Today's homework, while not difficult, is a bit exhausting. The last Federal Reserve meeting of 2025 has passed, and overall, it did not have a significant impact on the market. From the dot plot perspective, it is actually a bit more dovish compared to September, but there is still quite a gap from market expectations. However, it’s fine; the biggest variable in 2026 will be Powell being replaced by Hasset, and the dot plot after the handover in June will be even more important.

Aside from being somewhat dismissive about the possibility of a rate cut in January, Powell's speech did not reveal any hawkish direction. He was even quite optimistic about inflation, believing that as long as tariffs can be confirmed, the impact on goods inflation is likely to be one-time. If inflation declines, the Federal Reserve will consider more rate cuts, and he reiterated that if the labor market continues to decline, the Fed will also intervene (by cutting rates).

The next month will be about watching the data. As labor data worsens, the probability of rate cuts increases; as inflation data decreases, the probability of rate cuts also increases. These two points have not changed. In January, the Supreme Court is also expected to announce the issue of Trump's tariffs, so we will see then. Overall, Powell's performance today was much better than in December last year; that was truly hawkish. Moreover, Powell believes that GDP in 2026 will see significant growth.

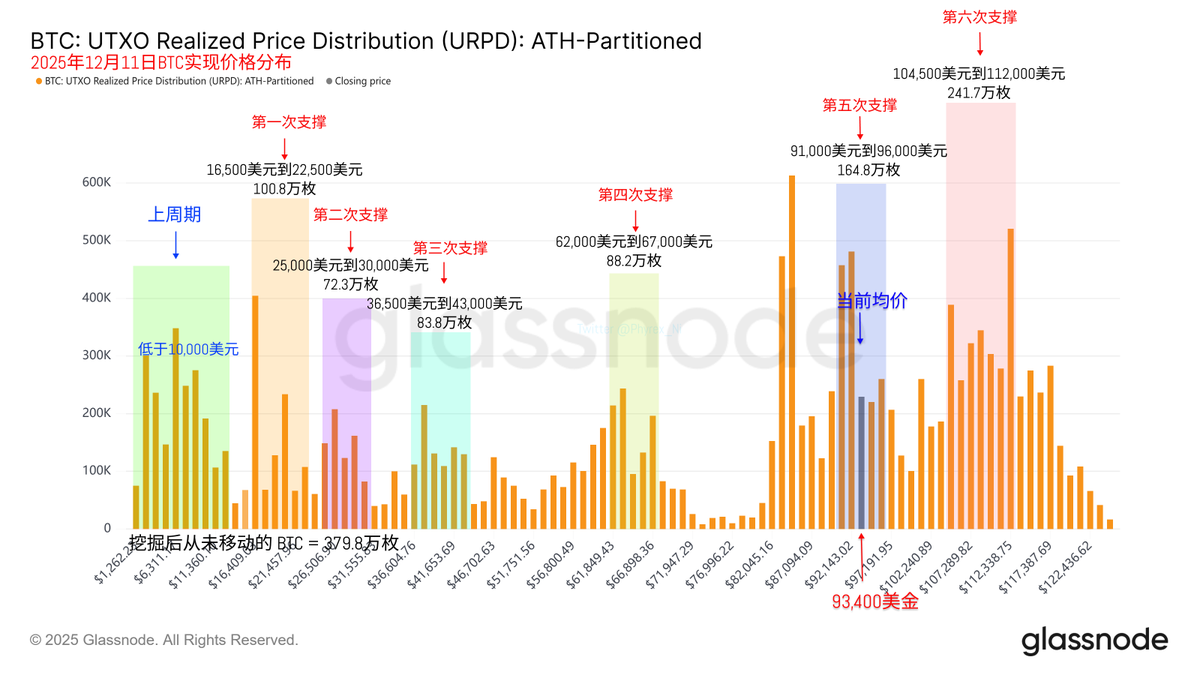

Looking back at Bitcoin's data, the turnover rate is still quite high, mainly due to investors' speculative behavior during this critical period. After today, the turnover rate may gradually decline. The increase in turnover rate also indicates that short-term investors are more active, and the data supports this. The highest turnover rate is still from investors who have been bottom-fishing in recent days, especially new investors who have reduced their holdings significantly with a cost price below $90,000.

The chip structure is still quite normal, and no stability issues have been found, especially since high-position loss investors have not shown signs of panic. Next, we will look at the data released in December. If the expectations for a rate cut in January can continue to rise, then the market's enthusiasm can still be maintained.

Bitget VIP, lower fees, better benefits

免责声明:本文章仅代表作者个人观点,不代表本平台的立场和观点。本文章仅供信息分享,不构成对任何人的任何投资建议。用户与作者之间的任何争议,与本平台无关。如网页中刊载的文章或图片涉及侵权,请提供相关的权利证明和身份证明发送邮件到support@aicoin.com,本平台相关工作人员将会进行核查。