Author: 0xBrooker

Accompanied by a liquidity crisis and the "cyclical curse," BTC, after experiencing a storm in November, welcomed a brief respite in December.

On one hand, with the probability of a rate cut in December returning to over 80%, the Federal Reserve has stopped quantitative tightening (QT) and started to slightly release liquidity into the market, while the Treasury's TGA account has also begun to spend; on the other hand, panic selling and large-scale losses have come to a halt. The panic selling pressure has diminished, but constrained by weak buying power, BTC's price trend remains in a stalemate.

More than 34% of on-chain BTC is in a state of loss, and the leading strategy of DAT has reduced purchases, signaling a defensive stance to the market. The funds in the BTC ETF channel are still in a high-beta asset aversion period, with outflows exceeding inflows.

The economic and employment data released this week still maintains the baseline scenario of a "soft landing" as the U.S. economy transitions from "overheating" to "moderate slowdown." Although Nvidia's stock price remains significantly below previous highs, the three major stock indices continue to show an upward repair trend, approaching prior peaks.

The short-term macro liquidity turning point has emerged. After a 25 basis point rate cut next week, the Federal Reserve's routine meeting will have a significant impact on short-term market volatility, depending on whether it releases "dovish" or "hawkish" signals, but the medium-term outlook remains secure.

Additionally, the Bank of Japan is likely to raise interest rates in December, which will also have a certain impact on the U.S. stock market, but the extent of the impact cannot be compared to the Carry Trade shock expected in 2024.

For the severely undervalued crypto market, the situation is even more severe. Although the long-term trend of increased asset allocation still exists, the short- to medium-term sentiment has already faded, requiring greater macro liquidity stimulation or a new surge in allocation enthusiasm to attract more capital inflows, in order to absorb the selling pressure generated by long-term holders locking in profits.

The current balance is more of a respite after passionate selling. Until we see a further reversal in buying and selling trends, we maintain the judgment that the probability of a "bull to bear" transition is greater than that of a "mid-term adjustment."

Policy, Macro Finance, and Economic Data

After the U.S. government ended its shutdown, the first important data—the September PCE data—was released late on Friday.

Core PCE grew by 2.8% year-on-year, slightly below the expected 2.9%, while nominal PCE remained in the 2.7% to 2.8% range, reinforcing the narrative of "inflation slowly declining but still above the 2% target." Due to the permanent absence of October PCE data and the November data being released only after the Federal Reserve's December meeting, the September PCE data has become the only reference before the December 10 meeting. The lower-than-expected inflation data strengthens expectations for a rate cut in December and even a continued rate cut into 2026.

In terms of employment, the ADP report shows that U.S. private sector employment decreased by 32,000 in November, contrasting sharply with the previous value (October) which was revised up from +47,000, while the market had previously expected a slight increase of about 10,000. Structurally, certain high-discretionary consumer sectors in the service industry showed significant drag, aligning with the market's judgment of "demand marginally slowing but not yet collapsing completely." For the FOMC, this is a signal of "employment cooling rather than uncontrolled deterioration"—strengthening the rationale for a rate cut, but insufficient to support aggressive easing.

This week, initial jobless claims fell to 191,000, the lowest since September 2022, but continuing claims rose to 1.94 million, slowly increasing. The tendency for companies to "hire less + control new positions" has strengthened (long-term bias towards hawkish), but there have been no large-scale layoffs, and the overall state is one of "no firing, no hiring," indicating a slow cooling state (short-term systemic risk is controllable). This also supports the judgment for a rate cut, but does not necessitate aggressive easing.

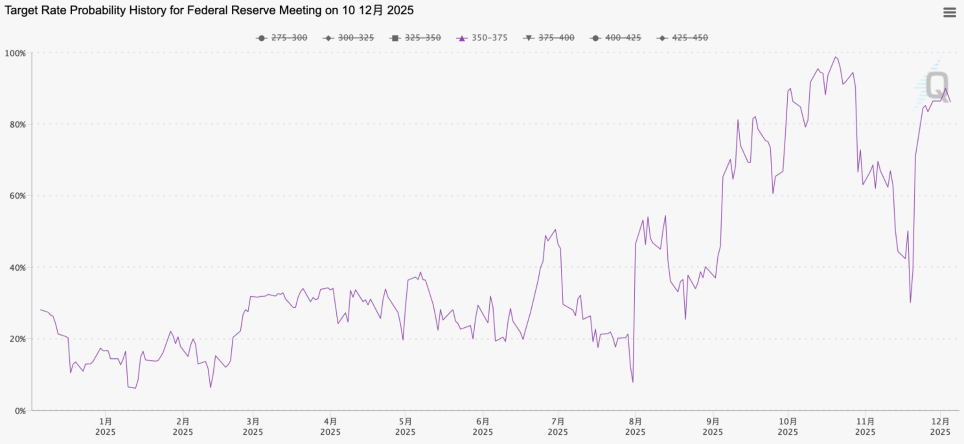

FedWatch December rate cut 25 basis point probability changes

After about a month of rollercoaster fluctuations, based on economic and employment data and statements from Federal Reserve officials, the market generally expects that at the FOMC meeting on December 10, the Federal Reserve will cut rates by 25 basis points, with its impact on the market mainly reflected in the "dovish-hawkish" statements after the meeting. If the guidance is "dovish," it will provide upward momentum for high-beta assets like the Nasdaq and BTC; if the guidance is "hawkish," significantly downplaying subsequent easing expectations, then the current risk asset pricing based on "continuous rate cuts + soft landing" will need to adjust downward, likely impacting BTC, which already has a high leverage and a significant proportion of floating losses, more than traditional assets.

Crypto Market

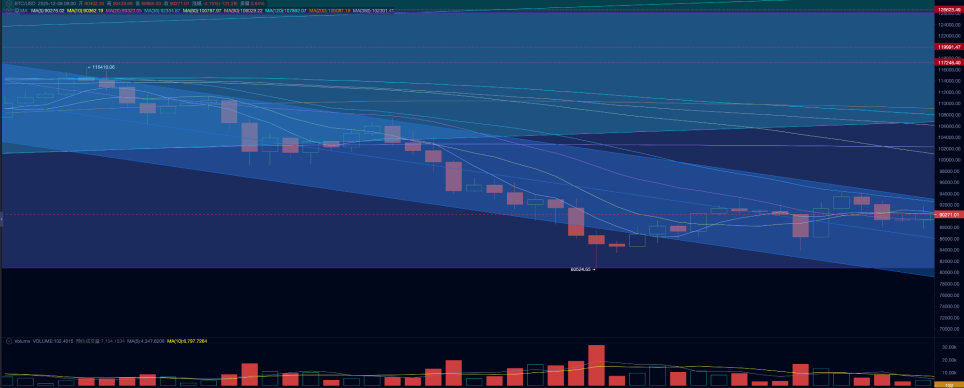

This week, BTC opened at $90,364.00 and closed at $94,181.41, with a weekly increase of 0.04%, a volatility of 11.49%, and trading volume remaining flat compared to last week.

BTC daily price trend

Based on the "EMC Labs BTC Cycle Judgment Model," we believe the main reasons for this round of BTC adjustment are short-term liquidity exhaustion + mid-term liquidity expectation fluctuations, compounded by long-term selling driven by cyclical laws.

On November 21, as Federal Reserve Chairman John Williams stated that "there is room for further rate cuts in the near term," U.S. stocks and BTC rebounded from their lows. Since then, the three major U.S. stock indices have gradually repaired their losses, approaching historical highs. However, after a 4.1% rebound last week, BTC again lost momentum and entered a state of fluctuation. The fundamental reason lies in the continued extreme scarcity of liquidity, and the behaviors of buyers and sellers have not truly reversed.

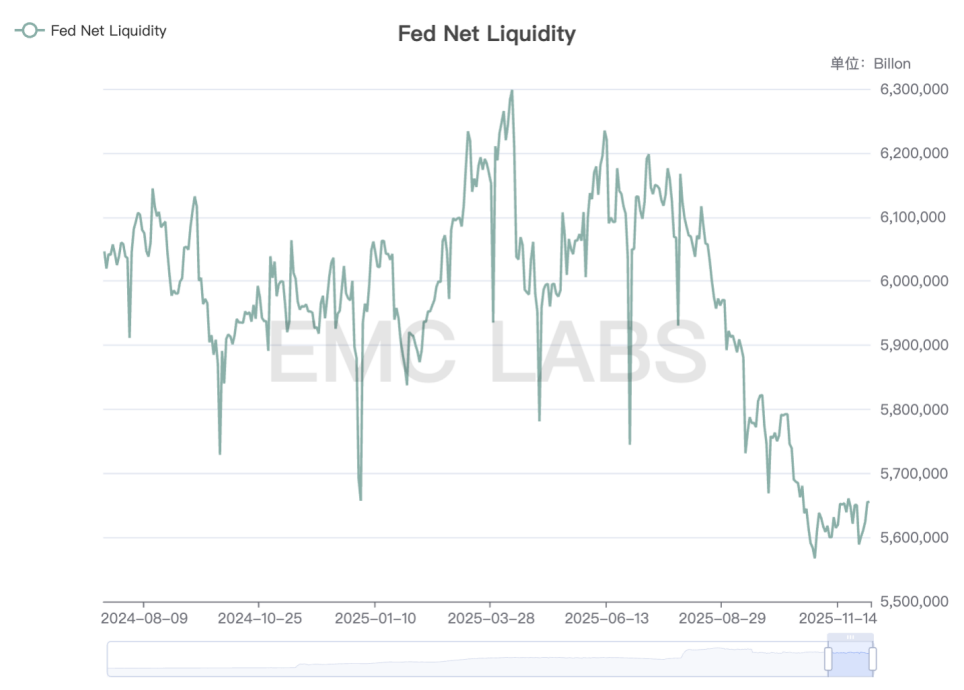

On December 1, the Federal Reserve stopped QT and provided about $16.5 billion in short-term liquidity through temporary repurchase agreements (Repo). The U.S. Treasury conducted two "repurchases" of U.S. Treasury bonds, totaling $14.5 billion. This slightly alleviated the market's short-term liquidity, but was still insufficient to promote inflows for high-beta assets like BTC.

Fed Net Liquidity

Although Fed Net Liquidity has rebounded, it remains at a low level, and its suppression of high-beta assets has not fundamentally improved.

In terms of capital, it can be seen that over the past two weeks, the overall capital in the crypto market has shifted from outflows to inflows, with last week at $3.146 billion and this week at $2.198 billion. This is also the fundamental reason why BTC was able to shift from a decline to a state of fluctuation.

Crypto market capital inflow and outflow statistics (weekly)

However, specifically regarding the BTC ETF channel, which plays a larger role in BTC pricing, it can be seen that this week still recorded an outflow of $84 million.

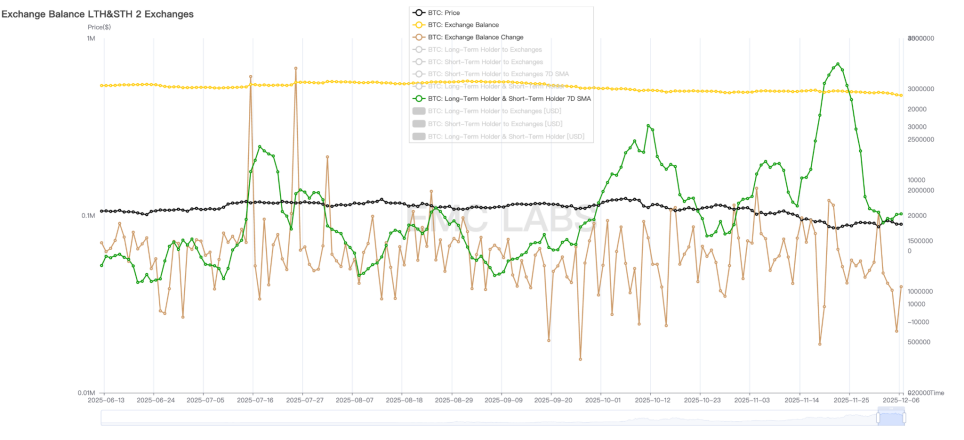

In terms of selling, the scale of long and short selling has rapidly decreased, but long selling is still ongoing this week, indicating that although the phase of clearing is nearing its end, long selling driven by the "cyclical curse" has not yet stopped.

Long and short selling and CEX inventory statistics

The pause in long selling may provide a possibility for market rebound. Just looking at the on-chain data from the past two weeks, there is still passive buying power in the market, with over 40,000 BTC transferred out of exchanges. The ebb and flow of selling pressure and buying power provides a possibility for market stabilization and rebound. However, for the market to truly reverse, a return of active buying power is still needed. This requires a tangible improvement in macro liquidity and a genuine recovery in BTC allocation demand.

A positive piece of news in this regard is that Texas, USA, passed the first batch of spot ETF purchases of about $5 million in BTC ETF products in November to enrich its BTC reserves. Although this is insufficient to hedge against ETF redemptions, it has a positive demonstration effect on market sentiment.

Cycle Indicators

According to eMerge Engine, the EMC BTC Cycle Metrics indicator is at 0, entering a "downward phase" (bear market).

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。