Author: 1912212.eth, Foresight News

At 21:00 Beijing time on December 8, the Stable mainnet will officially launch. Stable, supported by Bitfinex and Tether, is a Layer 1 blockchain focused on stablecoin infrastructure. Its core design aims to use USDT as the native gas fee, achieving sub-second settlement and gas-free peer-to-peer transfers. As of the time of publication, exchanges including Bitget, Backpack, and Bybit have announced they will list STABLE spot trading. However, Binance, Coinbase, and Korean exchanges have not yet announced the listing of STABLE spot trading.

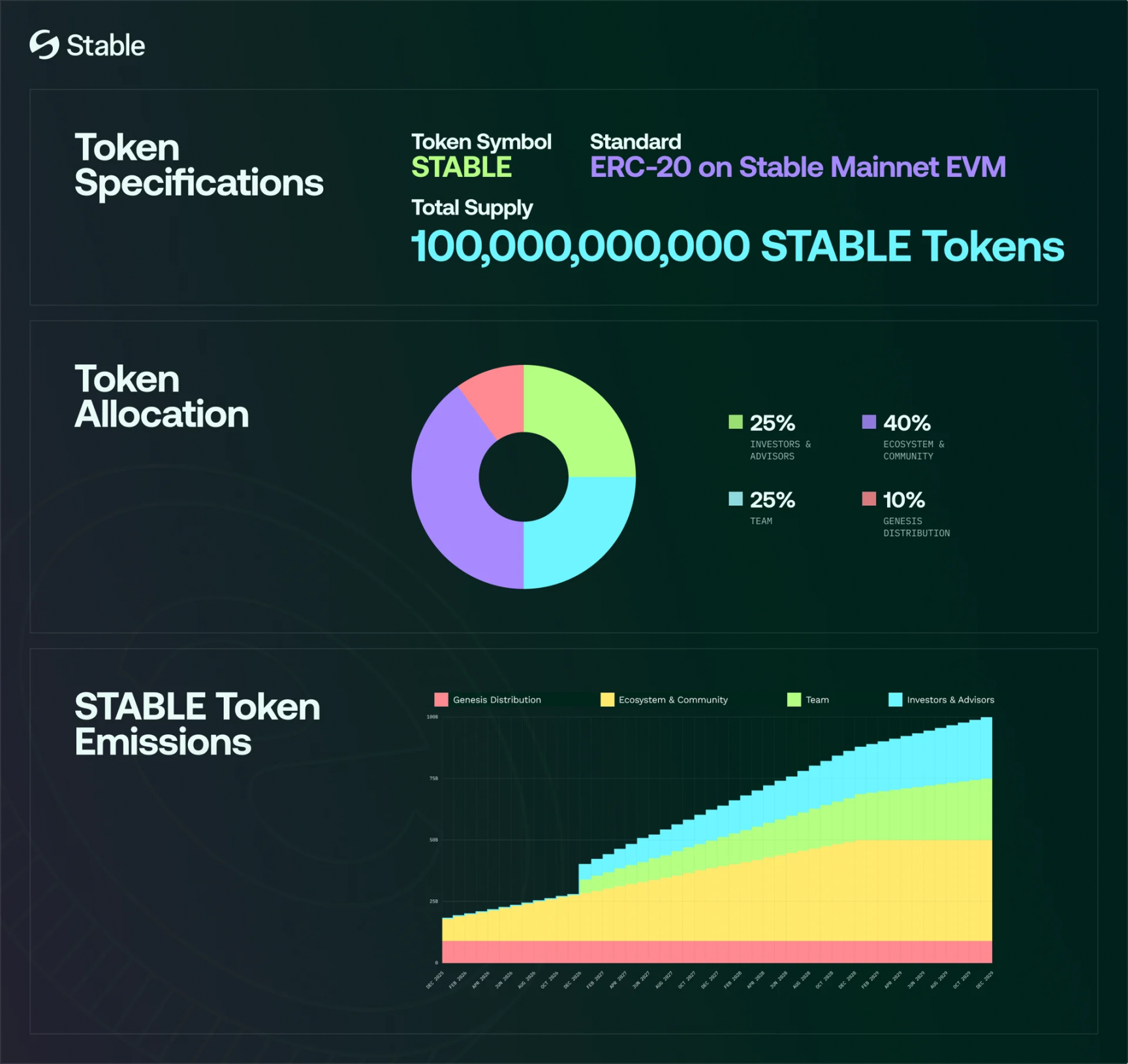

Total Supply of 10 Billion, Tokens Not Used for Gas Fees

The project team has released a white paper and details on token economics before the mainnet launch. The native token STABLE has a total supply of 10 billion tokens, which is fixed. Transactions, payments, and trading on the Stable network will be settled in USDT, and STABLE will not be used for gas fees but will coordinate the incentive mechanisms between developers and ecosystem participants. The distribution of STABLE tokens is as follows: Genesis Distribution accounts for 10% of the total supply, supporting liquidity, community activation, ecosystem activities, and strategic distribution efforts in the early stages of the launch. The Genesis distribution portion will be fully unlocked at the mainnet launch.

The ecosystem and community account for 40% of the total supply, allocated for developer funding, liquidity programs, partnerships, community programs, and ecosystem development; the team accounts for 25% of the total supply, allocated to the founding team, engineers, researchers, and contributors; investors and advisors account for 25% of the total supply, allocated to strategic investors and advisors supporting network development, infrastructure building, and promotion.

The shares for the team and investors have a one-year cliff period, meaning no unlocking for the first 12 months, followed by linear release. The shares for the ecosystem and community fund are unlocked by 8% at launch, with the remaining portion gradually released through linear vesting to incentivize developer, partner, and user growth.

Stable employs a DPoS (Delegated Proof of Stake) model through its StableBFT consensus protocol. This design supports high throughput settlement while maintaining the economic security characteristics required for a global payment network. Staking STABLE tokens is the mechanism for validators and delegators to participate in consensus and earn rewards. The main roles of the STABLE token are governance and staking: holders can stake tokens to become validators, participate in network security maintenance, and influence protocol upgrades through DAO voting, such as adjusting fee rates or introducing new stablecoin support.

Additionally, STABLE can be used for ecosystem incentives, such as liquidity mining or cross-chain bridging rewards. The project team claims that this separation design can attract institutional funds, as the stability of USDT is much higher than that of volatile governance tokens.

Pre-deposit Controversy: Insider Trading, KYC Delays

Like Plasma, Stable opened two rounds of deposits before the mainnet launch. The first phase of pre-deposits started at the end of October, with a cap of $825 million, but it was filled within minutes of the announcement. The community questioned whether some players engaged in insider trading. The top-ranked wallet deposited hundreds of millions of USDT 23 minutes before the deposit opened.

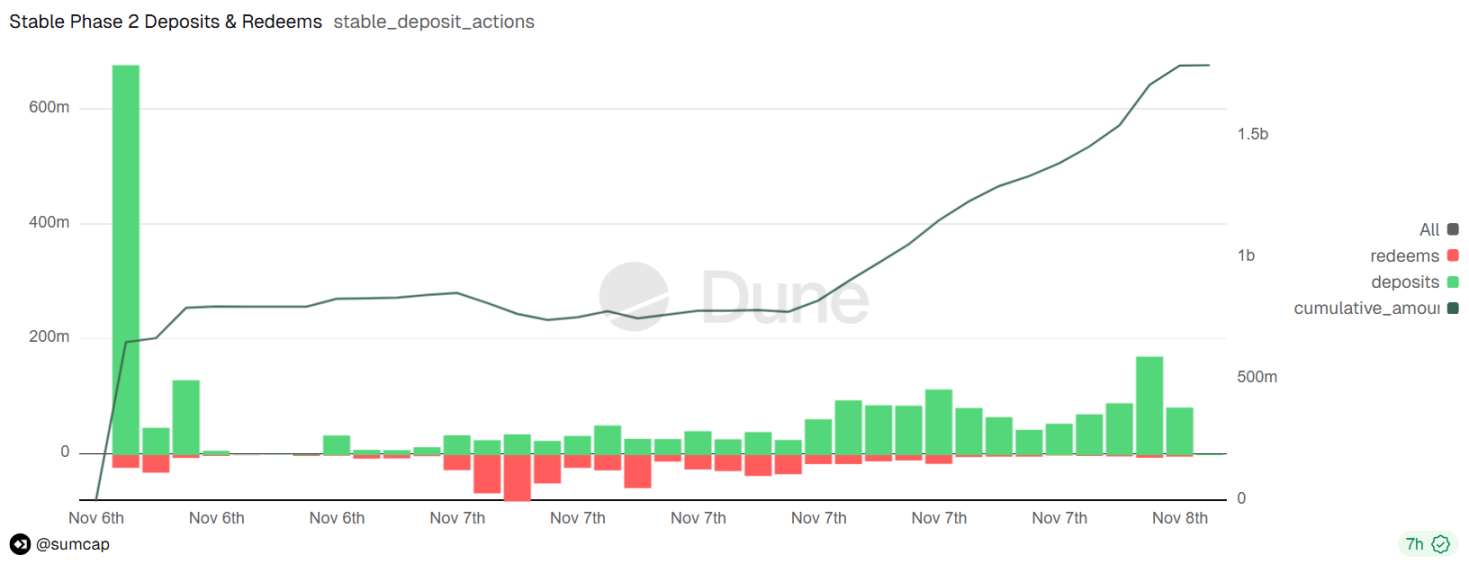

The project team did not respond directly and launched the second phase of pre-deposit activities on November 6, with a cap of $500 million.

However, Stable still underestimated the market's enthusiasm for deposits. The moment the second phase opened, a massive influx of traffic caused their website to slow down. Therefore, after updating the rules, users can deposit through the Hourglass frontend or directly on-chain; the deposit function reopened for 24 hours, with a maximum deposit of $1 million per wallet and a minimum deposit amount still set at $1,000.

Ultimately, the total deposits in the second phase reached approximately $1.8 billion, with around 26,000 participating wallets.

Review times ranged from a few days to a week, with some community users complaining about system slowdowns or repeated requests for additional materials.

85% Probability of $2 Billion FDV

At the end of July this year, Stable announced the completion of a $28 million seed round of financing, led by Bitfinex and Hack VC, bringing its market valuation to around $300 million.

In comparison, Plasma's current market cap is $330 million, with an FDV of $1.675 billion.

Some optimists believe that the stablecoin narrative, Bitfinex's backing, and Plasma's initial rise followed by a drop may indicate that there will still be some heat and price increase potential in the near term. However, the pessimistic voices are stronger: gas payments not in STABLE have limited utility, especially as the market has entered a bear cycle, and market liquidity has become tight, which could lead to a rapid decline in its price.

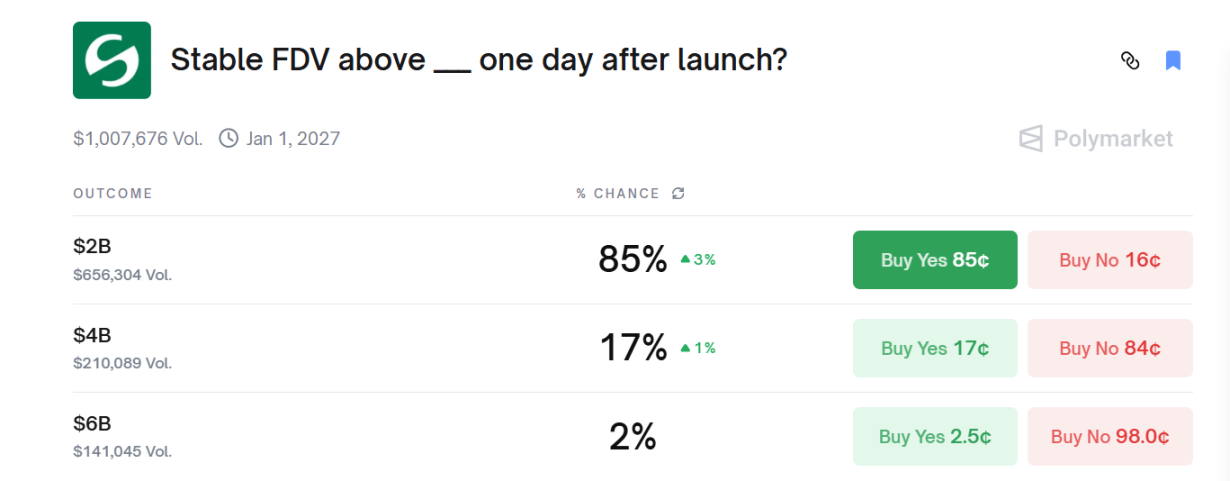

Currently, Polymarket data shows that the market bets on the probability of its FDV exceeding $2 billion on the first day of launch is 85%. Based on a conservative estimate of $2 billion, the corresponding price for STABLE would be $0.02.

In the perpetual contract market, according to Bitget's quotes, the current price for STABLE/USDT is $0.032, indicating an estimated FDV of around $3 billion.

Stable's first phase of pre-deposits reached $825 million, and the second phase contributed over $1.1 billion, but after proportional distribution, only $500 million actually entered the pool. The total pre-deposit scale is $1.325 billion. The token economics disclose an initial allocation of 10% (for pre-deposit activity incentives, exchange activities, initial on-chain liquidity, etc.). Assuming Stable ultimately airdrops 3%-7% of the pre-deposit, based on the pre-market price of $0.032, the corresponding returns would be approximately 7% to 16.9%, meaning that every $10,000 deposit corresponds to $700 to $1,690.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。