Bitcoin and Ether ETFs End Week in the Red as Solana and XRP Shine

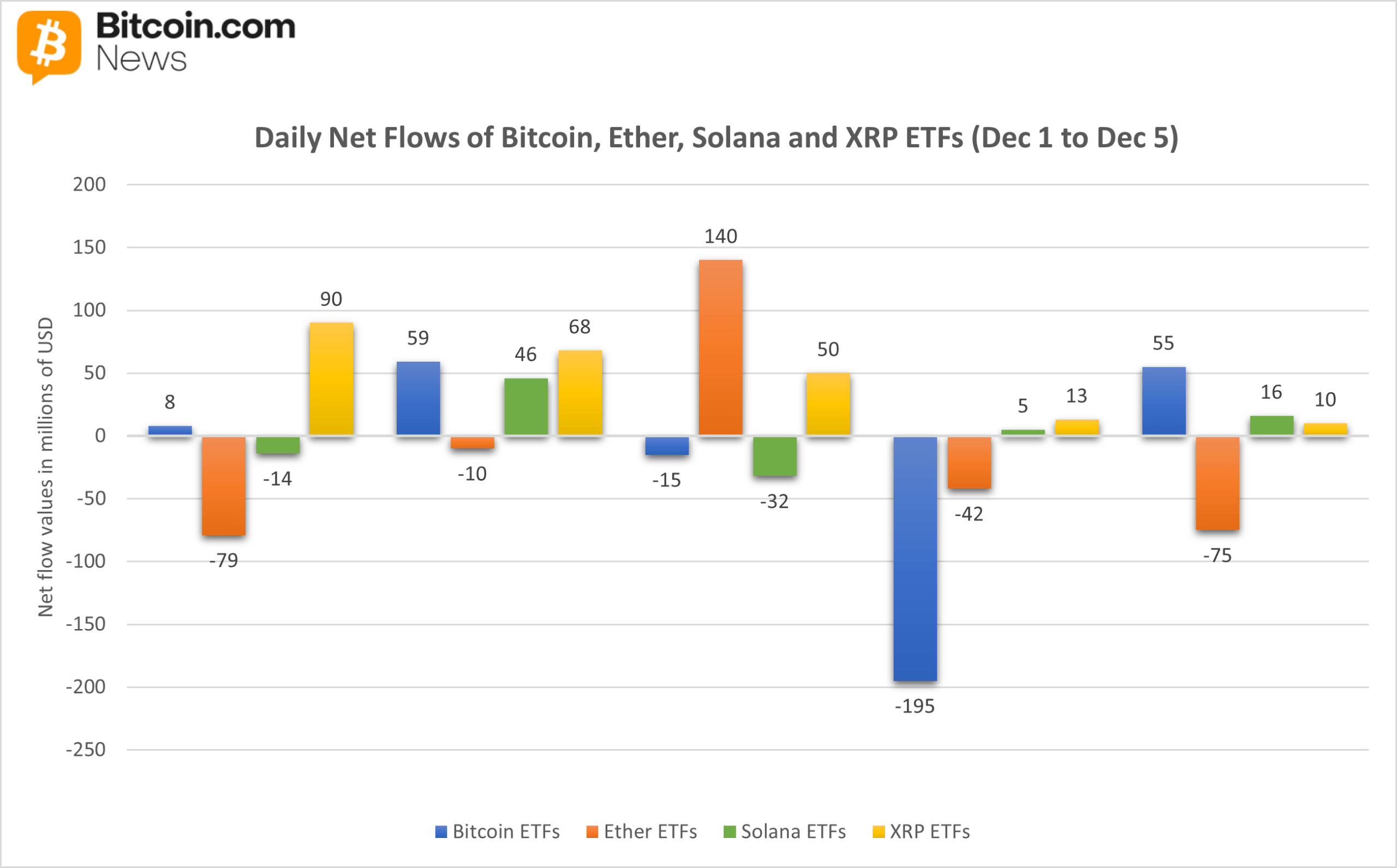

The first week of December felt like a market trying to find its rhythm. Bitcoin and ether exchange-traded funds (ETFs) lost ground after a mix of heavy mid-week reversals, while solana and XRP quietly kept stacking inflows. Beneath the headline totals, each issuer traced its own story, some recovering, some stumbling, and others riding persistent momentum.

Bitcoin ETFs: A Week of Sharp Turns

Across all spot bitcoin products, the category closed the week with a net outflow of -$87.77 million. Based on the daily data provided (Dec. 1–5), fund-level flows took on dramatically different shapes.

Blackrock’s IBIT swung wildly but ultimately finished up in the negative with a -$48.99 million, thanks to large outflows offsetting two notable inflow days. Fidelity’s FBTC ended the week up $61.96 million, with Bitwise’s BITB delivering a steady $9.30 million inflow.

ARK & 21Shares’ ARKB posted the steepest decline at –$77.86 million for the week. Grayscale’s GBTC added another –$29.77 million decline, while its Bitcoin Mini Trust slipped –$411.52K. Vaneck’s HODL closed at –$2.95 million, and Wisdomtree’s BTCW added a small but positive $947.22K.

Despite the outflows, the weekly trading volume ended at $22.57 billion to signal healthy interest in BTC ETFs.

Ether ETFs: Heavy Outflows Driven by a Single Issuer

Ether ETFs shed -$65.59 million this week. Blackrock’s ETHA was responsible for nearly the entire weekly decline, finishing –$55.87 million. On the other hand, Fidelity’s FETH performed strongly, adding $35.50 million.

Grayscale’s Ether Mini Trust finished in the green with $7.51 million, while ETHE slipped –$53.17 million. Bitwise’s ETHW added a modest $4.48 million while Vaneck’s ETHV matched that with a -$4.03 million exit.

Solana ETFs: A Strong, Steady Week

Solana ETFs posted a net inflow of $20.3 million from Dec. 1–5, with fund-level totals showing widespread strength.

Bitwise’s BSOL led the week with a strong $65.11 million inflow. Fidelity’s FSOL added $14.11 million, and Grayscale’s GSOL contributed $11.19 million. Vaneck’s VSOL brought in $2.71 million, with Canary’s SOLC adding $1.09 million, while 21Shares’ TSOL logged a sizable –$73.91 million outflow.

Read more: Ether ETFs Lead Weekly Gains as Bitcoin and Solana Stay Green

XRP ETFs: Four Weeks of Steady Gains

XRP ETFs continued their weekly gains with another strong week, ending $230.74 million in the green. All four players saw solid weekly gains. Grayscale’s GXRP added $140.17 million for the entire week, while Franklin’s XRPZ brought in $49.29 million. Bitwise’s XRP and Canary’s XRPC rounded up the weekly streak with additions of $21.10 million and $20.19 million each.

This extended XRP ETFs’ green streak to four consecutive weeks, as investors continue to diversify their ETF holdings.

FAQ📈

- Why did bitcoin ETFs finish the week negative?

BTC ETFs saw a -$87.77 million outflow as several major issuers faced sharp reversals. - What drove the decline in ether ETFs?

Ether ETF outflows were largely due to Blackrock’s ETHA, which erased weekly gains elsewhere. - Why did solana ETFs stand out this week?

Solana funds posted $20.3 million in inflows, supported by strong demand across multiple issuers. - How did XRP ETFs perform compared to others?

XRP ETFs surged $230.74 million, marking their fourth straight week of consistent inflows.

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。