CoinW Research Institute

Key Points

The total market capitalization of global cryptocurrencies is $3.15 trillion, up from $3.14 trillion last week, representing an increase of approximately 0.32% this week. As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $57.62 billion, with a net outflow of $87.77 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.88 billion, with a net outflow of $65.59 million this week.

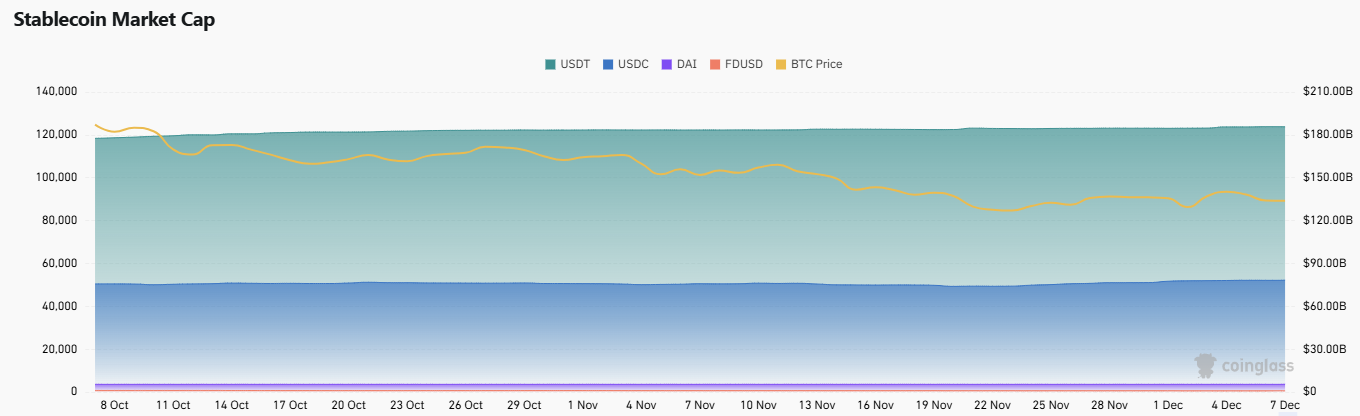

The total market capitalization of stablecoins is $312 billion, with USDT having a market cap of $185.7 billion, accounting for 59.55% of the total stablecoin market cap; followed by USDC with a market cap of $78.19 billion, accounting for 25.07%; and DAI with a market cap of $5.36 billion, accounting for 1.72%.

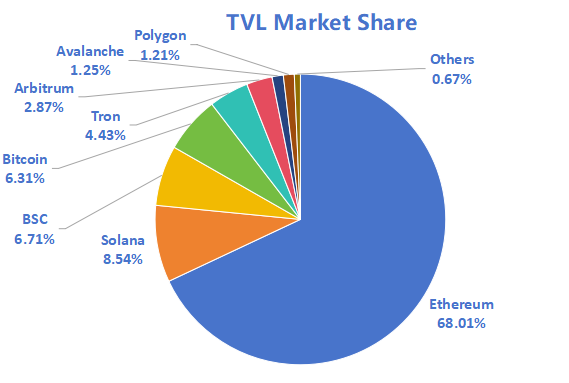

According to DeFiLlama, the total TVL of DeFi this week is $120.8 billion, up from $119.9 billion last week, an increase of approximately 0.75%. By public chain, the top three chains by TVL are Ethereum, accounting for 68.01%; Solana, accounting for 8.54%; and BNB Chain, accounting for 6.71%.

The gap between strong-performing public chains and those that have significantly declined has further widened this week. In terms of daily trading volume, Solana performed the strongest, rising approximately 10.4%, while BNB Chain rose about 9.6%. In contrast, Sui fell approximately 35.5%, Aptos fell about 30.7%, Ton fell about 44.6%, and Ethereum fell about 3.6%. In terms of transaction fees, only Solana's transaction fees increased by about 100%, while Ethereum, BNB Chain, Ton, Sui, and Aptos remained unchanged. In terms of daily active addresses, overall on-chain user activity has declined, with Sui experiencing the largest drop of about 37.9%, BNB Chain down about 31.3%, Ethereum down about 28.1%, Aptos down about 17%, and Ton down about 12.1%, with only Solana remaining relatively stable. In terms of TVL, Ton saw the most significant increase, rising about 9.8%, Sui up about 4.5%, Ethereum up about 2.8%, while BNB Chain and Solana fluctuated slightly, and Aptos fell about 4.1%.

New Project Focus: Beep is a decentralized finance protocol aimed at the autonomous agent economy, built on the Sui network, dedicated to allowing AI agents to automatically manage funds and payments; Sunrise is a liquidity entry for Solana initiated by Wormhole Labs, aimed at helping users seamlessly transfer assets from other chains to Solana through a single interface and immediately access its DeFi ecosystem; Taoshi is a decentralized AI trading network based on the Bittensor ecosystem, aggregating machine learning and autonomous agents through dynamic sub-networks to generate high-precision trading signals across asset classes.

Table of Contents

Key Points

I. Market Overview

Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

Fear Index

ETF Inflow and Outflow Data

ETH/BTC and ETH/USD Exchange Rates

Decentralized Finance (DeFi)

On-Chain Data

Stablecoin Market Cap and Issuance

II. This Week's Hot Money Trends

Top Five VC Coins and Meme Coins by Growth This Week

New Project Insights

III. Industry News

Major Industry Events This Week

Major Upcoming Events Next Week

Important Investments and Financing from Last Week

IV. Reference Links

I. Market Overview

1. Total Cryptocurrency Market Cap / Bitcoin Market Cap Proportion

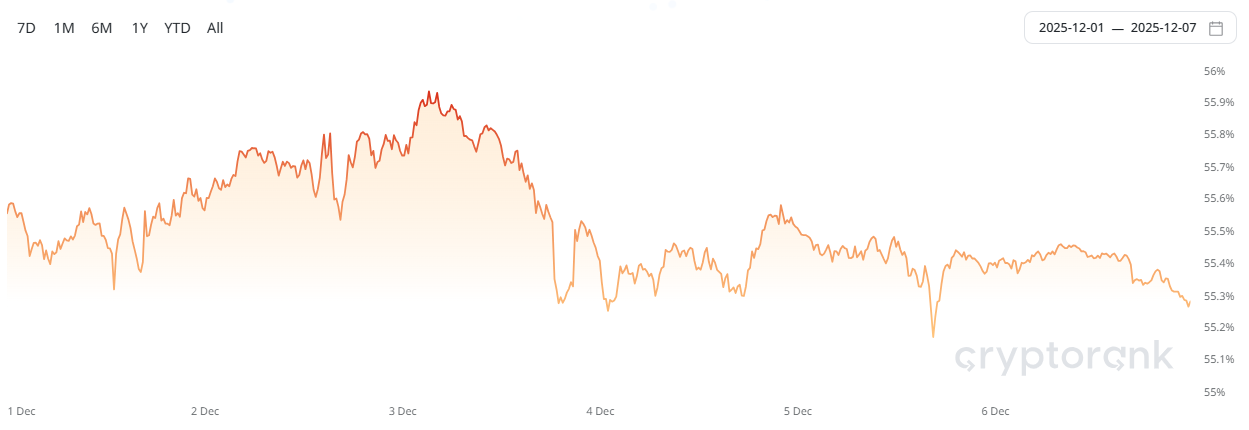

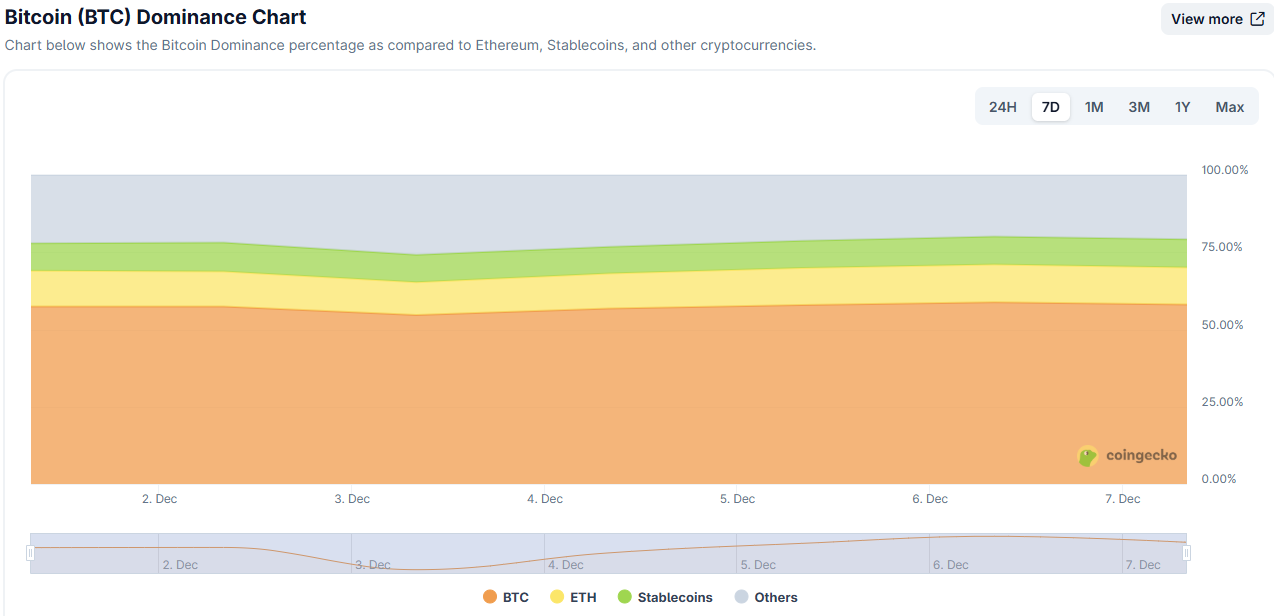

The total market capitalization of global cryptocurrencies is $3.15 trillion, up from $3.14 trillion last week, representing an increase of approximately 0.32%.

Data Source: Cryptorank, https://cryptorank.io/charts/btc-dominance

Data as of December 7, 2025

As of the time of writing, the market cap of Bitcoin is $1.8 trillion, accounting for 57.25% of the total cryptocurrency market cap. Meanwhile, the market cap of stablecoins is $312 billion, accounting for 9.92% of the total cryptocurrency market cap.

Data Source: Coingecko, https://www.coingecko.com/en/charts

Data as of December 7, 2025

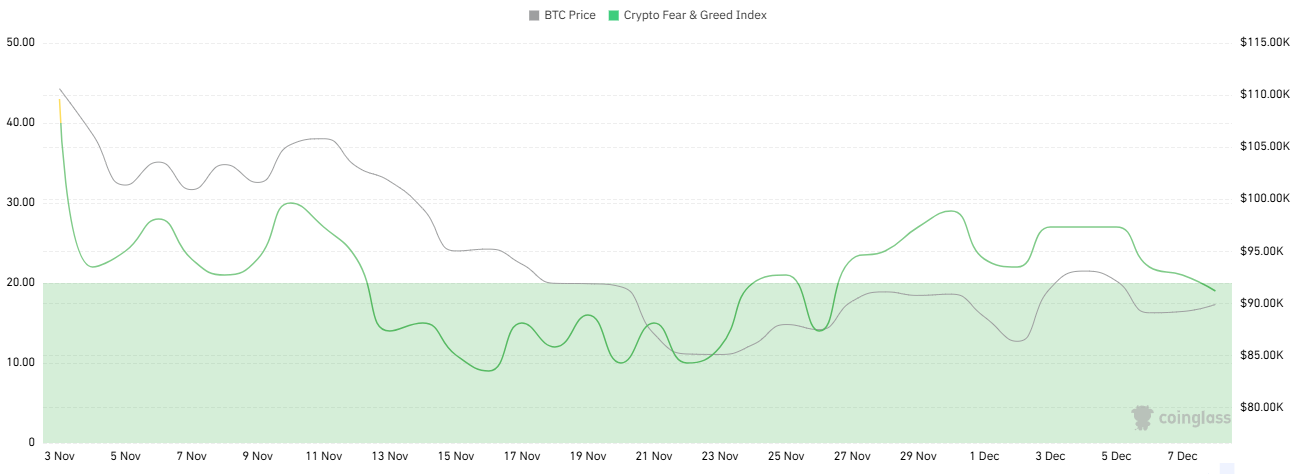

2. Fear Index

The cryptocurrency fear index is 19, indicating extreme fear.

Data Source: Coinglass, https://www.coinglass.com/pro/i/FearGreedIndex

Data as of December 7, 2025

3. ETF Inflow and Outflow Data

As of the time of writing, the cumulative net inflow of the U.S. Bitcoin spot ETF is approximately $57.62 billion, with a net outflow of $87.77 million this week; the cumulative net inflow of the U.S. Ethereum spot ETF is approximately $12.88 billion, with a net outflow of $65.59 million this week.

Data Source: Sosovalue, https://sosovalue.com/zh/assets/etf

Data as of December 7, 2025

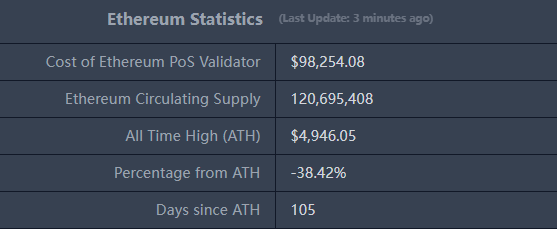

4. ETH/BTC and ETH/USD Exchange Rates

ETHUSD: Current price $3,068, historical highest price $4,946.05, down approximately 38.42% from the highest price.

ETHBTC: Currently at 0.033928, historical highest at 0.1238.

Data Source: Ratiogang, https://ratiogang.com/

Data as of December 7, 2025

5. Decentralized Finance (DeFi)

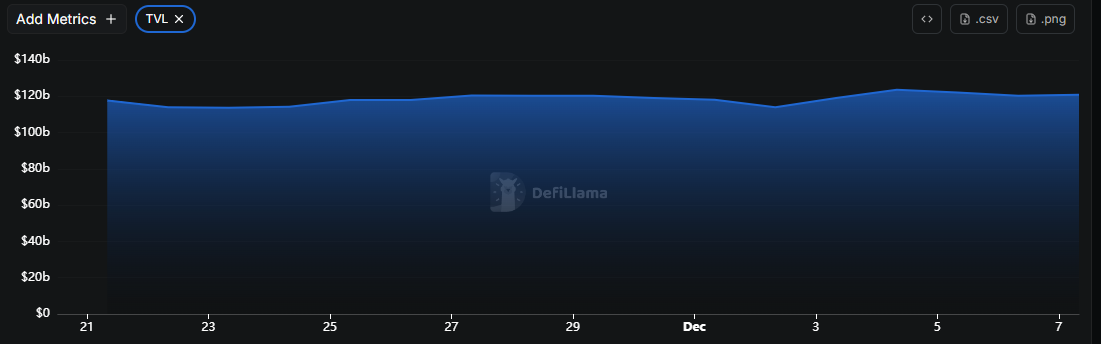

According to DeFiLlama, the total TVL of DeFi this week is $120.8 billion, up from $119.9 billion last week, an increase of approximately 0.75%.

Data Source: Defillama, https://defillama.com

Data as of December 7, 2025

By public chain, the top three chains by TVL are Ethereum, accounting for 68.01%; Solana, accounting for 8.54%; and BNB Chain, accounting for 6.71%.

Data Source: CoinW Research Institute, Defillama, https://defillama.com

Data as of December 7, 2025

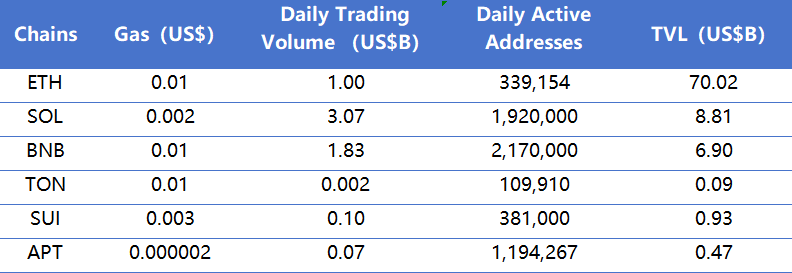

6. On-Chain Data

Layer 1 Related Data

Mainly analyzing the current data of major Layer 1 chains including ETH, SOL, BNB, TON, SUI, and APT based on daily trading volume, daily active addresses, and transaction fees.

Data Source: CoinW Research Institute, Defillama, https://defillama.com

Data as of December 7, 2025

Daily Trading Volume and Transaction Fees: Daily trading volume and transaction fees are core indicators of public chain activity and user experience. In terms of daily trading volume, Solana performed the strongest, rising approximately 10.4%, while BNB Chain rose about 9.6%. In contrast, Sui fell approximately 35.5%, Aptos fell about 30.7%, Ton fell about 44.6%, and Ethereum fell about 3.6%. In terms of transaction fees, only Solana's transaction fees increased by about 100%, while Ethereum, BNB Chain, Ton, Sui, and Aptos remained unchanged.

Daily Active Addresses and TVL: Daily active addresses reflect the ecological participation and user stickiness of public chains, while TVL reflects the level of trust users have in the platform. In terms of daily active addresses, overall on-chain user activity has declined, with Sui experiencing the largest drop of about 37.9%, BNB Chain down about 31.3%, Ethereum down about 28.1%, Aptos down about 17%, and Ton down about 12.1%, with only Solana remaining relatively stable. In terms of TVL, Ton saw the most significant increase, rising about 9.8%, Sui up about 4.5%, Ethereum up about 2.8%, while BNB Chain and Solana fluctuated slightly, and Aptos fell about 4.1%.

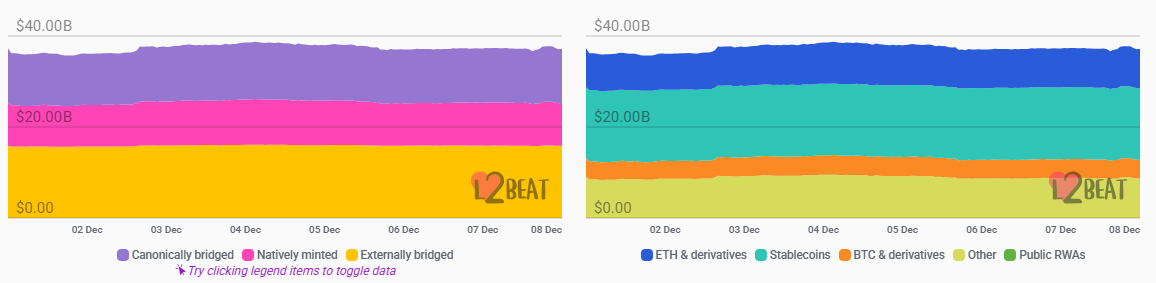

Layer 2 Related Data

According to L2Beat data, the total TVL of Ethereum Layer 2 is $37.17 billion, up from $36.21 billion last week, an increase of approximately 2.65%.

Data Source: L2Beat, https://l2beat.com/scaling/tvs

Data as of December 7, 2025

Base and Arbitrum occupy the top positions with market shares of 36.85% and 34.77%, respectively, with Base ranking first in TVL among Ethereum Layer 2 this week.

Data Source: Footprint, https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Data as of December 7, 2025

7. Stablecoin Market Cap and Issuance

According to Coinglass data, the total market cap of stablecoins is $312 billion, with USDT having a market cap of $185.7 billion, accounting for 59.55% of the total stablecoin market cap; followed by USDC with a market cap of $78.19 billion, accounting for 25.07%; and DAI with a market cap of $5.36 billion, accounting for 1.72%.

Data Source: CoinW Research Institute, Coinglass, https://www.coinglass.com/pro/stablecoin

Data as of December 7, 2025

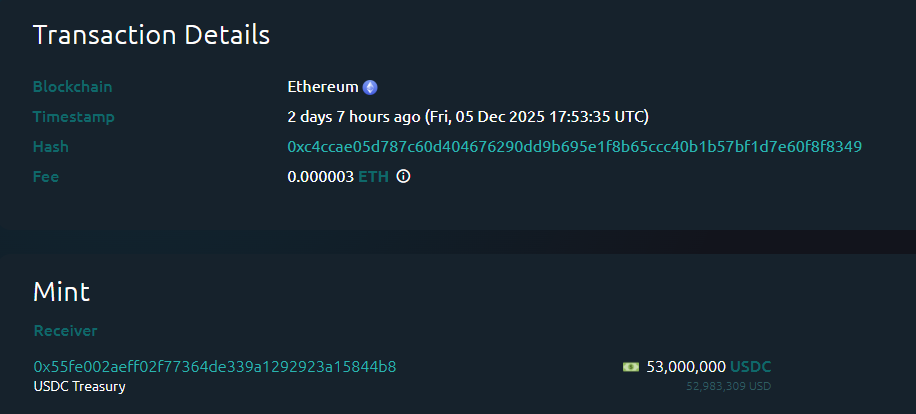

According to Whale Alert data, this week the USDC Treasury issued a total of 2.955 billion USDC, and the Tether Treasury issued a total of 1 billion USDT this week. The total issuance of stablecoins this week is 3.955 billion, down approximately 11.97% from last week's total issuance of 4.493 billion.

Data Source: Whale Alert, https://x.com/whale_alert

Data as of December 7, 2025

II. This Week's Hot Money Trends

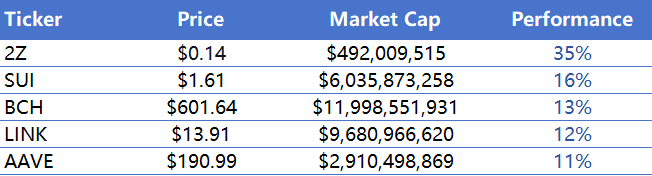

1. Top Five VC Coins and Meme Coins by Growth This Week

The top five VC coins by growth over the past week

Data Source: CoinW Research Institute, Coinmarketcap, https://coinmarketcap.com/

Data as of December 7, 2025

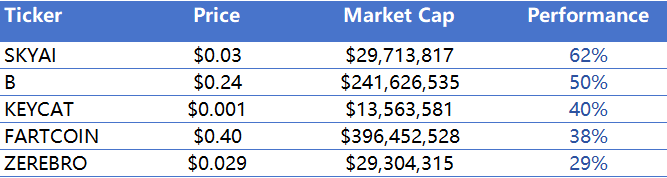

The top five Meme coins by growth over the past week

Data Source: CoinW Research Institute, Coinmarketcap, https://coinmarketcap.com/

Data as of December 7, 2025

2. New Project Insights

Beep is a decentralized finance protocol aimed at the autonomous agent economy, built on the Sui network, dedicated to allowing AI agents to automatically manage funds and payments. Its core design includes Agentic Yield, which allows non-custodial agents to scan and score multi-protocol yields in real-time and automatically compound stablecoin earnings; and Beep Pay, which enables instant, nearly zero-fee stablecoin payments through gas sponsorship and revenue-sharing mechanisms. Beep's goal is to completely hand over fund management and trading processes to autonomously operating financial AIs, allowing users to earn and experience payments without manual operation.

Sunrise is a liquidity entry for Solana initiated by Wormhole Labs, aimed at helping users seamlessly transfer assets from other chains to Solana through a single interface and immediately access its DeFi ecosystem. It integrates cross-chain bridges and liquidity access into a one-stop experience, enhancing the efficiency and availability of cross-chain funds entering Solana.

Taoshi is a decentralized AI trading network based on the Bittensor ecosystem, aggregating machine learning and autonomous agents through dynamic sub-networks to generate high-precision trading signals across asset classes. It provides incentive mechanisms for miners, traders, and developers to participate in training predictive models and contributing signals, enabling market prediction capabilities to be shared, competed, and sustainably monetized on-chain.

III. Industry News

1. Major Industry Events This Week

The ZKP acceleration project Cysic Foundation announced that the token airdrop query website has officially launched, allowing users to confirm their airdrop eligibility and amount in real-time based on their participation in mining, testing, or contributions. Cysic is a full-stack computing network aimed at transforming computing resources such as GPUs and ASICs into assets with liquidity and yield attributes. Its product system includes the zero-knowledge proof layer Cysic Network, hardware products, and Cysic AI for computing power optimization, providing efficient and profitable computing infrastructure for zero-knowledge computing and high-performance on-chain applications.

The Soneium ecosystem liquidity protocol Kyo has opened a query for airdrop eligibility, allowing Kyo and Soneium users to check and confirm their eligibility for its structured reward system. Kyo Finance is the liquidity hub on Soneium, and its configurable liquidity pools support not only ERC-20 tokens but also various types of on-chain assets, including ERC-721 and ERC-1155, providing efficient liquidity infrastructure across assets through unified liquidity management and incentive mechanisms.

The SVM Layer1 blockchain project Fogo announced the launch of its ecosystem points program 1.5 and the mainnet performance testing project Fogo Fishing, which will simulate high-frequency trading and throughput on-chain to test the mainnet. The activity will last about two weeks, during which several random snapshots will be taken. Fogo will airdrop to users participating in fishing activities on Fogo Fishing and LP activities on Valiant Pools, with the current TPS of the Fogo Fishing project exceeding 1000.

The zero-knowledge privacy technology project AZTEC has completed its public token sale, with a total subscription amount of 19,476 ETH and participation from 16,741 users.

The Web3 cultural asset issuance platform Ultiland announced that its second RWA ARToken HP59 officially opened for public sale on December 3. The issuance volume was 1 million tokens, with a subscription price of 0.016 USDT per token, and it sold out in 8 minutes.

2. Major Upcoming Events Next Week

HumidiFi announced that its new round of public sale will restart on December 8. HumidiFi is a decentralized exchange based on Solana, aimed at providing efficient and low-cost trading and liquidity services for on-chain assets through automated market-making mechanisms. The WET token will serve as the core asset for fee payments, protocol governance, and liquidity incentives.

The Solana Mobile native token SKR will be issued in January 2026. The total supply of SKR tokens is 10 billion, with 30% allocated for airdrops, 25% for growth and partnerships, 10% for liquidity and launch, 10% for community treasury, 15% for Solana Mobile, and 10% for Solana Labs. Additionally, SKR will adopt a linear inflation mechanism to incentivize early participants to secure the ecosystem through staking and promote platform growth. The inflation rate for the first year is 10%, with a decay mechanism reducing it by 25% each year, stabilizing the terminal inflation rate at 2%.

The blockchain infrastructure Espresso will open airdrop registration on December 22, covering millions of addresses. So far, the official has released 22 airdrop eligibility paths, including participants of the Espresso hackathon, Caffeinated creators, holders of POAP from online and offline events, and users from partner chains. Additionally, the official will launch the second round of the Bantr activity.

The crypto wallet Rainbow will announce its TGE date this week. Additionally, the Rainbow Foundation will become the largest single shareholder of Rainbow Inc. at the time of the token issuance, holding 20% of the company's equity. Token holders and shareholders will be able to share the same profits. If Rainbow is acquired in the future, the foundation will gradually dissolve and distribute its net assets (including the earnings from its 20% equity stake) to token holders.

Doodles previewed that this week, 25,000 Doopie Cubes will be released on Solana, which community OGs and Dooplicators holders can claim for free.

3. Important Financing Events from Last Week

Ostium completed a $20 million Series A funding round, with a valuation of $250 million, backed by investors including General Catalyst, Jump Trading, and Coinbase Ventures. As a synthetic asset protocol based on Arbitrum, Ostium allows institutions and regular users to trade and hedge commodities such as energy, metals, and agricultural products in a non-custodial manner, enabling traditional commodity markets to operate transparently and efficiently within DeFi. (December 3, 2025)

Digital Asset completed a $50 million strategic financing round, with investments from BNY Mellon, S&P Global, Nasdaq, and iCapital. The funds will be used to expand the application scenarios of its enterprise-level blockchain infrastructure in financial institutions and accelerate global deployment and ecosystem collaboration. As a leading provider of blockchain software and services, Digital Asset builds interconnected multi-party network applications for enterprises based on its smart contract platform Daml, providing strong privacy protection, real-time synchronization, and highly reliable data collaboration capabilities, facilitating the transition of traditional financial infrastructure to the era of on-chain collaboration. (December 4, 2025)

Portal secured an additional $25 million in funding, exclusively invested by JTSA Global. The funds will be used to expand Bitcoin cross-chain trading infrastructure and global market layout. As a non-custodial interoperability protocol for Bitcoin, Portal enables low-cost exchanges between native BTC and Ordinals, as well as various L2s and other public chains, without the need for bridging or wrapping assets, thus providing secure and fast cross-chain asset interoperability for the Bitcoin ecosystem. (December 4, 2025)

IV. Reference Links

Coingeck: https://www.coingecko.com/en/charts

Sosovalue: https://sosovalue.com/zh/assets/etf

Ratiogang: https://ratiogang.com/

Defillama: https://defillama.com

L2Beat: https://l2beat.com/scaling/tvs

Footprint: https://www.footprint.network/public/research/chain/chain-ecosystem/layer-2-overview

Coinglass: https://www.coinglass.com/pro/stablecoin

Whale Alert: https://x.com/whale_alert

Coinmarketcap: https://coinmarketcap.com/

Beep: https://x.com/0xbeepit

Sunrise: https://x.com/Sunrise_DeFi

Taoshi: https://x.com/taoshiio

Ostium: https://x.com/ostiumlabs

Digital Asset: https://x.com/digitalasset

Portal: https://x.com/PortaltoBitcoin

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。