Recent capital flows in the US stock market have shown a significant structural change.

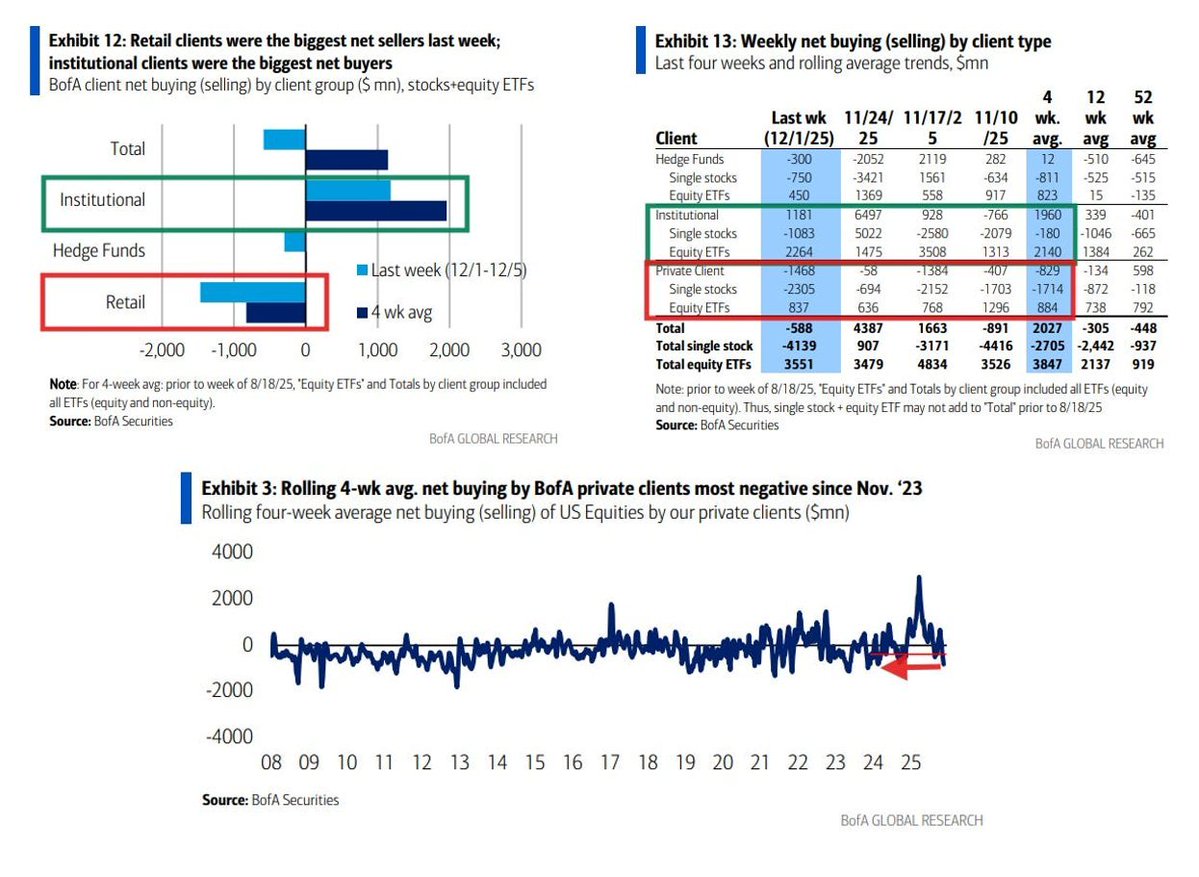

Retail investors, who had been buying on dips for 12 consecutive weeks, suddenly reversed their stance around Black Friday, with continuous net selling over the past 1 to 4 weeks. The selling has been very decisive, almost confirming that this retreat is triggered by the cash demand for the holiday season combined with uncertainty regarding the short-term macroeconomic outlook.

Hedge funds have maintained a neutral stance, with slight reductions in positions over the past few weeks, clearly waiting for the policy path of the December FOMC.

The only consistent buying force has been institutional investors, who have maintained a stable buying intensity in both stocks and ETFs, indicating that they view the pullback as a window for building positions for next year and are not affected by the market's short-term fluctuations.

The market's direction going forward will depend on the repricing of monetary policy, especially the guidance from the dot plot regarding the interest rate path for 2026, which will directly determine whether institutions continue to increase their positions, whether hedge funds will establish directional positions, and whether retail investors will have the opportunity to return to the market.

Meanwhile, $BTC remains highly correlated with technology stocks in the US market, and the movements of tech stocks will continue to drive the rise and fall of Bitcoin.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。