Written by: Eric, Foresight News

How many developers does a company with a market value of $2 trillion need? What are the development costs?

According to public data estimates, among the U.S. listed companies currently valued over $2 trillion, the number of technical or development personnel ranges from a few thousand to over ten thousand, with annual salary expenditures reaching hundreds of millions or even tens of billions of dollars.

For Bitcoin, which once reached a market value of $2.5 trillion and still has a market value of nearly $1.75 trillion today, these two figures are $41 million and $840 million, respectively. Yes, this absolute "big brother" in the cryptocurrency field has only 41 core developers in its core development organization, supported by several million dollars in donations each year and salaries from a few companies.

1A1z conducted dozens of hours of interviews and research, releasing a report that reveals the mysterious team behind Bitcoin Core and its sponsors. This report, published last October, showcases the full picture of Bitcoin's development team and donors for 2023 and 2024. Although it may seem slightly outdated, the changes in Bitcoin's developer system occur on an annual basis, and even today, it remains almost unchanged from the time of the report's investigation.

The purpose of this report is to inform participants that Bitcoin is still "fragile" to some extent while the world focuses on its price. As possibly the only truly decentralized project, each of us can contribute to it. Thanks to X user Aaron Zhang for interpreting the report and providing the latest information for 2025.

The Most Efficient Distributed Team in the World

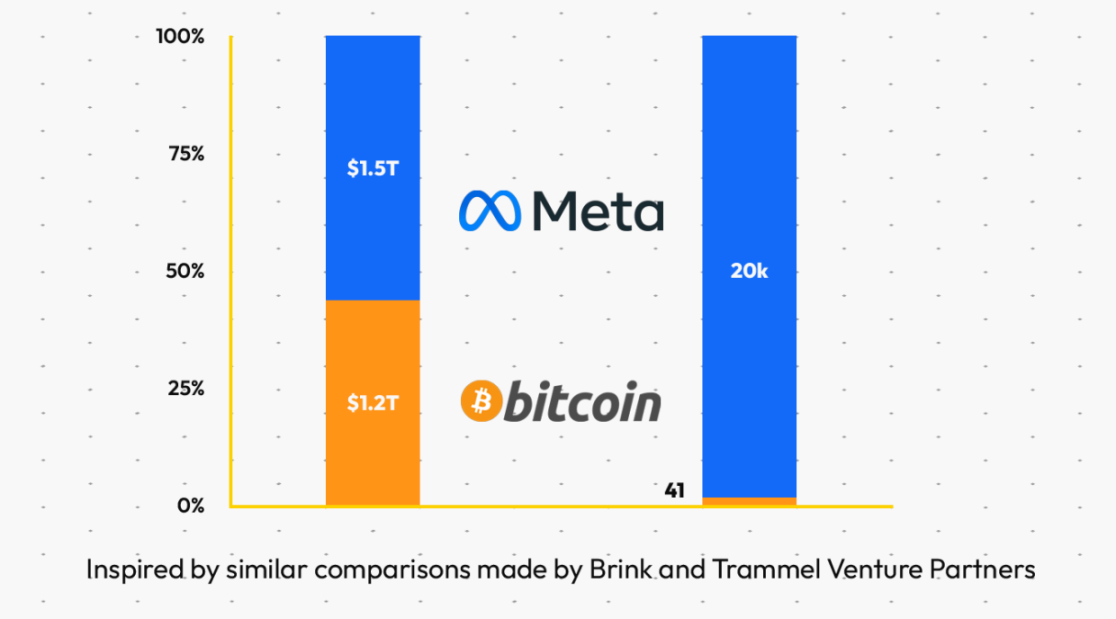

The first chart in the report illustrates the difference between Bitcoin and technology companies with similar market values:

In 2023, Meta had at least 20,000 developers, with a market value of about $1.5 trillion, while Bitcoin, with a market value of $1.2 trillion at the same time, had only 41 people. These 41 developers contribute code to Bitcoin Core, commonly referred to as Bitcoin core developers. Among the 41 core developers, there are 5 special maintainers who are the only five people in the world authorized to merge improvement proposals from core developers into Bitcoin Core.

It is worth noting that only 13 people have held this position in the past decade, and we will discuss the stories of these 13 individuals later.

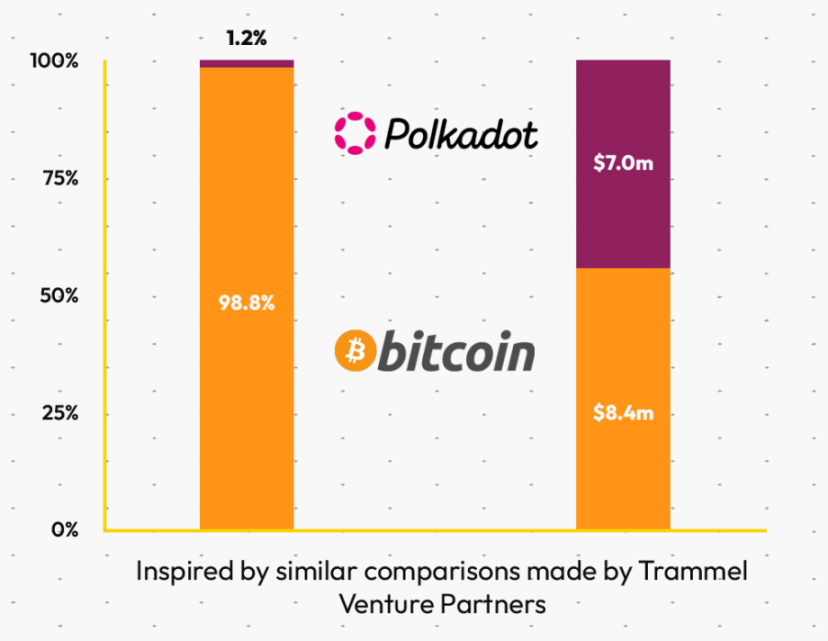

If you think Bitcoin and publicly listed companies are not comparable, the report also uses Web3 projects for comparison. Taking Polkadot as an example, in 2023, Polkadot's expenditure on core developers reached $7 million, but its market value was only 1.2% of Bitcoin's. In 2024, Polkadot's expenditure on activities similar to Bitcoin development rose to $16.8 million. Meanwhile, Ethereum's expenditure on core developers was approximately $32.3 million in 2023 and $50 million in 2024.

The number of people contributing to Bitcoin's code is certainly not limited to these 41 individuals. The figures provided in the report only cover those who directly contribute code to Bitcoin Core, excluding testing engineers, researchers, and others, as well as protocols like the Lightning Network and Nostr. Even the libsecp256k1 library, which is closely related to Bitcoin Core, is not included in the calculations.

The numerical "contrast" indeed reflects Bitcoin's strong "antifragility." Bitcoin lacks the standard foundation organizations of other projects, which means it does not have the financing and resource allocation capabilities of other projects. However, the author believes that this is precisely why Bitcoin does not rely on a single entity for decision-making and does not face issues of fund misuse; every penny is spent wisely: "Bitcoin's resolute resistance to any form of centralization or single point of failure is what makes it unique and is the only way we believe Bitcoin can succeed."

I once asked a question during an early interview with an investment institution: What is the value of a decentralized DAO in Web3, given its inefficiency and the difficulty in reaching consensus on simple matters? The response was that inefficiency is one of the operational modes of this system, as achieving broad consensus on a matter cannot be efficient. This seemingly mindless inefficiency of "democracy" is precisely where its value lies.

At this point, you might think the report itself resembles a "hymn" to Bitcoin. Perhaps these data reflect some resilience of Bitcoin, but this resilience is, to some extent, a helpless choice under a high degree of decentralization. In other words, as the author wants to express, Bitcoin Core is fragile, and our attention and investment in this trillion-dollar empire that has allowed many to leap across classes overnight are still insufficient at the protocol level.

Who Funds Bitcoin Core Developers?

The report's author makes a strict distinction between sponsors and donors. To clarify the difference, I believe sponsors are more inclined towards execution, such as ensuring funds are allocated to designated developers, while donors play the role of "financial backers."

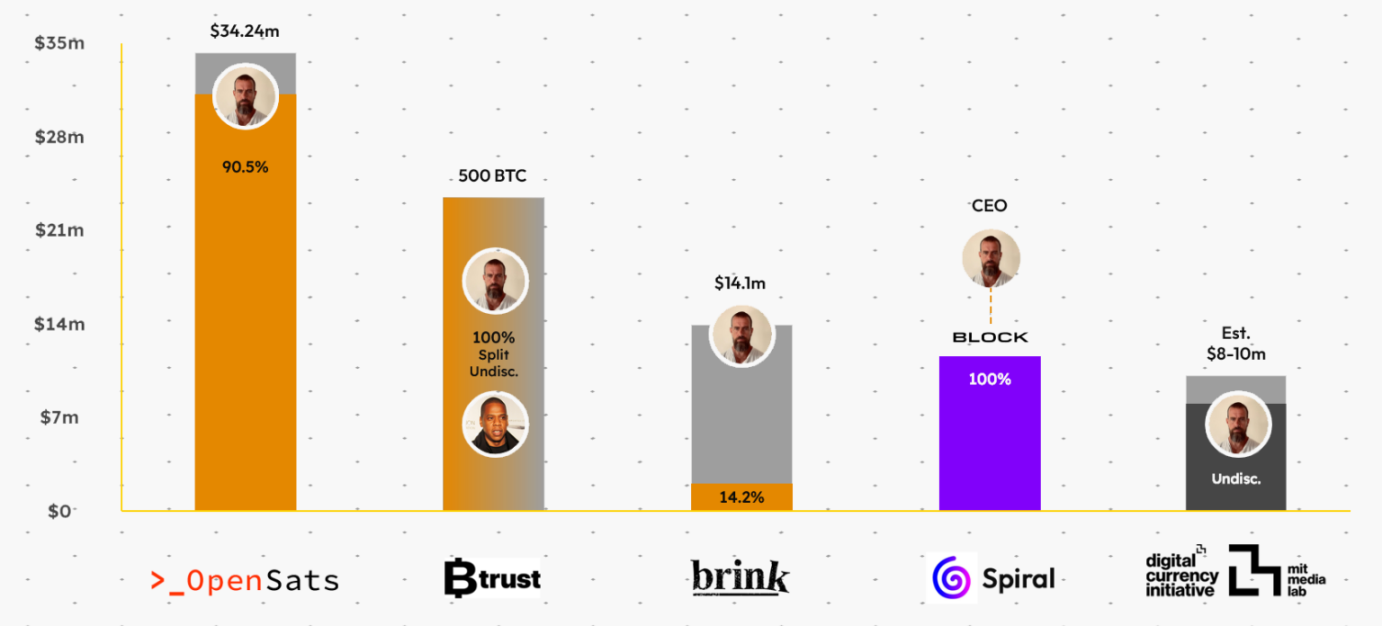

Before delving into the organizations that selflessly contribute to Bitcoin's development, let me present a chart to avoid overwhelming you.

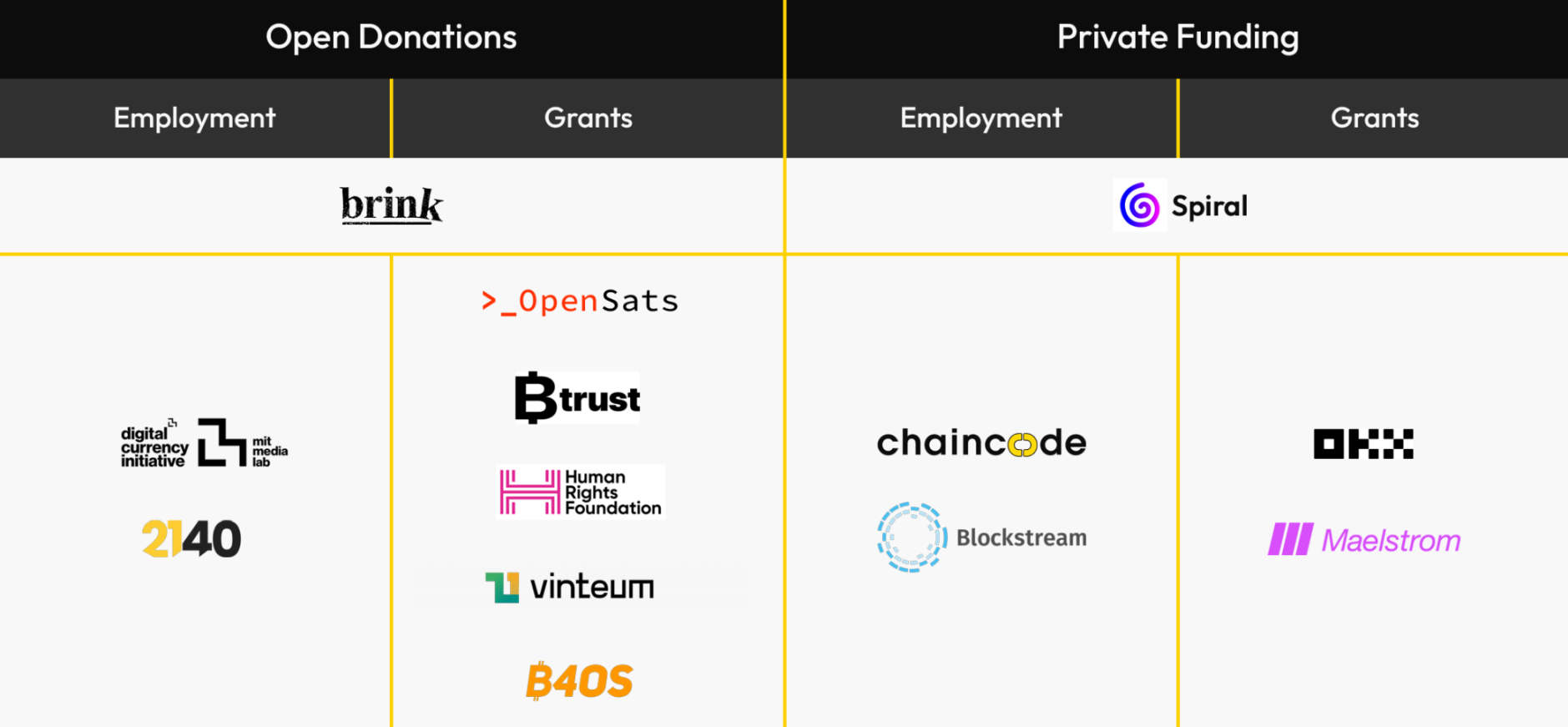

The report lists 13 major sponsoring organizations, which must directly employ Bitcoin core developers or have ongoing funding programs aimed at core developers. "One-time" funding or non-continuous funding programs are not included.

Blockstream

Blockstream was founded by early Bitcoin core developers and has contributed a significant amount of code to Bitcoin Core and libsecp256k1. However, its corporate identity has raised concerns about potential self-interest influencing Bitcoin. Currently, Blockstream employs only one core developer. Since 2014, Blockstream has disclosed six rounds of funding totaling at least $510 million, resembling "ConsenSys in the Bitcoin ecosystem."

Blockstream's co-founder and CEO Adam Back is regarded as one of the "closest people to Satoshi Nakamoto." His Hashcash proof-of-work system, proposed in 1997 to combat spam, served as the prototype for Bitcoin's PoW consensus mechanism. Satoshi Nakamoto referenced Adam Back's work in the Bitcoin white paper and communicated with him via email about technical details. After founding Blockstream, Adam Back also led the development of Bitcoin sidechain Liquid and scaling and privacy components like the Lightning Network.

Chaincode Labs

Chaincode Labs was founded in 2014 in Manhattan, New York, by Alex Morcos and Suhas Daftuar. Alex Morcos focused on automated trading and quantitative trading in his early years and became a Bitcoin core developer in 2012, remaining an active contributor to the Bitcoin Core development community. Suhas Daftuar also worked in trading-related roles before entering the Web3 industry and founded Hudson River Trading LLC (HRT). Both are pioneers in algorithmic trading on Wall Street.

Chaincode Labs promotes the development of the Bitcoin ecosystem through self-funding, including enhancing the reliability and scalability of the Bitcoin protocol; developing tutorials and funding projects to cultivate Bitcoin developers; and conducting cutting-edge research on potential threats to Bitcoin from quantum computing. Chaincode Labs released the report "Bitcoin Post-Quantum" this year, proposing a migration path based on NIST post-quantum encryption standards, including introducing new signature schemes (such as Dilithium or Falcon) through soft forks, expected to be implemented in phases from 2026 to 2028.

Chaincode Labs is also a key driver behind significant upgrades to the Bitcoin network, such as Taproot and SegWit, and was one of the sponsors of the first independent third-party audit of Bitcoin Core.

Notably, Aaron Zhang, mentioned earlier, announced on X on the 3rd of this month (https://x.com/zzmjxy/status/1996092229962916119) that he has become the China partner for the Chaincode Labs BOSS (Bitcoin Open Source Software) Challenge. The BOSS Challenge is a free 30-day coding challenge combined with a two-month practical period to help developers enter open-source projects, having already assisted dozens of developers in starting from scratch to become full-time open-source engineers.

Digital Currency Initiative

The Digital Currency Initiative (DCI) cannot strictly be considered an organization; it was launched by the Massachusetts Institute of Technology (MIT) in 2015 as a neutral academic platform to support core developers after the Bitcoin Foundation was dissolved. MIT DCI accepts donations to employ Bitcoin developers long-term, providing stable salaries and research environments, allowing them to focus on protocol security, performance, and consensus improvements, producing academic papers, open-source code, and public reports, and participating in central bank digital currency (CBDC) research in collaboration with the Boston Federal Reserve Bank on Project Hamilton.

DCI emphasizes open-source, self-custody, and privacy protection principles, aiming to demonstrate the value of decentralized technology to policymakers while maintaining independent contributions to the Bitcoin Core codebase.

Spiral

Spiral is an independent Bitcoin development entity under Block (formerly Square), established in 2019 (initially named Square Crypto) and officially renamed Spiral in January 2022. As of December 2025, Spiral has funded over 100 open-source projects, investing hundreds of millions of dollars to promote improvements in Bitcoin's privacy, security, scalability, and user experience (UX). Spiral emphasizes independence, not being directly controlled by Block or its founder Jack Dorsey, but driven by the Bitcoin developer community.

The current head of Spiral is former Google engineer Steve Lee, and the team includes former Bitcoin Core maintainers and Lightning Labs engineers. According to public information, while Spiral's funding scope is broad, its core focus is on the Lightning Network, aiming to enhance Bitcoin's payment efficiency, which aligns with Satoshi Nakamoto's original vision.

OKX

This naturally needs no introduction. What is worth mentioning is that OKX's funding program began with OKCoin in 2019, later taken over by OKX and maintained to this day, now primarily driven by executives Lennix Lai and Hong Fang. OKX currently supports key developers such as Amiti Uttarwar and Marco Falke, as well as other organizations funding Bitcoin Core, such as Brink, Vinteum, and 2140, which we will discuss shortly.

Human Rights Foundation

Human Rights Foundation (HRF) was established in the United States in 2005, aiming to promote and protect human rights in closed societies worldwide, focusing on combating dictatorship, authoritarian governments, and tyranny. HRF has long supported Sakharov Prize and Havel Prize winners, as well as well-known dissidents like Liu Xiaobo, Alexei Navalny, and Kim Jong-nam. It has funded thousands of grassroots human rights projects in over 70 countries globally.

Since 2019, HRF has regarded Bitcoin as one of the most important "human rights technologies" of the 21st century, believing it to be a powerful tool against financial surveillance, financial oppression, and monetary tyranny. In May 2019, HRF established the HRF Bitcoin Development Fund to fund open-source development for Bitcoin and the Lightning Network, having donated over 120 Bitcoins to date.

Brink

Brink is a non-profit organization co-founded by Mike Schmidt and former Chaincode Labs developer John Newbery in 2020, aiming to cultivate and support a new generation of Bitcoin protocol developers through full-time salary funding, mentorship training, and community building, addressing the "succession crisis" in Bitcoin core development.

Brink selects 4 to 6 promising engineers each year, providing 1 to 2 years of full-time salary (approximately $120,000 to $180,000 per year) to allow them to contribute full-time to Bitcoin Core and related protocols. To date, it has funded over 20 developers, including notable figures like Gloria Zhao (now a Bitcoin Core maintainer), Greg Sanders, and Josie Baker. Brink is currently the most recognized "Bitcoin Core developer incubator" in the community, with nearly all newcomers who joined the Bitcoin Core maintenance team after 2022 having received funding or training from Brink.

Brink's operational funding comes 100% from donations, with donors including Twitter co-founder Jack Dorsey, the aforementioned Chaincode Labs, HRF, Spiral, as well as exchanges like Gemini, Bitfinex, Kraken, and hundreds of individual donors.

Btrust

Btrust was established in 2021, co-funded by Jack Dorsey and Jay-Z with 500 Bitcoins, headquartered in Lagos, Nigeria, focusing on promoting the participation of African and Indian developers in Bitcoin and Lightning Network open-source development through education and funding. As of December 2025, Btrust has trained hundreds of African developers and funded over 50 open-source projects. Btrust early on acquired the African Bitcoin developer training program Qala and integrated it into the Btrust Builders Fellowship.

Btrust acts as Bitcoin's "African operations center," providing funding and training, and also hosts BitDev events in major African cities while maintaining weekly Bitcoin ecosystem news for the African community.

In September 2024, Nigerian Bitcoin core developer Abubakar Nur Khalil was appointed as the interim CEO of the organization; he is also a co-founder of Qala, which was acquired by Btrust. In addition to this role, Abubakar Nur Khalil has been one of Bitcoin's core developers since 2020 and provides insights on the development of the African Bitcoin ecosystem for Forbes, focusing on macro trends in investment. Additionally, he is a founding partner of Recursive Capital.

OpenSats

OpenSats was established in 2020, initiated by the Bitcoin open-source community, with key promoters including Lightning Labs co-founder Elizabeth Stark. The establishment of OpenSats largely stemmed from concerns in 2020 about the stagnation of Bitcoin protocol development and maintenance due to a shortage of funding for developers. Since its inception, OpenSats has focused its funding not only on Bitcoin core developers but also on a wide range of open-source projects surrounding Bitcoin, including Nostr and lightweight full nodes. Over the past five years, OpenSats has provided approximately $30 million in funding to over 330 contributors.

Vinteum

Vinteum was founded in August 2022 by Bitcoin core contributors Lucas Ferreira and former Brink developer Bruno Ely Garcia, aiming to support Bitcoin ecosystem builders in Brazil and Latin America.

Vinteum can be seen as a product of the "developer diversification" wave in Bitcoin in 2022, having funded over 20 developers to become full-time open-source project developers, contributing to the review, testing, and improvement of the Taproot upgrade. The 2025 report shows that its projects account for over 15% of Bitcoin contributions in Latin America. Additionally, Vinteum is committed to promoting Bitcoin adoption in Brazil against a backdrop of high inflation.

Maelstrom

Maelstrom is a Bitcoin-focused venture capital initiative led by the family office of BitMEX co-founder Arthur Hayes. Maelstrom primarily focuses on investment activities and has established the "Bitcoin Grant Program." According to information on its website, the fund currently provides funding for four full-time developers, involving projects related to Bitcoin privacy tools like Payjoin, Silent Payments, and developments related to peer-to-peer network privacy, in addition to Bitcoin core developers.

Previously, Maelstrom funded the Nostr protocol and client ecosystem, the Fedimint ecosystem, and sponsored Chaincode's BOSS Challenge this year. Additionally, in the third quarter of this year, Maelstrom launched the Bitcoin-focused funding initiative Bitcoin Moonshot Grants, designed for "crazy-sounding but potentially game-changing" high-risk, high-potential Bitcoin projects, emphasizing radical innovation. As of December 2025, this initiative has funded 5 to 10 early projects, with a total investment of approximately $20 million to $30 million.

B4OS (Bitcoin For Open Source)

B4OS was launched in April 2024 by the Spanish-speaking Bitcoin learning community Librería de Satoshi, offering a free advanced Bitcoin open-source training course aimed at senior developers in Latin America, the Caribbean, and Spain. B4OS provides training courses on Bitcoin fundamentals, Lightning Network development, and FOSS tools (such as Rust/Python). B4OS has a smaller funding scale, with funding for each developer ranging from $1,000 to $5,000.

2140

2140 was announced by Bitcoin developers Josie Baker and Ruben Somsen at the 2024 Bitcoin Amsterdam conference, with OKX as the main funder of the program. The name 2140 comes from the year Bitcoin is expected to be fully mined, and the organization's purpose is to promote the development of related protocols to prepare Bitcoin for the situation of having no block rewards by the time 2140 arrives.

2140 is currently the only organization of its kind registered in Europe, hiring full-time developers at its Amsterdam headquarters while also providing one-year funding for newcomers.

In addition to the organizations mentioned above, according to BitMEX research, institutions that have funded the development of Bitcoin and the Lightning Network since Bitcoin's inception nearly 17 years ago include Bitmain, Bitfinex, and others, while exchanges such as Coinbase, Kraken, and Gemini have also provided grants to varying degrees, though most have not been continuous.

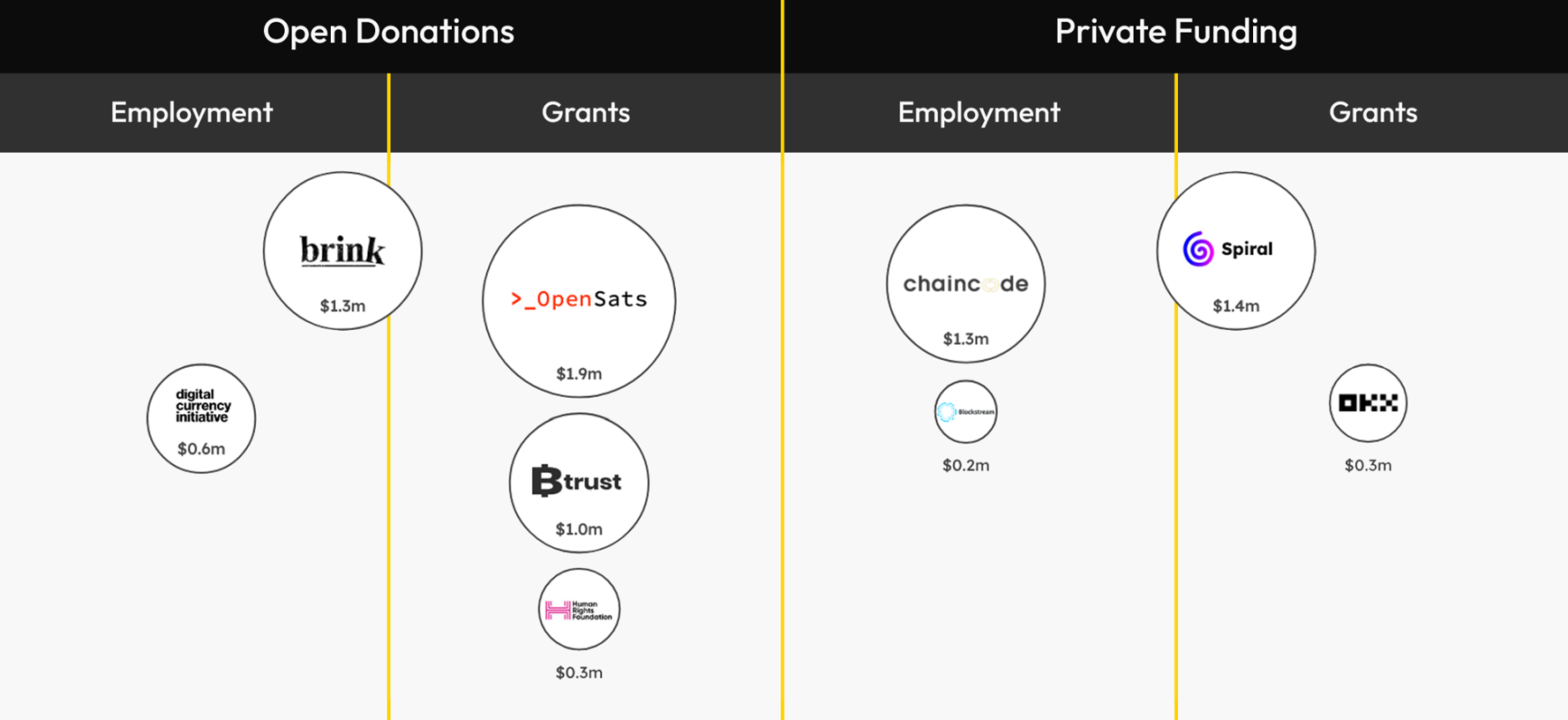

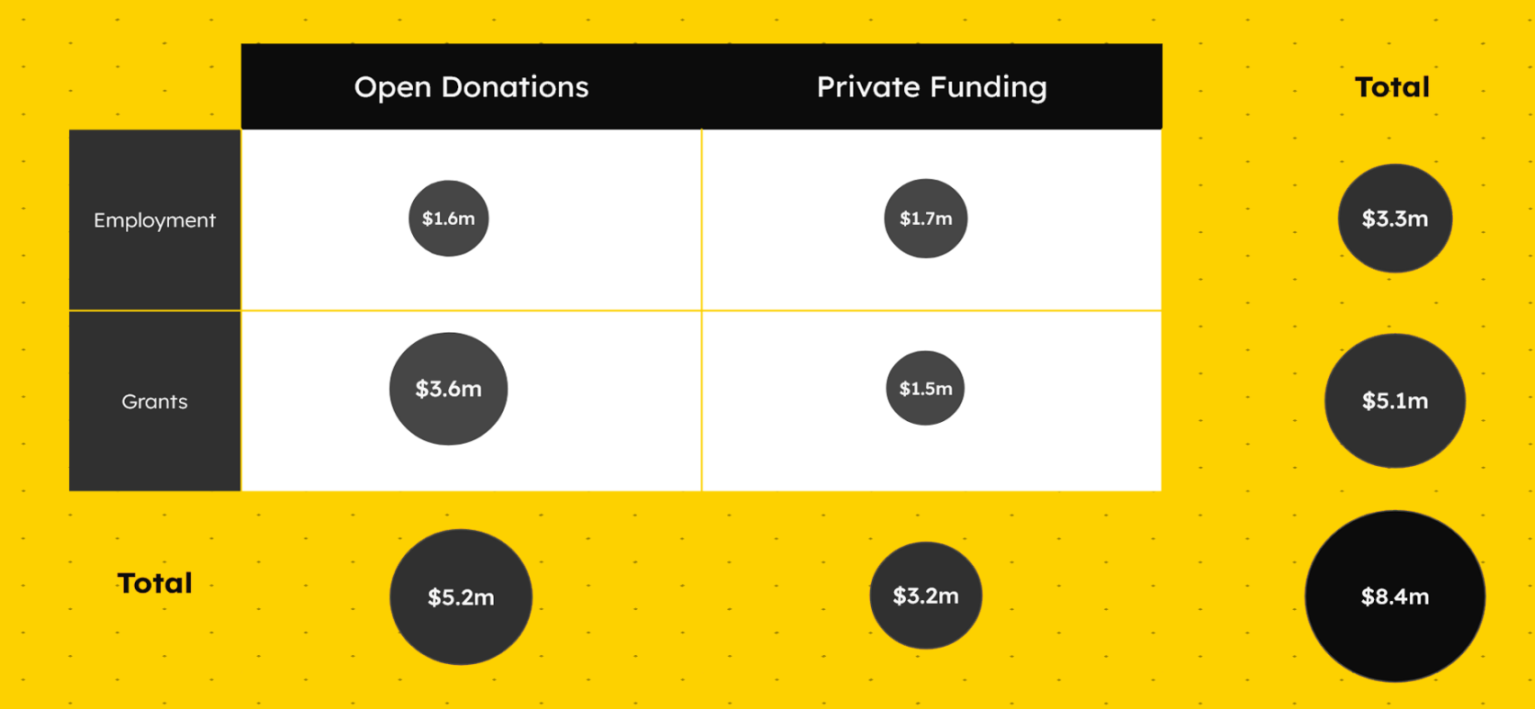

The funding methods of these sponsors vary; some openly accept donations and then provide them to developers, while others directly support through company profits. Some organizations hire developers as full-time employees with job security, while others only provide grants, as illustrated in the image at the beginning of this section.

After interviews, the report's author found that many in the developer community inevitably need to support their families, pay mortgages, and optimize their resumes, making them more inclined to choose employment models. Some developers describe the grant model as "having to reapply for a job every one or two years." The author notes that while funding from grants has significantly increased in recent years, there is still a need for more employment-based funding to retain talent. The author also states that the current funding structure still needs to find a balance between non-profit organizations and companies to prevent the departure of unpaid donors and the risks posed by a sluggish market environment.

Between the lines, we can sense a delicate balance between the current developer ecosystem and the organizations initiating funding. Developers are not all "working for Bitcoin out of love," and the imbalance between employment and pure funding creates a sense of insecurity among developers, as we will see more evidence in the subsequent introductions.

Regarding the amounts, the author mentions that some figures are estimates based on public information and are not entirely accurate. The report states that the total expenditure of organizations that openly accept donations (61.5%) is nearly double that of companies (38.5%), with funding (60.8%) exceeding salaries (39.2%). The difference mainly arises from the total funding of donation organizations (70%) being much higher than that of corporate entities (30%), while the total salary expenditures of both are similar.

The support from donors and the resource mismatch with some purpose-driven developers, coupled with insufficient support from profit-oriented companies, is an important issue reflected in the report. The exodus of talent from Ethereum serves as a warning for Bitcoin; we still need more companies to step up and take responsibility for maintaining the value anchor of cryptocurrencies. The author believes that high-profit companies in the industry, such as stablecoin issuers and exchanges, should be required to provide long-term, employment-based support for Bitcoin developers, and cannot "just reap the benefits without contributing."

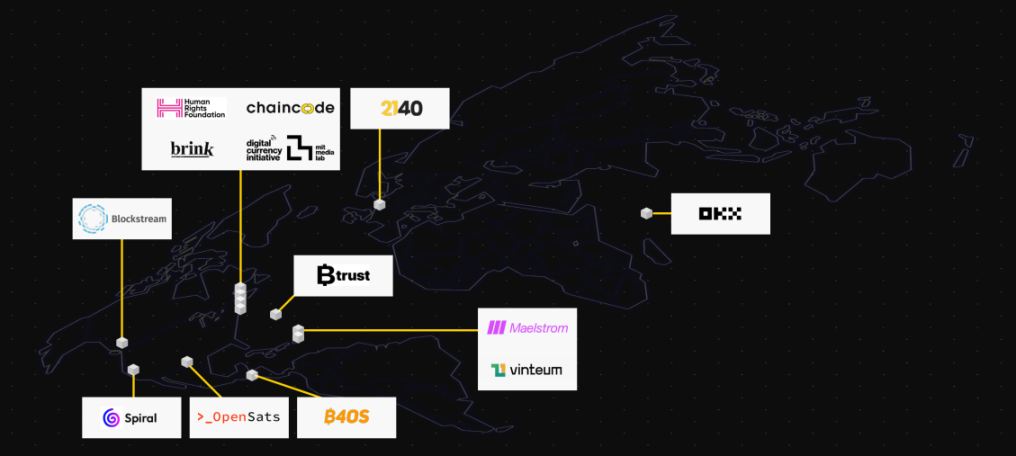

Where Are the Funding Organizations?

Among the 13 organizations, 7 are located in North America, with 6 having their legal headquarters in the United States. Although Blockstream is registered in Canada, it also has an operational center in the U.S. It can be said that the U.S. covers more than half of the funding organizations, and it is also home to the "longest-established" 7 organizations.

Outside of North America, apart from 2140, which was established in Amsterdam, the Netherlands last year, the other organizations are registered in tax havens. The author lists the distribution of registration locations considering that differences in regulatory attitudes may affect the diversity of organizations, especially with concerns about the U.S. crackdown on the cryptocurrency industry. However, with the election of Trump as the new U.S. president, this issue has been resolved. Nonetheless, the author's concern that funding privacy technology development may pose legal risks to donors and developers is indeed a matter worth considering.

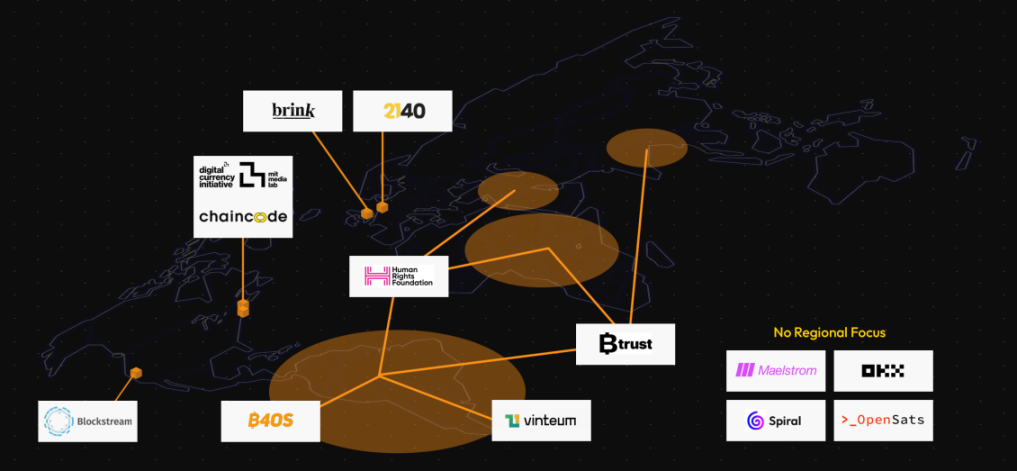

As for the coverage of funding provided by these organizations, it has been touched upon to some extent in previous introductions. The funding from Brink, OpenSats, Maelstrom, Spiral, and OKX is not fixed to any specific region, while Blockstream, MIT DCI, and Chaincode primarily focus on the U.S. and mainly on employment, with others primarily targeting Europe, Africa, and Latin America, most of which adopt a funding model.

Where Are the Developers?

The report shows that as of 2024, among the 41 active core developers who have had at least 5 submissions merged into Bitcoin Core, 33 have publicly disclosed their locations.

The statistics show that there are 26 developers in the U.S. and Europe combined, 3 in Latin America, located in Argentina, Brazil, and El Salvador. The remaining four are distributed across Africa, Asia (India), Australia, and Canada.

Developers from different regions also show significant differences in code contributions. In the year leading up to October 2024, among the 41 active core developers, the top 15 developers accounted for 71% of all contributions, the top 5 accounted for 41%, and the most active developer alone contributed 11%. Although the U.S. has the most core developers, it ranks second in submission numbers (25%), lagging behind Europe (56%), with the UK alone accounting for 30% of the submission count. Additionally, a single developer from Sweden contributed as much as half of the total contributions from all U.S. developers.

Regarding the distribution of funding organizations and developers, both the report's author and Aaron Zhang raised a question: Asia, which has 78% of the global population, has no core developers except for India. In response to this situation, the report's author used the phrase "huge growth potential," while Aaron Zhang candidly stated that the contribution of Asian developers to Bitcoin Core is almost zero, "which means that a system serving global users has a core development circle that is almost isolated from Asia."

The author believes that this is largely due to cultural differences. The open-source culture that originated in Europe and America is not widely accepted in Asia, and there does not seem to be a strong sense of "freedom" in the region. Although Asia does not lag behind Europe and America in terms of talent strength and density, the cultural incompatibility makes it difficult to organize effectively in such a decentralized community. However, the author also believes that once such organizations can develop, Asia will have a voice in the future development path of Bitcoin.

The Mysterious "Maintainers"

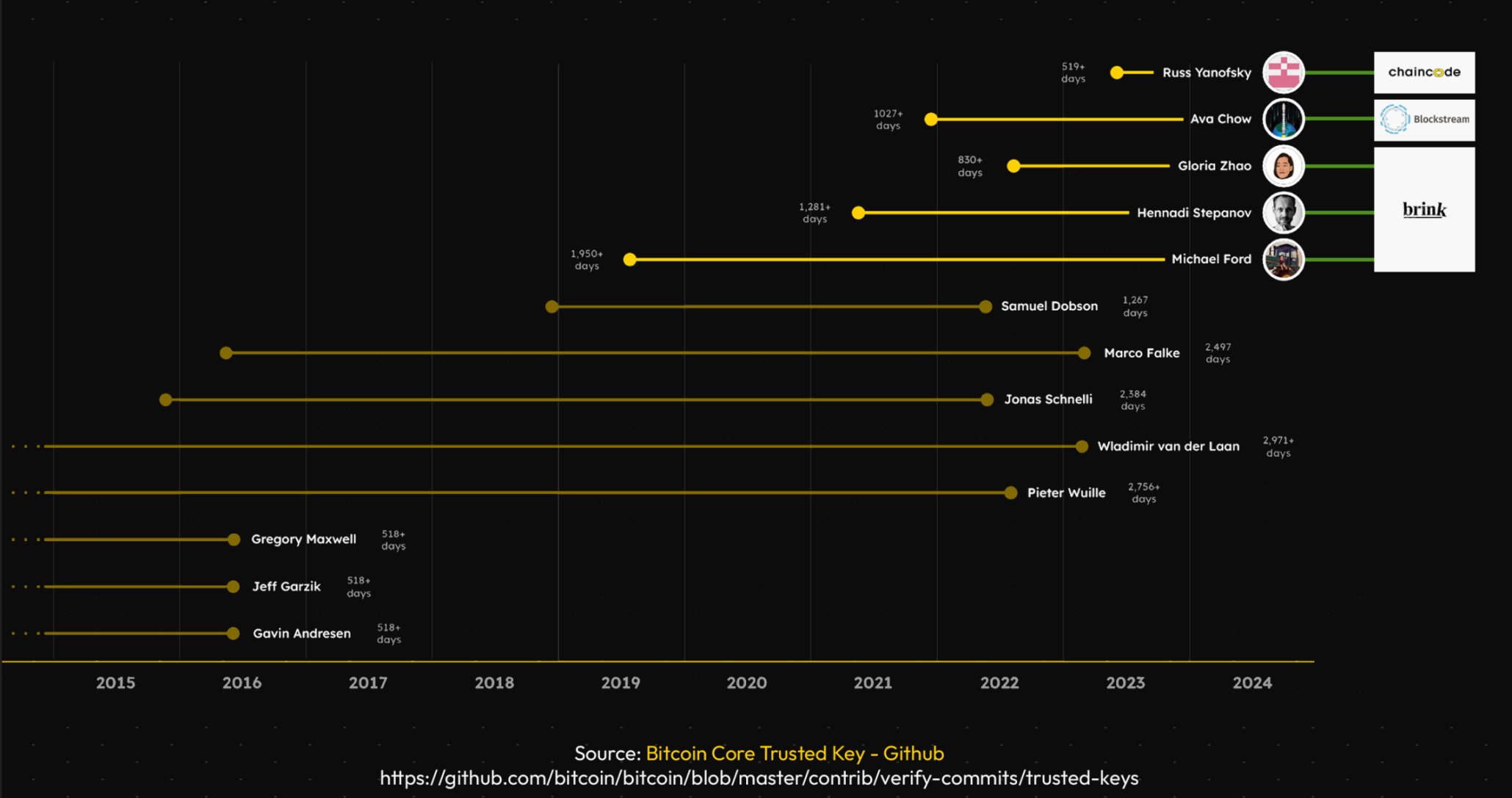

The report reveals the 13 maintainers of Bitcoin Core over the past 10 years, who have the authority to merge code into Bitcoin Core.

Currently, there are 5 maintainers; at the time of writing the report, three belong to Brink, while the other two come from Chaincode and Blockstream, respectively. Two years later, although the personnel has not changed, Ava Chow has moved from Blockstream to Localhost, and Gloria Zhao has transitioned from Brink to Chaincode.

Russ Yanofsky, funded by Chaincode, is currently one of the most active and respected long-term contributors, known for his extreme rigor, focus on code quality, and long-term maintainability. Russ Yanofsky's most notable contribution is assumeUTXO, which allows nodes to "assume" that the historical UTXO set provided by the official source is correct during synchronization, only needing to verify the most recent blocks, thus significantly shortening the initial synchronization time for new nodes (from several days to a few hours).

However, the idea was actually proposed by James O’Beirne, but Russ Yanofsky spent nearly 5 years refining it and ultimately merging it into Bitcoin Core 27.0. Currently, Russ Yanofsky is leading the transition of Bitcoin Core from a single-process to a multi-process architecture (enable-multi-process), greatly enhancing future security and scalability. This is an extremely complex and controversial restructuring project that has been in progress for several years.

Ava Chow, who transitioned from Blockstream to Localhost, is a transgender female developer focusing on the practicality and security of the Bitcoin ecosystem, known for her contributions in wallet functionality and hardware integration. Ava Chow is the main developer of the Hardware Wallet Interface (HWI) open-source library, supporting the integration of hardware wallets like Ledger and Trezor with Bitcoin Core.

In 2024, amid controversy, Ava closed Luke Dashjr's PR aimed at restricting Ordinals, citing "lack of consensus and creating noise." If you made money on ORDI, you might want to thank her.

As the only female maintainer among the 5, and the first physiologically female maintainer in Bitcoin's history, Gloria Zhao focuses on research in the areas of mempool, transaction relay, and consensus policy, and is regarded as a leading figure among the younger generation (around 26 years old) in the Bitcoin developer community.

Gloria Zhao led the "Cluster Mempool" project (PR #30611, etc.), introducing the concept of transaction clusters and rewriting the mempool logic to improve the efficiency and fairness of RBF (Replace-By-Fee) and package relay. This feature has been partially activated in Bitcoin Core v28.0, significantly improving the network's resistance to pinning attacks.

Hennadii Stepanov is a Ukrainian developer who worked at a university before becoming a full-time Bitcoin developer. He resigned to go "all in on Bitcoin" after receiving funding from CardCoins and Payvant in 2020. Hennadii Stepanov focuses on GUI (Graphical User Interface) and is responsible for the Bitcoin Core GUI sub-library, fixing multiple GUI crashes and cross-platform compatibility issues.

According to the information I found, this developer seems to care a lot about "user experience" and is one of the important promoters of Bitcoin's adoption by the public. His technical philosophy always starts from the perspective of the "end user," and he even uses old laptops to simulate niche scenarios during testing.

The last maintainer, Michael Ford, has been in his position the longest (over 6 years). He started contributing code to Bitcoin in 2012 and was nominated as a maintainer at the CoreDev conference in 2019. Unlike the previous four, Michael Ford focuses on making "Bitcoin development" easier, facilitating Bitcoin's transition from a resource-intensive model to a modern, modular open-source project.

Michael Ford led the migration from the old Autotools to modern CMake, improving cross-platform build efficiency (Windows, macOS, Linux) and reducing the number of dependency packages by 44%. Additionally, he pushed for the migration of security checks from old tools to LIEF (Library to Instrument Executable Formats) to prevent supply chain attacks. It can be said that Michael Ford is a "developer serving Bitcoin developers."

The "Dorsey Problem" in the Funding System

The report identifies two hidden dangers in the current funding system, one of which is the "Dorsey Problem."

Although the current funding organizations appear to be relatively decentralized, in reality, five organizations' funding comes from Jack Dorsey to varying degrees.

- 90.5% of OpenSats' donations come from Jack;

- 14.2% of Brink's donations come from Jack;

- Btrust's funding comes entirely from Jack and Jay-Z;

- Jack has also donated to MIT DCI's Bitcoin program, though the specific amount has not been disclosed, it is estimated to be relatively small;

- Spiral is also a project under Block, where Jack serves as co-founder and CEO.

The author learned during interviews that Jack Dorsey generally does not interfere with the direction of donation funds and that some decisions are not particularly direct. However, this reliance on a "top donor" still raises concerns. The author expresses the same view as I do, that more "Jack-level" donors, especially private enterprises that profit from Bitcoin, should take on more responsibility in this regard. Fortunately, the newly established organizations are unrelated to Jack, and the two new organizations that the report's author learned about are the same.

The second hidden danger lies in the sustainability of donation funds. Although most interviewees believe that the current funding available for support is abundant, whether this level of funding can be maintained is actually questioned. During the bear market in 2022, the $8 million donation commitment received by MIT DCI in 2021 significantly shrank, and donations to Brink also dropped by 58% that year. Based on the cyclical nature of the cryptocurrency market, many organizations may choose to be cautious in funding during non-bear market periods to prevent depletion of funds during bear markets.

Given that the current Web3 industry products and companies still lean towards trading, most companies' revenues will fluctuate with the price volatility cycles of risk assets for a considerable time in the future. Solutions to this issue may require a third mention of having companies with cross-cycle profitability (such as exchanges) take on the responsibility of ensuring that donation funds maintain a certain level.

Asia Needs to Step Up

The report concludes with several major issues in the Bitcoin developer ecosystem: a low number of active developers, insufficient funding amounts, concentration of funding organizations in specific jurisdictions, a gap in the Asian region, high concentration of maintainers (in 2024, three maintainers belong to the same company, but this issue has improved), scarce employment opportunities (most funding is still in the form of grants), concentrated funding sources, and fragile sustainability.

Regarding the gap in the Chinese-speaking Web3 community concerning Bitcoin developers, I have analyzed the reasons in the text. In fact, there are countless excellent developers in the country, but it is not enough to just shout slogans; individuals or organizations need to step up to take on this task to truly address the issue.

Many may worry about regulatory issues, especially with the recent publication of several documents strengthening regulations, which has caused anxiety. However, I want to say that in the current complex international competition, especially in the context of great power rivalry, strengthening regulation of cryptocurrencies essentially initiates a classic "fool-proof mechanism," which aims to prevent a surge in fraud cases and capital outflows during periods of slower economic growth. However, this does not hinder grassroots organizations in the industry from striving for our voice in Bitcoin.

Looking through the report from start to finish, it is fortunate that over the past decade, a large number of talented technicians have continuously contributed to the improvement and maintenance of Bitcoin, and there are also bosses constantly supporting these developers with rockets and planes. This seemingly insufficient support has allowed Bitcoin to become a representative of new assets in less than 20 years, which can be called a "miracle."

What is concerning, however, is precisely that "this is a miracle."

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。