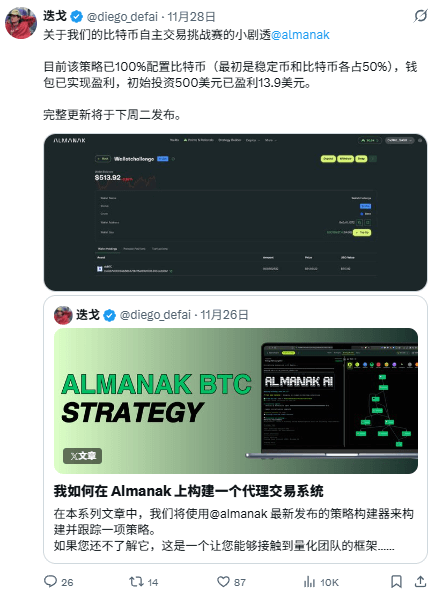

@almanak: Just released the Strategy Builder, allowing users to create: autonomous trading strategies or autonomous LP strategies.

@glider_fi: A DeFi portfolio automation tool that uses AI to allow users to create simple yet highly useful personalized investment indices, such as the "Big Five" strategy ($BTC, $ETH, $SOL, $XRP, and $DOGE).

AI agents as trading companions

Use case: Trading is one of the biggest use cases in the crypto space, and AI agents can be used to improve win rates and enhance the overall trading experience.

Top projects:

@Velvet_Capital: A trading terminal with various AI features that helps traders complete the entire process from research to execution.

@Cod3xOrg: If you already have a strong trading belief, that's great. You input your trading thesis, and the agent provides insights and can even operate autonomously based on that.

@modenetwork: Launched the Mode AI trading agent, which is a 100% autonomous entity that trades for you. You just need to decide which markets to allow the agent to trade, the maximum leverage, and then deposit stablecoins into the agent's wallet.

@FigmentTrade: A new framework that allows anyone to create autonomous trading agents in minutes. Interestingly, once the agent starts trading, it will continuously share the reasoning behind each trade, addressing the trust issue of trading agents operating as "black boxes."

Prediction agents help you bet better

Use case: Similar to trading agents, prediction agents assist users in making better predictions and can even fully automate the entire process.

Top projects:

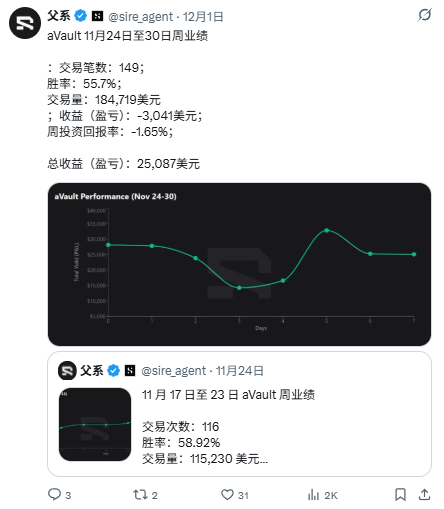

@sire_agent: An autonomous prediction agent that bets on various sports markets. Since its deployment, its win rate has remained at 55-58%.

@polybroapp: Like ChatGPT for prediction markets: you can ask it to analyze any prediction, and it will provide you with the probability percentages of different outcomes.

@SemanticLayer: The first framework that allows agents to trade autonomously on Polymarket using the x402 standard, now evaluating the best AI models used in prediction markets through its "Prophet Arena" (with @grok currently winning).

@aixbet_ai: A prediction terminal that provides high-quality, AI-driven cross-market insights. It tracks sentiment, capital flows, and other indicators.

Tracking the entire AgentFi space

The above is just a small portion of all the agents currently available. Over the past few months, I have created a spreadsheet to track all agents and categorize them by their use cases.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。