Written by: Wenser (@wenser2010), Planet Daily

As 2025 comes to a close, it also means that the time until the current Federal Reserve Chairman Jerome Powell "steps down" is getting closer, and speculation about the candidates for the new Federal Reserve Chairman continues.

According to previous reports from U.S. Treasury Secretary Scott Bessent here, the list of candidates has now narrowed down to five, including "Trump faction figure" Kevin Hassett and hawkish Kevin Warsh. The final winner among these five candidates will take charge of the Federal Reserve, the "heart of the U.S. economy and finance," for the next few years.

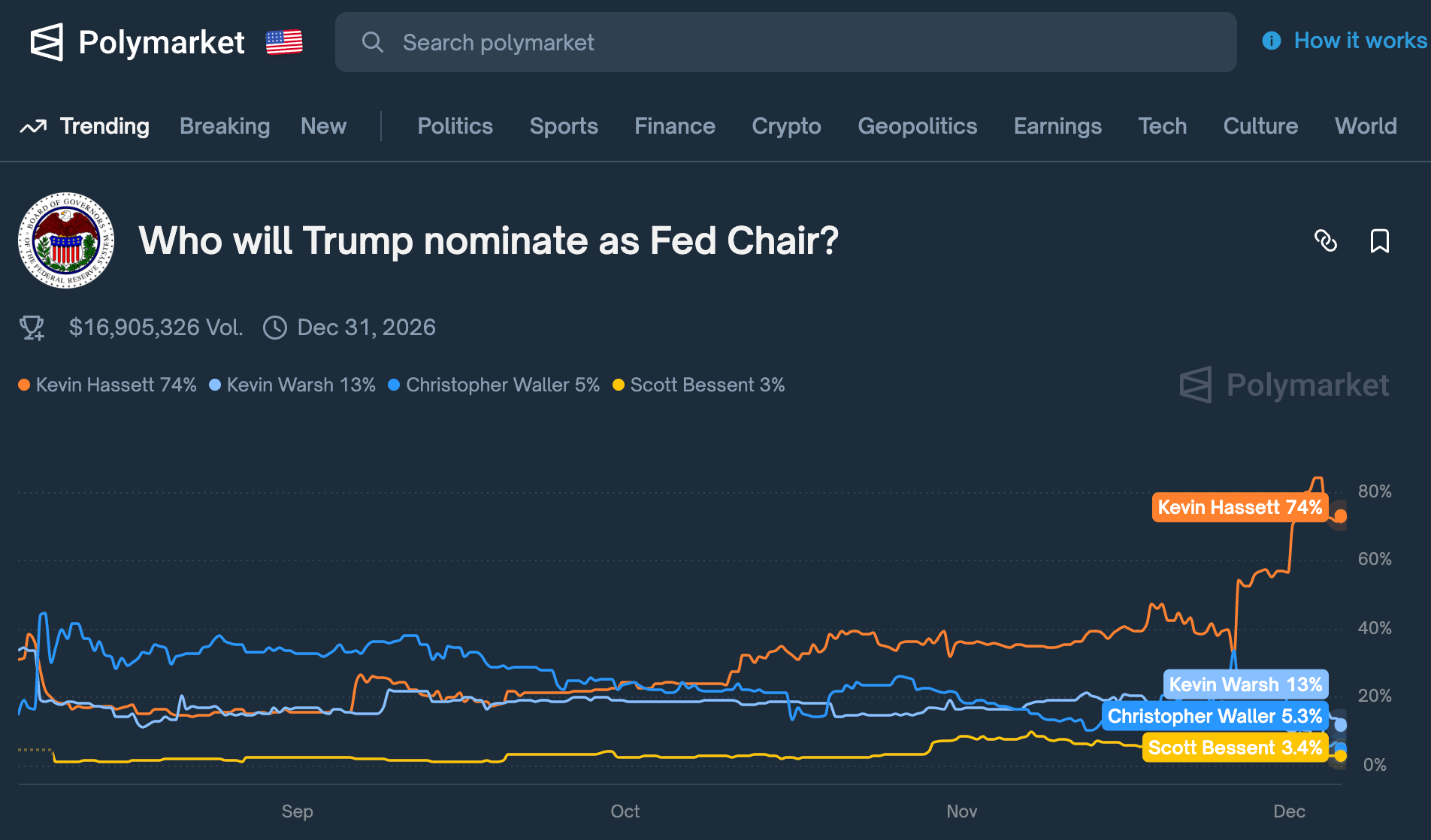

Although Hassett currently leads with a 74% probability in the Polymarket event "Trump's Nomination for Federal Reserve Chairman", considering Trump's past erratic behavior, the final outcome remains uncertain until it is officially announced. Odaily Planet Daily will provide a brief introduction to the existing five candidates for the Federal Reserve Chairman in this article for readers' reference.

Elimination Round for New Federal Reserve Chairman Candidates: From 11 to 5, and then Selecting 1

In August of this year, when the Trump administration was evaluating candidates for the new Federal Reserve Chairman, the list still included 11 names.

At that time, Treasury Secretary Scott Bessent stated that the review would start in September, and the candidates were all "very strong contenders." Among them, Jefferies Chief Market Strategist David Zervos, BlackRock Global Fixed Income Chief Investment Officer Rick Rieder, and Federal Reserve officials Christopher Waller and Michelle Bowman all held an open attitude towards cryptocurrencies.

By the end of October, the candidate list had been narrowed down to five, with three of the previously mentioned "crypto-friendly" candidates—BlackRock executive Rick Rieder, Federal Reserve officials Christopher Waller and Michelle Bowman—still on the list. This indicates that Trump administration officials continue to adhere to the "crypto-friendly" standard in selecting candidates for the Federal Reserve Chairman. As for former Federal Reserve Governor Kevin Warsh, he has drawn attention for his hawkish style, perhaps only serving as a "prince's companion" to show fairness.

On December 1, Trump stated emphatically, "I know who I want to choose as the Federal Reserve Chairman, and I will announce it soon." Combined with previous information released by Treasury Secretary Scott Bessent, Trump's choice is expected to be revealed before Christmas. Below is a basic introduction to the existing five candidates for the Federal Reserve Chairman, compiled by Odaily Planet Daily for readers' reference.

"Top Contender": Kevin Hassett, Director of the National Economic Council, Trump Faction Figure, Crypto Friendliness: High

At the end of November, informed sources revealed that as the selection process for the new Federal Reserve Chairman entered its final weeks, National Economic Council Director Kevin Hassett had become the top contender to take over the Federal Reserve in the eyes of the White House advisory team and Trump's allies.

The reason is simple: based on current information, if Hassett is nominated, he would become Trump's "dovish nail" embedded in the independent central bank of the Federal Reserve, bringing Trump's rate-cutting philosophy into the Federal Reserve from a top-level planning perspective, which is precisely one of the criticisms Trump had against the current Federal Reserve Chairman Powell.

As the most direct way for a U.S. president to influence central bank decisions, the selection of the Federal Reserve Chairman and board members has always been regarded as "one of the greatest powers in the president's hands." During Trump's first term, Powell was nominated by him, and when the latter failed to advance rate cuts as expected, Trump expressed deep regret over that decision.

In the field of economic policy, Hassett is undoubtedly a loyal supporter of Trump and a vocal "rate cutter." He previously stated that if he were to lead the Federal Reserve, "he would immediately implement rate cuts," because "the data supports this decision." He also mentioned, "If I were to lead the Federal Reserve, hiring top global forecasting experts who can build nonlinear time series models would be a wise investment. I believe that leaders with this understanding will help the Federal Reserve achieve better development."

Additionally, his friendly attitude towards the crypto market, viewing Bitcoin as a tool to hedge against inflation, may promote a relaxation of regulations on the crypto market. According to Bloomberg's report in June this year, due to his role as an advisor to the U.S. cryptocurrency exchange Coinbase, Hassett holds Coinbase stock valued at least $1 million, potentially up to $5 million.

"Hawkish Candidate": Kevin Warsh, Former Federal Reserve Governor, Crypto Friendliness: Low

As a former government official who served as a Federal Reserve Governor from 2006 to 2011, Kevin Warsh has experience dealing with the 2008 financial crisis; additionally, he has served as a researcher at the Hoover Institution, with personal policy positions leaning towards hawkishness, favoring interest rate tightening and prioritizing inflation prevention, and advocating for a reduction in the central bank's balance sheet. Undoubtedly, he does not belong to the "rate-cutting faction," and therefore, despite being one of the key figures in the Republican economic circle, he does not align closely with Trump's economic policy stance.

As for his attitude towards cryptocurrencies, his public statements have been somewhat contradictory.

In an interview with CNBC in early 2021, he stated, "In a situation where the dollar is weakening, Bitcoin makes sense as part of an investment portfolio." In 2022, he also invested in BTC and ETH ETFs through major asset management firm Bitwise. By this logic, he could be considered a "crypto-friendly person," but unlike Trump, he does not openly oppose CBDC (Central Bank Digital Currency) and instead supports the digital dollar.

It is worth mentioning that he previously worked as a VP/ED in Morgan Stanley's M&A department, and during the 2008 financial crisis, Kevin Warsh served as a bridge between the Federal Reserve and Wall Street, mediating between government agencies and capital giants.

Last November, Trump once considered Kevin Warsh for the position of Treasury Secretary, with the intention of later succeeding him as Federal Reserve Chairman. However, Scott Bessent ultimately became the best candidate.

"Neutral Figure": Christopher Waller, Current Federal Reserve Governor, Crypto Friendliness: Medium

As the current Federal Reserve Governor, Christopher Waller's policy stance leans towards a moderate dovish approach, supporting gradual rate cuts. He has publicly stated that digital assets can serve as a complement to payment tools and opposes CBDC, believing that stablecoins can enhance the dollar's position under proper regulation.

Waller's prudent style may limit the occurrence of significant monetary policy easing, and relatively speaking, there will not be the large rate cuts that Trump hopes for or the continued tightening policies maintained by hawkish figures.

However, compared to others, Waller does not have a background in large investment banks or major investment funds; his main active areas are concentrated in academia and the Federal Reserve. In the post-pandemic monetary policy landscape, he is primarily recognized by Wall Street as a neutral-to-hawkish Federal Reserve Governor, with limited connections to Wall Street, demonstrating a degree of independence.

Additionally, it is worth noting that due to Hassett's high profile, there has been strong opposition from Wall Street and insiders in the U.S. business community, leading to a collective effort to prevent Trump from nominating Hassett as the new Federal Reserve Chairman in order to safeguard the independence of the Federal Reserve. Waller is therefore seen as a potentially suitable candidate, and his current position as a Federal Reserve Governor means that if he is nominated by Trump, he would only need one round of nomination voting to be elected.

"Financial Giant": Rick Rieder, Current Executive at BlackRock, Crypto Friendliness: High

As the Chief of Global Fixed Income at BlackRock, Rick Rieder directly controls the allocation of trillions of dollars in funds, with no background as a career politician, no experience as a Federal Reserve Governor, and no government department political experience. He has previously been viewed as one of the "king of bonds" due to his donation records to the Republican Party. His monetary policy stance is slightly dovish. He emphasizes that the Federal Reserve should remain cautious and flexible after reaching a neutral interest rate.

Of course, as a current executive at BlackRock, his friendly attitude towards cryptocurrencies is beyond doubt. He has previously stated that "Bitcoin is the gold of the 21st century," believing that in an environment where traditional asset correlations are converging, cryptocurrencies have unique hedging and risk-averse value.

However, given his Wall Street capital background, it is difficult to gain sufficient political support in the current political environment. After all, to some extent, the Federal Reserve needs to maintain its political and economic position as an independent central bank, which naturally conflicts with Wall Street capital. After all, it is unreasonable to expect the Federal Reserve to be at the mercy of Wall Street figures. Therefore, his chances of taking office are relatively low.

"Transparent Companion": Michelle Bowman, Current Federal Reserve Governor, Crypto Friendliness: Medium

As the current Federal Reserve Governor, Michelle Bowman was previously labeled as hawkish by Democrats for "speaking for big banks," but now her public statements tend to be more neutral to dovish in monetary policy.

In August of this year, she stated, "Considering concerns about the vitality of the job market and the overall U.S. economy, there should be three rate cuts this year." She worries that further delaying rate cuts may "lead to a deterioration in the job market and further slow economic growth."

In October of this year, he stated emphatically: "I continue to expect two more rate cuts before the end of the year."

Additionally, his family owns a small bank, and he has previously served as the bank's director. He has also criticized regulatory agencies for being overly cautious in their regulation of cryptocurrencies, advocating for "deregulation" for banks and the regulatory system.

Despite this, considering his personal banking background and earlier statements, he is likely to be a runner-up in the Federal Reserve Chairman nomination.

As of the time of writing, the "Trump's Nomination for Federal Reserve Chairman" event on Polymarket** shows the following probabilities:**

- Hassett: 74%

- Kevin Warsh: 13%

- Christopher Waller: 5.3%

- Scott Bessent: 3.4%

- Rick Rieder: 2.9%

- Michelle Bowman: 1.6%.

Will Polymarket successfully reveal this year's new Federal Reserve Chairman nominee, just as it successfully predicted Trump's victory in the U.S. presidential election last year? Let's wait and see.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。